Gasgoo Munich - BMW has officially launched the 2026 iX1, its all-electric compact SUV, with a starting price of CNY 228,000. Yet across multiple platforms, dealers are already listing it at just over CNY 160,000 — a case of "discounts upon launch." That price gap highlights the very real pressure BMW’s electric lineup faces in today’s market.

A key pillar in BMW’s EV matrix, the 2026 iX1 focuses largely on configuration upgrades for this annual refresh, aiming to hold its ground as competition intensifies in the luxury compact electric SUV segment.

The rollout underscores BMW’s continued tech iteration, yet it also mirrors deeper challenges in its China energy transition: market acceptance, maintaining a pricing structure, and fierce rivalry from local startups.

In many ways, the debut and pricing of the 2026 iX1 serve as a vivid snapshot of BMW’s new energy strategy playing out in China.

Annual Refresh: What’s New?

The 2026 iX1 carries an official guide price ranging from CNY 228,000 to 268,000. Positioned as a compact electric SUV, it is essentially the battery-powered derivative of the combustion-engine X1, targeting urban drivers seeking luxury and electric mobility. It goes head-to-head with the Audi Q4 e-tron and Mercedes EQA.

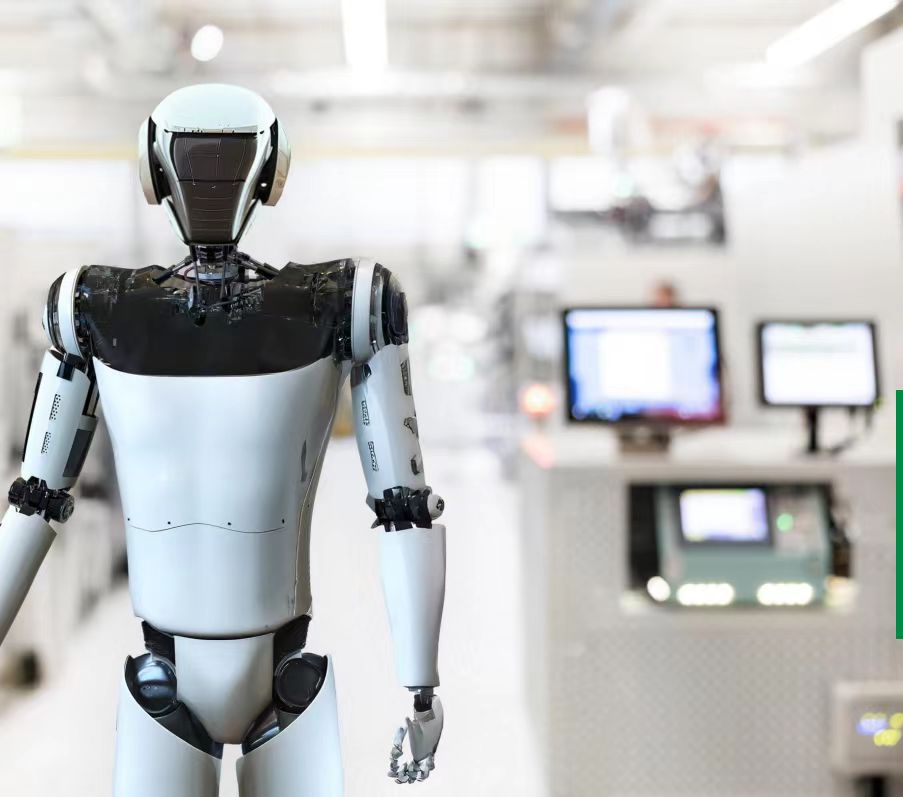

Image Source: BMW

Visually, the changes aren’t radical. The car sticks to BMW’s signature design language, featuring a large closed-off kidney grille with diamond-patterned mesh and chrome trim — signaling its electric identity while keeping the brand’s classic look.

Side lines are fluid, with a waistline stretching from nose to tail. Semi-hidden door handles cut wind resistance without sacrificing practicality, complemented by various wheel options and colors like Skyscraper Grey and Star Twilight Blue.

