From Jan.–Nov. 2025, China's smart cockpit component market showed clear concentration and localization. China's local suppliers led in cockpit domain controllers, displays, HUD/AR-HUD, and voice systems. Desay SV, Foryou Multimedia, and iFLYTEK remained the top players in their respective segments. Qualcomm still dominated cockpit domain controller chips, but Huawei Technologies and SiEngine gained market share, signaling faster localization.

At the same time, AR-HUD adoption is accelerating and smart display penetration continues to rise, pushing cockpit technology competition into the "deep water." Traditional Tier-1 suppliers, tech companies, OEM in-house teams, and emerging supply chain players are engaging in multi-dimensional competition. While China's local substitution deepens, the industry is moving toward clearer technology tiers, deeper ecosystem integration, and stronger differentiation, laying a solid foundation for sustained growth in the smart cockpit sector.

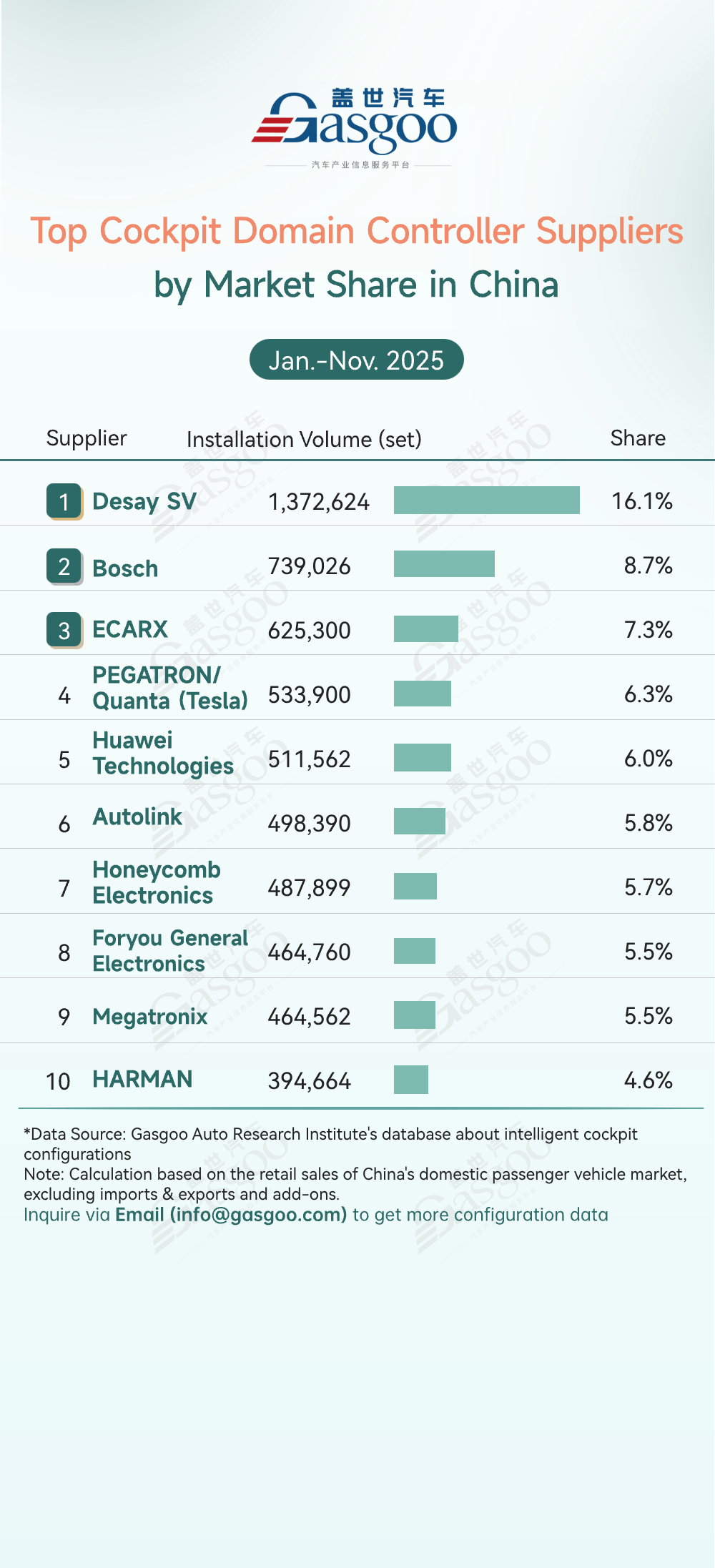

Top cockpit domain controller suppliers

Desay SV: 1,372,624 sets installed, 16.1% market share

Bosch: 739,026 sets installed, 8.7% market share

ECARX: 625,300 sets installed, 7.3% market share

PEGATRON/Quanta (Tesla): 533,900 sets installed, 6.3% market share

Huawei Technologies: 511,562 sets installed, 6.0% market share

Autolink: 498,390 sets installed, 5.8% market share

Honeycomb Electronics: 487,899 sets installed, 5.7% market share

Foryou General Electronics: 464,760 sets installed, 5.5% market share

Megatronix: 464,562 sets installed, 5.5% market share

HARMAN: 394,664 sets installed, 4.6% market share

From January to November, cockpit domain controller market penetration accelerated, and under the trend of integration, domestic suppliers continued to consolidate their leading position. Desay SV led the pack strongly with over 1.37 million sets installed (16.1% share), further widening its lead. Bosch followed with an 8.7% share, and together the two formed the market's first tier.

ECARX, PEGATRON/Quanta (Tesla), Huawei Technologies and other players performed steadily, holding market shares in the 6%–7.3% range and forming the second tier. Notably, Foryou General Electronics and Megatronix achieved identical market shares, reflecting both the narrowing strength gap among China's local suppliers and the intensifying competition between traditional Tier-1s and tech companies. Meanwhile, the participation of PEGATRON and Quanta within Tesla's supply chain, combined with the entry of tech players such as Huawei Technologies, is further driving the market toward a more diversified competitive landscape.

Overall, with cockpit domain controller penetration steadily rising and smartization demand continuing to expand, leading suppliers maintain their advantage through scale and technological accumulation, while Chinese suppliers further strengthen their market influence. International Tier-1s, tech companies, and emerging supply chain players are actively competing across multiple dimensions, driving the industry toward greater intelligence and integration. The market remains highly concentrated, yet the competitive ecosystem is increasingly diverse, with clear differentiation and strong growth momentum.

