Early 2026 marked the final curtain call for Qoros Auto, signaled by a contentious asset auction. On one side, the controlling de facto owner cried foul over a "fire sale"; on the other, the market offered only silence on valuation. The uproar surrounding Qoros is more than just the end of a single automaker—it is a brutal microcosm of an industry survival race now entering its deepest waters.

Whistleblowing, Failed Auctions, and the Turmoil Over Core Assets

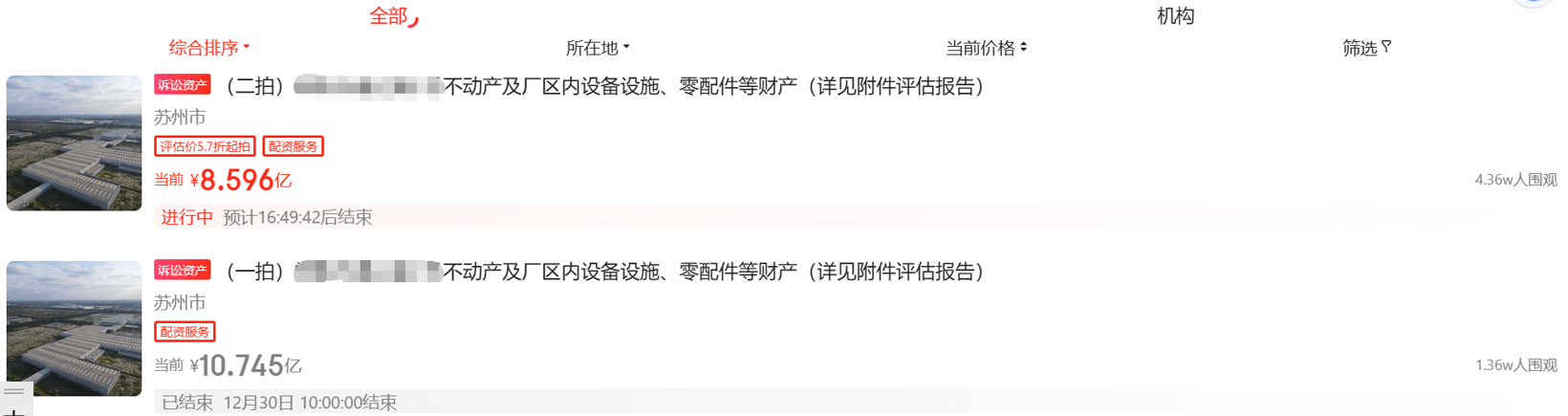

At 10:00 a.m. on January 15, 2026, a package of Qoros Auto Co., Ltd.'s core assets went under the hammer on JD.com's judicial auction platform. The lot, carrying a starting price of roughly 859.6 million yuan, comprised usage rights for 716,000 square meters of industrial land, 183,000 square meters of buildings, and production line equipment. Yet, despite drawing over 43,600 onlookers by press time, the auction saw just a single registrant—and zero bids. The market response was strikingly cold.

Image source: JD Asset Trading Platform

This marked the second attempt to sell the asset package. The initial auction, held on December 30, 2025, with a starting price of roughly 1.075 billion yuan, failed to attract a single bid. Under judicial auction rules, the starting price was slashed to 80% of the original amount, yet even that failed to spark any enthusiasm among bidders.

Just a day before the auction that would decide the fate of Qoros's physical assets, the situation escalated sharply. On January 14, Yao Zhenhua—chairman of Baoneng Group and the de facto controller of Qoros Auto—released a video whistleblowing under his real name. He accused local authorities of procedural irregularities in a debt enforcement case involving a mere 270 million yuan, which he claimed led to the forced auction of Qoros's valuable core assets.

