On Jan. 7, the China–South Korea Innovation and Entrepreneurship Forum was held in Shanghai. South Korean President Lee Jae-myung attended and, during the event, shook hands with a humanoid robot from China's Zhiyuan Robotics, taking stock of progress in the field.

President Lee's presence turned a gathering of nearly 300 representatives from Chinese and Korean companies in intelligent manufacturing, new materials and artificial intelligence into a pivotal lever for tech cooperation across Northeast Asia.

The image of Lee shaking hands with a Chinese robot has become a moment rich in symbolism — more than a simple interaction, it signaled deeper cooperation in frontier industries as global supply chains are rewired, implying three layers at once: technological recognition, market complementarity and strategic alignment.

Meanwhile, Gasgoo noted that among the more than 4,300 companies at this year’s CES, 942 were from China, second only to the host U.S. (1,476), with South Korea third at 853. Of the 598 robotics exhibitors, Chinese firms made up nearly a quarter; in humanoids specifically, Chinese participants accounted for more than half.

As the global economy shifts to new growth engines, intelligent manufacturing and AI have become the core arenas for both competition and collaboration. China and South Korea — anchors of the Northeast Asian economy — have highly complementary industrial structures and a deep foundation for cooperation. Lee’s decision to center his Shanghai trip on an innovation and entrepreneurship forum was no accident.

On the surface, it was routine diplomacy and business outreach; at a deeper level, it reflected a joint effort to keep supply chains steady and seize the high ground in future industries as de-globalization and geopolitical frictions build. The detail of "shaking hands with a Chinese robot" offers a sharp window into the logic, foundations and future direction of China–South Korea tech collaboration.

Nearly 300 companies convene, underscoring China–Korea industrial complementarity

The forum on Jan. 7 may look like a standard cross-border business gathering, yet its scope and participant mix trace the core contours of China–Korea tech cooperation.

Close to 300 companies spanned six areas — intelligent manufacturing, new materials, artificial intelligence, healthcare, cultural creativity and consumer services — effectively covering today’s most promising growth tracks. The lineup speaks to the strong complementarity of the two economies and a precise match in cooperation needs.

Customs data show that in the first 11 months of 2025, China–South Korea trade totaled 2.14 trillion CNY, up 1.6% year on year, including 1.2 trillion CNY of imports from South Korea and 940 billion CNY of exports to South Korea. Trade with South Korea accounted for 5.2% of China’s total, with the bilateral relationship deepening in practice.

By industrial base, South Korea brings deep expertise in precision manufacturing, semiconductors and new materials, long anchoring mid-to-high segments of global value chains; China, for its part, leverages market scale, a complete supply system and rapid advances in AI and robotics to serve as both a source and a proving ground for emerging industries.

This "technology + market" — "manufacturing + application" pairing is the core engine of China–Korea tech collaboration.

The forum provided a targeted matchmaking platform: Korea’s advanced technologies can find deployment scenarios, while China’s market demand and industrial capabilities can secure the technical backing they need.

Notably, President Lee’s attendance itself signaled Seoul’s emphasis on China–Korea tech cooperation. It was his first visit to China since taking office — and the first by a South Korean president in nearly nine years.

At the forum, President Lee said he looks forward to vibrant exchanges among Chinese and Korean youth, sharing views and advancing innovation together.

The strong turnout of nearly 300 companies also underscores, from a market perspective, why this cooperation is both necessary and feasible. As global value chains are reshaped, going it alone no longer works; cross-border and cross-industry collaboration has become the natural path to sharpen core competitiveness.

Behind the handshake: probing China–Korea competitiveness in robotics

Many read the moment when President Lee shook hands with a Chinese robot as a sign that China’s robotics technology is winning broader international recognition.

In fact, the vignette reflects the rapid rise of China’s robotics industry in recent years — and the deep coordination already underway between China and South Korea.

Industry watchers widely see 2026 as the first year of mass production — and a pivotal year for commercialization — in robotics. At that juncture, China–Korea cooperation will influence not only each country’s industrial upgrading but also the global competitive landscape.

China’s robotics sector has moved from follower to peer — and in some areas, to leader.

Market researcher Omdia recently released its "Embodied General-Purpose Robots Market Radar", outlining 2025 trends, key commercial metrics and comparative technical strength. It estimates global humanoid shipments at 13,000 units in 2025, with Chinese vendors in the lead.

Zhiyuan Robotics, with more than 5,100 units shipped and a 39% share, ranked first by both volume and share, followed by Unitree Robotics and UBTECH. The report projects exponential growth ahead, with shipments potentially reaching 2.6 million units by 2035.

