Top 10 China-built PV, car, SUV, MPV models by Mar. wholesales

Shanghai (Gasgoo)- In March, automakers in China sold 1,021,584 locally-produced PVs (hereby referring to cars, SUVs, MPVs and minibuses), which showed a year-on-year plunge of 48.3%. Year-to-date PV wholesales also plunged 45.5% to 2,866,569 units.

The decrease in SUV wholesales stood at 43.7% last month, 5.2 percentage points fewer than that of cars. The MPV sector saw its sales tumble nearly 70%.

Thanks to the effective control of COVID-19 spread, the work resumption has taken place across most automakers and dealers in China, so that the market demands have gradually increased. Some regional governments have released incentives in response to the central authority's encouragement to lift car sales. However, the efficacy has so far remained limited to a certain point.

The VIA (Vehicle Inventory Alert Index) reached 59.3% in March, slumping 27 percentage points compared to February, according to the China Automobile Dealers Association (CADA). However, the number still exceeded the official warning threshold, and was 7.2 percentage points higher than that of a year-ago period.

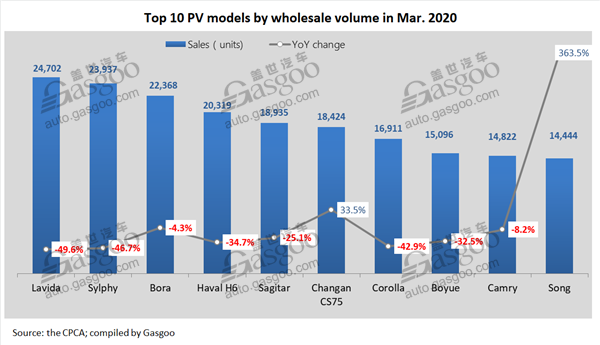

There were six car models and four SUV models on the top 10 China-built PV models by March wholesales volume. The new entrant BYD Song was the only one that achieved growth.

Car

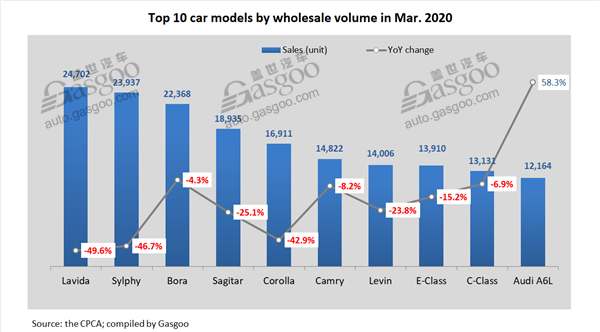

In March, China's car wholesales slumped 48.9% from a year earlier to 478,828 units, making the first-quarter volume totaled 1,316,651 units (-47.8%).

With a relatively high cost effectiveness and outstanding brand reputation, the Lavida regained the championship among all locally-produced car models in terms of March wholesales, closely followed by the Sylphy. The Bora was honored the second runner-up, while its sales only edged up 4.3%.

(Photo source: GAC Toyota)

The Camry moved up to the sixth place with a sales volume of 14,822 units. Besides, it was also crowned the sales champion among China-made mid-sized car models.

There were three premium models—the E-Class, the C-Class and the Audi A6L—included on the top 10 car list. The sales of the Audi A6L surged 58%, mainly attributable to the small base number for the year-ago period.

SUV

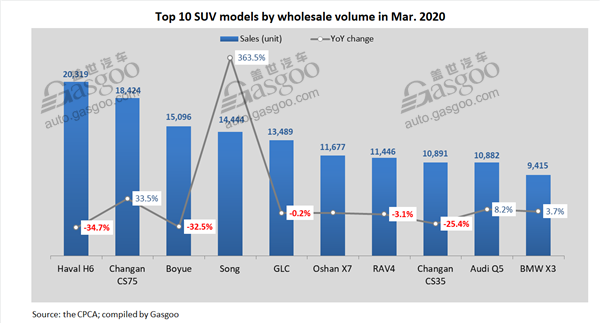

The wholesale volume of SUVs fall 43.7% over the previous year to 476,166 units. The year-to-date volume reached 1,370,131 units, dipping 39.8%.

Compared to February, many new faces appeared on the top 10 SUV model list by March wholesales, including the BYD Song, the GLC, the Oshan X7, the RAV4, the Changan CS35, the Audi Q5 and the BMW X3.

The Haval H6 was the best-selling SUV and it also the unique one whose March sales exceeded 20,000 units. The Changan CS75 dropped to the runner-up place, while it boasted a year-on-year surge of 33.5%.

(Photo source: BYD)

The BYD Song skyrocketed to the fourth place. The classic Song re-entered the market in March with a more affordable price range. Its production was suspended after the Song Pro hit the market in last July.

There were three premium models on the top 10 SUV list. The sales of the Mercedes-Benz GLC edged down 0.2%, while both the Audi Q5 and the BMW X3 gained sales increase.

MPV

MPV's March and first-quarter wholesales nosedived 69.2% to 45,509 units and 62.3% to 136,172 units.

(Photo source: SAIC-GM-Wuling)

The hottest-selling Hongguang posted a 73.4% year-on-year plunge, while accounted for up to 24% of the country's total MPV sales. The Orlando climbed to the third place, and possessed the only year-on-year increase among the top 10 MPV models.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.