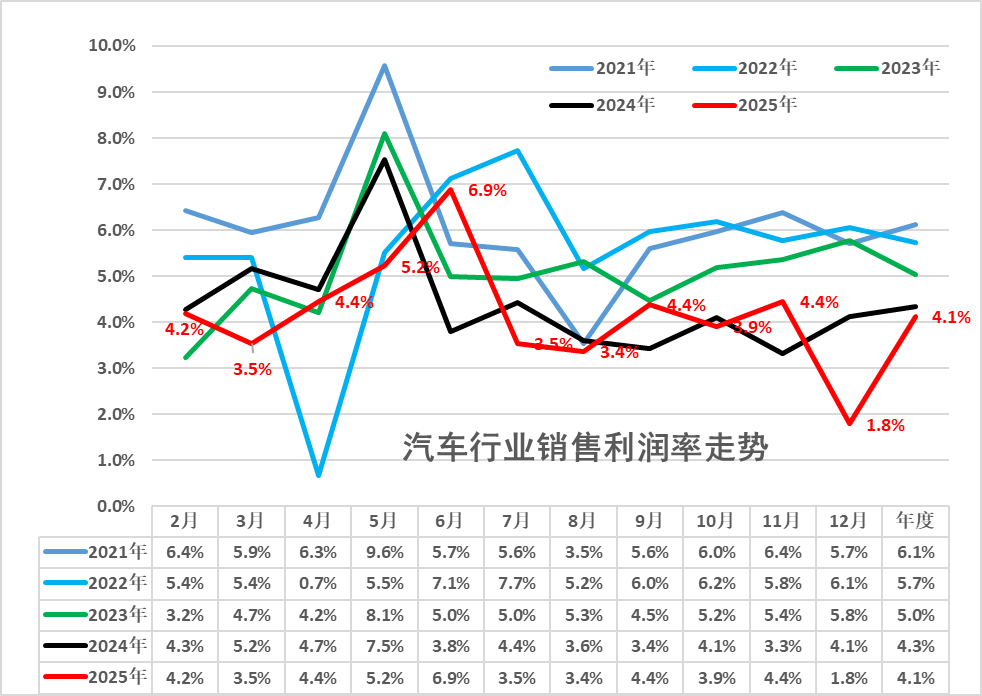

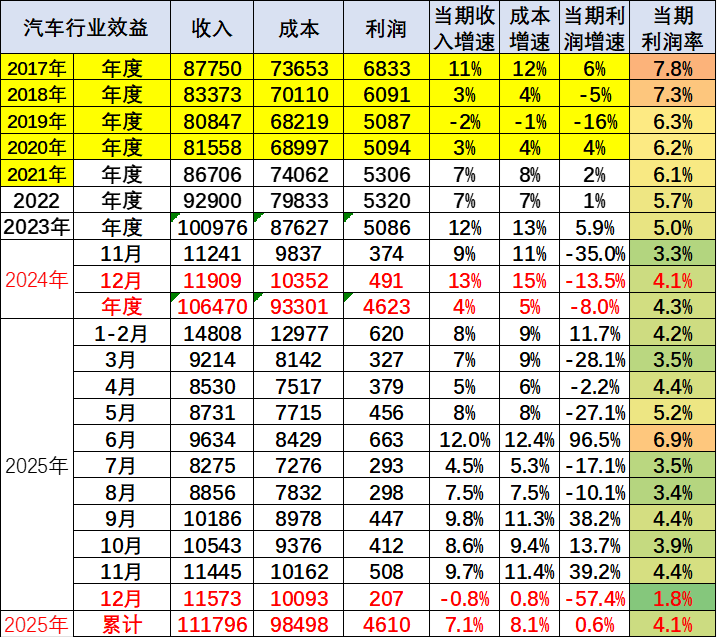

The year-end data for China's auto industry in 2025 reveals a cold reality. In December, the industry's sales profit margin plunged to 1.8%.

This figure means that for every 100 yuan of sales revenue, only 1.8 yuan of profit is generated. Compared with 4.1% in the same period last year, this is effectively a halving. Total profit for the month was 20.7 billion yuan, a staggering 57.4% drop year-on-year.

Image credit: Cui Dongshu

Even looking at the full year, the average profit margin of 4.1% remained persistently below the 5.9% level of downstream industries. A sharp question emerges: When the world's largest production and sales scale meets historically low profitability, what is the cost behind the prosperity of China's auto industry?

High Growth, Low Efficiency

China's auto market in 2025 presented a divided prosperity.

Production and sales figures remained impressive. Data from the China Association of Automobile Manufacturers (CAAM) shows annual vehicle production and sales reached 34.531 million and 34.4 million units respectively, up roughly 10% year-on-year. Market size stands firmly at number one globally.

