Based on the regional breakdown of Chinese independent automakers' passenger vehicle exports in November 2025, the global expansion paths of leading players have clearly diverged. Although BYD, Geely Holding, and Chery Holding all rank in the top tier, they differ markedly in core market focus, regional concentration, and growth logic: some have prioritized breakthroughs in high-barrier markets such as North America and Europe, others continue to leverage strengths in the CIS and Middle East, while some rely on a single anchor market to drive multi-regional volume expansion. These differing export footprints are increasingly outlining distinct global expansion rhythms and strategic orientations for the three automakers.

The regional export destination ranking of BYD passenger vehicles in November 2025 is as follows:

North America: In November, BYD exported 34,618 units to the region

EU + UK + EFTA: In November, BYD exported 22,630 units to the region

Southeast Asia: In November, BYD exported 20,921 units to the region

Middle East: In November, BYD exported 17,084 units to the region

Central & South America: In November, BYD exported 14,561 units to the region

CIS countries: In November, BYD exported 10,776 units to the region.

Oceania: In November, BYD exported 4,301 units to the region.

Other Asia: In November, BYD exported 4,038 units to the region.

Africa: In November, BYD exported 2,198 units to the region.

Other Europe: In November, BYD exported 428 units to the region.

Transcaucasia: In November, BYD exported 52 units to the region.

In November 2025, from a regional perspective, North America emerged as BYD's largest export market for passenger vehicles. BYD exported 34,618 units to the region, significantly outperforming other markets, with the monthly volume nearly double that of some traditional core export regions. Starting January 1, 2026, Mexico will raise tariffs on imported vehicles originating from China from 20% to 50%, sharply increasing tariff expectations. During the policy window ahead of its implementation, BYD's exports to the Mexican market surged, reflecting a typical strategy among automakers to front-load deliveries and accelerate customs clearance in order to hedge against rising tariff costs.

Europe remains a core pillar in BYD's export portfolio, but with increasingly differentiated regional dynamics. Exports to the EU, the UK, and EFTA totaled 22,600 units, ranking second and underscoring the continued resilience of overall European demand. By contrast, exports to "other European" markets were limited to just 428 units, indicating that BYD's European expansion is more tightly focused on countries with supportive policy frameworks, well-developed charging infrastructure, and higher acceptance of new energy vehicles (NEVs). Rather than broad-based expansion, BYD is pursuing a more selective and targeted market strategy across Europe.

Southeast Asia, the Middle East, Central & South America, and the CIS each maintained monthly exports in the 10,000–20,000 unit range, together contributing a sizable share of total overseas volume. BYD's advantages in cost control, supply chain integration, and product portfolio support further expansion across these markets. By contrast, exports to Africa, the Caucasus, and other parts of Asia remain relatively small. As local policies, infrastructure, and consumer awareness continue to improve, these regions offer low-base but high-elasticity growth potential.

Overall, BYD's passenger vehicle exports have formed a dual-engine pattern of breakthroughs in mature markets and steady progress in emerging ones. Volume growth in North America and Europe has lifted the quality and value of its export mix, while Southeast Asia, the Middle East, and other regions continue to underpin scale stability. This balanced regional portfolio helps BYD diversify risks, smooth cyclical fluctuations, and lay a solid foundation for deeper global expansion in the competitive global NEV market.

The regional export destination ranking of Geely Holding passenger vehicles in November 2025 is as follows:

CIS countries: In November, Geely Holding exported 19,607 vehicles to the region.

North America: In November, Geely Holding exported 13,329 vehicles to the region.

Africa: In November, Geely Holding exported 8,919 vehicles to the region.

Middle East: In November, Geely Holding exported 8,680 vehicles to the region.

EU + UK + EFTA: In November, Geely Holding exported 5,747 vehicles to the region.

Central & South America: In November, Geely Holding exported 3,624 vehicles to the region.

Southeast Asia: In November, Geely Holding exported 2,371 vehicles to the region.

Other Asia: In November, Geely Holding exported 2,111 vehicles to the region.

