From January to October, China's automotive intelligent components market further moved toward higher concentration and localization. China's local suppliers strengthened their positions in cockpit domain controllers and related segments, backed by scalable mass production and strong supply-chain integration. Desay SV led multiple cockpit integration categories, Foryou Multimedia topped both HUD and AR-HUD, and iFLYTEK remained dominant in smart speech solution systems. While Qualcomm still leads cockpit chips, Huawei Technologies and SiEngine posted clear share gains, highlighting accelerating localization.

Meanwhile, AR-HUD adoption is accelerating and large smart displays continue to gain traction, pushing cockpit competition into a deeper phase as Tier 1s, tech firms, automakers' in-house teams, and new entrants compete across dimensions—driving deeper localization and steering the industry toward clearer tech tiers, tighter ecosystems, and more differentiated innovation.

Meanwhile, faster AR-HUD rollout and rising adoption of large smart displays are pushing cockpit competition into a deeper phase, as Tier 1s, tech firms, automakers, and new entrants drive localization and shift the industry toward clearer tech tiers, tighter ecosystems, and differentiated innovation.

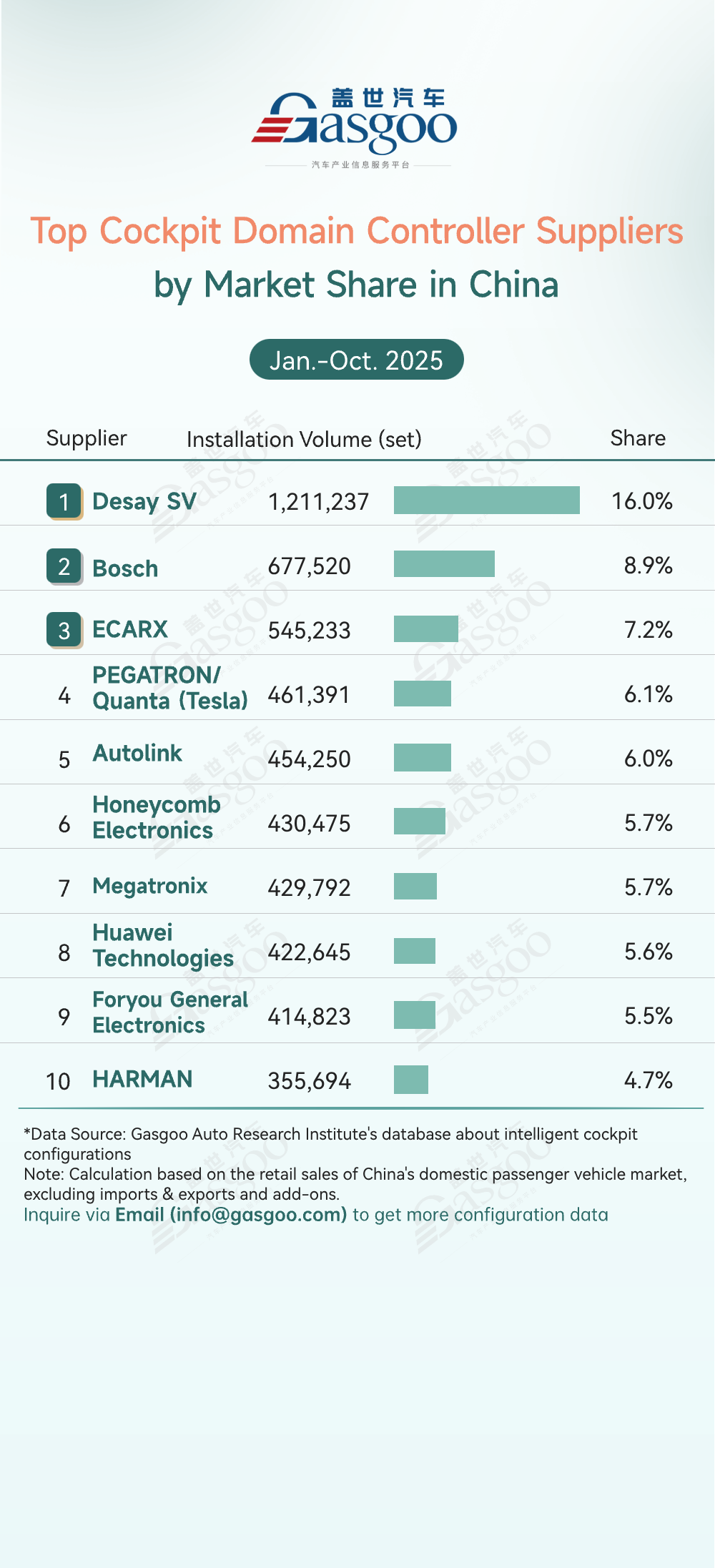

Top cockpit domain controller suppliers

Desay SV: 1,211,237 sets installed, 16.0% market share

Bosch: 677,520 sets installed, 8.9% market share

ECARX: 545,233 sets installed, 7.2% market share

PEGATRON/Quanta (Tesla): 461,391 sets installed, 6.1% market share

Autolink: 454,250 sets installed, 6.0% market share

Honeycomb Electronics: 430,475 sets installed, 5.7% market share

Megatronix: 429,792 sets installed, 5.7% market share

Huawei Technologies: 422,645 sets installed, 5.6% market share

Foryou General Electronics: 414,823 sets installed, 5.5% market share

HARMAN: 355,694 sets installed, 4.7% market share

