Gasgoo Munich- China's automotive sector is currently undergoing a brutal and profound transformation.

The dual revolution of electrification and intelligence hasn't just reshaped the core and form of products; it has fundamentally rewritten the rules of competition. As emerging players gain a foothold and traditional giants pivot aggressively, market share is rapidly concentrating at the top—a classic case of the "Matthew effect."

Yet, on the periphery of this fiercely contested "red ocean," some players once counted out are struggling to rise from the quagmire of bankruptcy restructuring.

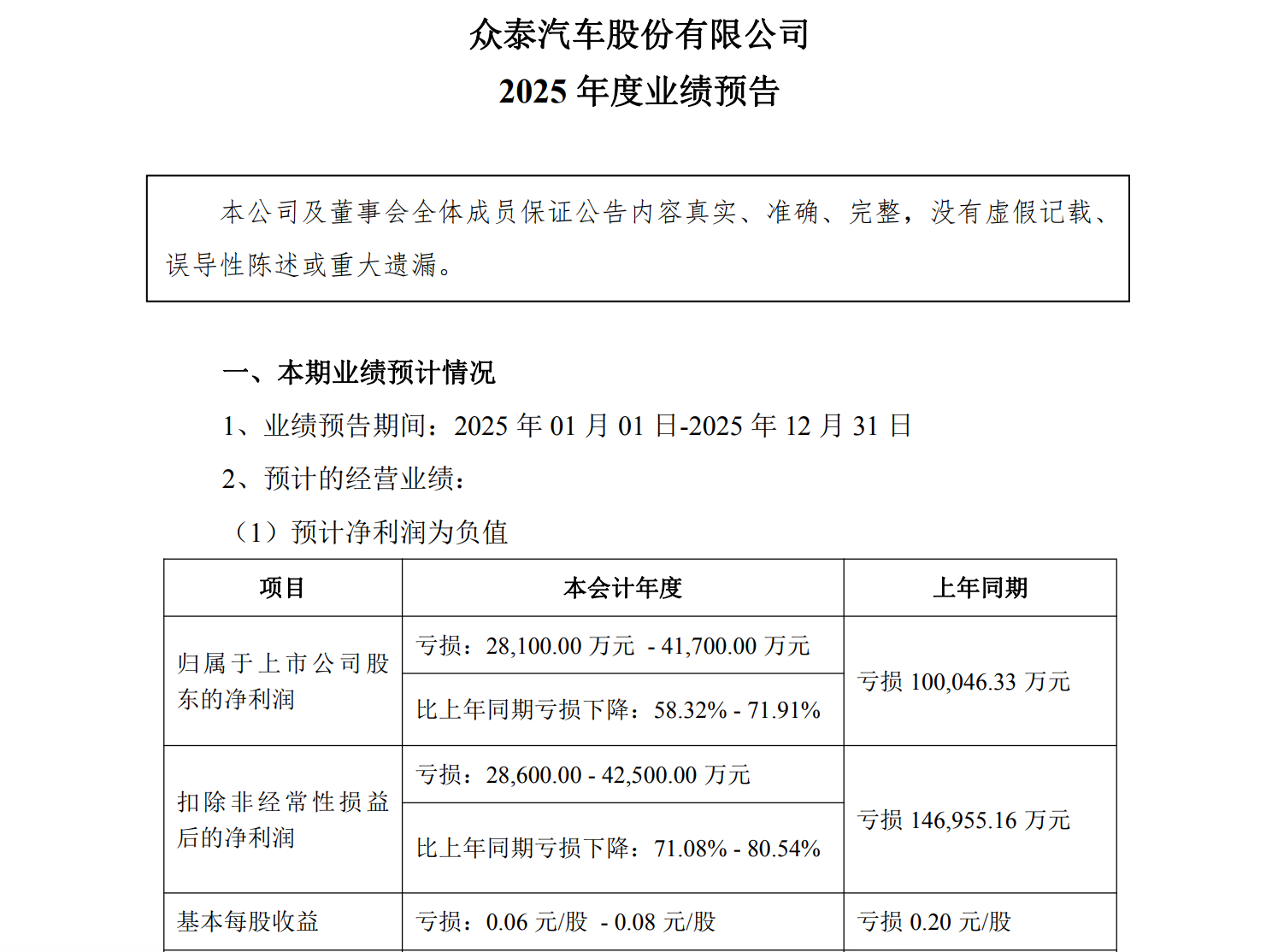

Recently, the bankruptcy restructuring case of HiPhi’s parent, Human Horizons, hit a key milestone as its interim administrator released a draft restructuring plan to creditors. HiPhi had previously signaled a potential return to production, launching a smart green tech upgrade project at its original Yancheng factory. Zotye Auto, too, has made a series of bold moves: not only did it repay hundreds of millions in debt early, but it also launched a massive recruitment drive for R&D roles. Just yesterday (January 28), Zotye released a performance forecast projecting a significant narrowing of losses in 2025 compared to 2024.