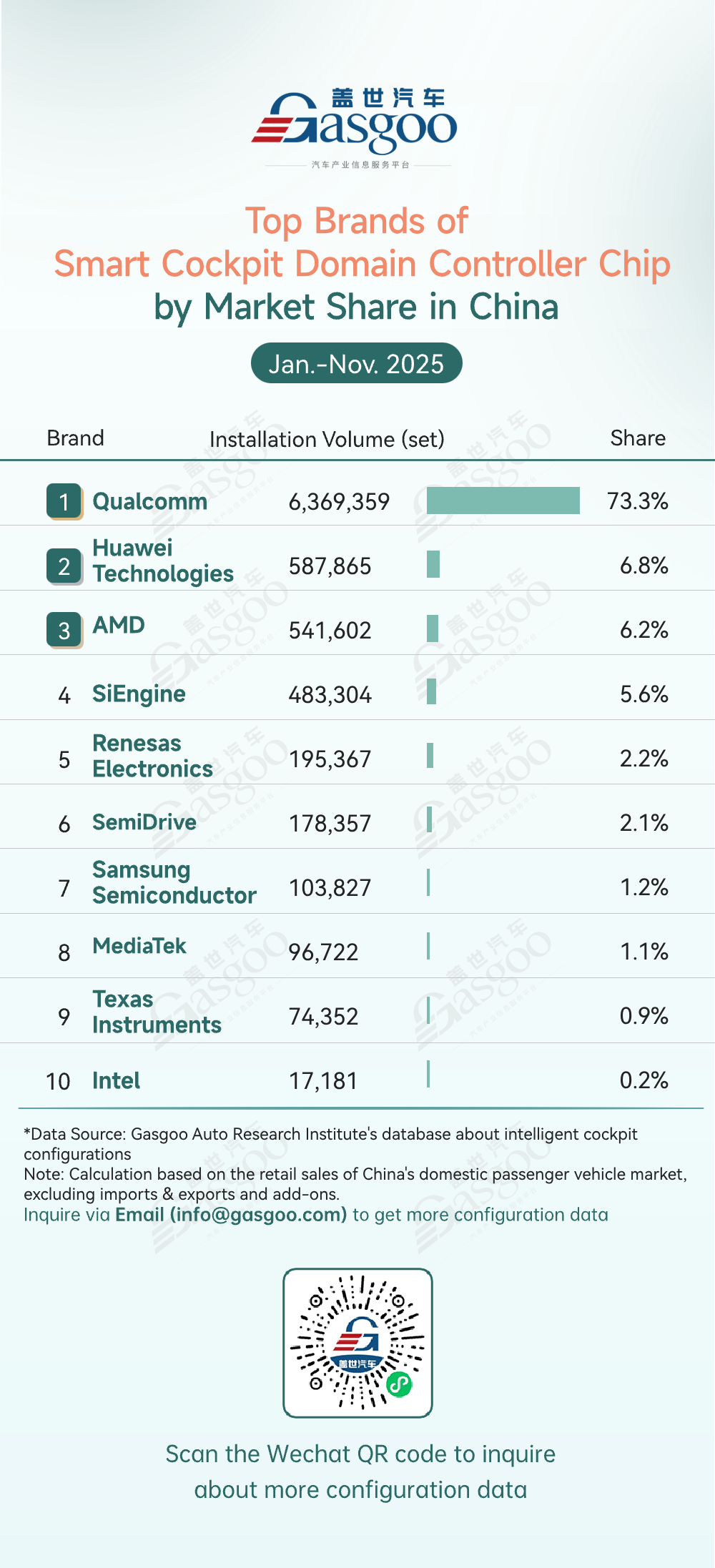

Top brands of smart cockpit domain controller chip

Qualcomm: 6,369,359 units installed, 73.3% market share

Huawei Technologies: 587,865 units installed, 6.8% market share

AMD: 541,602 units installed, 6.2% market share

SiEngine: 483,304 units installed, 5.6% market share

Renesas Electronics: 195,367 units installed, 2.2% market share

SemiDrive: 178,357 units installed, 2.1% market share

Samsung Semiconductor: 103,827 units installed, 1.2% market share

MediaTek: 96,722 units installed, 1.1% market share

Texas Instruments: 74,352 units installed, 0.9% market share

Intel: 17,181 units installed, 0.2% market share

From January to November, the cockpit domain controller chip market remained highly concentrated, with China's local chip share steadily rising. Qualcomm continued to dominate with over 6.36 million units installed (3.3% share ), thanks to its mature technology and strong supply chain. Huawei Technologies ranked second with 6.8%, while local players such as SiEngine and SemiDrive also saw growth in both installation volume and market share, reflecting stronger competitiveness.

Overall, Qualcomm's leading position is likely to remain stable in the short term. However, rapid technological progress and faster market penetration by domestic chips are accelerating the localization of cockpit domain controller chips. As China's local manufacturers continue to strengthen their performance and cost competitiveness, the market is expected to move away from a single dominant player. The industry will evolve through multi-party competition toward smarter solutions that better meet China's local cockpit requirements.

