Shanghai (Gasgoo)- On Jan 4, Dongfeng Honda Engine Co., Ltd. (hereinafter "Dongfeng Honda Engine") completed a major corporate change: Dongfeng Motor Group and other shareholders exited, and GAC Honda became the sole controlling shareholder. The company name was simultaneously changed to GAC Honda Engine Co., Ltd.

Image source: Tianyancha screenshot

What looks like a simple equity shuffle is, in fact, a snapshot of legacy automakers making hard choices amid the shift to new-energy vehicles (NEVs). As the gasoline-car market keeps shrinking and NEV penetration passes a critical threshold, every asset tweak carries the urgency — and survival instinct — of transition.

Control changes hands — telegraphed long ago?

As early as August 2025, the Guangdong United Assets and Equity Exchange website disclosed that Dongfeng Motor Group planned to sell its 50% stake in Dongfeng Honda Engine, a joint venture with Honda Motor.

On Sept 30, 2025, GAC Group said in a filing it had approved GAC Honda's cash capital increase to acquire Dongfeng Motor Group's 50% stake in Dongfeng Honda Engine, with a listing floor price of 1.172 billion yuan. After completion, GAC Group and Honda would keep their 50:50 split at GAC Honda, while Dongfeng Honda Engine would exit the Dongfeng orbit entirely to become a wholly owned subsidiary of GAC Honda.

A look back at Dongfeng Honda Engine's development shows the ownership reshuffle had been years in the making.

According to the Gasgoo Global Automotive Industry Database, Dongfeng Honda Engine was founded on July 1, 1998, with shareholders Dongfeng Motor Group, Honda Motor Co., and Honda Motor (China) Investment Co., holding 50%, 40% and 10% respectively. The Guangzhou-based engine maker develops, manufactures and sells passenger-car engines and related components, and provides aftersales service. Its products mainly supply GAC Honda's passenger models. The company currently has annual capacity for 480,000 engine assemblies and more than 650,000 sets of components.

Image source: Dongfeng Honda Engine

Given the tight business linkage, GAC Honda relies heavily on this engine supplier, while Dongfeng's stake has long looked like a cross-group capital tie-up — planting the seeds for today's consolidation.

Volatile financials, meanwhile, became the immediate catalyst. Disclosures show a roller-coaster in recent years: revenue came in at 9.566 billion yuan in 2024, yet the company posted a net loss of about 228 million yuan; in the first half of 2025, revenue fell 18.3% year on year to 3.807 billion yuan, but net income swung back to a profit of 371 million yuan.

Several factors sit behind that pattern. Analysts say the 2024 loss stemmed mainly from a broader slide in the ICE market and higher raw-material costs that pushed up engine production expenses. The rebound in the first half of 2025, by contrast, owed more to short-term drivers: GAC Honda rolled out promotions on select gasoline models, lifting engine orders for a spell; Dongfeng Honda Engine also squeezed costs by optimizing lines and trimming overheads, improving profitability in the near term.

Short-term profits, however, don't remove the long-term overhang. As a company centered on ICE engine R&D, manufacturing and sales, its product mix clashes with the auto industry's march toward electrification. In this market, demand for ICE engines keeps eroding, narrowing the core business runway for Dongfeng Honda Engine.

For Dongfeng Motor Group, holding a non-core asset with limited growth that sits outside its mainline business no longer fits strategy. For GAC Honda, taking full control tightens supply-chain integration and deepens control over key components — the core logic that allowed the deal to move quickly.

The 1.172 billion yuan floor price and the cash-increase structure also reveal each side's calculus. For Dongfeng, the cash inflow bolsters liquidity and funds the NEV pivot. For GAC Group, a capital increase limits near-term financial strain while full ownership can lift management efficiency.

With the deal closed, the company was renamed GAC Honda Engine Co., Ltd., formally folding the supplier into GAC Honda's core supply chain and laying the groundwork for subsequent restructuring and transition.

Heading for "new", meeting in the middle

The change of control at Dongfeng Honda Engine is not an isolated asset trade. It reflects how Dongfeng Motor Group and GAC Group are positioning for the NEV era — and their differing needs and paths. Dongfeng's decision to "let go" sheds non-core ICE assets to lighten the load and channel funds to NEVs. GAC Honda's "takeover" targets end-to-end supply-chain control to sharpen competitiveness and underpin the shift to intelligent, electric cars. This two-way integration is, at heart, the inevitable choice for legacy automakers entering the deep-water phase of transformation.

Image source: Dongfeng Motor

For Dongfeng Motor Group, selling the stake is a key move to optimize its portfolio and focus on NEVs. In recent years, Dongfeng has faced a pincer: shrinking scale and intensifying price competition in ICEs squeezing margins, even as its NEV push demands sustained spending on R&D, product cycles and marketing.