Image Credit: HiPhi

The flurry of activity from HiPhi and Zotye has jolted the market. In an era where technology iterates by the month, brand trust takes years to build but can collapse overnight, the "resurrection match" these companies have launched raises critical questions. What is the underlying path? Is this the beginning of a genuine corporate rebirth, or merely a phantom born of financial engineering? With reputations tarnished and technology lagging, what core competitiveness can they possibly sustain?

Pursuing these answers is not just about the ultimate fate of companies like HiPhi and Zotye; it is an examination of the resilience of China's automotive ecosystem.

Different Paths, Same Destination for the "Bankrupt"

HiPhi and Zotye: one positioned itself as high-end luxury, while the other was famous for "imitation" in the mass market. Though their starting points diverged, they both slid into operational distress. Their chosen paths to "resurrection" clearly reflect the differences in their resource endowments and the forces driving them.

HiPhi’s path relies on a systematic restructuring within the legal framework and a power game dominated by external capital.

The core vehicle for HiPhi’s comeback attempt is the substantive consolidation restructuring of its parent, Human Horizons, and several affiliated entities. The recently published draft restructuring plan is more than a debt repayment scheme; it is a systematic blueprint designed to reconstruct the company's capital and governance structure.

The draft's core logic lies in a thorough conversion of debt. Priority claims, such as employee wages and taxes, will be fully repaid in cash from investment proceeds. For other ordinary creditors, the plan offers a "cash plus equity" option: amounts of 30,000 yuan or less per creditor will be fully repaid in cash; for the excess, creditors can choose proportional cash repayment or convert their claims into equity.

This means that if most major creditors choose the latter, the restructured HiPhi will no longer be a simple entity but a relatively dispersed consortium of "creditors-turned-shareholders." While this design drastically reduces immediate cash repayment pressure—creating the financial conditions for the new operating entity to start with a clean slate—it also plants a "deep water bomb" for future corporate governance. Decision-making efficiency and consistency in strategic direction will face significant challenges.

Meanwhile, the introduction of potential strategic investors may be a parallel track. The draft reveals two potential investors are still in negotiations. While their identities remain undisclosed, Canadian EV company EV Electra has been the subject of strong market rumors. Last year, EV Electra established a joint venture with Human Horizons to form Jiangsu HiPhi Automobile Co., Ltd.

These moves outline a path to clearing historical baggage through judicial restructuring, introducing new strategic investors, and attempting to restart HiPhi’s operations by upgrading existing production capacity.

Zotye’s path, by contrast, is more about asset maneuvering under debt settlements.

Compared to HiPhi, Zotye’s fight for survival resembles conservative therapy under the crushing weight of historical baggage. Its most striking recent move was the early repayment of approximately 400 million yuan in debt to the Yongkang branches of Bank of China and China Construction Bank. The direct aim was to unfreeze the listed company's shares and deposits caused by financial loan disputes, thereby releasing liquidity for core assets—an emergency measure to resolve current judicial restrictions.

Against this backdrop, the massive recruitment posters released by Zotye Engineering Research Institute carry significant weight.

Image Credit: Screenshot from Liepin

Posting dozens of positions covering frontier fields like power batteries and intelligent driving sends a clear positive signal to the market, suppliers, and potential investors: Zotye still has the intent and plan to restart its technology engine.

Of course, this signal stands in stark contrast to Zotye’s grim financial reality. A massive chasm remains between the sustained payroll and R&D spending required for hiring and a restart, and Zotye’s current cash flow and financing capabilities—highlighting the fragility of its operations. The resignation of former chairman Li Lizhong just months after taking office late last year serves as a perfect illustration.

