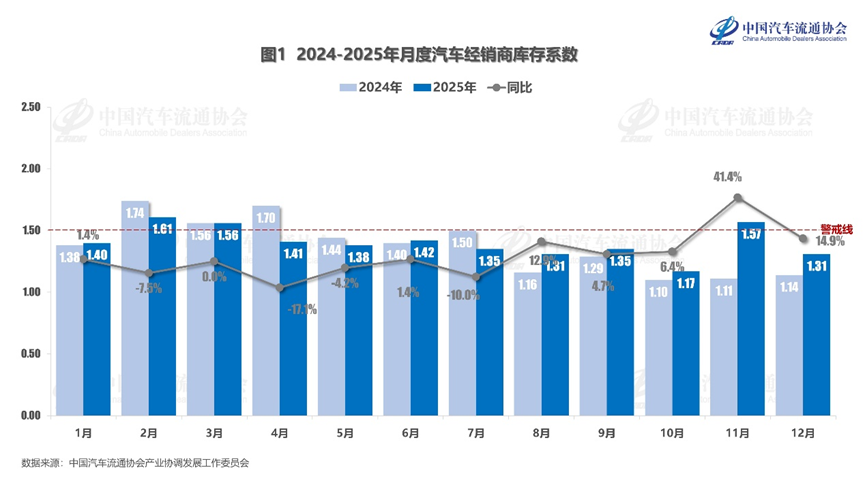

Shanghai (Gasgoo)- On January 13, 2026, data released by the China Automobile Dealers Association showed the composite inventory coefficient for auto dealers stood at 1.31 in December 2025 — down 16.6% from November but up 14.9% from a year earlier. Inventory levels were below the warning line yet above the reasonable range. Based on retail passenger-car sales of 2.261 million that month, total dealer inventory at end-December was roughly 3 million units.

Image source: China Automobile Dealers Association

The usual year-end bounce failed to materialize in December, with retail demand staying soft. Carmakers and local governments rolled out cross-year purchase-tax top-up subsidies and special consumption vouchers, yet sales still fell short of targets. The main drag was a wait-and-see mood among buyers: after authorities signaled that optimized “two upgrades” policies — trade-in and scrappage programs — would continue into 2026, some consumers postponed replacement plans; and a new rule that took effect on December 30 shifted passenger-car subsidies to a percentage of vehicle price, further diluting year-end urgency and weighing on retail sales. Even so, dealers pursued a “lighten-the-load for the holidays” approach, cutting stock levels and improving the mix.

According to the association, as policies shifted at year-end most automakers adopted a cautious wholesale stance, helping industry inventory pull back from November and easing pressure on some high-inventory brands. Even so, year-end dealer subsidy schemes at certain manufacturers indirectly pushed inventories higher, while chatter about policy extensions amplified consumer hesitation — a mix that produced temporary swings in inventory structure. In light of this, the association will not name high-inventory brands separately this month and urged them to tighten inventory management, pace supply more carefully, and bring stock back to a reasonable range.

Looking ahead to January 2026, expectations are improving. The rollout of trade-in and scrappage upgrade policies is moving markedly faster than a year earlier, shortening the policy gap while keeping subsidies for mainstream models intact — up to CNY 20,000 for scrapping and replacing with an NEV, and up to CNY 15,000 for trading in for an NEV — easing consumer hesitation. With the Spring Festival schedule pushed back, the pre-holiday buying window is longer; coupled with purchase-tax backstops taking effect for some NEV models, the association expects the market to start the year on a strong footing.

The association advised dealers to stay disciplined amid uncertainty: gauge demand prudently, step up promotion of the trade-in and scrappage programs, lift service quality to bolster consumer confidence, and keep cost reduction and efficiency at the core to guard against operating risks.