In 2025, Dongfeng's NEV sales topped 1 million, up 22% year on year. Sales of its self-owned brands surpassed 1.5 million, a 12% gain, accounting for 63% of total sales — effectively achieving its "1:1" target between self-owned and JV sales.

Commenting on the sale, a Dongfeng executive told local media that, with China's NEV market developing rapidly, both Chinese brands and JVs face mounting competitive pressure. The company aims to optimize ICE assets through this transaction to better align with Honda's China strategy, while accelerating Dongfeng's own shift to NEVs.

GAC Group, for its part, is pursuing supply-chain integration and efficiency. It said the stake purchase and capital increase would enable integrated operations in engines at GAC Honda, improve supply-chain stability and autonomy, and enhance management efficiency and operating performance — paving the way for intelligent and electric transformation.

As the industry transitions to electrified and intelligent cars, supply-chain stability and autonomy have become central to competitiveness. While Dongfeng Honda Engine has been a core supplier to GAC Honda, a three-way ownership structure can slow decisions and blunt responsiveness. Full control gives GAC Honda end-to-end command of the engine business — from production planning to supplier layout — lowering procurement and coordination costs and lifting overall efficiency.

The move also dovetails with GAC Group's broader NEV strategy. In recent years it has pushed a dual-track approach to strengthen both ICE and electrified products. GAC Toyota pursued oil–electric synergy in 2025 and, in 2026, set an explicit acceleration for pure EVs along with user-centric reforms, targeting NEVs to exceed 20% of sales.

As GAC Group's key JV platform with Honda, GAC Honda's electrification pace directly shapes the group's trajectory. With full ownership of the engine unit, GAC Honda can secure the legacy ICE supply chain while leveraging existing plants and teams to pivot the engine business toward electrification — from hybrid engines to e-drive systems — enabling a smoother shift from ICE to NEV powertrains.

Image source: Honda China

Viewed more broadly, Dongfeng "lightening the load" and GAC "integrating for efficiency" are two archetypal strategies for legacy players in transition. Whether by divesting non-core assets to focus on the core, or by consolidating supply chains to raise efficiency, the goal is the same: move first in an increasingly fierce market.

