Rankings of smart cockpit component suppliers in China (Jan.-Apr. 2025): Desay SV leads cockpit domain controller market

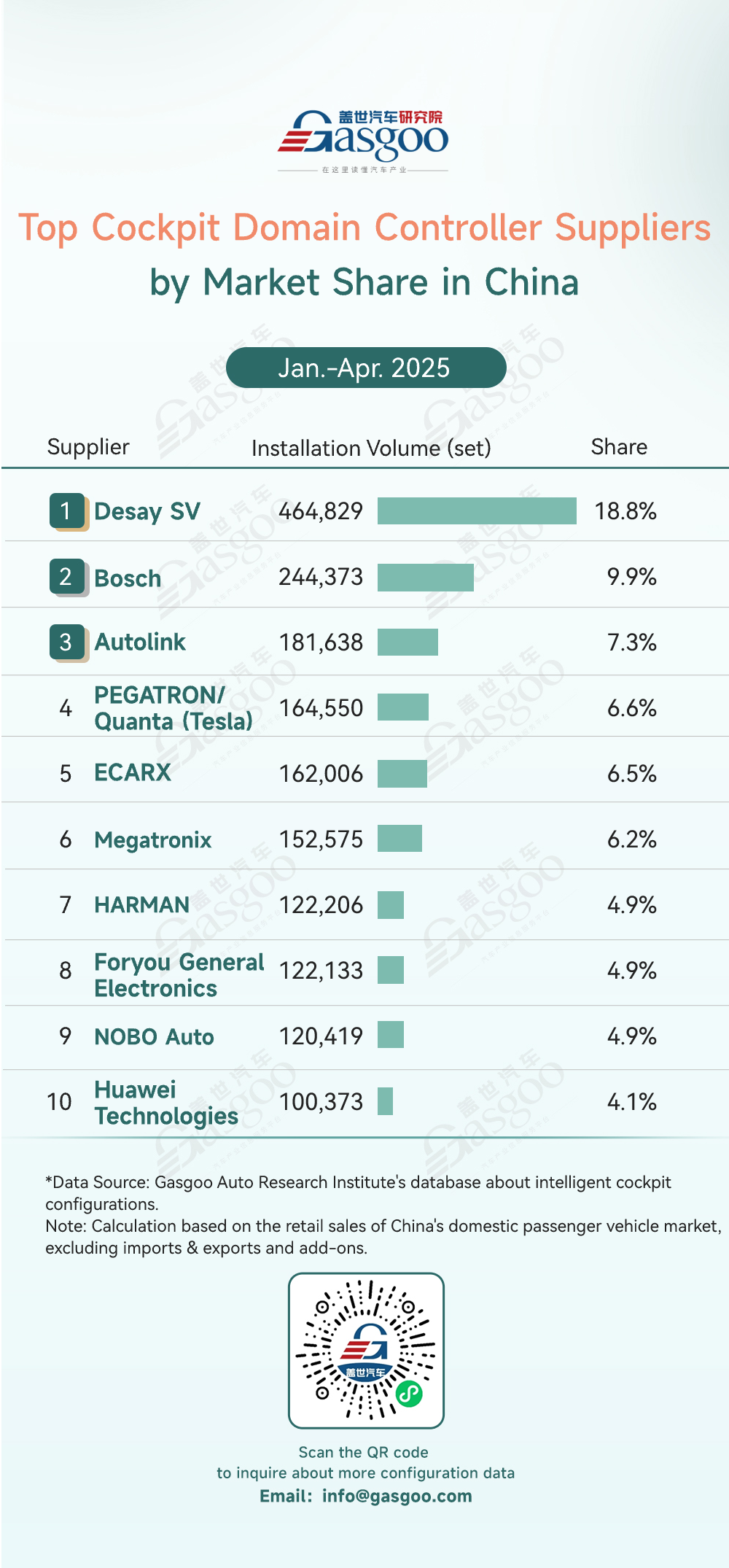

Top cockpit domain controller suppliers

With the rapid growth of the smart vehicle industry, cockpit domain controllers—essential for multi-screen interaction, intelligent voice, and vehicular network—are seeing fast-rising market penetration.

According to data compiled by the Gasgoo Automotive Research Institute, China's local suppliers have established a clear competitive edge in the cockpit domain controller market for the Jan.–Apr. 2025 period. Seven of the top 10 suppliers are Chinese companies, collectively holding a 52.7% market share. Desay SV leads the market with an 18.8% share, almost double that of second-place Bosch. Suppliers like Autolink, ECARX, and Megatronix have also secured top positions, driven by strong local service capabilities and rapid response.