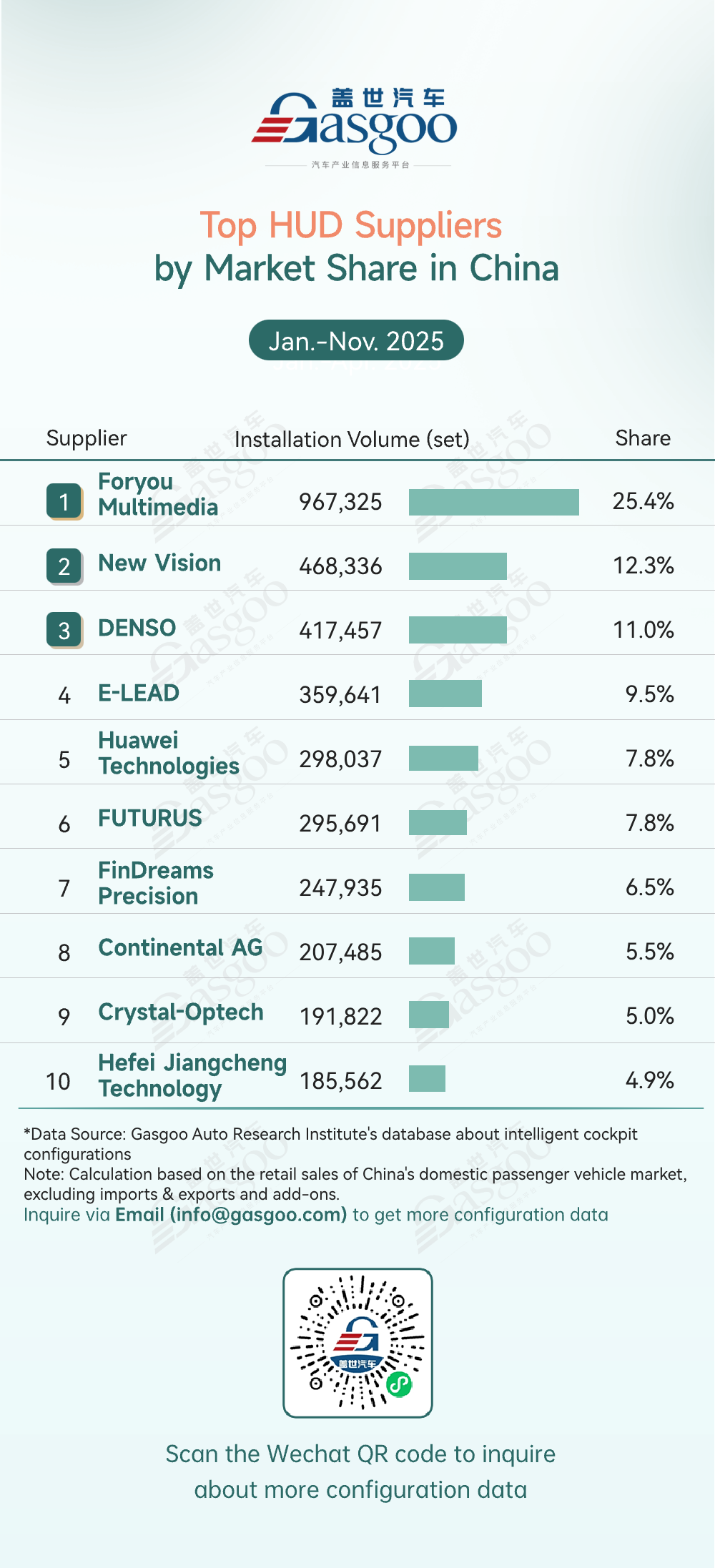

Top HUD suppliers

Foryou Multimedia: 967,325 sets installed, 25.4% market share

New Vision: 468,336 sets installed, 12.3% market share

DENSO: 417,457 sets installed, 11.0% market share

E-LEAD: 359,641 sets installed, 9.5% market share

Huawei Technologies: 298,037 sets installed, 7.8% market share

FUTURUS: 295,691 sets installed, 7.8% market share

FinDreams Precision: 247,935 sets installed, 6.5% market share

Continental AG: 207,485 sets installed, 5.5% market share

Crystal-Optech: 191,822 sets installed, 5.0% market share

Hefei Jiangcheng Technology: 185,562 sets installed, 4.9% market share

From January to November, the HUD market continued to expand as in-vehicle displays became more widely adopted, showing a pattern of domestic leadership and diverse competition. Foryou Multimedia led strongly with 967,325 sets installed (25.4% share), further strengthening its advantage. New Vision and DENSO followed with 12.3% and 11.0% shares respectively, making competition within the top tier increasingly intense. E-LEAD ranked in the mid-tier with a 9.5% share, while Huawei Technologies and FUTURUS were tied. China's local players such as FinDreams Precision competed alongside traditional international Tier 1 suppliers like Continental AG, highlighting the diverse mix of participants in the HUD track.

As cockpit adoption rises, HUD suppliers must keep advancing AR-HUD technology, improve vehicle ecosystem compatibility, and scale up delivery. The market shows a clear mix of competition and cooperation: local firms leverage cost and responsiveness, international Tier 1s rely on manufacturing strength, and tech companies drive scenario innovation. Together, they are pushing HUDs toward smarter, more user-friendly solutions, fueling continued growth in in-vehicle displays.

