In the final month of 2025, China's robotics industry struck a strong note across both primary and secondary capital markets.Gasgoo's tally shows 36 disclosed financing deals in December across domestic robotics and core enabling technologies. While some transactions kept amounts under wraps, the disclosed sums alone point to fundraising that neared 10 billion yuan for the month — including several billion‑yuan rounds.Meanwhile, the door to the secondary market is being knocked on in quick succession. OneRobotics debuted in Hong Kong, claiming the first listing for AI embodied home robots; DEEPINFAR, LDRobot and SEER Robotics filed prospectuses; Deep Robotics kicked off its IPO coaching program…

These capital moves, resonating with the heat in the primary market, mark a clear divide: after an incubation period fueled by venture money, China's robotics sector is collectively stepping into a new phase shaped by public-market scrutiny and commercial execution. The industry's core logic is shifting — irreversibly — from "R&D and prototype demos" to "scaled deliveries and commercial validation."For robotics, an execution cycle defined by orders, margins and self‑sustaining cash generation is quietly arriving.

Hot money in primary markets shifts course, pragmatism takes hold

Hot money in primary markets shifts course, pragmatism takes holdThe 2025 financing wave in robotics reveals a sharp turn in capital logic: the ability to achieve stable mass production and secure real commercial orders has become the yardstick that determines financing success and valuation.That same trend drove December’s mix of "overall growth with structural divergence." In short, capital is systematically flowing to two types of assets that offer "certainty": first, platform makers with sizeable order backlogs crossing the mass‑production threshold; second, core components that truly crack performance and cost bottlenecks.At the whole‑machine level, the new "money magnets" aren't defined by spec sheets — they're defined by the depth of their orders.