Notably, Huawei Technologies is the only major tech player on the list without a dedicated automotive electronics subsidiary, yet its cockpit domain controllers have scaled up significantly, reflecting solid technical expertise and cross-industry integration. The top three suppliers each exceed 180,000 sets, highlighting a strong market concentration at the forefront.

The cockpit domain controller market is now at a critical stage of simultaneous technological evolution and rapid scaling. Chinese suppliers reshape the market by meeting local demands with flexible R&D, efficient customization, and competitive pricing. As smart cockpit capabilities advance, import substitution will gain momentum, propelling the industry into higher-value sectors.

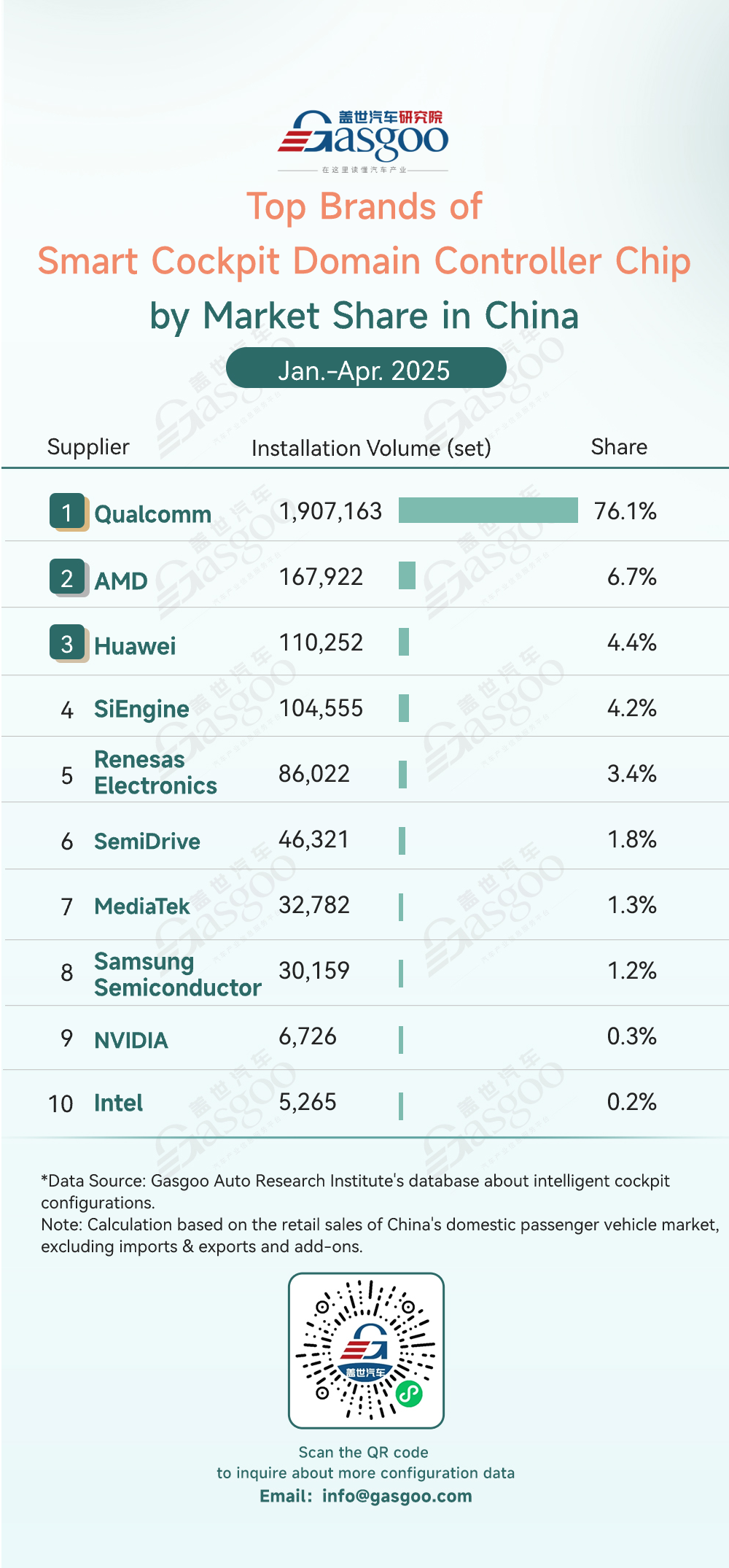

Top brands of smart cockpit domain controller chip

Smart cockpit domain controller chips, known as the "brain" of smart cockpits, directly determine the performance of in-car infotainment, voice interaction, and multi-screen coordination. According to the rankings below, Qualcomm leads the market with a 76.1% share (1,907,163 units installed). This not only highlights Qualcomm's strong technical foundation in cockpit chips but also shows its central role in the global automotive electronics supply chain.

