According to data compiled by the Gasgoo Automotive Research Institute, China's ADAS supply chain underwent accelerated restructuring from January to November 2025. Across segments including LiDAR, forward-facing cameras, China's local suppliers significantly strengthened their presence—achieving share breakthroughs in individual categories and establishing clear leadership in multiple key areas. These rankings highlight both the rapid maturation of Chinese suppliers in technology and manufacturing capacity, and the fact that hardware localization in China's intelligent driving industry has entered a full acceleration phase.

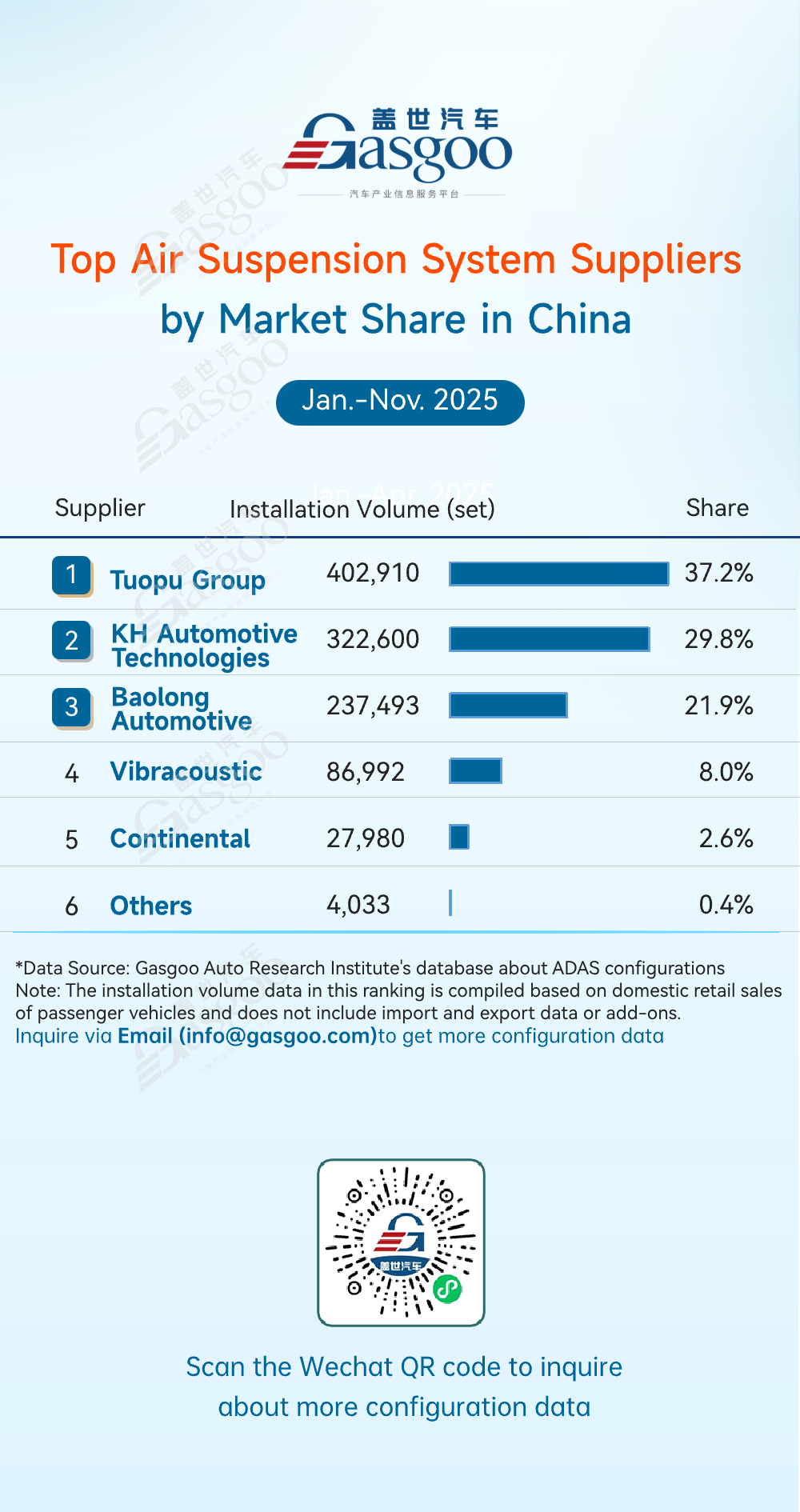

Top air suspension system suppliers

Tuopu Group: 402,910 sets installed, 37.2% market share

KH Automotive Technologies: 322,600 sets installed, 29.8% market share

Baolong Automotive: 237,493 sets installed, 21.9% market share

Vibracoustic: 86,992 sets installed, 8.0% market share

Continental: 27,980 sets installed, 2.6% market share

Others: 4,033 sets installed, 0.4% market share

From January to November 2025, China's air suspension supplier landscape was clearly dominated by China's local players. Tuopu Group ranked first with 402,910 sets installed (37.2% share), up from 36.4% in January–October, further strengthening its lead. KH Technologies and Baolong Automotive followed, with the top 3 together capturing nearly 90% of the market, significantly squeezing the space of foreign suppliers such as Vibracoustic and Continental, whose combined share stood at just 10.6%. This reflects both the technological and capacity breakthroughs achieved by domestic suppliers in air suspension systems and the growing acceptance of local supply chains in China's passenger vehicle market.

Top LiDAR suppliers

Huawei Technologies: 1,156,799 units installed, 41.6% market share

Hesai Technology: 943,979 units installed, 34.0% market share

RoboSense: 489,447 units installed, 17.6% market share

Seyond: 188,737 units installed, 6.8% market share

Others: 247 units installed, 0.01% market share

From January to November 2025, China's LiDAR installation landscape showed a clear pattern of "high concentration at the top, led by domestic players." Huawei Technologies ranked first with 1,156,799 units installed (41.6% share), supplying both primary and blind-spot lidar solutions. Hesai Technology and RoboSense followed closely, with the top 3 together accounting for over 90% of total installations, underscoring the dominant position of leading Chinese suppliers in the lidar market. As a core perception hardware for intelligent driving, LiDAR has seen rapid installation growth alongside the rising penetration of advanced driver assistance systems, while China's supply chain has largely achieved technological and capacity-level self-sufficiency in this segment.