From January to October, the cockpit domain controller market expanded rapidly, with Chinese suppliers further consolidating their dominance. Desay SV led the pack with 1,211,237 sets installed (16.0% share), widening its lead, followed by Bosch at 8.9%, together forming the first tier. ECARX, PEGATRON/Quanta (Tesla), and Autolink each held 6%–7%, making up the second tier. Notably, Honeycomb Electronics and Megatronix posted equal shares, while Huawei Technologies and Foryou General Electronics were separated by less than 0.1%, highlighting converging capabilities among local players and intensifying competition between tech firms and traditional Tier 1s. Meanwhile, PEGATRON and Quanta's roles in Tesla's supply chain, alongside the rise of newcomers like Megatronix, are further diversifying the competitive landscape.

Top brands of smart cockpit domain controller chip

Qualcomm: 5,701,662 units installed, 73.9% market share

Huawei Technologies: 489,625 units installed, 6.3% market share

AMD: 468,136 units installed, 6.1% market share

SiEngine: 428,183 units installed, 5.5% market share

Renesas Electronics: 185,159 units installed, 2.4% market share

SemiDrive: 154,886 units installed, 2.0% market share

Samsung Semiconductor: 90,129 units installed, 1.2% market share

MediaTek: 80,469 units installed, 1.0% market share

Texas Instruments: 66,192 units installed, 0.9% market share

Intel: 15,698 units installed, 0.2% market share

From January to October, the cockpit domain controller chip market showed a pattern of strong concentration at the top with steadily rising shares for China's local chips. Qualcomm maintained an overwhelming lead with 5,701,662 units installed (73.9% share), underscoring its entrenched technological and scale advantages. Meanwhile, Chinese players made notable progress: Huawei Technologies ranked second with a 6.3% share, while SiEngine and SemiDrive continued to expand their presence, reflecting ongoing technical breakthroughs and growth momentum among domestic chipmakers. Overall, Qualcomm's dominance is unlikely to be challenged in the short term, but rapid gains in shipments and iteration by local suppliers are making the path toward localization increasingly clear.