In a market dominated by leading players, China's local suppliers are rapidly rising. Huawei, SiEngine, and SemiDrive have all secured positions in the top 10, collectively holding a 10.4% market share. Huawei ranks third with 110,252 units installed, closely followed by SiEngine with 104,555 units. Notably, SemiDrive, the only startup on the list, has 46,321 units installed, demonstrating strong momentum in technological innovation and market expansion.

Qualcomm's Snapdragon chips continue to be preferred by many automakers, supported by strong computing performance and a well-developed software ecosystem. At the same time, Chinese suppliers are gaining traction in specific segments by offering differentiated solutions. As smart cockpit functions have seen rising complexity, computing power, energy efficiency, and software adaptability will be crucial to shaping future market competition.

The cockpit domain controller chip market has now formed a "one dominant player among many strong contenders" landscape. Qualcomm leads the pack with its first-mover advantage and economies of scale, while Chinese chip suppliers are steadily closing the gap through sustained R&D and deep local market engagement, driving renewed competition in the smart vehicle sector.

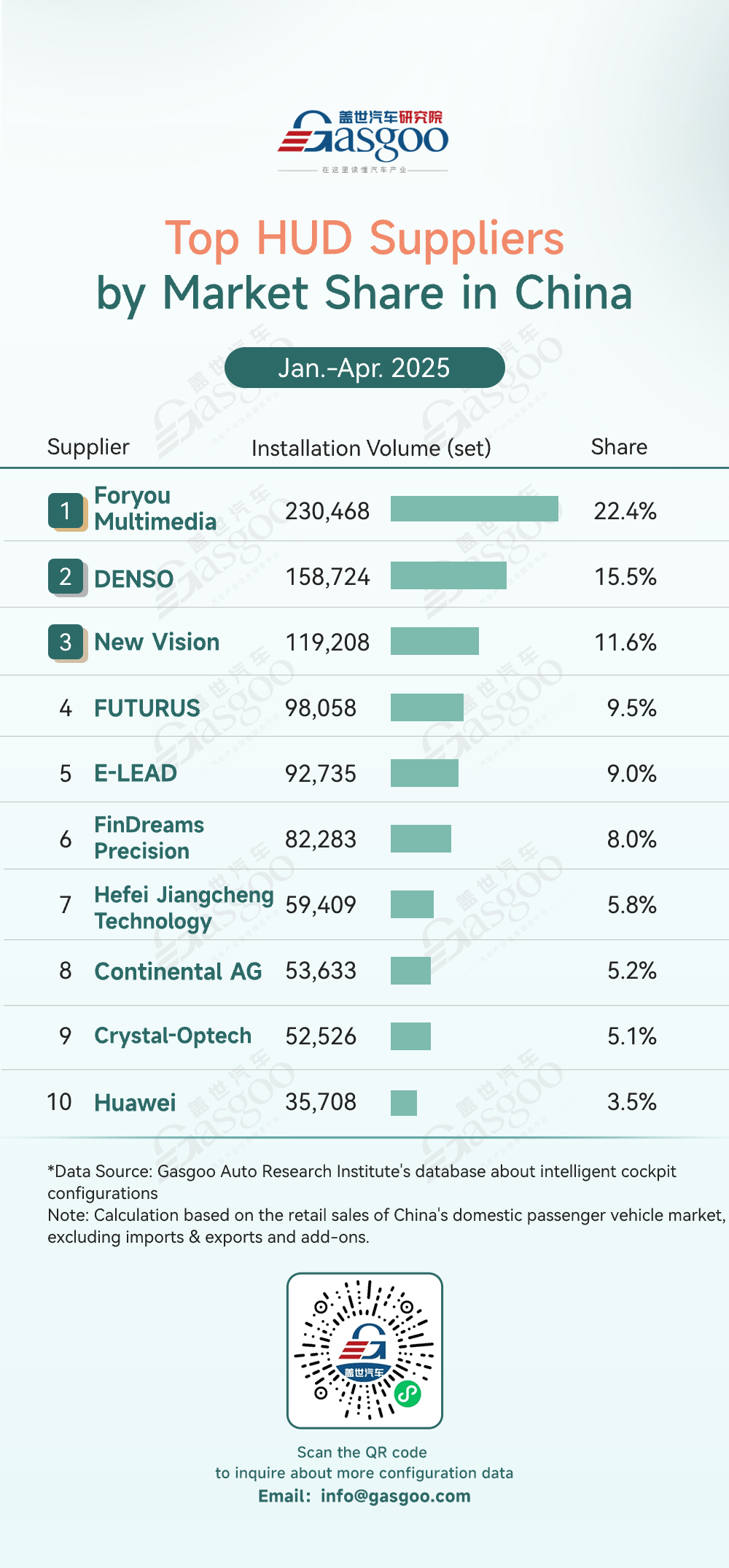

Top HUD suppliers