Despite their different paths, the "resurrection" attempts of both HiPhi and Zotye point to a common core dilemma: a lack of sustainable "blood-making" (profit-generating) ability. Analyst Ye Sheng put it bluntly in an interview with Gasgoo: "The sustainability of both companies' comebacks is very low, and the risk is extremely high." Ye noted that if capital injection is primarily used to settle historical debts rather than fund future-oriented R&D and market expansion, the companies remain far from achieving genuine, competitive large-scale operations.

The essence of capital is profit-seeking. For the industrial capital HiPhi might attract or the market investors Zotye faces, if the dawn of profitability isn't visible within a foreseeable timeframe, withdrawal is a Sword of Damocles that could fall at any moment.

Therefore, the current flurry of activity is largely about building a pipeline or platform to secure a "blood transfusion," rather than a restoration of intrinsic vitality.

Can Competitiveness Be Rebuilt?

Even if HiPhi and Zotye manage to cross the funding and debt hurdles in some way and get production lines running again, they face challenges far more thorny than finance: With reputations severely damaged and technology generations behind, where is the core competitiveness they need to survive and develop?

In automotive consumption—especially for high-value goods costing hundreds of thousands—brand trust is the cornerstone. HiPhi positioned itself as "luxury," with its first model, the HiPhi X, starting near 600,000 yuan. The product itself was an extreme bet on the brand promise. The parent company's bankruptcy restructuring was a devastating blow to that promise. As Ye Sheng accurately pointed out, the biggest resistance now is rebuilding "consumer trust." Restoring that trust requires long-term, stable, visible action and investment—not advertising. The cost and timeline could far exceed those required to resolve debt issues.

Zotye’s brand problem is even more fundamental. The label of "copycat ancestor" is a product of its past business model and has become a heavy burden in its quest for revival. This label implies not only a lack of original spirit and respect for intellectual property but, more deeply, anchors its brand value firmly to the dimensions of low price and copied aesthetics.

Image Credit: Zotye Auto

In today's market, where consumption is upgrading and consumers increasingly value brand substance, original design, and technical confidence, Zotye’s historical brand equity can barely support its products, let alone command a premium—it may even be a serious drag. Ye Sheng believes the perceived price range for such brands is locked in the low-end market, making it difficult to reposition upward. Shedding this label is nothing short of a difficult self-revolution, requiring complete product generational shifts, design language innovation, and prolonged positive market education.

The technological generation gap is another mountain to climb, fundamentally determining the rapid narrowing of the catch-up window.

Competition in the domestic auto market has essentially become a race in the speed of technological iteration. Smart cockpits, chip computing power, assisted driving algorithms, battery energy density, charging efficiency, and vehicle E/E architectures are all advancing at a breakneck pace.

Take HiPhi. After falling into crisis in late 2023, its R&D investment and continuity were inevitably hit hard. Even with previous technical reserves, years of stagnation have undoubtedly widened the gap with the industry leaders.

Are the "flashy" features HiPhi once prided itself on—like its falcon doors and programmable smart headlights—still consumer focal points? Is its accumulation in core areas like intelligent driving and battery systems sufficient to handle current market competition? These are massive question marks.

Zotye’s technical predicament is even more severe. Its historical success was not built on a solid independent R&D system. Prolonged production halts caused the loss of its existing R&D team and interrupted technical projects. Mass hiring of R&D staff now is merely the first step in rebuilding the organizational structure. From assembling a team, defining the tech roadmap, and developing products, to testing, validation, and mass production, it is a long process measured in "years," requiring sustained, massive capital injection.

On a track where competitors have already built deep technological barriers and are iterating rapidly, players like Zotye attempting to rebuild R&D capabilities from "ruins" face not just financial pressure, but the powerlessness of a closing time window.

Seeking a differentiated positioning may be the key to finding a market niche in the red ocean.

A basic judgment is that for the "bankrupt" to rebuild core competitiveness, it is not simply about resuming production. They must, while acknowledging their severe shortcomings, find an extremely precise differentiated market positioning that they have the capacity to occupy.

Where Does the Road Lead?

The "resurrection" prospects for automakers like HiPhi and Zotye are shrouded in a fog of multiple uncertainties. Their long-term value and ultimate way out must be sought within narrow, thorny possibilities, viewed through a lens of rational pessimism.

First, we must re-examine the value dimensions of these "resurrection" acts.

