On February 2, Gasgoo learned that Waymo recently closed a massive funding round worth $16 billion, pushing its valuation close to $110 billion.

People familiar with the matter said its parent company, Alphabet, will contribute roughly $13 billion, with the remainder coming from other investors, including new backers Sequoia Capital, DST Global, and Dragoneer Investment Group. Some sources added that Mubadala Capital is also participating. The individuals requested anonymity because the discussions are private.

Just 15 months ago, the company was valued at only $45 billion.

Waymo stands at a critical pivot point, moving from technical validation to commercial expansion.

Co-CEOs Tekedra Mawakana and Dmitri Dolgov stressed that this round is "built on a foundation of safety." Waymo claims its Waymo Driver system already outperforms human driving statistically. "We have moved beyond the proof-of-concept phase to commercial scale," the CEOs said, noting that the new capital will fuel growth at "unprecedented speed" while maintaining industry-leading safety standards.

This massive financing reflects a profound shift in the autonomous driving sector from "tech storytelling" to "commercial reality" — a clear sign that the global "arms race" has entered its decisive phase.

Capital Fever: The Commercial Logic and Strategic Expansion Behind a $100 Billion Valuation

If the autonomous driving industry sees another capital rush in 2026, Waymo's multi-billion-dollar round is likely to be the brightest star of the show.

This round not only sets a record for single-round financing in the sector but also underscores capital's firm confidence in the commercial future of autonomous driving.

Waymo's current valuation is several times what it was five years ago, reflecting a rapid appreciation of its commercial value.

Sources told the Financial Times that demand for the round overshot the target by three times. The same sources noted that Waymo's annual recurring revenue (ARR) exceeded $350 million in 2025. Alphabet typically keeps such figures under wraps, making comparisons with 2024 difficult; however, Bank of America had previously projected the company's ARR for that year would fall between $50 million and $75 million.

In any case, the three-times oversubscription signals strong recognition from the capital markets for Waymo's business model.

The massive capital injection will directly fuel Waymo's global expansion plans.

Waymo plans to expand its U.S. operations to Detroit, Las Vegas, Nashville, and Washington, D.C. in 2026, while launching its first overseas commercial deployment in London. Currently, Waymo is testing in London and Tokyo and has entered confirmatory discussions with the Australian government regarding potential cooperation.

This expansion marks Waymo's transformation from a regional operator into a global mobility platform.

Notably, Waymo's operational metrics are equally impressive.

Waymo expects to serve 1 million rides per week this year, up from 250,000 reported in the spring of 2024, covering cities like San Francisco, Los Angeles, Phoenix, and Miami. It has also partnered with Uber to expand into secondary markets like Austin and Atlanta.

Landscape Reshaped: The Autonomous Driving Race Enters an Era of Three Major Camps

The competitive landscape of the autonomous driving industry is undergoing profound change. With a flood of capital and diverging technological paths, the market has largely settled into a "three-camp" structure.

First is the industry pioneer, the Waymo camp, which currently leads thanks to its first-mover advantage and mature commercial layout. As an independent subsidiary of Google parent Alphabet, Waymo enjoys robust support from its parent in both capital and technology.

Image Source: Waymo

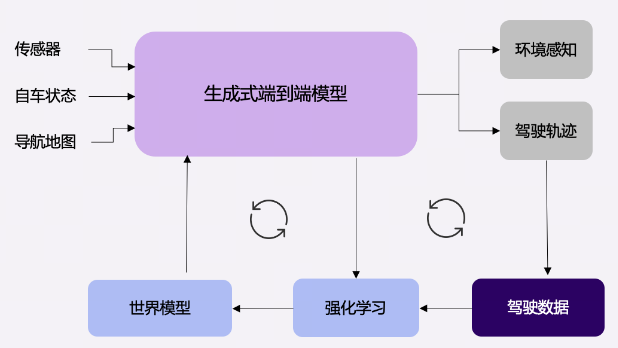

Second is the challenger, the Tesla camp, which is rapidly closing the gap with end-to-end technology and cost advantages. Tesla sticks to a "pure vision + end-to-end" approach, relying on massive amounts of real-world data collected from millions of production vehicles globally for model training.

Elon Musk has stated that solving the final 1% of "long-tail" problems requires 10 billion miles of training data, and Tesla is the only player approaching that scale.

Third is the ecosystem enabler, the NVIDIA camp, forming an "open-source alliance" by partnering with automakers and mobility platforms.

NVIDIA released Alpamayo, the world's first open-source autonomous driving vision-language-action model capable of thinking and reasoning, simultaneously opening up its supporting high-fidelity simulation framework, AlpaSim, and a large-scale driving dataset.

More broadly, the industry faces the difficult task of balancing commercial expansion with safety assurance. As autonomous vehicles become increasingly common on city streets, their interactions with pedestrians, cyclists, other vehicles, and urban infrastructure grow more complex.

Traffic rules, driving culture, and road conditions vary in every city, posing a challenge to the universality of autonomous driving systems.

There is no doubt that the endgame for autonomous driving has not yet arrived, but the decisive battle has already quietly begun.