As smart cockpits push for more immersive interaction, head-up display (HUD) technology is rapidly gaining prominence in cockpit display systems. From January to April 2025, Chinese suppliers have taken a clear lead in the HUD market. Among the top 10, eight are Chinese suppliers—Foryou Multimedia, New Vision, FUTURUS, FinDreams Precision, E-LEAD, Hefei Jiangcheng Technology, Crystal-Optech, and Huawei—together securing 74.9% of the market. Foryou Multimedia ranks first with a 22.4% share, leading DENSO by about 72,000 sets.

Huawei has successfully secured a spot in the top 10 HUD suppliers (3.5% share). This milestone highlights the tech giant's strategic move into smart automotive components and shows its strengths in technology integration and ecosystem building.

Chinese suppliers have already achieved large-scale production of windshield head-up displays (W-HUD) and are quickly making breakthroughs in advanced technologies like augmented reality head-up displays (AR-HUD). In comparison, international suppliers such as DENSO and Continental AG remain focused on traditional joint-venture vehicle market, with a slower pace in technology upgrades and localization.

The HUD market is now undergoing a phase of both technological upgrades and cost optimization. Chinese suppliers are reshaping the competitive landscape with rapid response, localized services, and close collaboration with domestic carmakers. As demand for immersive experiences continues to grow, HUD adoption is expected to rise further, accelerating the localization of the supply chain.

