As the humanoid robot sector heats up, a wave of auto executives—both current and former—are setting their sights on embodied intelligence, sparking a fresh surge of entrepreneurship.

Their involvement isn't just injecting fresh technical perspectives and industrial resources into robotics; it also reflects a strategic shift by the auto industry to expand into a broader ecosystem of intelligent terminals.

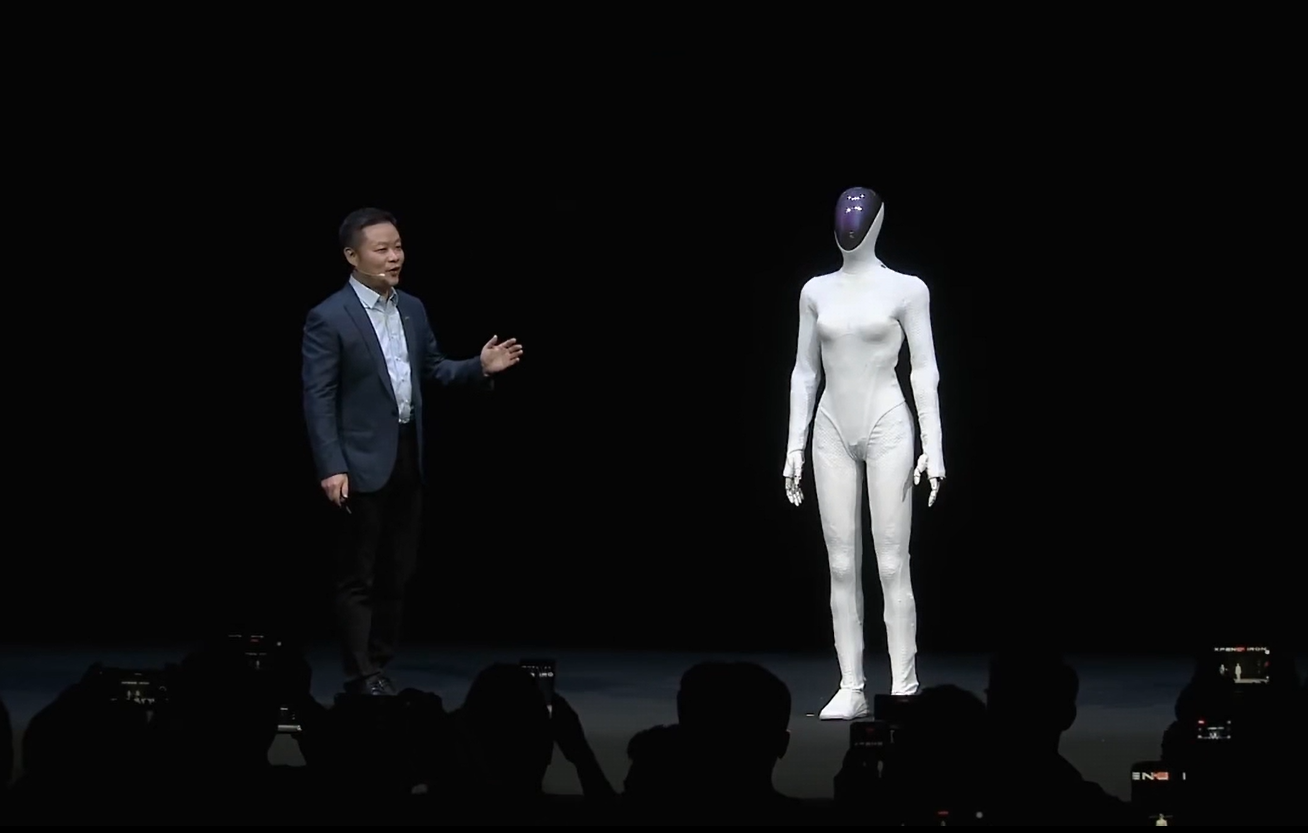

Image Source: AI² Robotics

Betting on a New Frontier

In the field of embodied intelligence, entrepreneurs with backgrounds in autonomous driving have already become a formidable force.

Consider Guo Yandong, founder of the closely watched startup AI² Robotics. He previously held key roles at Microsoft and XPENG. As XPENG's chief scientist, he drove the mass-market application of deep learning technology in vehicles.