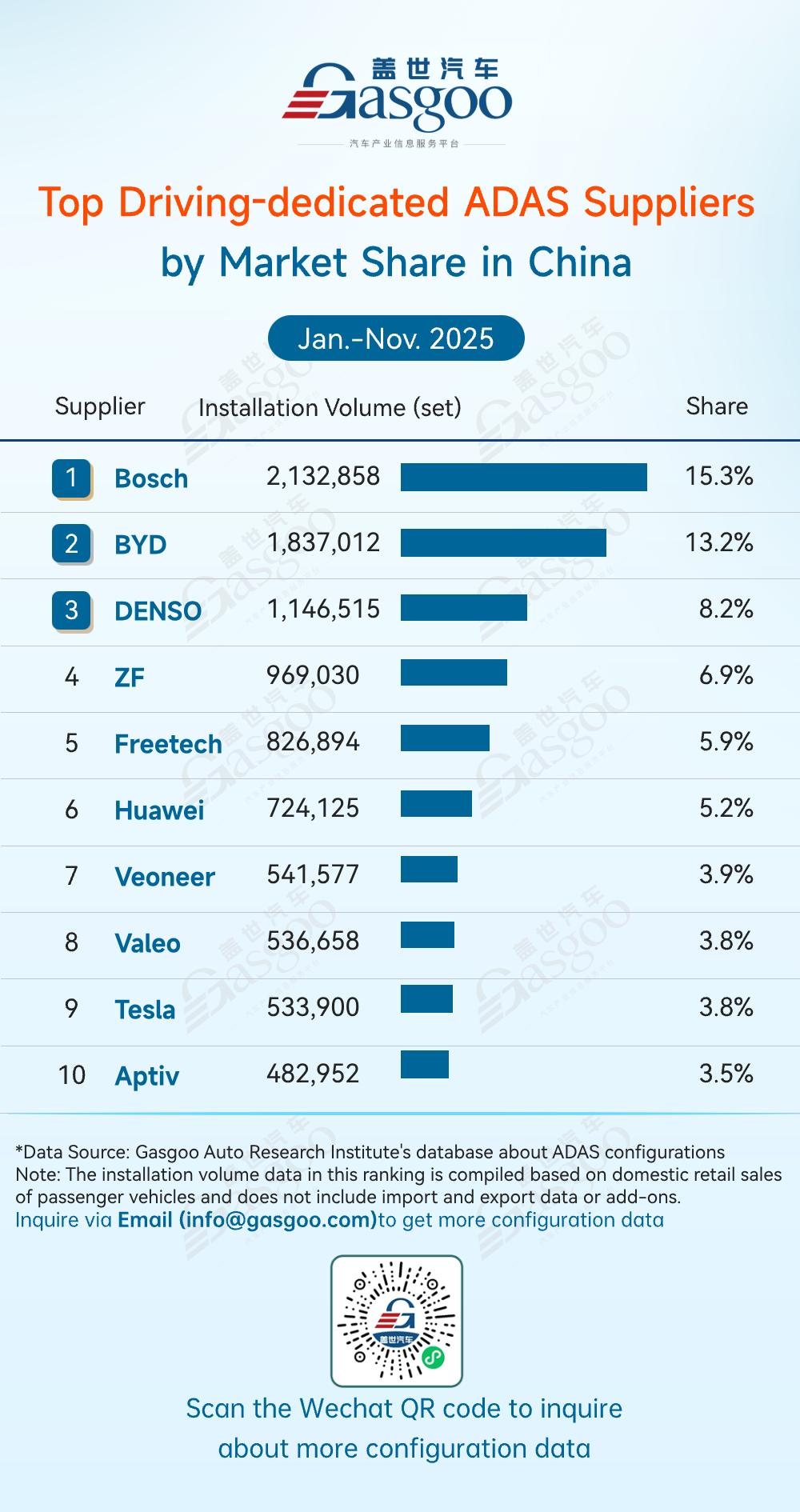

Top driving-dedicated ADAS suppliers

Bosch: 2,132,858 units installed, 15.3% market share

BYD: 1,837,012 units installed, 13.2% market share

DENSO: 1,146,515 units installed, 8.2% market share

ZF: 969,030 units installed, 6.9% market share

Freetech: 826,894 units installed, 5.9% market share

Huawei Technologies: 724,125 units installed, 5.2% market share

Veoneer: 541,577 units installed, 3.9% market share

Valeo: 536,658 units installed, 3.8% market share

Tesla: 533,900 units installed, 3.8% market share

Aptiv: 482,952 units installed, 3.5% market share

In the January–November 2025 Chinese driving-dedicated ADAS supplier market, the pattern is clear: "global Tier-1 leaders remain stable, while China's local challengers rise rapidly." Bosch led the pack with 2,132,858 units installed (15.3% market share, slightly down from 15.9% in January–October. BYD ranks second with a 13.2% share, becoming the top China's local supplier. Foreign suppliers (Bosch, Denso, ZF, etc.) still dominated the top 4 reflecting their strong technical foundation and supply chain advantages. At the same time, the presence of Chinese players such as FURETEX and Huawei, along with BYD's high ranking, indicated that Chinese ADAS suppliers—especially front-view integrated solutions—are gaining rapid recognition in both capacity and product competitiveness.

