Gasgoo Munich - As preliminary figures for the 2025 fiscal year landed, Bosch shed its usual halo. Instead, the industrial giant offered a candid look at its reality amidst the sweeping waves of industrial transformation.

There were no flowery words to dress up the performance, no vague forecasts about the future. Stefan Hartung, chairman of the Bosch board of management, was blunt: "For Bosch, 2025 was a difficult year."

Image source: Bosch (same below)

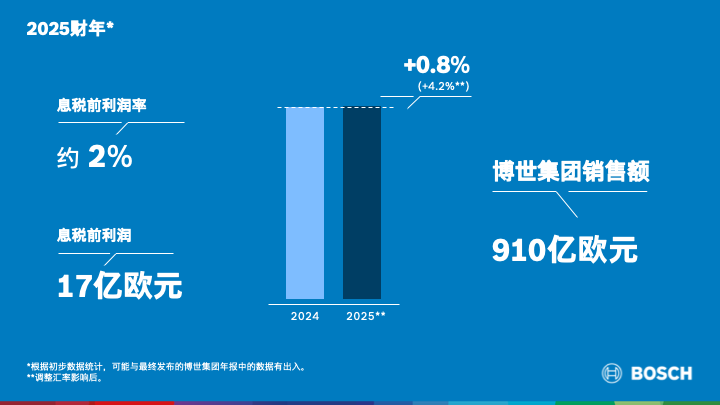

Official preliminary statistics put 2025 sales at 91 billion euros. While that figure underscores the resilience of an industry leader, an EBIT margin of only about 2% lays bare the intense pressure of its deep transformation. Yet, the plan to reach a 7% margin "as early as 2027" reveals a strategic resolve that is pragmatic yet ambitious.

(Note: Financial data for Bosch's 2025 fiscal year mentioned in this article are based on official preliminary statistics and may differ slightly from the final annual report.)

2025 was indeed tough

In truth, 2025 was a struggle for companies across the automotive supply chain. This hardship was no accident triggered by a single factor, but an inevitable result of a macroeconomic slowdown, fierce market competition, and the heavy lifting of internal transformation.

For Bosch, group sales reached 91 billion euros in 2025, a slight increase from 90.3 billion euros in 2024. Stripping out currency effects, the actual rise was 4.2%. On the surface, the leader's foundation remains solid, but core profitability indicators slipped. The EBIT margin hovered around just 2%, down from 3.5% a year earlier.

One industry insider told Gasgoo that the decline in foreign Tier 1 margins was expected. "Their high margins previously relied heavily on profit contributions from China. If the global average was 5% to 7%, China often contributed 10% or more. But over the last two years, overall profitability in China has slid as competition intensified, naturally squeezing their earning space."

According to Bosch, the weight on performance came from several sources: a sluggish macroeconomy, intensifying competition, rising tariff costs, and "substantial provisions for necessary structural adjustments and personnel measures."

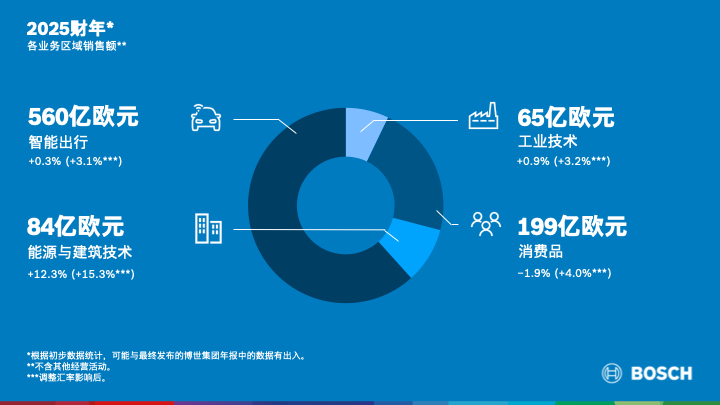

In its most watched division, Mobility Solutions, sales climbed to 56 billion euros in 2025. That represents a nominal increase of 0.3% from the previous year, or 3.1% after adjusting for currency effects.

Bosch noted that the structural shift to electrification, combined with brutal price competition across the global auto industry, has created a cost gap of roughly 2.5 billion euros annually for its mobility business compared to its target margins.

The Energy and Building Technology business told a different story, with sales jumping 12.3% year-on-year—or 15.3% adjusted for currency. This surge was no accident; following Europe’s energy crisis, global demand for heating, ventilation, and air conditioning (HVAC) systems spiked. Bosch moved quickly to capture share by acquiring and integrating related businesses.