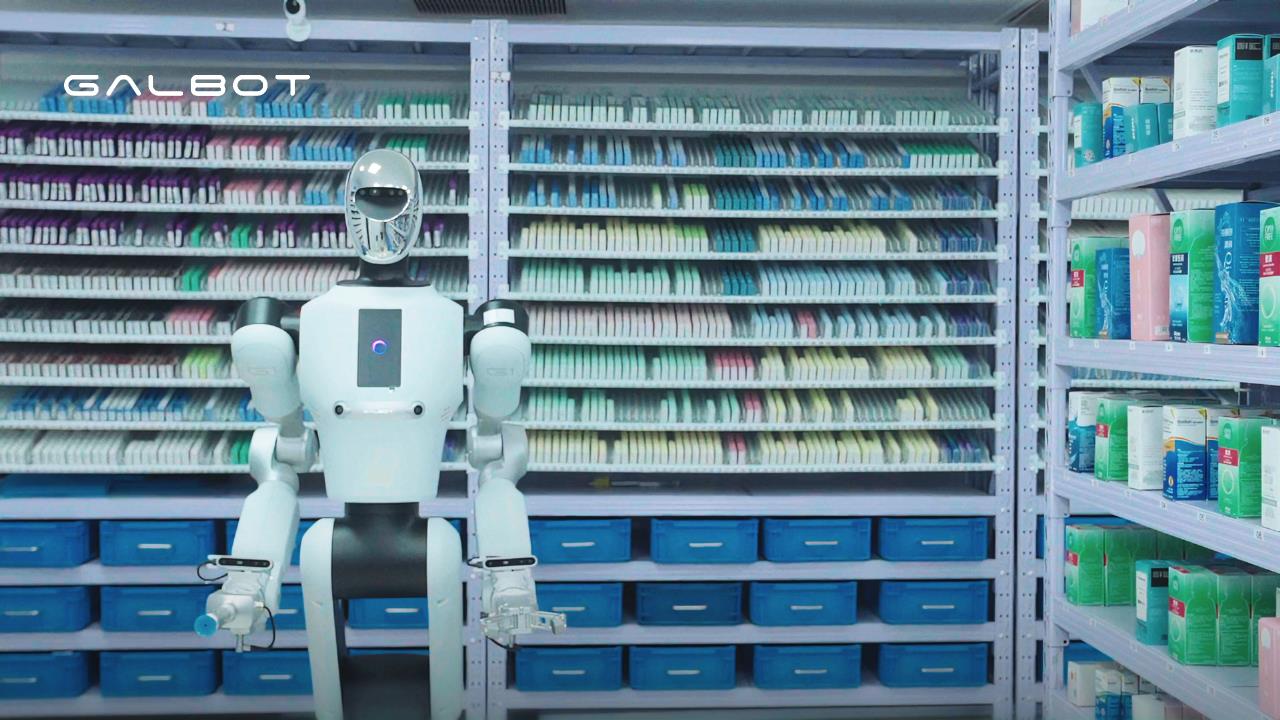

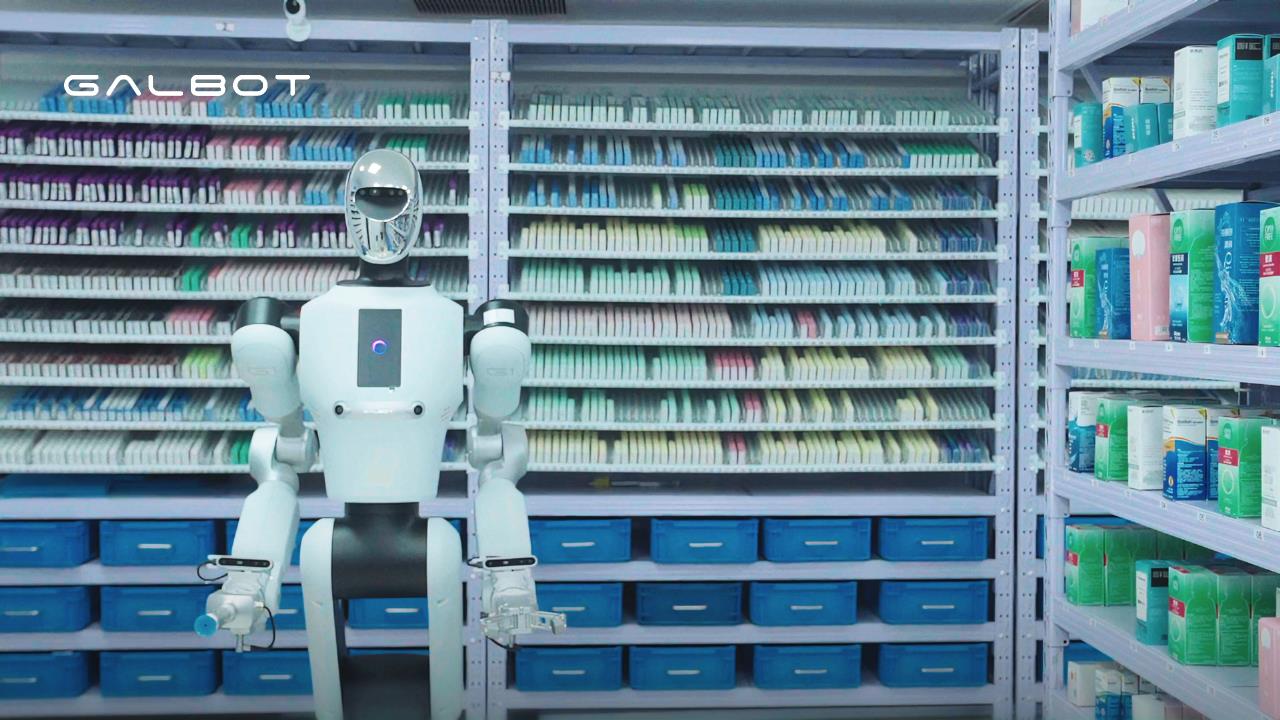

Image source: Galbot

Galbot' more than $300 million round is one example. The company has forged partnerships with Bosch, CATL and Toyota across industrial manufacturing, smart retail and medical care, securing thousands of units in orders and crossing the critical bridge from technology to business.

DeepRobotics closed a C round of over 500 million yuan in December, followed by a pre‑IPO raise worth several hundred million yuan. The ramp‑up aligns with its full‑stack "perception–decision–execution" system and a diversified lineup spanning the Bobcat M20 quadruped and the DR02 humanoid.Its quadruped business now covers 34 provincial‑level regions in China and 44 countries and regions overseas. In the 2024 global quadruped market, DeepRobotics ranked second with an 18.9% share of sales, behind Unitree Robotics. In September, founder Zhu Qiuguo said shipments could reach around 10,000 units in 2025.On the components side, dexterous hands, integrated joints, precision transmissions and compute platforms drew particular investor interest.

