What moved China's new-energy vehicle market this week?

Xiaomi livestreams a teardown, Lei Jun: 2026 delivery target of 550,000 units

On Jan. 3, the final day of the New Year holiday, Xiaomi founder Lei Jun kicked off the year by taking the engineering team — and a brand-new YU7 — into a live "teardown."

Lei Jun and his engineers chatted while dismantling the Xiaomi YU7 on camera, laying bare its internal architecture, technical thinking and manufacturing process. The move was more than a show of confidence in the YU7's build quality. It was also Xiaomi's bid to ground the public debate in facts and fairness. Lei called for "more balanced voices," pushing back against hype or trash talk for clicks.

Image source: Screenshot from Lei Jun's personal video account

Xiaomi's marketing emphasis has clearly shifted from early traffic-chasing to transparency on technology and materials — aiming to build long-term trust. Publicly dissecting a product is one of the most candid, confident ways engineers engage, and it signals technology that can withstand scrutiny. As a tech giant crossing into carmaking, Xiaomi is out to prove it not only masters software and ecosystems, but also top-tier hardware R&D and vehicle manufacturing.

On the stream, Lei also shared Xiaomi Automobile's 2025 performance: full-year deliveries topped 410,000 units (surpassing the initial 300,000 target and later-raised 350,000 guidance), and he set a 2026 delivery goal of 550,000 units.

Once dismissed as an automotive "outsider," Xiaomi is reshaping the rules of competition in China's NEV market — with delivery beats and technical showcases that keep outpacing expectations.

Gasgoo take: For Xiaomi EV, a teardown isn't just about exposing a car's structure; it's a crucial bridge to deeper consumer trust and a more durable brand footing.

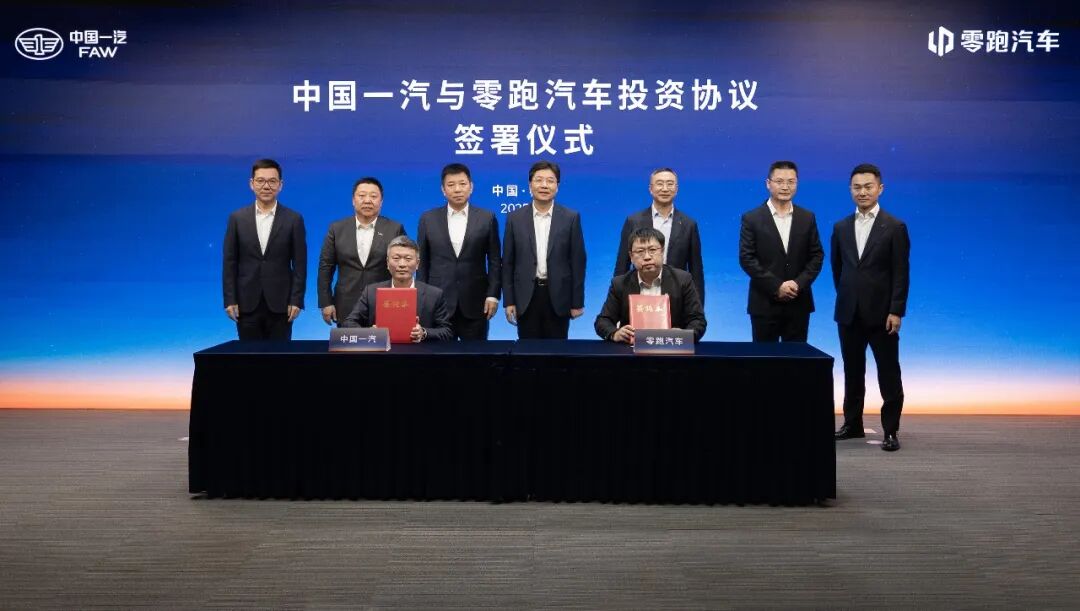

FAW Group to invest 3.744 billion yuan in Leapmotor

On Dec. 29, China FAW Group said it signed an investment cooperation agreement with Leapmotor on Dec. 28. Under the deal, FAW-affiliated companies will subscribe to Leapmotor's new share issuance for about 3.744 billion yuan, taking roughly a 5% stake on completion and becoming a key strategic shareholder.

The signing marks a rapid upgrade from the cooperation intent reached in March — moving from technology collaboration to a deeper blend of capital, technology and production.

Image source: China FAW Group

On Mar. 3, FAW and Leapmotor signed a memorandum of understanding, outlining joint development of NEV passenger cars and cooperation across components and capital — establishing the framework for their relationship.

Just 20 days later, the partnership quickly landed its first project: Leapmotor won the bid for joint development of Hongqi's G117 model and the associated platform technology licensing, underscoring strong execution. Since then, the two sides have deepened talks on components, vehicle platforms and software systems, pushing multiple plans toward implementation.

By the Dec. 28 signing, the pair had crossed from business collaboration into capital linkage, forming an all-round model of "technology + capital + production." The progression shows a steady elevation in cooperation — from early technical coordination toward strategic integration of resources across the full industry chain.

Per the framework, Hongqi models for overseas markets developed on Leapmotor's platform are slated for mass production and global rollout in the second half of 2026. The tie-up lets FAW leverage Leapmotor's technology to sharpen its international NEV competitiveness, while Leapmotor can tap FAW's overseas network to accelerate globalization — a complementary push to go abroad.

In short, the cooperation has moved beyond single projects or short-term tech exchanges, building a multi-layer system spanning joint development, technology licensing, supply-chain coordination, capital alignment and global market expansion.

Gasgoo take: This step-by-step deepening reflects FAW's open-cooperation strategy amid industry transformation, and shows Leapmotor's platformization of its in-house technology to pursue broader industrial synergies.