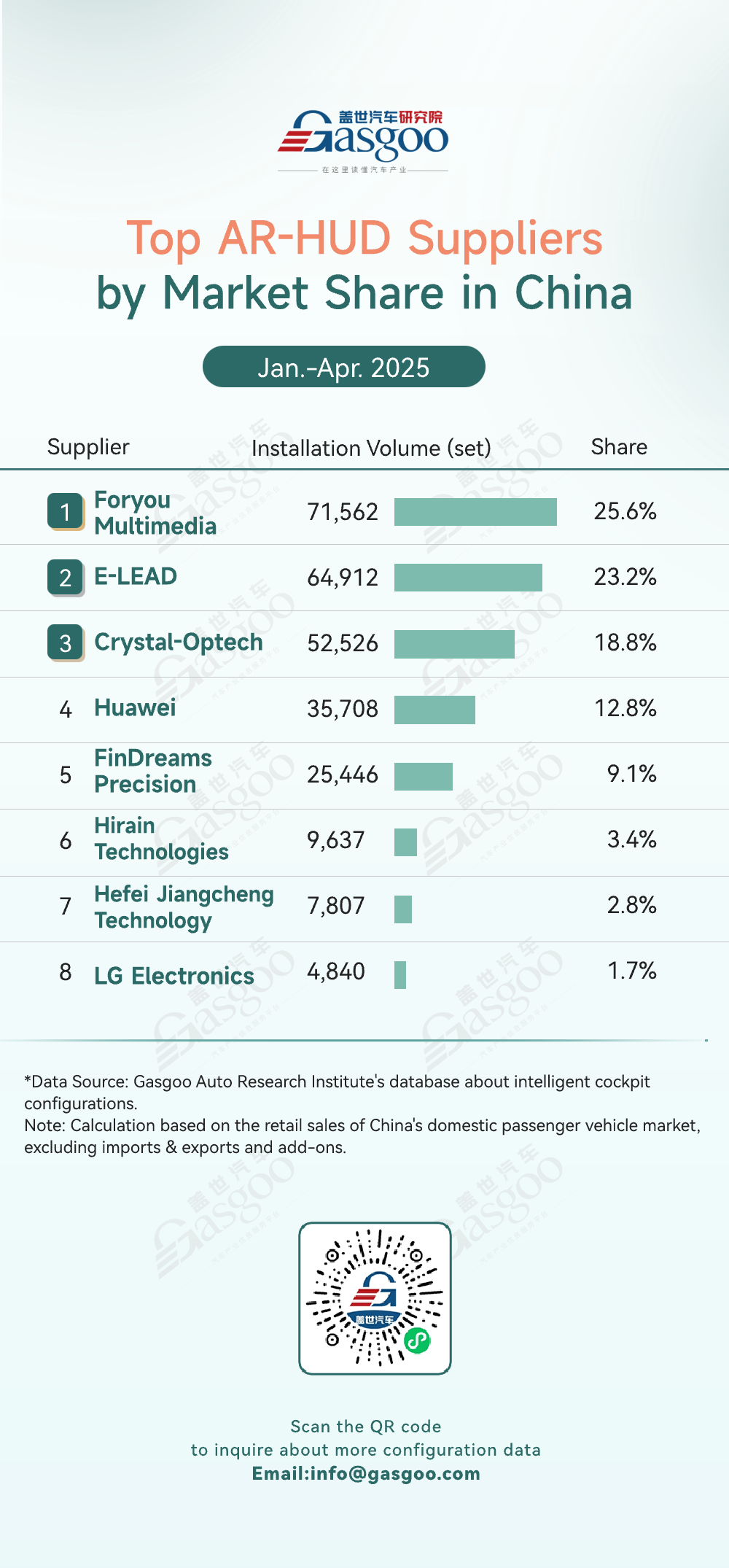

Top AR-HUD suppliers

According to the rankings of AR-HUD suppliers, Chinese brands have secured a dominant position in this field. Among the top eight suppliers, seven are local companies—Foryou Multimedia, E-LEAD, Crystal-Optech, Huawei, FinDreams Precision, Hirain Technologies, and Hefei Jiangcheng Technology—together holding 95.7% of the market, forming a near-monopoly driven by domestic substitution. Foryou Multimedia takes the lead with a 25.6% market share, followed by E-LEAD at 23.2% and Crystal-Optech at 18.8%. Together, these three companies account for over 67% of the market, forming a strong first-tier competitive barrier.

Technological breakthroughs are driving the rise of Chinese manufacturers in the AR-HUD market. Huawei, backed by strong optical expertise, captured a 12.8% market share (35,708 sets installed), becoming the fastest-growing supplier. FinDreams Precision, supported by BYD's vertically integrated system, achieved 25,446 sets of in-house installations, showing the strength of supply chain synergy.

The AR-HUD market is entering a critical phase of mass adoption. Chinese suppliers are reducing costs through localized supply chains, making AR-HUD products more affordable. This is accelerating the adoption of AR-HUD in mainstream vehicles and redefining the way drivers interact with the cockpit.