Image: LinkerBot

Dexterous hands stood out: six companies — Xynova, LinkerBot, Daimon Robotics, CASIA Hand, ENCOS and Stella-Robot — raised fresh capital in December. The reason is straightforward: dexterous hands have become the key choke point for moving robots from "perception and mobility" into the age of "dexterous manipulation."

The next leg of growth hinges on breaking into trillion‑yuan markets such as automotive assembly, precision electronics, high‑end surgery and complex household services. The common threshold is the ability to mimic — or exceed — the human hand in fine grasping, adaptive force control and flexible operations. High‑DOF, touch‑integrated dexterous hands pursued by firms like Xynova and LinkerBot are the essential keys to that "vault."

Joint modules, critical to agile robot motion, are also in focus. ENCOS raised close to 200 million yuan in a round led by Huakong Fund and Shenzhen Capital Group. It has built a multi‑product matrix spanning integrated joints, dexterous hands and communications modules for the next generation of humanoid and embodied‑intelligence robots.

ASTRALL secured nearly 100 million yuan in angel funding. Its breakthroughs in axial‑flux motors and integrated joints reflect the progress of domestic core‑component makers.Even as commercialization becomes the core yardstick, investment strategies haven't gone one‑note — the market still shows rational structural divergence. On one hand, investors continue to back early ideas and technical breakthroughs; capital flowing to ASTRALL, Xynova underscores sustained sensitivity to original innovation.

On the other hand, while mid‑to‑late stage deals are fewer, they dominate in size. DeepRobotics' C round topping 500 million yuan highlight a tilt toward companies that can land commercialization. Behind the split is a deeper shift from "chasing concepts" to "scrutinizing real orders."

Racing to list, the secondary‑market breakout intensifies

December's robotics IPO rush mirrors the primary‑market fundraising boom — two sides of the same historical moment. It signals a sector laden with capital and ambition entering a pivotal transition from private incubation to public‑market oversight.Two forces are at work: years of venture investment are entering harvest, making exits a natural part of the capital cycle; and leading players have moved beyond 0‑to‑1 technical validation into the 1‑to‑N stage of scaling and self‑funding, where listing helps finance capacity expansion, product iteration and market combat.In other words, the IPO wave isn't a victory parade — it's a collective breakout to secure "survival ammo." The primary‑market logic of "orders are king" translates at the exchange door into a hard look at revenue mix, gross margins and cash‑flow health. The exam opens new space — and starkly exposes uneven maturity and hidden financial strain across segments.First to the line are the "cash cows" with proven models in standardized scenarios. Home and commercial service‑robot firms such as OneRobotics, with clearer B2C or B2B models, verifiable revenue and products the public can grasp — are leading to market.

Image: OneRobotics

On December 30, OneRobotics listed on the Hong Kong main board, securing the first AI embodied home‑robot IPO. The shares ended at HK$73.85, valuing the company at more than HK$16.4 billion.

A leading global provider of AI embodied home‑robot systems, OneRobotics's business spans smart control, household chores, smart butlers and elder care, with sales to more than 90 countries and regions. Revenue came in at 275 million yuan, 457 million yuan and 610 million yuan in 2022–2024, a 49% compound annual growth rate.

Even so, its prospectus reveals a common industry pain point: to win share, sales and marketing expenses run high, sometimes eclipsing R&D. Listing proceeds will largely fuel continued market expansion.

Next are the "heavyweights" tackling industrial hard demand. Their value lies in directional certainty and deep embedding in manufacturing upgrades — yet many still wrestle with prolonged losses.

SEER Robotics, focused on robot control systems, ranked No.1 in controller sales in both 2023 and 2024. More than 2,000 robot models have been deployed via its platform, spanning over 20 sub‑industries including 3C, autos, automation equipment, new energy, semiconductors, construction machinery and biopharma.

Revenue has risen for three straight years — 184 million yuan, 249 million yuan and 339 million yuan in 2022–2024 — but net losses remain elevated at 32.26 million yuan, 47.70 million yuan and 42.31 million yuan. For SEER, listing is a crucial leap to offset heavy R&D and push past breakeven.Even the cutting edge of humanoid robots is making a faster run at public markets.

Image: Leju Robotics

With technical routes unsettled and costs to mass‑produce still to crack, listing is not just about financing — it's a vital springboard for survival and positioning.