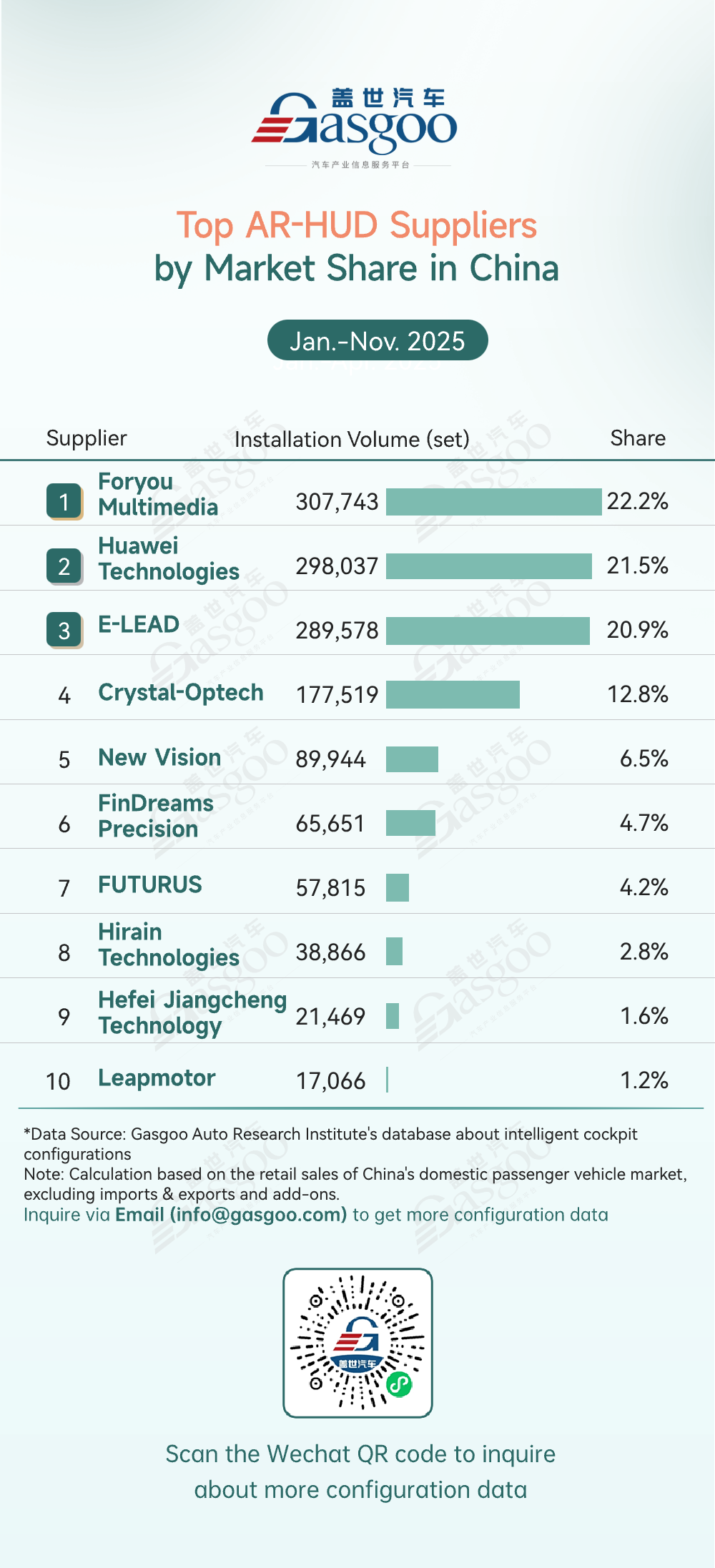

Top AR-HUD suppliers

Foryou Multimedia: 307,743 sets installed, 22.2% market share

Huawei Technologies: 298,037 sets installed, 21.5% market share

E-LEAD: 289,578 sets installed, 20.9% market share

Crystal-Optech: 177,519 sets installed, 12.8% market share

New Vision: 89,944 sets installed, 6.5% market share

FinDreams Precision: 65,651 sets installed, 4.7% market share

FUTURUS: 57,815 sets installed, 4.2% market share

Hirain Technologies: 38,866 sets installed, 2.8% market share

Hefei Jiangcheng Technology: 21,469 sets installed, 1.6% market share

Leapmotor: 17,066 sets installed, 1.2% market share

From January to November, AR-HUD adoption accelerated, with China's local suppliers dominating a highly concentrated market. Foryou Multimedia led the pack with 307,743 sets (22.2% share), followed by Huawei Technologies (21.5%) and E-LEAD (20.9%), together holding over 64% of the market. Crystal-Optech ranked fourth with 12.8%. New Vision and FinDreams Precision focused on niche scenarios and ecosystem collaboration, while Leapmotor's entry as an automaker added a new dimension to competition, further enriching the market landscape.

Overall, the AR-HUD market is now firmly dominated by China's local players, with production capability and cost control forming the key competitive barriers. The industry is in a critical phase of rapid adoption and ongoing consolidation. With advantages such as local responsiveness and strong technical adaptability, China's local suppliers remain the main engine driving market expansion and technological upgrades, and will continue to make AR-HUD a key differentiating feature in in-vehicle displays.