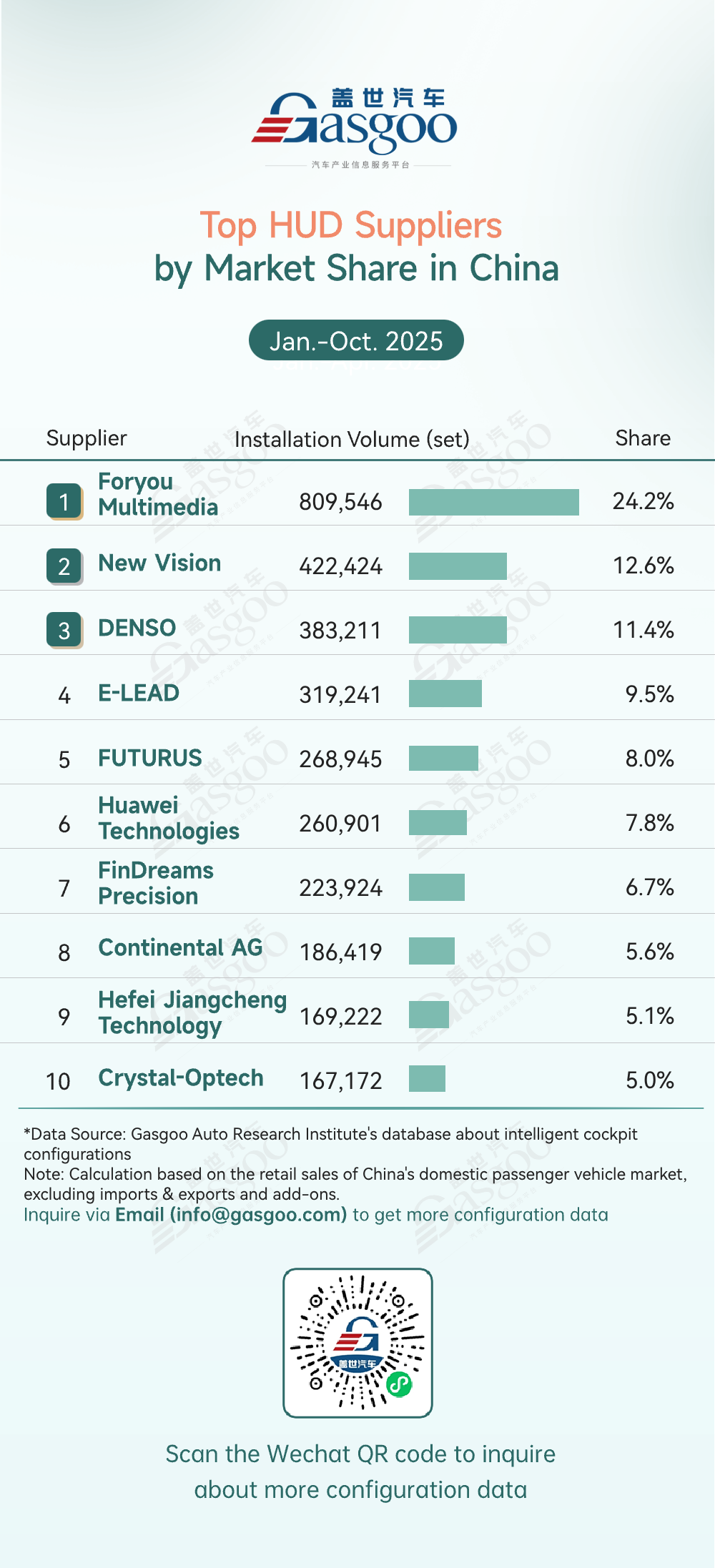

Top HUD suppliers

Foryou Multimedia: 809,546 sets installed, 24.2% market share

New Vision: 422,424 sets installed, 12.6% market share

DENSO: 383,211 sets installed, 11.4% market share

E-LEAD: 319,241 sets installed, 9.5% market share

FUTURUS: 268,945 sets installed, 8.0% market share

Huawei Technologies: 260,901 sets installed, 7.8% market share

FinDreams Precision: 223,924 sets installed, 6.7% market share

Continental AG: 186,419 sets installed, 5.6% market share

Hefei Jiangcheng Technology: 169,222 sets installed, 5.1% market share

Crystal-Optech: 167,172 sets installed, 5.0% market share

From January to October, HUDs drove a new wave of growth in in-vehicle displays, with the market characterized by top-player leadership amid diversified competition. Foryou Multimedia led the pack with 809,546 sets installed (24.2% share), further widening its lead. New Vision and DENSO followed with 12.6% and 11.4% shares, respectively, as competition among leading players remained tight without a clear monopoly. E-LEAD ranked in the mid-tier with a 9.5% share, while FUTURUS and Huawei Technologies competed at around 8%. Meanwhile, China's local players such as FinDreams Precision competed alongside traditional Tier 1 suppliers like Continental, highlighting the HUD segment's increasingly diverse competitive landscape.