From a macro industry perspective, the value may not lie in birthing a new competitive brand, but rather in revitalizing and utilizing existing resources and orderly resolving some historical issues. Assets like HiPhi’s Yancheng factory, Zotye’s multiple production bases, and most importantly, their "automotive production qualifications," are valuable industrial assets. Getting them running again through restructuring helps maintain local employment and partial supply chain stability, avoiding total waste. Furthermore, allowing creditors (especially small creditors and employees) to receive a partial repayment through restructuring or debt settlement is a suboptimal but relatively orderly way to clear risk compared to liquidation.

However, viewed from the perspective of the enterprise as a market competitor—or from the angle of consumer value—the outlook is far more severe. "For consumers, these brands hold little value now; the risk likely outweighs the benefit," Ye Sheng noted. This risk spans product quality consistency, long-term after-sales guarantees, sustainable software updates, and used-car residual value stability. If any value exists, it is likely limited to providing short-term, high-value transportation tools for highly price-sensitive consumers, accompanied by significant hidden risks.

Acknowledging these limitations, a few narrow paths may still exist for the "bankrupt" to move forward.

Become an extremely focused niche market expert. Completely abandoning the illusion of full-category, all-scenario coverage, they could choose a highly vertical niche that mainstream giants currently ignore or are unwilling to invest in heavily—such as city micro-logistics vehicles or specific-use vehicles for scenic areas. This, of course, requires rapid product definition capabilities, extreme cost control systems, and flexible customized service abilities.

Or transform into a contract manufacturer. This may be the most realistic way to strip away negative brand equity and leverage existing manufacturing value. By utilizing their production qualifications and factory capacity to provide OEM services for other emerging brands (especially those lacking permits or needing capacity), or by becoming suppliers for specific parts and modules, they can give up the brand dream but might gain more stable cash flow and survival space.

Another option is attaching to a larger industrial ecosystem. Being acquired or reorganized by a massive industrial group to become a pawn or test bed in its diversified layout is also a way out. For instance, serving a tech company, mobility platform, or major parts group to explore specific tech routes, acting as a vanguard or supplementary capacity for their entry into auto manufacturing.

Another theoretically possible path is "going global," following the example of brands like Jishi Auto that target specific overseas markets. But as Ye Sheng remarked, "For current leading NEV companies, going abroad already faces significant resistance, let alone for companies trying to resurrect." Today's auto exports require localized adaptation, channel construction, after-sales network building, and a deep understanding of local regulations and culture. For a company just clawing its way back from the brink, this is undoubtedly a massive burden.

Image Credit: Zotye Auto

So comes the ultimate question: what exactly constitutes "resurrection"? Is it the restart of production lines? The temporary improvement of financial statements? Or the survival of the legal entity?

Judging by the internal laws of industrial development, true "resurrection" should contain at least three levels. The first is physiological recovery: restoring basic operational capabilities by solving debt and resuming production. The second is rebuilding market competitiveness: establishing sustainable product power, brand recognition, and profit models in a specific niche. The third is regenerating evolutionary capability: reshaping R&D and iteration capabilities for the future to keep pace with or even lead industry changes.

Viewed this way, HiPhi and Zotye’s current efforts are mostly still struggling at the edge of the first level. Whether they can bridge the gap from surviving on transfusions to surviving on their own "blood-making," and find a foothold at the second level, is the key marker of their "resurrection" success. Reaching the third level, for now, is a distant prospect.

Conclusion

The signs of "resurrection" from HiPhi and Zotye are not isolated cases in the auto industry. They are a complex ecological phenomenon inevitable as China's automotive industry shifts from frenzied expansion to deep adjustment. They demonstrate the other side of the market economy: not just the cruelty of survival of the fittest, but the tenacious resilience of asset restructuring and resource reallocation. The various measures they take—restructuring, debt repayment, capital introduction, hiring—are rational self-rescues under established legal and market rules. The process itself provides living case studies for observing the implementation of bankruptcy law, industrial capital operations, and local economic governance.

However, in an industry as highly integrated, technology-intensive, brand-sensitive, and scale-hungry as automobiles, financial restructuring is merely the beginning of the story—perhaps just the prologue. Repairing brand trust requires years of sustained sincerity in delivery; catching up on technology gaps demands massive funds and time; and the intensity of market competition and the harsh choices of consumers will show no mercy to any "reborn" entity.

Whether they eventually find a habitat in a niche market, transform into a supporting role in the supply chain, or sink back into silence, they will serve as a set of footnotes worth pondering as China's automotive industry moves from scale expansion to high-quality development.