Regional performance varied.

In its home market of Europe, sales fell 0.6% in nominal terms but rose 1.5% adjusted for currency. The primary drag came from sluggish auto demand, compounded by policy wavering and skepticism toward technological progress, which slowed Bosch’s related business momentum.

The Americas and Asia-Pacific, meanwhile, showed positive growth. Data reveals sales in the Americas reached 18.5 billion euros, a nominal gain of 3.6% or 9.2% in real terms. Asia-Pacific sales hit 28.3 billion euros, up 1.2% nominally and 5.6% adjusted.

China stood out as the most resilient pillar in Bosch’s global portfolio. In fiscal 2025, Bosch generated 149.8 billion yuan (about 18.46 billion euros) in sales in China, a 4.9% increase. As Xu Daquan, president of Bosch China, put it, the region maintained strong business resilience in 2025, with mobility solutions remaining the core engine of growth.

Markus Forschner, Bosch’s CFO and board member, added: "Despite multiple uncertainties and trade barriers, we maintained our competitiveness in most markets."

The adjustment in headcount is perhaps the most direct reflection of Bosch's "difficult" 2025. By December 31, 2025, the global workforce stood at 412,400—down roughly 5,400 people, or about 1%, year-on-year. While acquisitions in the Comfort Technology sector added staff, strategic role optimization and the divestiture of the Building Technology business drove the total down. The decline was sharpest in Germany, where the workforce fell by about 6,500, or nearly 5%, to 123,100.

Even more telling, in September 2025, Bosch announced plans to cut an additional 13,000 jobs in its automotive parts division. The reductions represent about 3% of the global workforce and will extend through 2030, hitting German employees hardest. Behind these cuts lies a reluctant move to optimize cost structures and weather the pressure of transition.

The industry insider noted that for foreign Tier 1s, these adjustments are concentrated in European and U.S. markets. The core reason is a broad downturn in those regions, forcing companies to shed jobs to relieve operational pressure.

He added that the critical question going forward is how to build a new development order after breaking the old one. "China is moving fast in electronic and electrical architecture, automotive electronics, software, and AI, as well as traditional hardware and comfort features. After cutting jobs in Europe and the U.S., will these foreign firms have the boldness to shift massive R&D and innovation resources toward China and Asia? That trend is worth watching."

The turning point may come in 2027

Facing difficulties head-on is not a retreat; it is a prerequisite for planning the future with a clear mind.

Bosch projects global economic growth of 2.3% in 2026, with the mild slowdown persisting. Competition and pricing pressure in the auto sector will likely intensify further. Crucially, the impact of new tariffs introduced in 2025 will be fully felt for the first time in 2026.

Bosch believes that to ensure long-term economic resilience and financial independence, the company must achieve annual sales growth of 6% to 8% and a margin of at least 7%. Based on current market assessments, it expects to hit that 7% margin target no earlier than 2027.

"If we effectively improve our cost structure and competitive position, margins will gradually recover," Forschner said.

To get there, Bosch has devised a "combination punch" centered on two main lines: cutting costs and boosting efficiency, and innovating for the future. Every step targets current pain points.

Cost reduction is the most urgent task. "We are comprehensively optimizing material cost structures, deepening AI applications to boost production efficiency, and evaluating every investment with greater prudence," said Stefan Hartung. To safeguard long-term competitiveness and investment capacity, the company must intensify efforts to further optimize labor costs and streamline its organizational structure.

He emphasized that the board deeply understands the weight of these decisions and takes employee concerns seriously. Yet, even as a foundation-owned company, Bosch must secure its own survival—an unavoidable commercial reality. "Bosch is committed to advancing necessary adjustments in a way that considers social impact as much as possible, through close consultation with employee representatives, even if that incurs higher costs initially."

Beyond layoffs, Bosch is optimizing supply chains and production processes. In China, it is lowering supply chain costs through deep cooperation with local firms. Globally, it is deepening AI use to lift efficiency; to date, Bosch has filed over 2,000 patent applications in AI and plans to invest a total of 2.5 billion euros in the field by the end of 2027.

If cost cutting is "tightening the belt," then innovation is "opening new taps"—and it is the core confidence Bosch needs to seize future tracks. Despite short-term pressure on mobility solutions, Bosch has not slowed its investment. Instead, it continues to pour resources into R&D, aiming to convert deep technical reserves into tangible profit advantages.