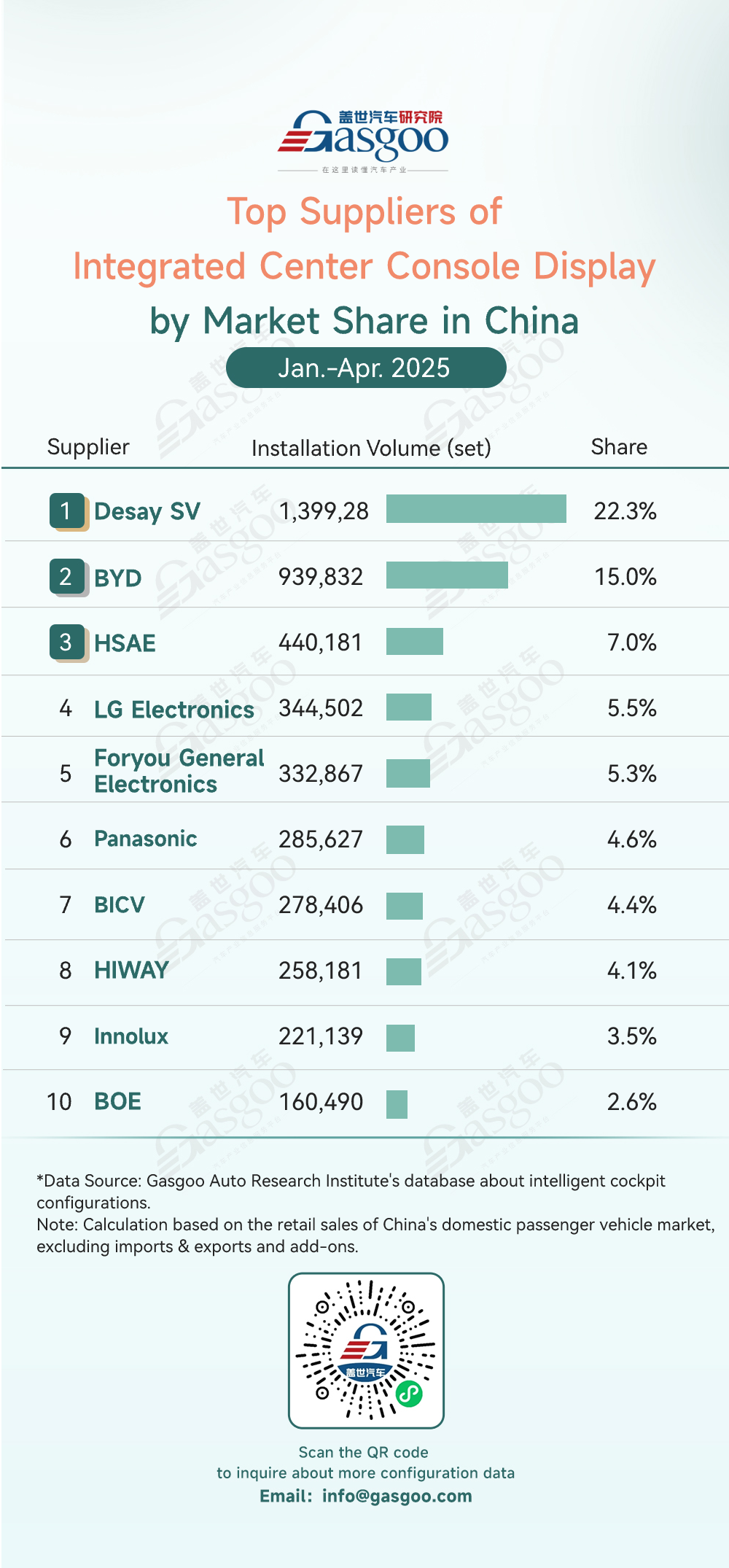

Top suppliers of integrated center console display

According to the rankings below, Chinese manufacturers have built a strong competitive edge in the integrated center console display sector. Seven Chinese companies—Desay SV, BYD, HSAE, Foryou General Electronics, BICV, HIWAY and BOE—together account for 60.7% of the top 10 market share, showing the strong rise of local players. Desay SV leads the market with a 22.3% share, installing nearly 460,000 more sets than second-place BYD, highlighting its large-scale capability.

Notably, BYD's vertically integrated approach has enabled it to have 939,832 sets installed, capturing a 15% market share and showing the distinct strengths of OEM-linked suppliers. HSAE, a veteran industry player, ranks third with 440,181 sets installed, leveraging its deep expertise in multi-screen integration as a core competitive edge.

Chinese suppliers lead the market due to technological advances. Desay SV has scaled up production of integrated curved displays, overcoming visual distortion with innovative lamination and optical adhesives. HIWAY uses Mini LED backlighting to deliver improved brightness uniformity and enhanced dynamic contrast. China's local suppliers have perfected integration technologies for key formats, delivering comprehensive solutions across the main price segments.