Measuring 4,616 mm long, 1,845 mm wide, and 1,641 mm tall, the iX1 boasts a 2,802 mm wheelbase that ensures ample interior space. The five-seat layout handles family duties well, with rear legroom and cargo capacity ranking above average for the class — striking a balance between comfort and utility.

Inside, the highlight is a dual-screen setup combining a 10.25-inch digital cluster and a 10.7-inch central display. Running the latest BMW iDrive 9 system, it offers improved logic, faster response, and richer features, integrating navigation, entertainment, and vehicle controls.

Image Source: BMW

Configuration upgrades are central to this refresh. All models now come standard with 5G connectivity, significantly boosting data speeds for online navigation, music streaming, and remote controls — addressing previous user complaints about network lag.

On the driver-assist front, standard features include front and rear parking sensors, a reversing camera, lane-keeping assist, lane-change assist, and reversing assist — all designed to aid daily driving and parking, enhancing both safety and convenience.

Powertrain options include two versions, both powered by a 66.5 kWh ternary lithium battery. The eDrive25L features a front-mounted single motor with 204 horsepower and 250 Nm of torque, delivering a CLTC range of 510 km — sufficient for city commuting and short trips.

The xDrive30L employs a dual-motor, all-wheel-drive setup, generating 313 horsepower and 494 Nm of torque. With stronger performance but higher energy consumption, its CLTC range drops to 450 km, catering to those demanding extra power.

Are BMW EV Sales Tanking?

Even with the 2026 iX1’s upgrades and its bid to shore up market position via improved product specs, the launch struggles to reverse BMW’s sluggish energy transition in China, where deep-rooted challenges persist.

Lagging updates have worsened its competitive disadvantage. The iX3, for instance, hasn’t seen a generational overhaul since the 2022 model, relying on an aging platform to fight a market where tech and consumer tastes are evolving fast. Its looks, interior, and range are increasingly overshadowed by rivals, and market interest is waning.

The 2026 iX1 is merely an annual update; with no fundamental changes to core design or powertrain, minor configuration tweaks are unlikely to deliver a breakthrough. This reflects the slow pace of BMW’s EV R&D and iteration.

Image Source: BMW

Pricing imbalances are hitting both brand value and sales volume. The 2026 iX1 starts officially at CNY 228,000, yet dealers are asking just over CNY 160,000 — a markdown exceeding CNY 60,000. The i3, listed at CNY 353,900, is selling as low as CNY 191,900, a cut of nearly CNY 160,000. The i5’s CNY 439,900 sticker has slid to CNY 281,600, while the long-in-the-tooth iX3 also carries heavy incentives.

Such steep discounts suggest official pricing is detached from market realities, offering poor value without incentives. Worse, frequent, deep cuts can erode trust in brand value, triggering a "wait for a lower price" mentality that further drags down sales.

The fallout is bleak sales figures. Monthly data for 2025 shows the iX1 moving just over 1,000 units, while the i3 manages around 2,000 — a chasm compared to blockbusters like the Tesla Model 3. The iX3 and i5 are stuck in the three-digit range, effectively marginalized in the luxury electric SUV market.

Notably, these dismal numbers are achieved *with* heavy dealer subsidies. Strip away the discounts, and the performance would be even grimmer, underscoring the extremely low market acceptance of BMW’s EVs and a lack of consumer buy-in for its energy transition.

The core shortfall lies in insufficient tech focus and a sluggish market response. BMW hasn’t prioritized the EV market enough, leaving both R&D and market reaction trailing industry leaders.

Several electric models are conversions of internal combustion engine platforms rather than built on dedicated EV architectures. Consequently, they struggle to match native EVs in space utilization, range efficiency, and intelligent integration.

BMW has also misread Chinese consumer needs. Improvements in smart features, localized infotainment, and range optimization have been slow. Compared to the rapid iteration of Chinese brands, BMW’s EV upgrades feel like a drop in the bucket.

Furthermore, BMW has failed to establish a differentiated advantage in charging networks or user service experiences. These combined factors have left its new energy transition in China stuck in a deep rut.