Behind that consensus lies the urgency and complexity unique to the segment. Humanoid R&D is a money‑burner with no bottom; in extreme cases, the tally just for testing, iteration and data collection can reach several billion yuan. Listing isn't only to extend runway — it's to lock in brand mindshare, bind strategic customers and stockpile capital for a long fight with "million‑unit capacity" giants on the eve of mass production.

As many players sprint toward IPOs, leaders are quietly elevating their capital playbooks.

On December 24, UBTECH — Hong Kong's first humanoid‑robot listing — announced plans to take 43% of A‑share company Fenglong Co. for 1.665 billion yuan via a mix of agreement transfer and tender offer, securing control.This is more than financial engineering. The goals are to acquire Fenglong's precision‑manufacturing capability to open mass‑production channels, and to build an "A+H" dual‑market financing platform to feed capital into cash‑hungry businesses and improve UBTECH's overall structure.

In essence, it's a high‑stakes wager — trading capital for time, and space for survival — executed on the industry's mass‑delivery "eve." It lays bare a reality: even top names under the tech spotlight must engage in risky, costly capital battles before profits come into view, just to secure a scarce ticket to the next era.

Outlook for 2026: from capital stories to delivery reality

The capital shifts of 2025 suggest 2026 won't be a smooth continuation. It will be a brutal year of divergence — and a year of verification.

On applications, expect continued breadth — with the enterprise side entering a delivery surge.

Image: UBTECH

While general‑purpose home services spark imagination, capital and technology are concentrating on industrial pain points with fast‑verifiable economics. Flexible stations in autos and consumer electronics, plus logistics, warehousing and high‑risk specialty jobs where "human–machine collaboration" or "machines replace humans" is urgent, are moving to the front of the deployment and commercialization queue.

At the same time, 2026 is widely seen as the "first year" of scaled mass‑production deployments for robots — especially humanoids. That shift will end the noise around concepts and push the industry into a hard phase where "delivery notes" and "financial statements" carry the weight.

As a result, the "gold content" of orders will face tougher vetting in 2026, and delivery capability will become the survival line.

Despite many large orders signed in 2025, institutions including Morgan Stanley note that a substantial share are "framework agreements" or "letters of intent," with uncertain execution. Whether these convert into firm, non‑cancelable purchase contracts — and are delivered — will be the litmus test in 2026.

For now, leaders are still climbing from "hundreds" toward "thousands" of units delivered — far from order volumes of several thousand or even tens of thousands. As scale grows, capacity constraints, supply‑chain management and yields will be magnified. Under that pressure, companies with orders but no deliveries will be left behind by capital.

That rule has been proven in autonomous driving and new‑energy vehicles. In robotics, with mass‑production trials approaching, consolidation and reshuffling will accelerate.

Zhang Chi, chairman of Xinding Capital, expects a reckoning in 2026, unlike 2025 when almost everyone raised money. "Of the 100‑plus humanoid‑robot companies in China, perhaps only 10 to 20 will remain — some in general‑purpose scenarios, others focused on verticals. It mirrors the auto‑EV path: a crowded start, then concentration. Humanoid robots will go through the same."Earlier warnings from the National Development and Reform Commission against "repetitive clustering" already suggest that the window for policy arbitrage is closing.

With competition intensifying, "PowerPoint robot" companies that lack core technology and rely solely on funding will see their space shrink. In contrast, leaders will use the closed loop of mass production to build high‑quality datasets and algorithm moats, reinforcing their edge — and raising the bar for newcomers.ConclusionIn 2025, China’s robotics sector, buoyed by capital, delivered a collective pledge at a transitional moment.

Nearly 10 billion yuan of primary‑market flows sketched the industry's value map: hard‑tech components and machine‑platform leaders with commercial traction sit at the center. The opening of the IPO gate in secondary markets sets a clear milestone in this long capital marathon — and injects fresh energy for the next lap.

Looking to 2026, the spotlight will tighten. As the din fades, only companies that can ship reliable products, make unit economics work in defined scenarios and build sustainable cash‑generation engines will survive the test of "mass‑production hell."

Hot money in primary markets shifts course, pragmatism takes hold

Hot money in primary markets shifts course, pragmatism takes hold Image source: Galbot

Image source: Galbot Image: LinkerBot

Image: LinkerBot Image: OneRobotics

Image: OneRobotics Image: Leju Robotics

Image: Leju Robotics Image: UBTECH

Image: UBTECH