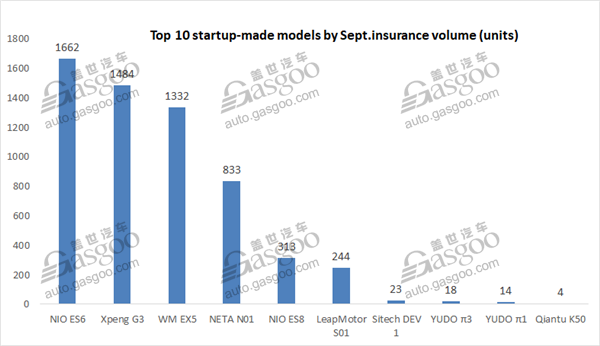

Top 10 Chinese-startup-built EV models by Sept. insurance registration

Shanghai (Gasgoo)- In September, Chinese consumers bought the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles (MLI) for a total of 5,930 vehicles made by Chinese startups, versus 5,061 units for the month of August, according to the China Insurance Regulatory Commission.

By the end of September, the insurance registration of startup-made vehicles amounted to 43,418 units.

Last month, automakers in China sold roughly 80,000 new energy vehicles (NEVs) across the country, plunging 34.2% year on year, which was also the third-month-in-a-row drop, said the China Association of Automobile Manufacturers (CAAM). Most EV-focused startups saw their Sept. deliveries climb over the former month, which were still far from their initial sales goal.

The top 3 startup-built models by the Sept. insurance volume—the NIO ES6, the Xpeng G3 and the WM EX5—accounted for around 76% of total number. The NIO ES6 regained the championship, while the Aug. champion WM EX5 dropped to the second runner-up place. Surviving the transition period following the new model's product, the Xpeng G3 moved up to the runner-up place.

With reference to Jan.-Sept. performance, WM Motor maintained its No.1 place from a month earlier, while only outnumbered NIO by 223 units who owns two established models. Xpeng Motors eventually saw its vehicle insurance registration exceed 10,000 units after three quarters of a year passed.

Let's review the performances of the top 3 startups by Sept. volume.

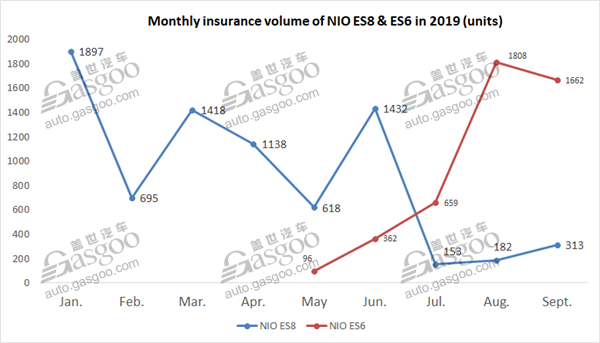

NIO

The insurance volume of NIO's ES6 and ES8 totaled 12,433 units through September, completing 31% of its 40,000-unit annual target.

According to NIO's latest financial report, the high-profile startup gained revenue of RMB1,508.6 million in the second quarter of 2019, of which vehicle sales fell 7.9% month on month, while zoomed up 3,086% year on year to RMB1,414.5 million. Vehicle margin was negative 24.1%, compared with negative 7.2% in the first quarter of 2019. Excluding accrued recall costs, vehicle margin in the second quarter was negative 4.0%.

(Photo source: NIO)

“Starting October, we will begin delivering the ES6 and ES8 with an 84-kWh battery pack, extending their NEDC driving range to 510 km and 430 km,” said William Bin Li, founder, chairman and chief executive officer of NIO.

NIO will continue to strive to expand market penetration in an environment of softer macro economy and auto market climate and enhance sales by strengthening value proposition through technology advancement, William Li added.

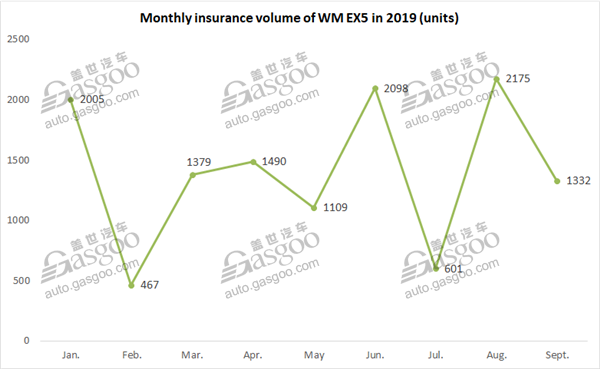

WM Motor

WM Motor was the champion in terms of cumulative number despite the month-over-month decline, whereas there is still a long road to its 100,000-unit yearly delivery goal.

To promote the simultaneous growth of product, brand image and sales channels, the startup has implemented a series of adjustments over its executive structure and strategic plan. According to a previous internal e-mail, effective September 1, 2019, WM Motor’s founder and CEO Freeman Shen has additionally served as the general manager of its sales company.

(Photo source: WM Motor)

In addition, Wang Xin, former Chief Marketing Officer (CMO) of the Chinese online used car transaction platform Uxin Group, has joined WM Motor as Chief Growth Officer, according to an internal e-mail released on Sept. 25 by Freeman Shen.

The startup has been strengthening onslaught in mobility service realm. By joining hands with the carsharing platform GoFun, WM Motor intends to explore a new retail business model that can enriches consumers' demands with a much easier communication method.

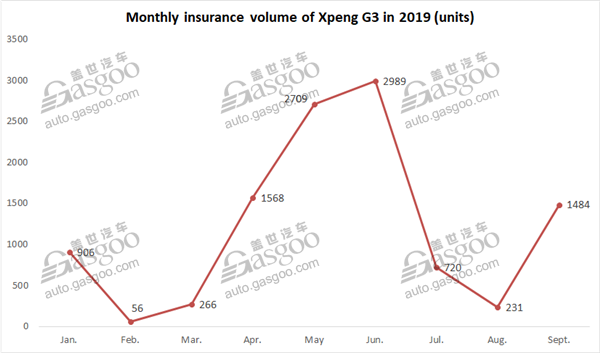

Xpeng Motors

Xpeng Motor's auto insurance registration slumped to 231 units in August after the G3 2020 hitting the market in July. Going through a period for clearing the inventories of the old G3 and kicking off the new model's delivery, the startup saw deliveries evidently grow last month.

The Guangzhou-based EV manufacturer is quickly pressing ahead with its sales channel deployment with over 120 off-line sales outlets expected to be operated by the end of 2019.

(Photo source: Xpeng Motor's WeChat account)

To offer users convenient and safe charging services, Xpeng Motor works on weaving its own charging network. The company said on September 26 the first flagship supercharger station jointly built with TELD, a Chinese leading charging pile operator, had been formally put into operation, a groundbreaking cooperation between Chinese EV startups and charging network operators.

Located in Shibei District of Qingdao, the significant supercharger station is surrounded by large residential quarters, shopping malls and office buildings and is equipped with 20 parking lots for to-be-charged vehicles, said the startup.

Moreover, the EV maker is ready to start the presale of its second mass-produced model, the Xpeng P7, at the forthcoming Guangzhou International Automobile Exhibition 2019 and begin the delivery in the second quarter next year.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com