Oceania: In November, Geely Holding exported 1,999 vehicles to the region.

Transcaucasia: In November, Geely Holding exported 84 vehicles to the region.

Other Europe: In November, Geely Holding exported 68 vehicles to the region.

From an export perspective, the CIS has become Geely Holding's most critical overseas market. In November 2025, Geely exported 19,607 units to the region, ranking first among all destinations. Strong demand for cost-effective, reliable ICE and hybrid models aligns well with Geely's current product mix, making the CIS a key pillar for stable volume growth. Meanwhile, exports to North America reached 13,329 units. While still smaller than its leading markets, this volume carries notable value given the stricter regulations, certification requirements, and intense competition. Leveraging its multi-brand portfolio and technology platforms, North America represents a long-term, strategic market for Geely, characterized by sustained investment and gradual scaling rather than short-term volume expansion.

Exports to Africa and the Middle East each approached 9,000 units in November, ranking third and fourth, respectively. These markets are large and highly price-sensitive, with relatively strong acceptance of both NEVs and conventional powertrains, enabling Geely to expand coverage quickly through multi-powertrain strategies and differentiated pricing, thereby lifting overall export volumes. By contrast, exports to the EU, the UK and EFTA totaled 5,747 units, a level well below that of the CIS and North America, indicating a more cautious and selective pace of market penetration in Europe.

Overall, Geely Holding's export structure reflects a strategy of "prioritizing emerging markets while steadily penetrating mature ones." Rather than aggressively pursuing high-end or new energy volume across all regions, Geely is consolidating scale in markets such as the CIS, Africa and the Middle East, while maintaining a measured presence in high-barrier markets like North America and Europe, leaving room for longer-term global upgrading.