Tesla's 9 millionth EV rolls off the line at its Shanghai plant

On Dec. 30, Tesla announced its 9 millionth electric vehicle had rolled off the Shanghai Gigafactory line — "adding another milestone to a 2025 that's drawing to a close." The car was a Model Y.

The 8 millionth EV came off the line in June 2025 at the Berlin Gigafactory — also a Model Y. It took just six months to go from 8 million to 9 million.

Image source: Tesla

Looking back, Tesla first crossed the 1 million global sales mark in March 2020, 12 years after its founding. In August 2022, CEO Elon Musk said Tesla had produced more than 3 million vehicles. In September 2023, Tesla announced cumulative production of 5 million cars — about six months after the 4 millionth rolled off the line.

Nearly half of Tesla's products have been built in Shanghai. In early December 2025, the Shanghai Gigafactory said its 4 millionth vehicle had come off the line. It took less than 14 months to go from 3 million to 4 million — a sign of the plant's pace and ramp-up efficiency.

Tesla said that over six years, the Shanghai Gigafactory has contributed nearly half of the company's global EV deliveries, achieved a localization rate of 95%+, and, on average, rolls a complete vehicle off the line every just over 30 seconds.

Gasgoo take: Shanghai's near-half contribution to Tesla's global deliveries is another proof point of how "Made-in-China" resonates with the worldwide shift to electrification.

CATL marks 1,325 battery-swap stations completed

On Dec. 30, CATL said its Choco-Swap battery-swapping network had reached 1,000 stations in Nanchang, while the Qiji battery-swapping network's 300th East–South China trunk-line station — Xiaoshan Transfar — opened in Hangzhou.

That means in just one year, Choco-Swap and Qiji built 1,020 and 305 stations, respectively — far outpacing industry norms. It also signals CATL has simultaneously achieved scaled networks for passenger-car convenience energy replenishment and commercial trunk logistics, ushering in a new phase for battery swapping services.

Image source: CATL

The two brands have tailored their networks to distinct use cases — from urban swapping to a national green trunk framework.

Choco-Swap focuses on core city clusters and now operates in 45 cities nationwide, serving the Yangtze River Delta, Beijing–Tianjin–Hebei, Chengdu–Chongqing and the Greater Bay Area. Its stations can run reliably in extreme conditions from -30℃ to 42℃.

Qiji is building green infrastructure for national trunk logistics, with a backbone network of "two east–west, two north–south" corridors that cover major highways including G42 Shanghai–Chengdu, G60 Shanghai–Kunming, G2 Beijing–Shanghai and G4 Beijing–Hong Kong–Macau. The network spans 78,000 km and 26 provinces, providing a foundation for electrifying core logistics routes.

By 2026, Choco-Swap plans to surpass 3,000 stations across more than 140 cities and begin building highway networks, with a long-term target of 30,000 stations and a franchise program. Qiji aims for 900 stations by 2026 and to expand the trunk network to "five east–west and five north–south" corridors, targeting by 2030 an "eight east–west, ten north–south" green grid that covers 80% of national trunk capacity.

Gasgoo take: Crossing 1,000 passenger-car and 300 commercial battery-swap stations within a year, CATL is opening a new chapter with a dual-line build-out at industry-beating speed.

2026 auto trade-in policy extended, subsidies up to 20,000 yuan

On Dec. 30, the National Development and Reform Commission and the Ministry of Finance issued a notice on implementing large-scale equipment renewal and consumer goods trade-in policies in 2026, setting detailed rules for auto trade-ins in the new year. Compared with 2025, the 2026 plan changes how subsidies are calculated, refines policy priorities and tightens oversight.

The biggest shift: subsidies for scrappage-and-replacement and trade-in scenarios move from fixed amounts to percentages of the vehicle's sale price.

Consumers who scrap an old car and buy a new-energy passenger vehicle will receive a subsidy equal to 12% of the car price, capped at 20,000 yuan; for qualifying gasoline cars, the rate is 10%, capped at 15,000 yuan. For trade-ins, the subsidy is 8% for NEVs and 6% for fuel vehicles. This replaces the 2025 fixed-amount approach, when scrapping and buying an NEV brought a uniform 20,000 yuan subsidy and fuel cars 15,000 yuan. Percentage-based support better aligns with actual purchase costs across different price points.

The 2026 policy continues to favor NEVs and emphasizes a unified national subsidy standard to advance the creation of a unified national market. The goal is to optimize consumption while avoiding fragmentation from differing local rules. In 2025, some provinces, including Shanghai, offered more granular support for plug-in hybrids and other models; the new rules push a single national approach.

Oversight will be tightened. The notice calls for cracking down on fraudulent claims, subsidy arbitrage and "raising prices before subsidies." In fact, the State Council meeting on Aug. 22 already demanded strong action to ensure funds are used effectively. Since then, many cities have strengthened guardrails on eligibility and subsidy disbursement. Building on that, the 2026 policy requires cross-department data sharing and end-to-end supervision to safeguard funds.

On funding, China will continue to use ultra-long special treasury bonds to support consumer trade-ins. The central and local governments will share costs on a 90:10 basis, with higher central support for central and western regions. That's consistent with 2025, but the new policy optimizes allocation and introduces pre-allocation of subsidy funds to ease corporate cash-flow pressure.

Overall, the 2026 auto trade-in policy shifts from simple fixed incentives to a more precise percentage-based guide, while strengthening risk controls based on past experience. The continuity should more effectively steer consumption toward NEVs and low-carbon choices and improve fiscal efficiency.

Gasgoo take: From fixed amounts to percentage-based guidance, the 2026 auto trade-in policy aims to drive greener consumption through tighter oversight and a unified market approach.