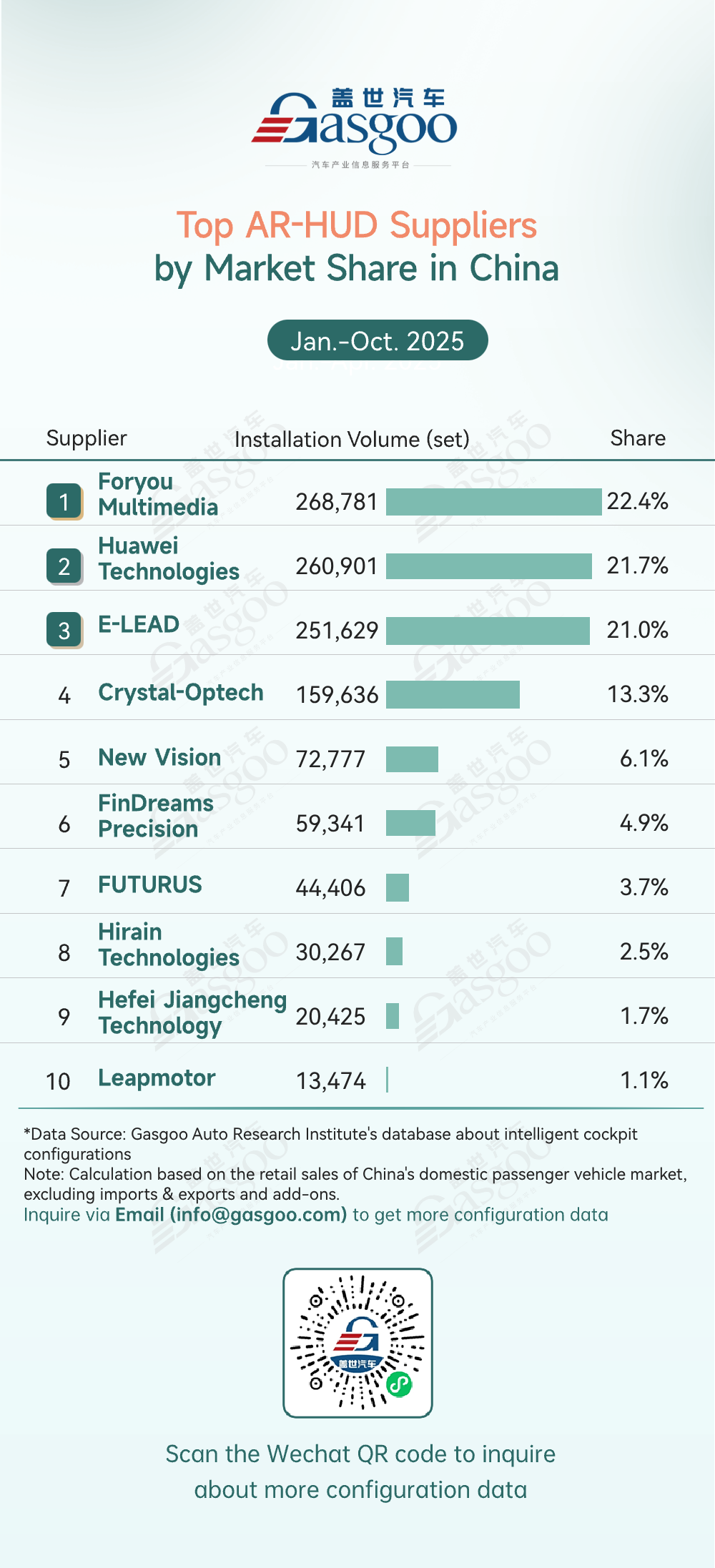

Top AR-HUD suppliers

Foryou Multimedia: 268,781 sets installed, 22.4% market share

Huawei Technologies: 260,901 sets installed, 21.7% market share

E-LEAD: 251,629 sets installed, 21.0% market share

Crystal-Optech: 159,636 sets installed, 13.3% market share

New Vision: 72,777 sets installed, 6.1% market share

FinDreams Precision: 59,341 sets installed, 4.9% market share

FUTURUS: 44,406 sets installed, 3.7% market share

Hirain Technologies: 30,267 sets installed, 2.5% market share

Hefei Jiangcheng Technology: 20,425 sets installed, 1.7% market share

Leapmotor: 13,474 sets installed, 1.1% market share

From January to October, China's local suppliers accelerated AR-HUD adoption, shaping a market marked by high concentration at the top. Foryou Multimedia, Huawei Technologies, and E-LEAD ranked top three, together accounting for over 65% of the market, underscoring local players' strengths in mass production and market penetration as the key drivers of AR-HUD rollout. Crystal-Optech placed fourth with a 13.3% share, while New Vision and FinDreams Precision pursued breakthroughs in niche scenarios and ecosystem collaboration. Leapmotor's entry as an OEM added a new competitive dimension to the segment.