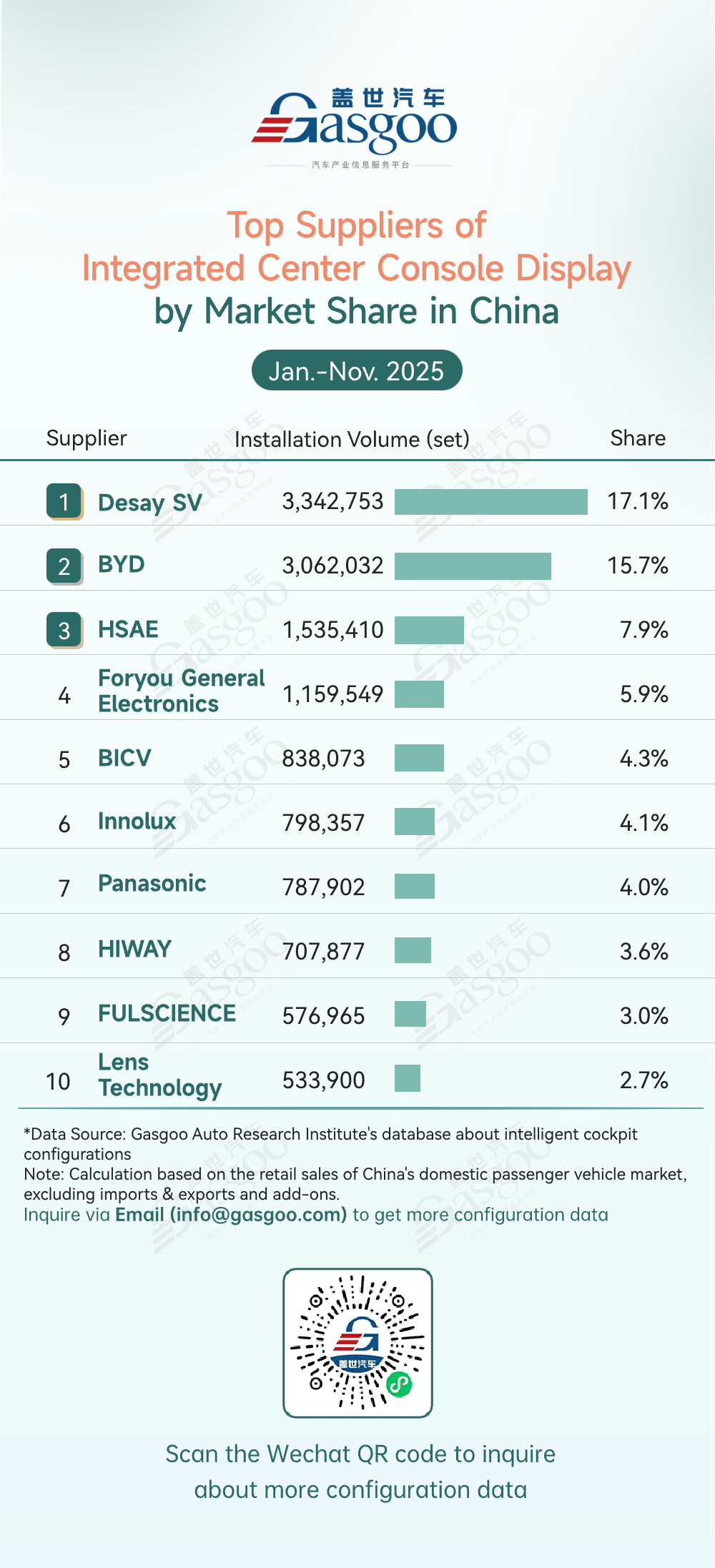

Top suppliers of integrated center console display

Desay SV: 3,342,753 sets installed, 17.1% market share

BYD: 3,062,032 sets installed, 15.7% market share

HSAE: 1,535,410 sets installed, 7.9% market share

Foryou General Electronics: 1,159,549 sets installed, 5.9% market share

BICV: 838,073 sets installed, 4.3% market share

Innolux: 798,357 sets installed, 4.1% market share

Panasonic: 787,902 sets installed, 4.0% market share

HIWAY: 707,877 sets installed, 3.6% market share

FULSCIENCE: 576,965 sets installed, 3.0% market share

Lens Technology: 533,900 sets installed, 2.7% market share

From January to November, the dominance of domestic suppliers in the central control screen market became increasingly clear. Desay SV led the pack with 3,342,753 sets installed (17.1% market share), maintaining a strong leading position. BYD followed closely with 3,062,032 sets (15.7% share), leveraging its vehicle ecosystem synergy. Together, the two accounted for over 32% of the market, forming the "top domestic duo" in central control screen integration.

HSAE ranked third with a 7.9% share. Foryou General Electronics, BICV, Innolux, and Panasonic continued to push forward with shares between 4% and 5.9%, solidifying their market positions. China's local players such as HIWAY, FULSCIENCE, and Lens Technology each held under 4% and competed through niche scenarios and cost optimization, making the market more diverse.

Overall, China's local substitution in the central control screen sector has entered a stage of stable deepening, with production scale and cost control becoming the core barriers for suppliers. The industry is advancing configuration adoption driven by leading players, while niche suppliers are improving user experience through differentiated offerings. Chinese strength remains the main engine pushing this track forward, continuously upgrading the central control screen—now a cockpit standard—into a more competitive component.