Image source: Screenshot from China Baoneng

Yao's video statement centered on two main grievances. First, the disparity in valuation. He claimed that third-party assessments valued Qoros's core assets, including its Changshu plant, at roughly 8 billion yuan. Yet, the official appraisal stood at just 1.535 billion yuan, with the second auction's opening price plunging to around 860 million yuan—a move he decried as a "low-price asset grab." Second, he questioned the legality of the proceedings. Yao noted that Qoros had been accepted for bankruptcy reorganization in December 2025. He argued that proceeding with the enforcement and auction violated the Enterprise Bankruptcy Law. He warned the move would directly damage Baoneng Group's cumulative investment of roughly 26 billion yuan as a shareholder, along with 13.9 billion yuan in creditor claims involving 1,500 suppliers and dozens of financial institutions.

This public complaint has thrust Qoros's final asset liquidation into a vortex of legal battles and public opinion. On one side, shareholders are aggressively crying foul over procedural injustice and undervalued assets; on the other, the judicial auction proceeds in silence despite the crowd of onlookers. That quiet response reflects the market's cautious assessment of the assets' actual worth amidst complex disputes and legal entanglements. As the controversy unfolds alongside the auction, Qoros's final chapter grows increasingly murky.

Qoros's Exit: A Defining Moment in the Auto Industry's Survival Race

Founded in 2007 as a joint venture between Chery Automobile and Israel's Quantum Group, Qoros was among the earliest Chinese brands to target the premium segment. The Qoros 3 debuted at the Geneva Motor Show in 2013, earning praise from European media for its design, safety, and craftsmanship.

Image source: Qoros Auto

Commercially, however, Qoros struggled from the start with the classic dilemma of critical acclaim but weak sales. The Qoros 3 was priced directly against mainstream joint-venture models like the Volkswagen Sagitar and Toyota Corolla—far above its domestic Chinese rivals.

Without established brand recognition, this aggressive "upward breakout" strategy proved too ambitious. Between 2014 and 2016, annual sales hovered around 10,000 units, while cumulative losses surpassed 6 billion yuan.

In late 2017, Baoneng Group acquired a 51% stake for 6.63 billion yuan, taking control. Sales briefly spiked to roughly 63,000 units in 2018. It quickly became apparent, however, that this volume was driven largely by internal purchases from Baoneng's own car-rental platform, Lian Dong Yun.

Such "left-hand-to-right-hand" maneuvers failed to generate genuine market demand. After 2020, as Baoneng Group fell into its own liquidity crisis and cut off funding, Qoros quickly foundered.

Stagnant R&D, halted production, a collapsing dealer network, and failing after-sales service sent Qoros into a rapid decline. Annual sales slumped to just 5,200 units in 2021, and by 2023, that number had fallen to fewer than 100.

Since 2025, competition in China's auto industry—particularly in the new energy vehicle (NEV) sector—has reached a boiling point, with price wars becoming the norm. In response, the Ministry of Industry and Information Technology, the National Development and Reform Commission, and the State Administration for Market Regulation jointly held a symposium to restore order to the competitive landscape.

Data from the China Association of Automobile Manufacturers shows that NEV production and sales reached 16.626 million and 16.49 million units respectively in 2025—year-on-year increases of 29% and 28.2%. Yet, even as the sector expands, overall profitability is under strain. Financial reports from listed automakers reveal that despite record NEV sales, overall profit margins are thinning and profit per vehicle continues to slide.

Qoros's story offers a multi-dimensional case study for the industry. Its early struggles demonstrate that success cannot be built on technical specifications alone; it requires a synchronized approach to brand narrative, channel development, and user relationship management.

The NEV survival race is far from over; it is entering a far more critical stage. If the past few years were a battle for market entry, then beginning in 2026, the industry will fully enter a period of value realization.

The countdown on the auction webpage ticks on, edging closer to the 10:00 a.m. deadline on January 16. Simultaneously, Qoros's bankruptcy review proceedings continue to move forward.

On one side stands a shareholder's complaint over a "low-price asset grab"; on the other, a market that has rendered its verdict on value by refusing to bid. The final controversy surrounding Qoros may well serve as a tension-filled footnote for China's auto industry—and its new entrants in particular—amid this fierce survival race. Once the market delivers its judgment, disputes over asset value do little to halt the iron law of industry consolidation.