In 2025, Bosch secured customer orders worth 10 billion euros for intelligent driver assistance solutions, related sensor technologies, and central vehicle computing platforms, maintaining a leading position in global competition. Notably, its vehicle motion management system—which centrally controls braking, steering, powertrain, and chassis—has received a very positive market response, becoming a key growth driver for mobility solutions.

Bosch is also hunting for growth in other sectors. For HVAC, the current "star performer," the plan is to lift sales to 8 billion euros in the medium term. The Power Tools division has shaved two months off the average time-to-market by optimizing R&D and plans to launch about 2,000 new products across tools and accessories by 2027. The Industrial Technology business is focusing on software services to drive factory automation upgrades.

The China market is particularly critical

In a year of global pressure for Bosch, China became its most solid pillar of growth—contributing stable revenue while serving as the core battlefield for its transformation push.

The resilience here is striking. Sales of 149.8 billion yuan and 4.9% growth not only significantly outpaced the global average but also accounted for 20% of total group sales. Mobility solutions remained the core engine, with products like e-drive systems and intelligent driving sensors fitting the needs of local new-energy vehicles and achieving steady volume growth.

Bosch's emphasis on China is evident in its sustained push for localized R&D and production. By December 31, 2025, Bosch employed roughly 57,000 people in China, forming a massive local team. On the project front, the commercial vehicle division's light e-drive base in Nanchang and the new steering system plant in Jinan are proceeding as planned. Bosch Comfort Technology is doubling down, establishing a global R&D center in Wuxi and a high-end compressor manufacturing base in Guangzhou to drive intelligent and green upgrades in the HVAC industry. These moves highlight China's central position in Bosch's global layout.

At the same time, Bosch is actively linking with the local supply chain and deepening cooperation with domestic firms. This optimizes supply layouts and reduces cost pressure, while also better aligning with the fast-paced demands of the Chinese market. To Bosch, China has become a critical market for scaling technology from innovation to application. Therefore, continuously increasing R&D and production investment in new energy, sustainability, and intelligence has become an inevitable choice.

Yet behind these opportunities, challenges cannot be ignored.

On one hand, competition from the rise of local component suppliers continues to intensify. In areas like e-drives and smart cockpits, domestic firms are squeezing Bosch's market share with lower costs and faster response times. Even some joint-venture models from foreign automakers are increasingly turning to local suppliers.

On the other hand, demand in China's new-energy vehicle market iterates at breakneck speed, with constant upgrades in intelligence and connectivity. Although Bosch possesses deep technical reserves, the localization speed of some products still needs improvement to fully keep pace with the R&D rhythm of local automakers.

Meanwhile, pressure from automakers to pass on costs has trickled down to Bosch China. In 2025, local carmakers generally demanded annual price reductions of over 10% for core components. To retain key client partnerships, Bosch may be forced to accept these terms, further compressing profit margins.

Overall, Bosch China delivered a standout report card in 2025, acting as the "ballast stone" for Bosch's global transformation. The key to breaking through will be how quickly it can adapt to the local market while holding onto its technological advantages.

Conclusion: Foreign Tier 1s seeking a way out in changing times

Bosch's 2025 performance and strategic adjustments are not just pragmatic choices for its own transformation; they reflect the collective reality of foreign Tier 1 suppliers amid the industry's upheaval. With the rapid acceleration of electrification and intelligent upgrades, combined with the swift rise of local supply chains, foreign Tier 1s face multiple challenges: squeezed margins, fiercer competition, and heavy pressure on tech investment. Declining global auto industry margins, rising demands for cost control from automakers, tariff volatility, and vertical integration strategies are all squeezing development space, testing the strategic resolve and adaptability of these enterprises.

But within these challenges lie transformation opportunities. Long-term accumulated technical reserves, rigorous quality control, and global supply chain integration capabilities remain irreplaceable core strengths for foreign Tier 1s. As Bosch's practice shows, deeply cultivating core growth markets like China, advancing localized R&D and production, and strengthening collaboration with local supply chains are the keys to navigating the cycle.

Industry transformation is both a disruption of traditional development models and an opportunity for high-quality growth. For foreign Tier 1s, only by maintaining an open mindset—proactively seeking change while holding onto core advantages, rooting in the local market, focusing on innovation, and optimizing the ecosystem—can they stand firm in a dynamic competitive landscape and carve out a new path for steady progress amidst the industry upheaval.