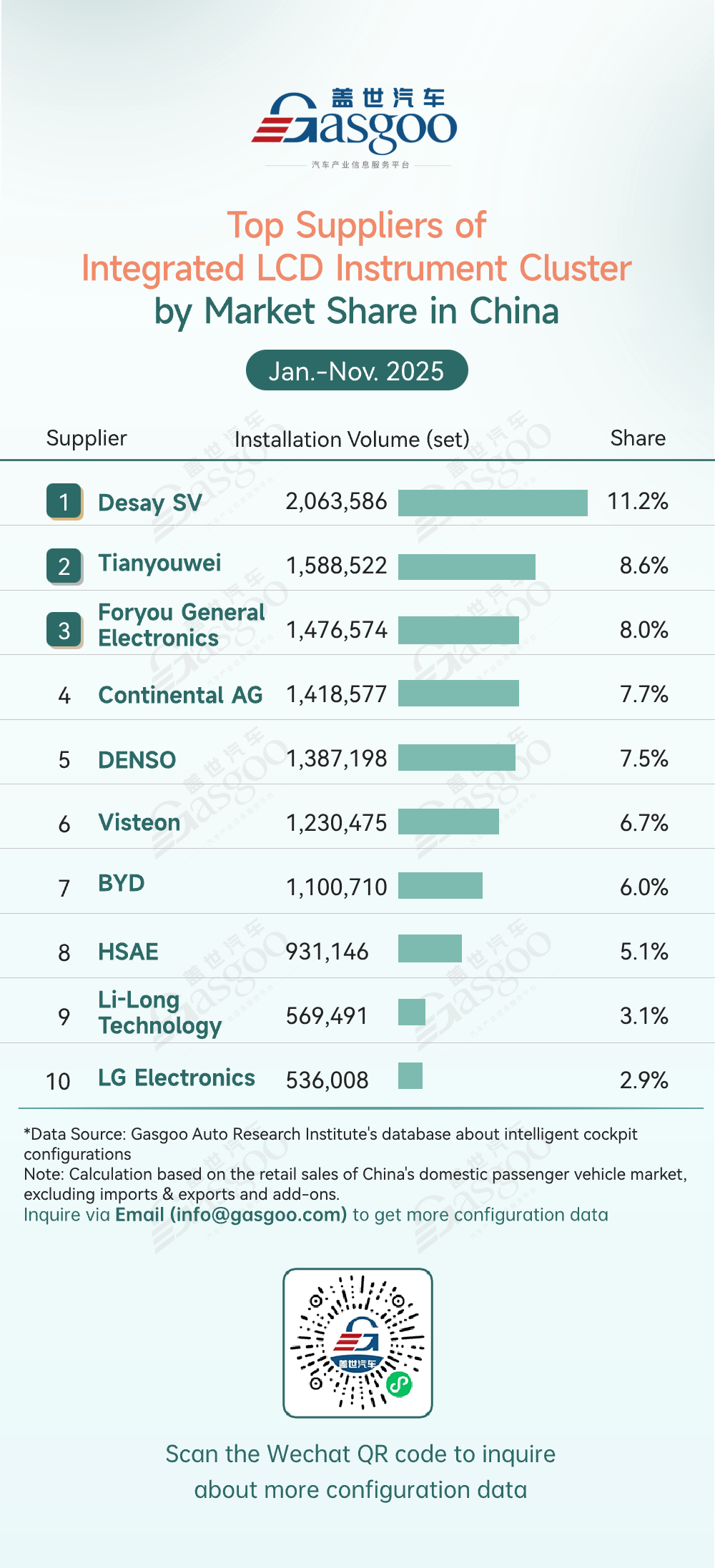

Top suppliers of integrated LCD instrument cluster

Desay SV: 2,063,586 sets installed, 11.2% market share

Tianyouwei: 1,588,522 sets installed, 8.6% market share

Foryou General Electronics: 1,476,574 sets installed, 8.0% market share

Continental AG: 1,418,577 sets installed, 7.7% market share

DENSO: 1,387,198 sets installed, 7.5% market share

Visteon: 1,230,475 sets installed, 6.7% market share

BYD: 1,100,710 sets installed, 6.0% market share

HSAE: 931,146 sets installed, 5.1% market share

Li-Long Technology: 569,491 sets installed, 3.1% market share

LG Electronics: 536,008 sets installed, 2.9% market share

From January to November, the market competition showed a vivid pattern of "domestic leadership with mixed competition between local and international players." Desay SV took the lead steadily with 2,063,586 sets installed (11.2% share), leveraging its mass-production experience in automotive electronics to maintain a strong advantage. Tianyouwei and Foryou General Electronics followed closely, ranking third with 8.6% and 8.0% shares respectively, putting domestic supply-chain execution capabilities at the forefront of the track.

In terms of competitive tiers, international Tier1s like Continental AG, DENSO, and Visteon form the second tier, holding 6.7%–7.7% of the market—they leverage technological depth to maintain their base but face direct pressure from China's local players on production efficiency and cost adaptation. Chinese companies such as BYD and HSAE continue to penetrate the market with shares at or below 6.0%, further enriching the competitive landscape. Meanwhile, firms like Li-Long Technology and LG Electronics focus on niche vehicle segments, using differentiated offerings to fill market gaps.