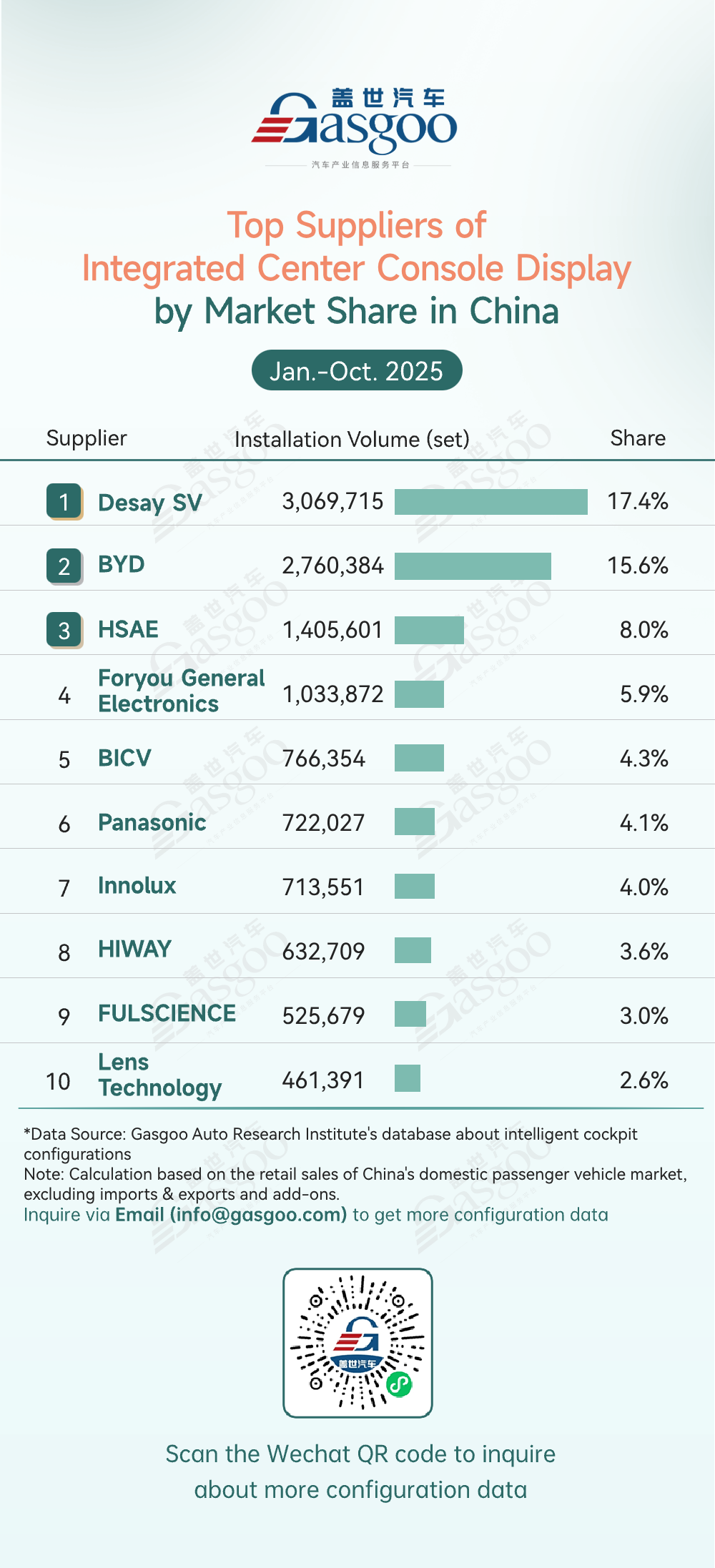

Top suppliers of integrated center console display

Desay SV: 3,069,715 sets installed, 17.4% market share

BYD: 2,760,384 sets installed, 15.6% market share

HSAE: 1,405,601 sets installed, 8.0% market share

Foryou General Electronics: 1,033,872 sets installed, 5.9% market share

BICV: 766,354 sets installed, 4.3% market share

Panasonic: 722,027 sets installed, 4.1% market share

Innolux: 713,551 sets installed, 4.0% market share

HIWAY: 632,709 sets installed, 3.6% market share

FULSCIENCE: 525,679 sets installed, 3.0% market share

Lens Technology: 461,391 sets installed, 2.6% market share

From January to October, China's local suppliers further consolidated their dominance in the integrated center console display market. Desay SV led the pack with 3,069,715 sets installed (17.4% share), followed closely by BYD at 15.6%, highlighting the growing strength of OEM-led supply chains. Together, the two accounted for more than 33% of the market, forming a clear "local duopoly." HSAE, Foryou General Electronics, BICV, Panasonic, and Innolux held steady with shares in the 4%–8% range, while emerging local players such as HIWAY, FULSCIENCE, and Lens Technology remained below 4%, reflecting increasingly segmented competition.

Top suppliers of integrated LCD instrument cluster

Desay SV: 1,884,148 sets installed, 11.3% market share

Tianyouwei: 1,433,866 sets installed, 8.6% market share

Foryou General Electronics: 1,300,443 sets installed, 7.8% market share

Continental AG: 1,298,577 sets installed, 7.8% market share

DENSO: 1,270,639 sets installed, 7.6% market share

Visteon: 1,135,634 sets installed, 6.8% market share

BYD: 1,001,176 sets installed, 6.0% market share

HSAE: 823,726 sets installed, 4.9% market share

Li-Long Technology: 513,044 sets installed, 3.1% market share

LG Electronics: 494,061 sets installed, 3.0% market share