Image Source: AI² Robotics

In 2025, AI² Robotics secured seven funding rounds in just eight months, raising billions of yuan. Its valuation has surpassed $1 billion, cementing its status as a unicorn. The company has also released FiS-VLA, an open-source version of its GOVLA large model, making it the only domestic startup offering an open-source robotics model.

Executives from the "Li Auto camp" are also making moves. In July 2025, Jia Peng, former head of autonomous driving at Li Auto, teamed up with ex-CTO Wang Kai to found Zhijian Power. The startup secured a $50 million angel round from Capital V immediately upon launch—Wang Kai serves as an investment partner at the firm.

During his five years at Li Auto, Jia Peng amassed deep technical expertise, driving the development of cutting-edge technologies like BEV perception, the AD Max 3.0 system, and VLA models. That experience is now being channeled directly into robotics.

The "Huawei camp" boasts similarly prominent credentials. Chen Yilun, former CTO of Huawei's autonomous driving unit, co-founded Tashi Zhihang with Ding Wenchao. The firm set a record for angel funding in China's embodied intelligence sector, securing more than $240 million in just three months. In a technical demonstration, a robot stitched the company's logo using an embroidery needle, showcasing its precision capabilities in complex spatial environments.

Image Source: XPENG

Beyond these startups, established automakers are aggressively pushing toward mass production of humanoid robots. Tesla views its Optimus bot as a core future product; XPENG has unveiled its self-developed IRON robot; GAC Group introduced the third generation of its GoMate; and Chery has released the "Mojia" intelligent robot, identifying it as a second growth curve. SAIC, Geely, and Great Wall Motors have also piled into the race.

Why the Fervor?

The rush of automotive talent into embodied intelligence stems largely from the high degree of technological overlap. Put simply, a modern smart car is essentially a "wheeled robot," while a humanoid robot is simply a different form factor. The two share remarkable similarities in algorithms, computing power requirements, and underlying hardware.

He Xiaopeng, chairman and CEO of XPENG, has noted that roughly 70% of an automaker's technical reserves can be directly transferred to robotics. Autonomous driving algorithms, for instance, share the same origins as robot navigation systems. Likewise, the permanent magnet synchronous motors, controllers, and battery packs used in electric vehicles can be miniaturized to serve as actuators and power sources for robots.

For automakers, "building humans" is thus a migration of capabilities—not a leap into an entirely new industry.

From a business logic standpoint, automakers need new drivers for valuation growth. The new energy vehicle market is locked in fierce competition, with relentless price wars and cut-throat competition eroding corporate margins.

In contrast, humanoid robotics represents a trillion-dollar market brimming with potential. Projections suggest global sales will exceed 5 million units by 2035, with a market value potentially surpassing 400 billion yuan. For companies, this offers a critical avenue to craft a new narrative for capital markets and boost their valuation.

Enthusiastic capital markets are fueling this trend further. Financing in the robotics sector is brisk, and teams with autonomous driving backgrounds are winning favor from investors—thanks to their experience in mass production, system integration, and resource mobilization.

Image Source: UBTECH

Both automakers and tech firms are accelerating their deployments. Tesla plans to kick off mass production of Optimus by late 2026, with a long-term goal of producing 1 million units annually. XPENG's IRON is also slated for volume production in 2026. Traditional players like GAC and Chery, meanwhile, are rolling out robot products through in-house development or partnerships, exploring applications in industrial and commercial settings.

For these automakers, developing robots isn't just about extending technology or expanding ecosystems—it's a strategic play to secure a position in the next generation of human-machine interaction.

That said, the embodied intelligence sector remains in the "early days" of the party. While enthusiasm is high, most companies have yet to turn a profit, with many still stuck in the stage of technical pre-research or small-scale testing.

After all, robots must achieve dynamic balance, precise manipulation, and human interaction in unstructured environments—demands that place far higher burdens on system real-time performance, robustness, and intelligence.

For instance, both Tesla's Optimus and XPENG's IRON are continuously iterating on humanoid movement and dexterous manipulation, yet widespread commercial use remains a ways off. Furthermore, viable business models are still taking shape; robots are currently limited to industrial collaboration, exhibition guidance, and research. Large-scale deployment in homes or public services will take time.