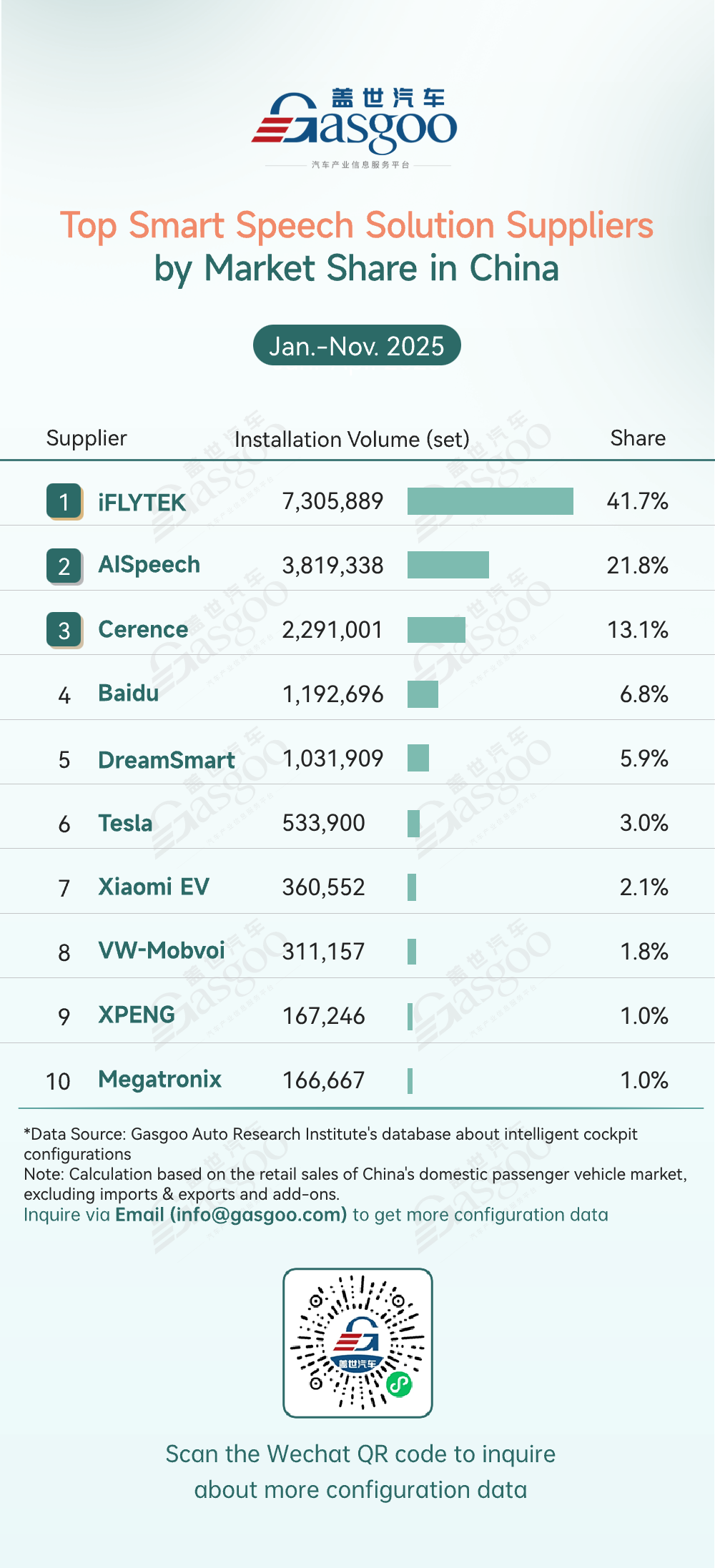

Top smart speech solution suppliers

iFLYTEK: 7,305,889 sets installed, 41.7% market share

AISpeech: 3,819,338 sets installed, 21.8% market shar

Cerence: 2,291,001 sets installed, 13.1% market share

Baidu: 1,192,696 sets installed, 6.8% market share

DreamSmart: 1,031,909 sets installed, 5.9% market share

Tesla: 533,900 sets installed, 3.0% market share

Xiaomi EV: 360,552 sets installed, 2.1% market share

VW-Mobvoi: 311,157 sets installed, 1.8% market share

XPENG: 167,246 sets installed, 1.0% market share

Megatronix: 166,667 sets installed, 1.0% market share

From January to November, the market clearly showed a "domestic-led, highly concentrated" structure. iFLYTEK maintained a firm lead with 7,305,889 sets installed (41.7% share), building strong barriers through technological strength and ecosystem compatibility. AISpeech followed closely with 3,819,338 sets (21.8% share), and together the top two accounted for over 63% of the market, cementing China's local dominance in in-vehicle voice systems. Cerence ranked third with 2,291,001 sets (13.1% share), serving as a key supporting player within the leading tier.

Baidu and DreamSmart held 5%–7% shares, competing through technology plus ecosystem—Baidu via its internet ecosystem and DreamSmart via automaker-linked resources. Tesla, Xiaomi EV, XPENG, and Megatronix each had shares below 3%, mainly offering customized voice systems for their own brands to meet specific user scenarios and fill niche gaps in the market.