Structural changes are even more profound. New energy vehicle (NEV) production and sales exceeded 16 million units, with market penetration approaching 48%. Almost one in every two cars sold is now a new energy vehicle. Meanwhile, vehicle exports surpassed 7 million units, an increase of over 20% year-on-year, marking a firm step in globalization.

The market share of Chinese-brand passenger vehicles rose to a historic high of 69.5%. In terms of volume, this is undoubtedly an excellent report card.

However, efficiency indicators paint a different picture.

Image credit: Cui Dongshu

Data from the China Passenger Car Association (CPCA) shows that from January to December 2025, the auto industry's revenue was approximately 11.18 trillion yuan, a year-on-year increase of 7.1%. But costs rose even faster, reaching 8.1%. Ultimately, profit came in at 461 billion yuan, a mere 0.6% increase year-on-year, locking the profit margin at 4.1%.

Zooming out, this downward curve is concerning. The industry profit margin has steadily declined from 7.8% in 2017, remaining below the average level of downstream industries since 2022.

"Producing more without earning more" has become the new normal.

The conflict intensified to a peak at the end of the year. In December, industry revenue fell 0.8% year-on-year, while costs rose by 0.8%. This opposing "scissors difference" ultimately cut the profit margin down to a freezing point of 1.8%.

This is no accidental fluctuation, but a concentrated explosion of trends. It clearly declares: the era relying on scale and price wars is ending.

Where Did the Profits Go?

The 1.8% profit margin is the result of multiple forces squeezing together. Understanding these pressures means understanding the industry's dilemma.

The most direct squeeze comes from the brutal "price war" in the terminal market. The 2025 price war was arguably the most intense in history, fought from the beginning of the year to the end. The number of participating automakers, the magnitude of price cuts, and the duration all set historical records.

Data from the CPCA branch shows that from January to November 2025, the average selling price of new energy vehicles was 204,000 yuan, with an average price cut of 24,000 yuan, a drop of 11.7%. Conventional internal combustion engine vehicles saw an average price cut of 16,000 yuan, a drop of 9%. More than 170 models saw price reductions.

To seize market share in a stagnant pool, automakers were forced to "exchange price for volume," but this extensive mode of competition ultimately backfired on corporate profitability.

The imbalance in profit distribution along the industrial chain, coupled with various industry irregularities, has further compressed profit margins. Amid the downstream price war, parts companies have become the direct victims; small and medium-sized suppliers are struggling, and even leading enterprises cannot escape shrinking profits.

Previously, some automakers extended payment terms to suppliers to over 120 days. Even though 17 automakers committed to implementing "60-day payment terms" in 2025, implementation across the multi-level supply chain remains challenging. Financial pressure is constraining the R&D and capacity of parts enterprises.

In the view of Cao Guangping, a partner at Chefu Network Consulting, the fierce competition among new energy vehicles themselves and between them and traditional fuel vehicles is the core cause of the current low profit margins, but the competition is systemic.

Behind the price war lie structural cost pressures and business model challenges. New energy vehicles generally follow technical routes with high battery costs, while prices of key battery materials remain high and cost reduction through recycling is difficult. At the same time, massive R&D investments in electrification and intelligence are far from paying off, and self-built charging and swapping facilities bring heavy asset burdens.

More critically, giants represented by Tesla continue to lower the benchmarks for manufacturing costs and selling prices through technological innovation and manufacturing revolutions, forcing the entire industry to remain in a state of high-pressure competition for the long term. This technology-driven cost decline has, paradoxically, intensified the difficulty of profitability for the whole industry.

Under multiple pressures, "producing more without earning more" has become a vortex the industry struggles to escape.

Meanwhile, Zhang Yongwei, chairman of the China EV 100, warns that the problem of structural overcapacity is prominent. On the supply side, there is clear structural overcapacity: traditional fuel vehicle capacity has not yet been fully digested, while new energy vehicle capacity is being built on a large scale, leading to low overall capacity utilization.

Traditional fuel capacity remains undigested, yet new energy capacity is being built at scale. Supply far exceeds effective demand, laying the groundwork for price wars.

Where Is the Way Out?

The high growth of new energy vehicles is undoubtedly the brightest chapter of 2025, yet it hides the deepest anxieties.

As the penetration rate approaches 50%, market dominance has shifted. Yet behind the prosperity, with the exception of a few companies like BYD and Tesla, the new energy sectors of most automakers remain deeply mired in losses or meager profits.

"Losing money on every car sold" is no exaggeration. The average loss per vehicle for new force companies is still in the tens of thousands of yuan. Even the new energy businesses of traditional automakers mostly rely on transfusions of profit from their internal combustion engine divisions.

However, there is no turning back in the transition. In 2025, internal combustion engine vehicle production was 18.25 million units, a slight year-on-year decline of 1%; market contraction is a foregone conclusion. As new energy vehicles shift from "policy-driven" to "market-driven," growing pains are inevitable.