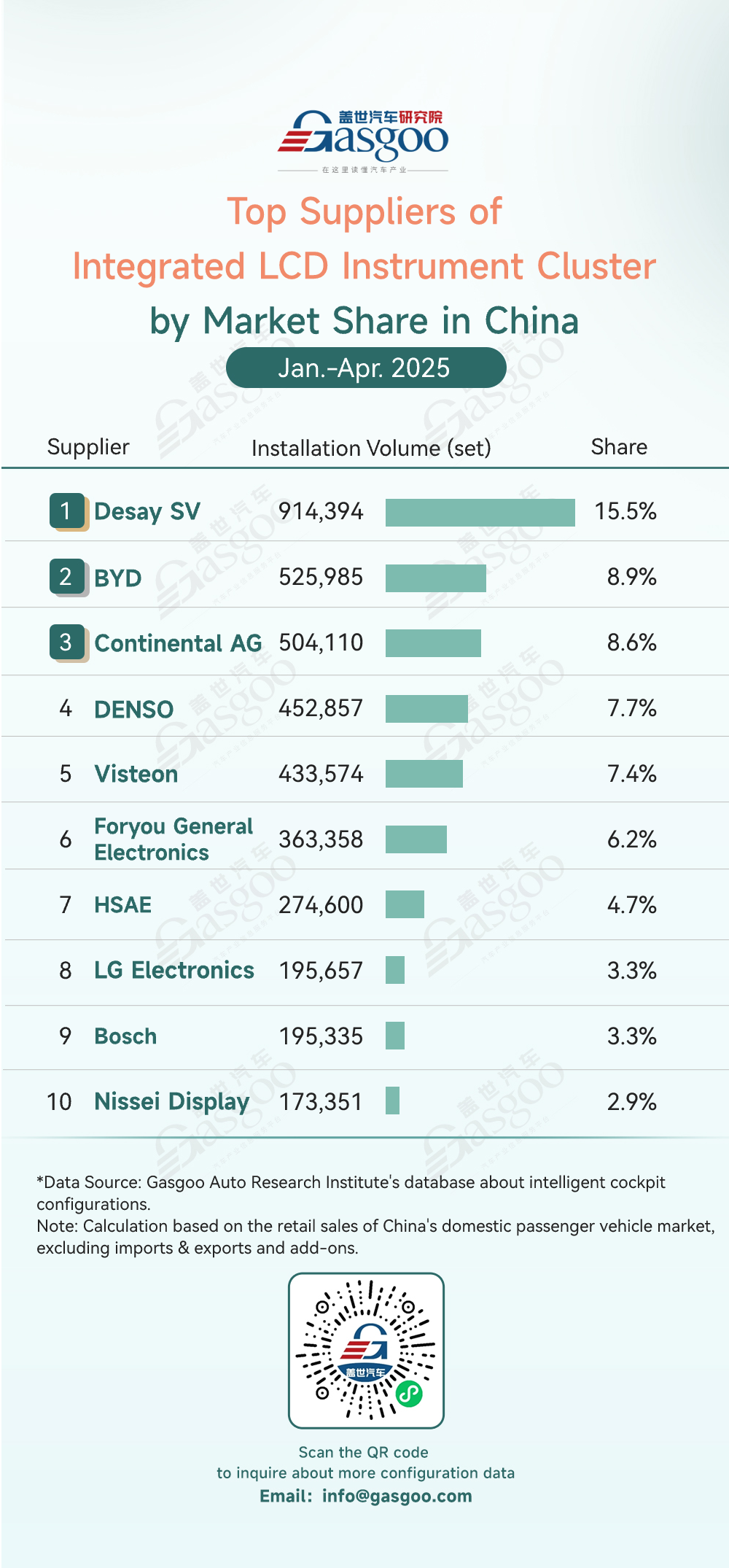

Top suppliers of integrated LCD instrument cluster

According to the rankings of integrated LCD instrument cluster suppliers below, the rapid digitalization of smart cockpits is reshaping the in-car display market. The rankings reflect the current competitive landscape: Desay SV takes the lead with a 15.5% market share (914,394 sets). BYD follows with an 8.9% share (525,985 sets), creating a strong two-leader dynamic among Chinese suppliers.

Among global suppliers, Continental AG, DENSO, and Visteon rank third to fifth, holding a combined market share of 23.7%. Notably, Chinese supplier Foryou General Electronics secures the sixth place with a 6.2% share (363,358 sets installed), showing strong growth momentum in the integrated LCD instrument cluster. HSAE, another key domestic player, ranks seventh with 274,599 sets, leveraging its deep expertise in all-digital instrument cluster solutions as a core competitive strength.

The integrated LCD instrument cluster market is now balancing technology upgrades with cost control. Suppliers are improving display performance while lowering system costs through SoC chip integration and software optimization. This is driving LCD clusters into more affordable vehicle segments, with some local manufacturers already supplying models priced around 100,000 yuan. As smart cockpits evolve, further integration and scenario-based design will be key to the next stage of competition.

