Gasgoo Awards: Top 100 Players of China's New Automotive Supply Chain for 2023

In 2023, the Chinese automotive market is brimming with excitement. With the continuous growth in the penetration rate of new energy vehicles (NEVs), the market share of domestic brands in China has surged to over 50%. Moreover, China became the world's largest exporter of automobiles in the first half of this year. Behind these achievements lies China's gradual establishment of a comprehensive industrial chain system that spans from infrastructures, essential materials, core components, complete vehicles, and even brand development. The Chinese automotive industry has begun to find its own development rhythm and is displaying vibrant growth.

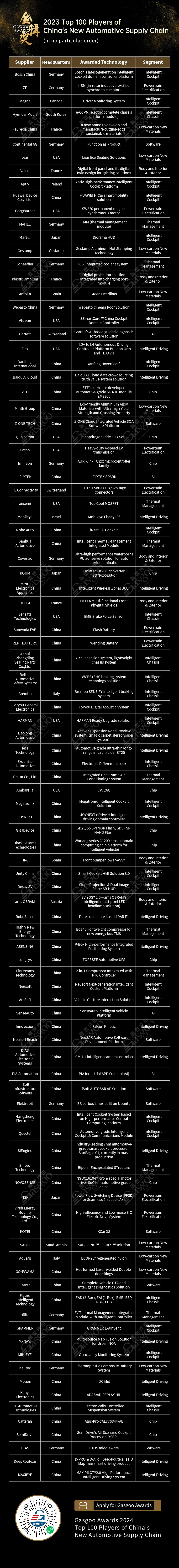

This year, the 5th Gasgoo Awards is still committed to finding out the "Top 100 Players of China's New Automotive Supply Chain", which attracted applicants from ten major technology sectors: intelligent cockpit, intelligent driving, intelligent chassis, chip, software, AI, powertrain electrification, thermal management, body and interior & exterior, and low-carbon new materials. By showcasing those outstanding companies, along with their advanced technology solutions, the Gasgoo Awards aims to help boost the development and progress for the automotive industry.

After 232 days, the 2023 list came out as a result of nearly 1 million online votes and months of experts’ assessment to award those players which play a leading role in industrial upgrading and revolution with their technology and business mode innovation.

As the competition within the industry intensifies, 60% of companies on the list are now competing in the realm of intelligence.

Against the backdrop of the ongoing restructuring of the new automotive supply chain in China, electrification, low-carbon and intelligence have emerged as the next phase's focal points to the industrial competition. Multiple companies are venturing into areas such as autonomous driving, smart cockpit, electrification, lightweight design, low-carbon initiatives, and software-defined vehicles. Innovation in related products and technologies is also advancing rapidly. This trend is particularly pronounced among the top 100 player of China’s new automotive supply chain honored by the Gasgoo Awards 2023.

Notably, among the award-winning companies, 62 are dedicated to the field of intelligence, including intelligent cockpit, intelligent driving, chip, software, and AI segments.

In recent years, as the growth rate and market penetration of new energy vehicles have slowed down, automotive companies have shifted their focus from the EV range to competing in terms of functions, fast-charging speed, price, and cost to capture more market share. Consequently, some features, such as automatic parking, AR-HUD, brake-by-wire, and air suspension, which were previously regarded as exclusive niceties to premium vehicles, are becoming a commonly seen part of the mass market.

According to data from the Gasgoo Auto Research Institute (“GARI”), thanks to rapid advancements in core technologies and increasing user acceptance of intelligent vehicles, intelligent driving features are spreading in the end-user market at a faster-than-expected rate. For the first five months of 2023, the penetration rate of Level 2 autonomous driving system in China reached around 40%, rising nearly 10 percentage points versus the 28.8% for the year-ago period.

With the improvement in consumers' emphasis on advanced driving assistance features and their willingness to pay, it is anticipated that by 2025, the penetration rate of Level 2 and above intelligent vehicles will reach 45%, with the scale production of Level 3 vehicles commencing after 2025, according to GARI's data.

Therefore, many industry experts, scholars, and corporate leaders agree that the next 3 to 5 years will be a crucial window period for global automotive companies to race in the intelligence domain. Yu Chengdong, CEO of Huawei's Intelligent Automotive Solutions Business Unit, even stated, "In the next five to ten years, only a few automakers will survive, because moving into the era of intelligence requires massive investment, and only giants can sustain future development."