Consequently, an industry consensus is forming: we must shift from a "price war" to a "value war." In the short term, as Cao Guangping assesses, due to rising battery material prices and continuous R&D and facility investment, the status quo of profit margin pressure is difficult to change quickly. Brutal competition may even lead some companies to lower design verification standards or iterate products excessively, which will harm user interests and industrial health in the long run.

Yet, within the pain, opportunities are gestating. Roland Berger Global Senior Partner Zheng Yun predicts that as some tail brands are eliminated and industry concentration increases, corporate procurement and amortized costs will be optimized.

He judges that starting from the third quarter of 2026, the auto industry profit margin may enter a relatively stable recovery phase. This points to a clear way out: the industry must shift from a disorderly "price war" to a "value war" based on systematic capabilities.

The core of this value rebirth lies in the exquisite balance between technological differentiation and cost control.

The 1.8% industry average profit margin is accelerating the process of differentiation.

Leading enterprises, with their advantages in scale, technology, and capital, are better equipped to survive the winter. In 2025, the top 10 automakers already occupied 71% of the market share, and profit concentration is likely even higher. Meanwhile, small and medium-sized enterprises face severe tests; some marginal automakers have seen their monthly profit margins fall below the 1% survival line, making integration and exit likely.

Future competition will not be about stacking configurations, but about whether real technological barriers and user experience advantages can be established in core areas like intelligence and energy efficiency. At the same time, moving upmarket and going global have become the necessary paths to break through the profit ceiling.

The average price of Chinese brands breaking 150,000 yuan is just the beginning. NIO and Li Auto have gained a firm foothold in the market above 400,000 yuan, proving that high-end positioning is not impossible. Among the over 7 million exports in 2025, the proportion of new energy vehicles continues to rise. In Southeast Asia, Chinese EVs are welcomed for technology adapted to local climates; in Europe, safety ratings and environmental standards have become new calling cards.

In the view of the industry, building brand premiums in overseas markets is far more helpful for improving profit structures than struggling in the cutthroat domestic competition.

Business models are also breaking through continuously. Paid software subscriptions, after-sales service packages, energy ecosystems... the full lifecycle value of the car as a "smart mobile terminal" is being deeply mined. At the policy level, rational competition is being guided; the State Administration for Market Regulation released the "Auto Industry Price Behavior Compliance Guide," and the Ministry of Industry and Information Technology is promoting the exit of backward capacity, jointly paving the way for healthy industry development.

Facing differentiation, the breakout paths for different enterprises are already clear:

Large groups may choose "vertical integration + going global," such as BYD self-developing batteries, motors, and semiconductors to build a moat; Chery and Great Wall have cultivated overseas markets for many years, gradually establishing strongholds.

New forces focus on "technological breakthrough + user experience." XPENG reduced the cost of its City NGP by 40% while improving performance by 60%; NIO builds a unique moat through its battery swapping network and service community.

For all players, some trends are clearly visible:

Intelligence is the next decisive point. Data from Gasgoo Auto Research Institute shows that in 2025, the penetration rate of L2 driver assistance in China approached 60%, with the penetration rate of NOA functions reaching 29% in November alone. This saw significant growth, especially in the second half, driven mainly by hit models in the 100,000 to 200,000 yuan price range. Meanwhile, L3 autonomous driving has obtained road permits. Whoever can establish an experience barrier in this field will seize the initiative.

Globalization is an inevitable choice. Domestic growth is slowing, while overseas space is vast. From trade exports to localized production, the globalization of Chinese automakers is entering deep waters.

The industrial ecosystem is also being reconstructed; the boundaries between OEMs, battery companies, tech firms, and energy companies are increasingly blurring, making competition and cooperation relationships more complex.

Conclusion:

That 1.8% profit margin in December 2025 is a microcosm of an era for China's auto industry.

It bluntly declares that the dividends of scale expansion are exhausted and extensive growth is unsustainable. But at the same time, it is catalyzing a rapid unfolding of a value revolution regarding technology, branding, and globalization.

Short-term pain is unavoidable. Cost pressure, competitive inertia, and transition investment will continue to test every enterprise. The return of industry profit margins to healthy levels will take time.

But the long-term direction is clear. The leap from a "major auto country" to an "auto powerhouse" will inevitably be accompanied by the repair and rise of the profit curve. When Chinese automobiles lead not only in volume but also in technology, brand, and value, today's freezing point will be the starting point of a new cycle tomorrow.

There are no bystanders in this transformation. Every enterprise, every practitioner, is in the midst of it. Crossing the freezing point requires not only courage but also wisdom, patience, and a firm belief in value.

The next chapter of China's auto industry is being written.