Revealed: 2019 full-year sales of automakers in China

Shanghai (Gasgoo)- China has seen its auto sales decline for the second year in a row. Saddled with the general downward pressure, most automakers in China also came across downturn last year.

Among nine major auto companies Gasgoo hereby enumerated, only Great Wall Motor achieved a slight growth in annual sales, but the Chinese biggest SUV maker saw its sales tumble 20.77% in December. By contrast, SAIC Motor, Changan Automobile, Geely Auto and JAC Motors all gained evident growth in the year-end spurt despite their waning performance for the whole 2019.

SAIC Motor

SAIC Motor announced its annual sales in 2019 shrank 11.54% from a year ago to 6,237,950 units. However, after suffering 15-straight-month year-on-year downturn, the Chinese biggest automaker finally posted growth in December.

Among the five subsidiaries whose full-year sales all exceeded 100,000 units, only SAIC Maxus sold more vehicles than that of 2018. Notably, the champion SAIC Volkswagen featured a decrease of 3.07%, 3.65 percentage points fewer than the drop in Jan.-Nov. sales. Clearly, the contracted decline should be attributed to the 37.67% surge in its Dec. sales.

(Photo source: SAIC-GM)

Both the runner-up and the second runner-up—SAIC-GM-Wuling and SAIC-GM—confronted double-digit decrease in YTD sales. The latter saw its Dec. sales tumbled 27.61%, and failed to obtain year-over-year increase during the entire second half of 2019.

The monthly sales volume of SAIC Motor PV was quite a bright spot. Despite the dismal climate of overall PV market, the group's self-owned PV unit has been continuously scoring sales rise between July and December.

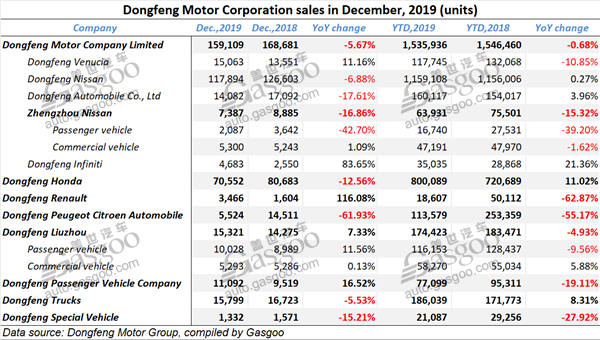

Dongfeng Motor Corporation

Dongfeng Motor Corporation, along with its subsidiaries, sold 2,931,953 new vehicles throughout 2019, posting a year-on-year downturn of 3.94%.

Of those, PV sales shrank 5.67% to 2,463,620 units, while CV sales climbed 6.3% to 468,333 units.

Dongfeng Motor Company Limited saw its full-year sales only edged down 0.68% thanks to the stable performance of Dongfeng Nissan and the increase in sales of Dongfeng Automobile Co.,Ltd and Dongfeng Infiniti.

(Photo source: Honda China)

The Sino-Japanese joint venture Dongfeng Honda had its annual sales jump 11.02% year on year to 800,089 units, substantially offsetting the plunge that hit Dongfeng Renault and DPCA.

As to December, the auto group still failed to achieve growth. Notably, Dongfeng Renault’s sales zoomed up 116.08% to 3,466 units, maintaining the rising impetus from November. However, its sharp decline between January to October still brought down the annual average.

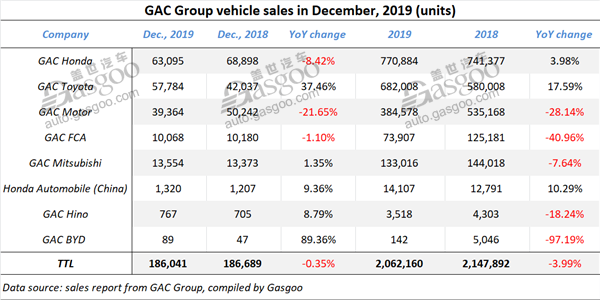

GAC Group

GAC Group stated its full-year auto production and sales of 2019 were better than expected. Last year, the automaker output 2,023,814 vehicles (-7.76%) and sold 2,062,160 new vehicles (-3.99%), and had roughly 2.0849 million vehicles delivered to consumers.

In spite of the group's overall downturn, two major Sino-Japanese joint ventures eventually maintained their rising impetus. In 2019, GAC Honda boasted a year-on-year growth of 3.98% with 770,884 vehicles sold, and GAC Toyota's annual sales leapt 17.59% to 682,008 units.

Both of them gained growth in cumulative deliveries as well. GAC Group stated that retail sales of GAC Honda and GAC Toyota amounted to 765,000 units and 665,700 units, rising 4.2% and 14.7% year on year respectively. The less prominent joint venture, GAC Mitsubishi, also achieved an increase of 3.5% in 2019 deliveries.