Industry reshuffle, competition moves up a gear

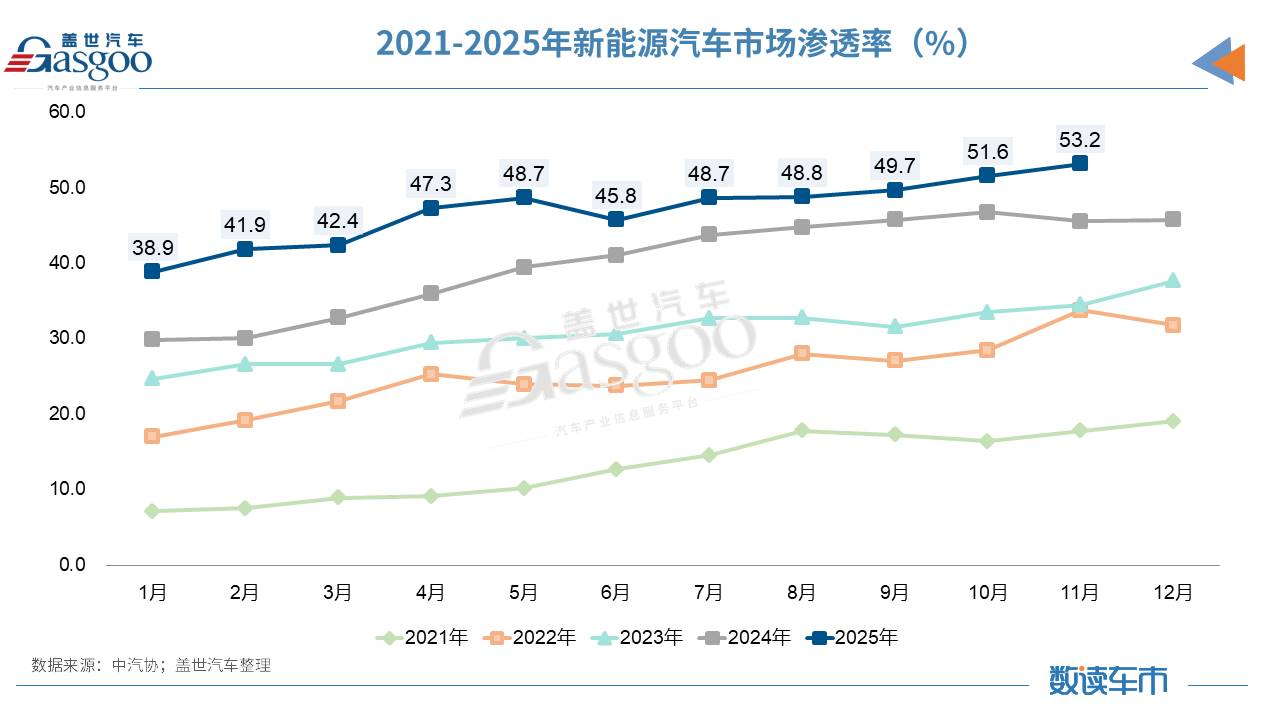

The transfer of Dongfeng Honda Engine doesn't just mark two companies' strategic pivots; it mirrors how China's auto industry is competing in the deep-water phase of transition. With NEV penetration topping 50%, the ICE value chain is being rebuilt as electrification and intelligence become the main battlegrounds. Competition is shifting from pure price to delivered value, and from single-track to multiple technology routes, with carmakers turning to asset reorgs, tech innovation and system reforms to find a way forward.

Three features stand out in today's competitive landscape:

First, NEVs have gone mainstream, with penetration still climbing. In November 2025, NEVs accounted for 53.2% of new-car sales — meaning more than five of every ten cars sold were electrified. The Gasgoo Auto Research Institute forecasts 2025 NEV sales at 15–17 million, with annual penetration exceeding 53%.

Second, the battlefield is moving from price to value. The first half of 2025 saw price wars rage on in NEVs, but their effects faded in the second half as consumers shifted from chasing the lowest sticker to weighing product strength, user experience and lifecycle services.

Third, intelligence has become a new fulcrum. With advances in AI, smart cockpits, voice interfaces and higher-level driver assistance have moved to center stage for consumers — and a key lever for differentiation. As industry veteran Fu Yuwu puts it, intelligence will provide the biggest incremental thrust in the "second half" of this transformation, shaping the future competitive order.

In this context, automakers are pursuing diverse survival paths, with asset restructuring and business optimization now commonplace. Beyond Dongfeng's sale, legacy global players are spinning off ICE assets to focus on NEVs. Volvo Cars, for example, said in November 2022 it would divest its 33% stake in JV Aurobay to Geely Holding, fully exiting ICE development and manufacturing — the first global automaker to do so.

Parts makers are also on the move. Schaeffler Group signed a deal in November 2025 to sell its China turbocharger business to Chengdu Xiling Power; FORVIA has started a process to sell portions of its interiors business. Such "cut-to-save" restructurings are, at their core, about freeing up capital, focusing on the core and carving out room for electrification.

Image source: Schaeffler

Multiple technology paths are the other pillar of transition. With electrification now irreversible, more carmakers recognize a single all-electric route won't fit diverse global markets. A portfolio spanning ICE, hybrids and BEVs is the pragmatic choice for the transition phase.

Audi China noted: "We see clear differences across markets. In North America, the tipping point is clearly later; in China, the NEV inflection point arrived last year." Based on that, Audi will extend the lifecycles of ICE and PHEV models beyond 2035 and offer a differentiated lineup across BEVs, PHEVs and ICEs. Mercedes-Benz, meanwhile, has pushed back its goal of EVs making up 50% of sales by 2025 and will keep refreshing its ICE range over the next decade, pursuing a dual-track strategy.

For Chinese automakers, deepening user-centric system reform and upgrading product strength and service quality have become core levers. GAC Toyota plans to accelerate pure EVs in 2026 while pushing user-centric reform, targeting NEVs above 20% of sales; Dongfeng Motor has built an NEV brand matrix spanning luxury, premium and mass segments, with 45 NEV passenger and commercial models on sale, and launched its "Tianyuan Intelligence" tech brand, claiming mastery of L2.9 city NOA core algorithms. At the same time, carmakers are stepping up local R&D and capacity to strengthen supply-chain stability and autonomy.

Policy is also lending support. From Jan 1, 2026, the purchase tax on NEVs is levied at half-rate, and the "two new" subsidy programs have been refined — injecting positive momentum into the market. Regulators are likewise moving to rein in cut‑throat "involution" competition, standardize market order and push companies toward higher-quality growth.

Looking ahead, China's auto transition remains challenging, but opportunity and potential abound. With continuous tech iteration, sustained policy backing and a maturing market, competition will focus more on core technological innovation, product strength and user experience. The transfer of Dongfeng Honda Engine is a microcosm of this shift, signaling that reconstruction of the traditional value chain has entered deep water. Only those able to reset strategy quickly, optimize asset structures and read market demand with precision will stand out in the shakeout.