Intelligence has become the main battleground for more and more companies to secure their future. In this year's Top 100 Players list, the field of smart cockpits alone brings together international giants like Bosch, Magna, and Continental AG, as well as local component companies such as Yanfeng, Neusoft, and Desay SV, along with prominent ICT company Huawei.

Furthermore, the capital market's enthusiasm for investment in intelligent electric vehicles remains high. According to GARI's statistics, as of September 30 this year, there have already been 201 financing cases in the field of intelligent electric vehicles disclosed so far this year, with 99 of which related to intelligent driving.

The automotive industry is undergoing a digital transformation, an upgrade in product digitalization, and a digital shift in consumer behavior. The entire industry chain is experiencing a profound restructuring and reshuffling. In this process, only those companies that keep pace with the trends of the times, and perhaps even lead the way, can establish themselves as unbeatable.

Experiencing rapid rise, Chinese companies takes half of the spots on the top 100 players of China's new automotive supply chain for 2023.

Since July 13, 1956, when the first domestically produced Jiefang-branded truck rolled off the assembly line, marking the end of China's inability to manufacture cars, China’s automotive industry has already celebrated 70 anniversaries. Furthermore, China has held the title of the world's No.1 country in terms of automotive production and sales for 14 consecutive years, and secured the highest position by NEV outputs and sales for eight successive years.

However, despite being the world’s top car producer and seller, China has still grappled with a slew of challenges, such as the lack of the first-move advantage, imbalanced industrial structure, and the scarcity of skilled talents, which left China struggling to assert itself in the core technologies domain of traditional oil-fueled vehicles. Thus, NEV becomes a new track for China to catch up with or even overtake other countries.

It is worth acknowledging that as new energy vehicles rapidly develop, China's automotive industry has risen to the challenge, leading in some areas and even outperforming foreign companies.

"In terms of the control of core components, China has already established a robust industrial chain covering the traditional internal combustion engine domain, which includes turbochargers’ electronic control system, and the new energy vehicle sector that encompasses batteries, electric motors, and electronic control units. This comprehensive chain is also characterized by the technologies related to electric air conditioning compressors, intelligent driving chassis, and chips,” Dr. Xin Jun, Co-founder of Sinobrook New Energy Technologies and an SAE fellow, made this statement at the 11th Automobile and Environmental Innovation Forum and the 15th Global Automotive Industry Summit, which were jointly organized by NDE Automotive Group, Gasgoo, and the Shanghai Euro-American Alumni Association Jiading Branch Automotive Committee.

In this context, the Top 100 Players of China's New Automotive Supply Chain features as many as 58 local companies. Beyond the aforementioned Yanfeng, Neusoft, Desay SV, and Huawei, there are familiar names like Minth Group, Zhongding, and JOYNEXT. Furthermore, there are cross-industry players such as Baidu, iFlytek, Longsys, and i-Soft Infrastructure Software, along with outstanding local newcomers like Figure Intelligent Technology, making their mark in the new arena of intelligent new energy vehicles.

As for the segments the companies on the list belong to, it is evident that most Chinese companies focuses on such fields as intelligent driving, AI, software, and intelligent chassis. Nonetheless, in the low carbon area, the presence of domestic firms is quite rare. We believe that with the accelerating global trend towards low-carbon solutions and ongoing technology advancements, Chinese enterprises will play a more remarkable role in this domain in the future.

It cannot be denied that external geopolitical conflicts, chip shortages, materials scarcities, and price hikes, coupled with the rapid development of NEVs with their ever-growing cost effectiveness, and industry's ongoing disruption due to technological shifts and evolving consumer behaviors, are consistently posing new challenges to the entire automotive supply chain.

However, in the words of Dr. Xu Zheng, Director of SAIC Motor R&D Innovation Headquarters and an SAE fellow, "We are indeed facing challenges, but we are also in one of the best eras. Technology revolution and shifts in consumer behaviors have brought new opportunities to the entire industry. We must adapt to the trends of the times, address these challenges, and continue to move forward."

Fu Yuwu, Honorary Chairman of the China Society of Automotive Engineers and the Auto Talents Committee of China Talents Society, emphasized, "We are at a critical juncture in historical development, and at this moment, the most important thing is to focus on our own growth, and adopting a long-term perspective is indeed the paramount prerequisite for achieving the ultimate goal of making China's automotive industry a powerhouse over the next ten to twenty years."

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.