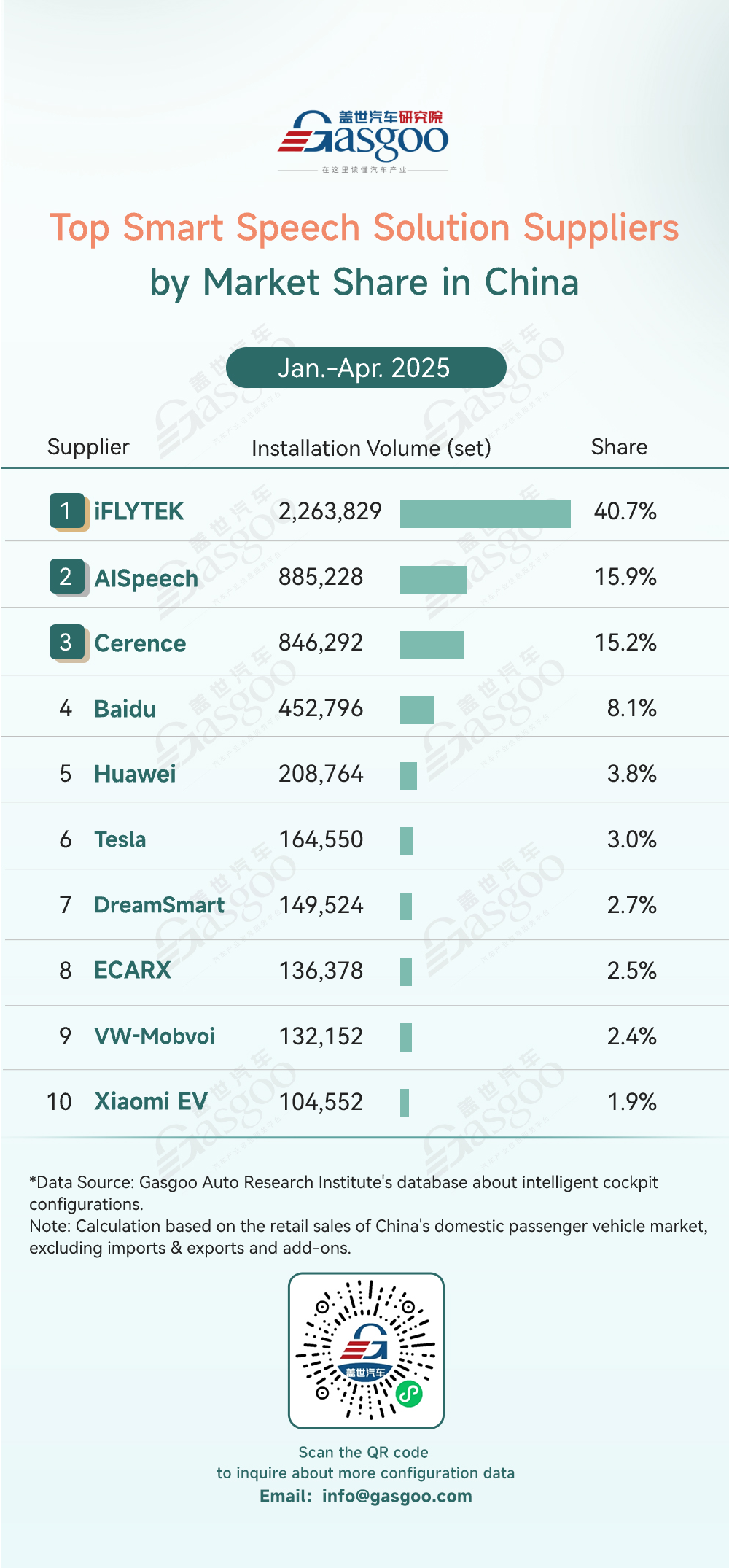

Top smart speech solution suppliers

The rankings of smart speech solution suppliers show that China's local suppliers have established a clear lead in the market. Seven Chinese companies—iFLYTEK, AISpeech, Baidu, Huawei, DreamSmart, ECARX, and Xiaomi EV—together hold 75.6% of the top 10 market share, creating a dominant domestic landscape. iFLYTEK tops the segment with a 40.7% market share, nearly 1.38 million sets ahead of second-place AISpeech, underscoring its strong technological dominance in the voice interaction space.

AISpeech ranks second with 885,228 sets installed (15.9% share), showing its strength in voice recognition. Baidu ranks fourth with 452,795 sets installed, with its Xiaodu system deployed across multiple vehicle models. Huawei builds a cross-terminal voice interaction loop based on HarmonyOS, while DreamSmart connects smartphone and car voice commands via Flyme Auto.

Technical breakthroughs become the core driver for Chinese suppliers leading the market. iFLYTEK's multimodal voice interaction system deeply integrates lip-reading with voice commands, maintaining over 95% recognition accuracy in an noisy environment even at a high speed of 120 km/h. Baidu empowers its voice interaction system with the ERNIE large language model, enabling contextual understanding and proactive suggestions, raising multi-turn dialogue coverage to 87%. AISpeech focuses on dialect recognition, with a dialect database covering 23 major dialects and a misrecognition rate controlled below 2%.

The smart speech solution market is now driven by China's local players and technological advancement. Chinese manufacturers are reshaping the technological ecosystem through three key strengths: rapid iteration for local scenarios to speed up dialect updates, large-scale interaction data to strengthen semantic understanding, and deep co-development with carmakers for fully customized voice solutions. This technology-data-ecosystem synergy is accelerating the shift toward more emotional and scenario-based in-car smart speech solution, redefining human-machine interaction in smart cockpits.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.