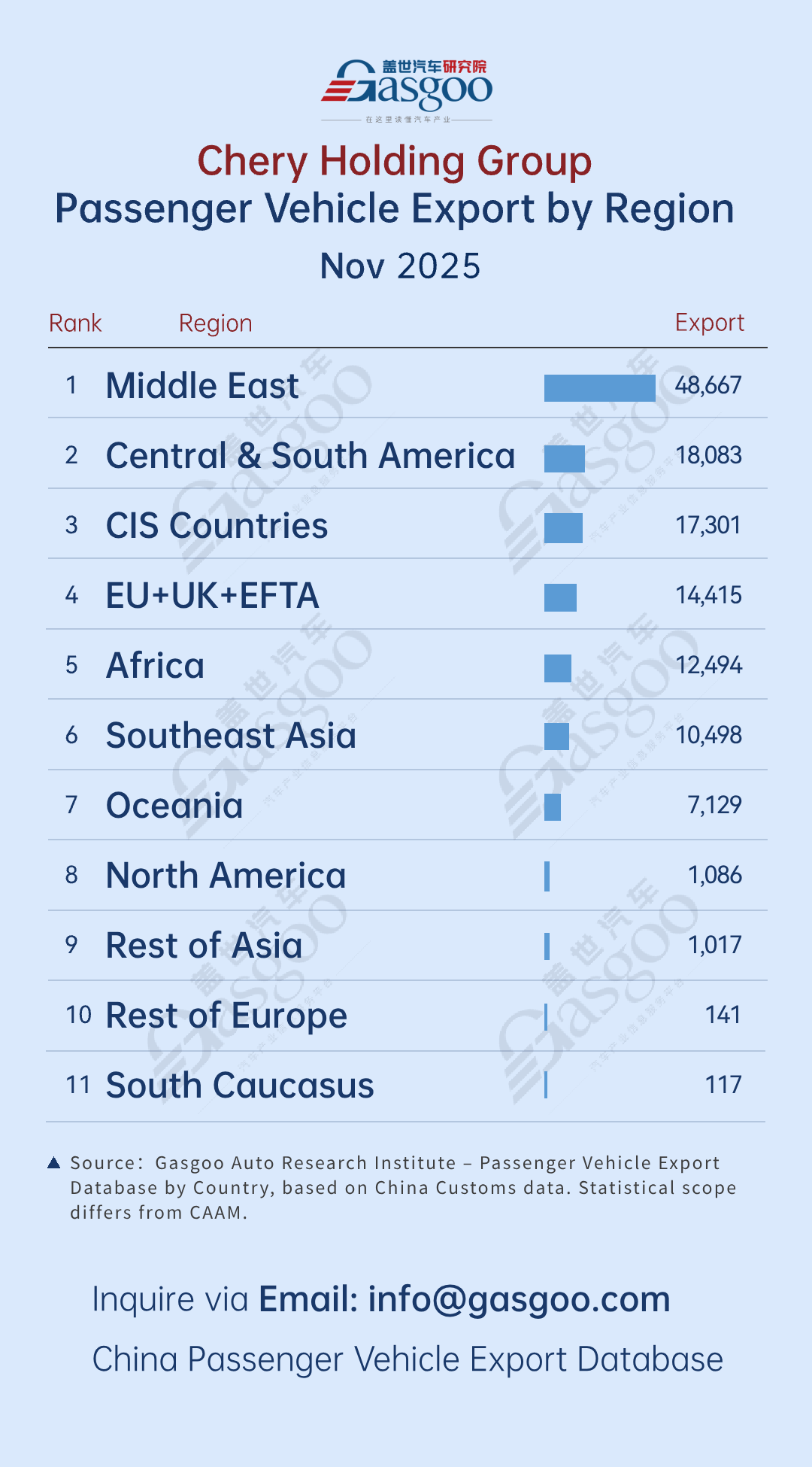

The regional export destination ranking of Chery Holding passenger vehicles in November 2025 is as follows:

Middle East: In November, Chery Holding exported 48,667 vehicles to the region.

Central & South America: In November, Chery Holding exported 18,083 vehicles to the region.

CIS countries: In November, Chery Holding exported 17,301 vehicles to the region.

EU + UK + EFTA: In November, Chery Holding exported 14,415 vehicles to the region.

Africa: In November, Chery Holding exported 12,494 vehicles to the region.

Southeast Asia: In November, Chery Holding exported 10,498 vehicles to the region.

Oceania: In November, Chery Holding exported 7,129 vehicles to the region.

North America: In November, Chery Holding exported 1,086 vehicles to the region.

Other Asia: In November, Chery Holding exported 1,017 vehicles to the region.

Other Europe: In November, Chery Holding exported 141 vehicles to the region.

Transcaucasia: In November, Chery Holding exported 117 vehicles to the region.

In November 2025, Chery Holding exported 48,667 vehicles to the Middle East, making it by far its largest single market—nearly equal to the combined volume of the second- and third-ranked regions. This scale reflects Chery's long-term accumulation of channel strength, brand recognition and product-market fit in the region, and indicates that the Middle East has moved from an export ramp-up phase to a stage of scaled, sustained operations.

Latin America and the CIS together form Chery's second growth tier. In November, exports to Central & South America and the CIS reached 18,083 units and 17,301 units, respectively, highlighting Chery's ability to sustain volume growth across multiple regions. Meanwhile, exports to the EU, the UK and EFTA totaled 14,415 units. Given the regulatory, tariff and competitive pressures Chinese brands face in Europe, this volume carries notable weight. Compared with its past reliance on emerging markets, Chery is strengthening its presence in Europe, signaling a gradual shift toward higher-standard markets in its export structure.

Exports to Africa and Southeast Asia each exceeded 10,000 units in November, underscoring Chery's strong product competitiveness and channel penetration in emerging markets. By contrast, exports to North America remained limited at just 1,086 units, well below other regions. This reflects Chery's cautious approach to the North American market, where current volumes primarily serve as brand testing, regulatory exploration and long-term market entry preparation rather than large-scale expansion.

Compared with other Chinese automakers, Chery holds a stronger scale advantage in the Middle East and multiple emerging markets, while gradually making inroads into Europe. This structure—anchored by a single "super market" and supported by coordinated growth across multiple regions—gives Chery greater resilience to volatility and stronger offensive flexibility in global export competition.