(Photo source: GAC Trumpchi)

Self-owned brands were somewhat eclipsed by the aforementioned joint ventures. GAC Motor saw its last year's sales tumble 28.14% over a year ago to 384,578 units.

As for monthly performance, the Guangzhou-based auto group sold 186,041 new cars in total, a slight drop of 0.35% from the year-ago period. Among subsidiaries, only GAC Honda, GAC Motor and GAC FCA posted decrease.

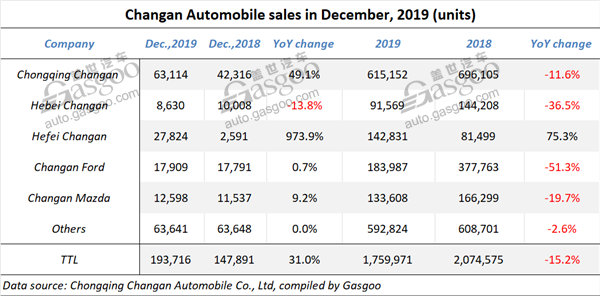

Changan Automobile

Chongqing Changan Automobile Co., Ltd said its new vehicle sales in December 2019 soared 31% over a year ago to 193,716 units, maintaining the growth from November.

Thanks to the vigorous increase in the year-end spurt, the decrease in Changan's year-to-date sales was shrunk to 15.2%, versus the year's highest level of 35.2% which took place in February.

Apart from Hebei Changan, the other subsidiaries all posted year-on-year increase in Dec. sales. Hefei Changan boasted a colossal growth of up to 973.9%, and had gained sales surge for the fourth month in a row.

(Photo source: Changan Ford)

I would be remiss not to mention Changan Ford's sales growth in December—0.7%, tiny but considerably significant as this was the first-time year-over-year increase the joint venture made for the past two years. It seems that the cooperation between Ford and Changan Automobile deepened for the sake of Changan Ford did generate some positive effects.

Changan Mazda saw its Dec. sales climb 9.2% to 12,598 units. The Sino-Japanese joint venture was mired in downturn for nine months of 2019, thus its full-year sales still represented a double-digit drop.

On the other hand, subsidiaries displayed a sweeping decrease in terms of year-to-date sales. Hefei Changan was the only one that obtained growth.

Geely Auto

Geely Automobile Holdings Limited (Geely Autombile or the group) announced its total sales volume (including the sales of Lynk & Co-branded vehicles) in December 2019 reached 130,036 units, soaring 39.3% from the year-ago period.

(Photo source: Geely Auto)

Among vehicles sold last month, 9,900 units were new energy and electrified vehicles (NEEVs). The hotter-selling NEEV models were the Xingyue MHEV, the Binyue MHEV and the Jiaji MHEV, which together accounted for around 73% of the group's Dec. NEEV sales. Besides, full-year NEEV sales shot up 66.5% to 113,067 units.

For the year of 2019, Geely Automobile sold a total of 1,361,560 new vehicles, posting a decrease of roughly 9% over the prior-year period, while successfully achieving the group's 1.36 million-unit sales target for 2019. This is also the third year in a row for the group to see both production and sales volume surpass 1 million units.

The Lynk & Co closed its 2019 with a cumulative sales volume of 128,066 units (+6.4%). As of December 2019, the brand has been gaining monthly sales topping 10,000 units for five consecutive months.

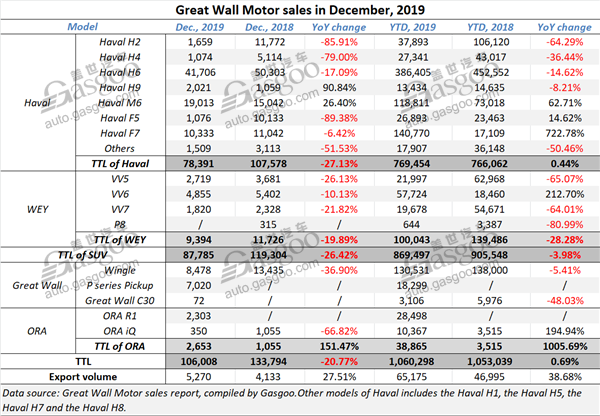

Great Wall Motor

Great Wall Motor (GWM) saw its full-year sales in 2019 edge up 0.69% year on year to 1,060,298 units, surpassing 1 million units for the fourth year in a row.

With 769,454 new vehicles sold, Haval was once again crowned the champion SUV brand in China by annual sales. As of December, the brand has sold nearly 5.8 million vehicles worldwide.

WEY witnessed its 2019 sales edged down 3.98% due to the plunge in sales of the VV5, the VV7 and the P8. Nonetheless, the VV6's full-year sales zoomed up 212.70%, which substantially offset the downturn caused by the other three models.