From January to October, the LCD instrument cluster market saw intense competition, characterized by head-end leadership and Sino-foreign rivalry. Desay SV topped the market with 1,884,148 sets installed (11.3% share), maintaining a clear lead, followed by Tianyouwei, underscoring the growing strength of local players in mass production and market penetration. Foryou General Electronics and Continental AG each held a 7.8% share, with DENSO close behind at 7.6%, reflecting tightening competition within the leading group. Overall, the market remains relatively concentrated but highly competitive, as China's local suppliers such as Desay SV and Tianyouwei increasingly challenge international Tier-1s including Continental, DENSO, and Visteon.

Top smart speech solution suppliers

iFLYTEK: 6,581,810 sets installed, 41.7% market share

AISpeech: 3,389,692 sets installed, 21.5% market share

Cerence: 2,120,520 sets installed, 13.4% market share

Baidu: 1,109,199 sets installed, 7.0% market share

DreamSmart: 910,199 sets installed, 5.8% market share

Tesla: 461,391 sets installed, 2.9% market share

Xiaomi EV: 314,443 sets installed, 2.0% market share

VW-Mobvoi: 295,703 sets installed, 1.9% market share

Megatronix: 153,033 sets installed, 1.0% market share

XPENG: 152,719 sets installed, 1.0% market share

From January to October, smart speech solution market continued to evolve, with China's local suppliers firmly dominating the market. iFLYTEK took the lead with 6,581,810 sets installed (41.7% share), building a clear lead through strong technology and ecosystem integration. AISpeech and Cerence ranked second and third, and together with iFLYTEK accounted for more than 76% of the market, forming a core competitive group. Baidu and DreamSmart competed in the 5%–7% range, reflecting diversified technical approaches and ecosystems, while OEM-developed solutions from Tesla, Xiaomi EV, and XPENG each remained below 3%, with smaller players focusing on niche interaction scenarios.

![[Gasgoo Express] Domestic Oil Prices Set to Surge](https://gascloud.gasgoo.com/production/2026/03/cc26f06f-c2c8-4873-a2e2-c5eb92a16ef2-1773091619.png)