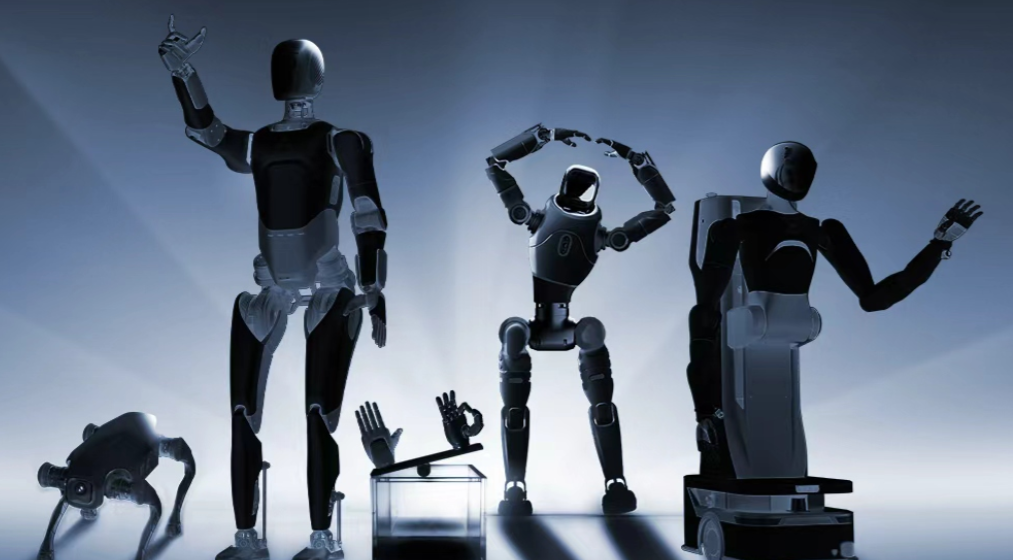

Image credit: Zhiyuan Robotics

In December 2025, China Report Hall noted that its "2025–2030 Global and China Intelligent Robotics Industry Status and Outlook" shows a diversified competitive landscape in China’s intelligent robotics market.

On one side, global robotics leaders leverage advanced technology, brand advantages and global footprints to claim share in China, with strong competitiveness in high-end industrial robots.

On the other, local companies are rising in mid- and low-end segments and in service robots through relentless innovation and cost control, building tangible advantages. New tech entrants drawing on AI and big data are also crossing into robotics, injecting fresh momentum into competition.

Technically, China’s core strengths keep firming up: for the "brain", multimodal foundation models are fusing with robot control to close the loop from perception to decision to execution; for the "cerebellum", dexterous hands now offer 22 degrees of freedom and localization of key parts such as six-axis force-torque sensors has topped 15%; for the "limbs", breakthroughs in lightweight materials and high torque-density servomotors have markedly improved motion performance and durability.

On the ecosystem side, China has built a relatively complete industrial chain in intelligent robotics, with independent capabilities from upstream core components and midstream body manufacturing to downstream systems integration.

Upstream core components include servomotors, reducers and controllers — all critical to robots. Chinese firms are increasing R&D, making breakthroughs and achieving domestic substitution, reducing reliance on foreign products.

In midstream body manufacturing, a cohort of competitive companies has emerged, producing high-quality, diversified industrial and service robots.

Downstream systems integrators tailor solutions to industry needs by combining robots with real-world application scenarios.

On the application front, Chinese robots now cover virtually all major scenarios.

In industry, UBTECH’s Walker S series has entered assembly lines at major domestic automakers; in commercial services, delivery and cleaning robots are gaining ground in hotels and malls; in extreme environments, Zhiyuan’s "Expedition A2" completed long-range tests over complex, real-world terrain.

Those rich use cases provide ample data for iteration, forming a virtuous cycle of R&D, deployment, feedback and optimization.

The Chinese robot that President Lee greeted embodies that progress — underpinned by China's combined strengths in technology, scenarios and capacity.

Meanwhile, South Korea’s robotics industry is accelerating under the twin forces of policy support and market demand.

In April 2025, the JoongAng Ilbo reported that South Korea has fully joined Big Tech's humanoid race, aiming to become the "world’s strongest" by 2030.

The Ministry of Trade, Industry and Energy announced the launch of the "K-Humanoid Alliance", bringing together more than 40 groups from academia, research and industry — including AI teams from Seoul National University, KAIST and POSTECH; robot makers such as Rainbow Robotics and Airobot; and major companies including Doosan Robotics, LG Electronics and HD Hyundai Robotics.

The alliance will focus on developing robot AI — effectively the machine’s brain — with a goal of creating a "foundational model for robot AI" by 2028. Korea will also push core parts such as sensors and actuators. Robot manufacturers and component suppliers will collaborate on force and torque sensors for fine manipulation, tactile sensors to enable touch in the hand, and lightweight, flexible actuators.

The industry ministry said it will use budgets for R&D, infrastructure and demonstrations to support companies’ technology development. To increase this year’s 200 billion won robotics budget, the ministry plans continued consultations with relevant agencies and the National Assembly.

In January, Hyundai Motor Group said it had begun mass-producing an on-device artificial intelligence chip that allows robots to operate autonomously without external network connections.

Unveiled at CES in Las Vegas, the Edge Brain chip stems from a three-year strategic collaboration between the group’s Robotics Lab and AI chipmaker DeepX. Consuming under 5 watts, it enables real-time perception and autonomous decision-making directly on the robot, without relying on cloud or network links. The chip will also be deployed in other projects at the group, including AI safety solutions and next-generation mobile robots.