(Photo source: ORA)

The BEV-focused ORA was another driver to GWM's annual increase. Despite the sharp decline in December, the ORA iQ's full-year sales still surged 194.94% from the year-ago period. The ORA R1, with 28,498 units sold through 2019, is a fresh power in China's NEV market.

GWM sold a total of 148,830 pickups last year, a year-on-year growth of 7.85%. The company said it has maintained its championship in China by both pickup domestic sales and exports for 22 consecutive years, and there have been over 1.6 million GWM's pickups running on roads worldwide.

Chery Holding

Chery Holding closed its 2019 with an annual sales volume of 745,000 new vehicles, versus 752,759 units for the year of 2018, according to Chery's statements. Of that, the sales of the group's self-owned models climbed 6.9% year on year.

Last month, the group sold 93,000 new cars, a remarkable growth of 25.1% compared with November, achieving month-by-month growth for five successive months.

(Photo source: Chery Automobile)

As of December 12, Chery Holding has had 8.3 million users worldwide, of which over 1.6 million are overseas consumers.

Driven by the sales growth of the all-new Tiggo 8 and the Arrizo series, Chery Automobile gained a stable growth of 9.4% in 2019 domestic sales. EXEED, a brand embodying Chery's aspiration to move upscale, rolled out three new models—the TX, the LX and the VX—within 2019.

Moreover, Jetour, a PV brand launched in 2018 by Chery Commercial Vehicle, has so far sold roughly 178,000 new vehicles. The brand is said to roll out five new models next year, including the X70 Coupe, the X70M, the new X70S, the 2020 X90 and the 2020 X95.

BYD

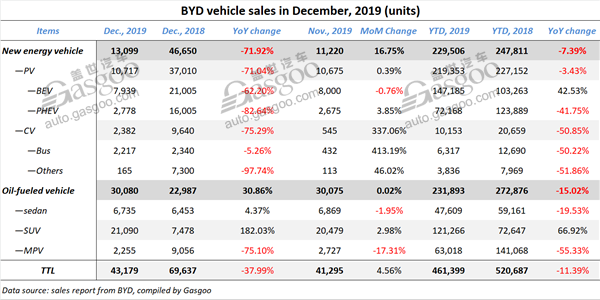

In 2019, BYD saw its full-year auto sales slide 11.39% year on year with both NEV and oil-fueled vehicle businesses hit by decrease.

In the last month of 2019, BYD's new car sales tumbled 37.99% over the previous year to 43,179 units, representing decline for the sixth month in a row. With only 13,099 units sold in December, the NEV unit suffered a year-over-year plunge of up to 71.92%. Since the new NEV subsidy policy came into effect, BYD has not achieved growth in NEV monthly sales yet.

(Photo source: BYD)

Nevertheless, the growth in fuel-burning vehicle sales still remained positive in December thanks to the surge in sedan and SUV sales volume. As of December 2019, the automaker has been gaining increase in oil-fueled vehicle sales for four consecutive months.

It is evident that the continuous downturn in NEV sales was the major factor that led to the final annual sales decrease. However, all-electric PV sales still shot up 42.53% from a year earlier, a blooming force defying against the overall flagging trend.

JAC Motors

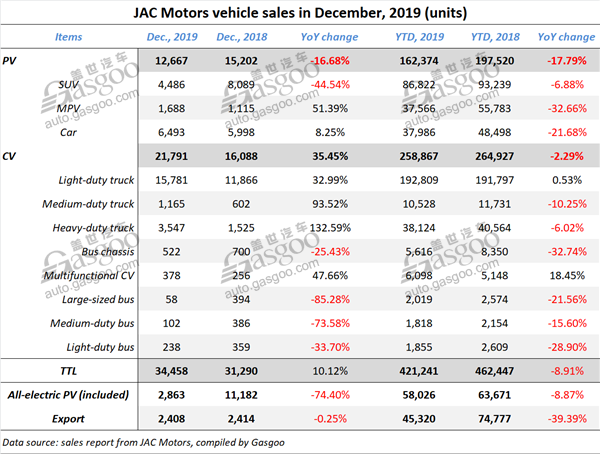

JAC Motors said its full-year sales slid 8.91% from the previous year with both the PV and CV units posting decrease. Of those, a total of 58,026 all-electric PVs were sold, a year-on-year drop of 8.87%.

During the last month of 2019, the Hefei-based automaker obtained a double-digit growth, the first-time and only increase for the second-half year. With sales surging 35.45%, the CV unit made a great contribution to the monthly increase. However, PV sales still dipped 16.68% over a year ago merely due to a 44.54% plunge in SUV sales.

(Photo source: JAC Motors)

Besides, annual export volume of JAC Motors slumped 39.39% to 45,320 units despite the almost unchanged performance in December.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com