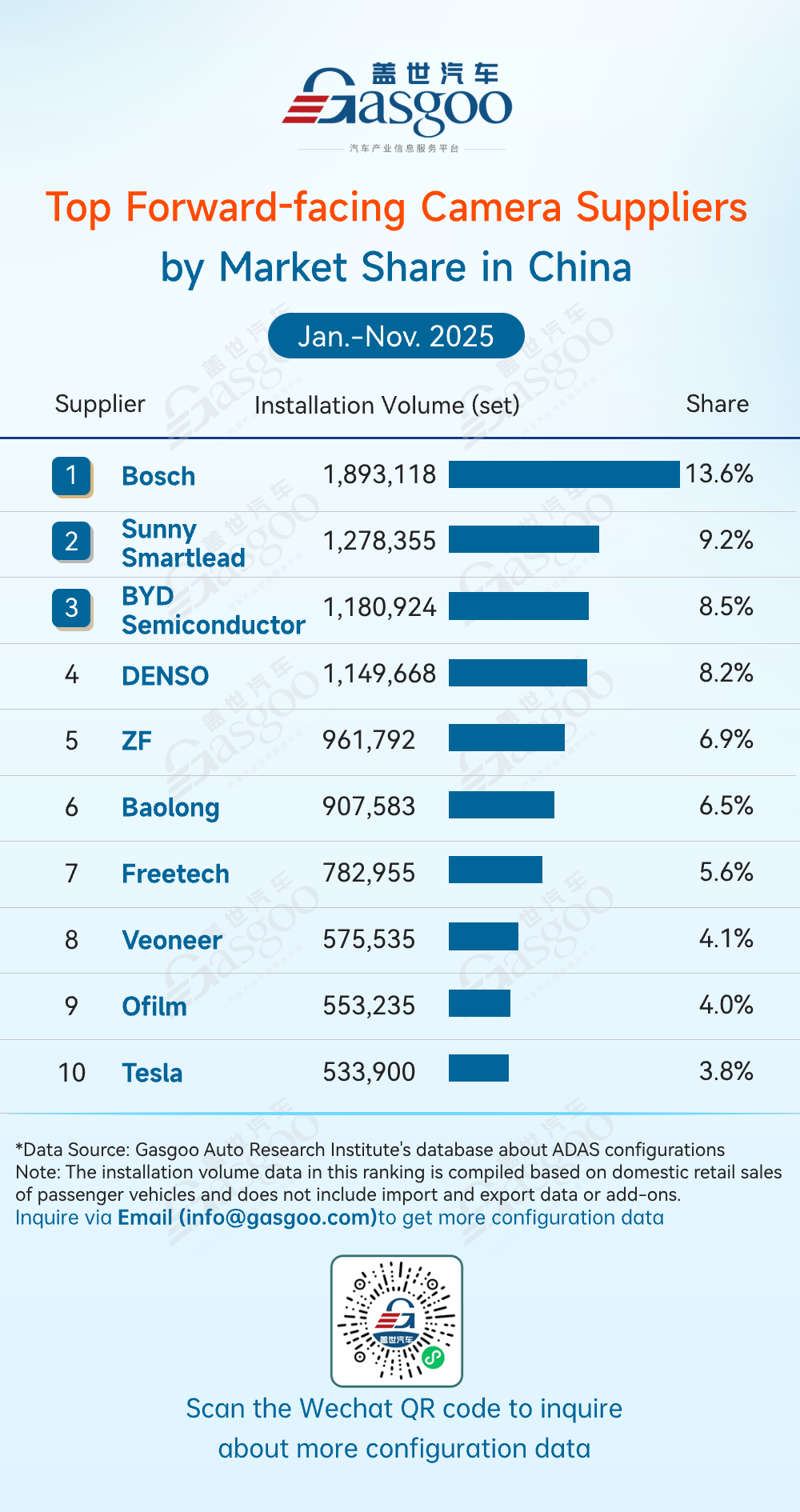

Top forward-facing camera suppliers

Bosch: 1,893,118 units installed, 13.6% market share

Sunny Smartlead: 1,278,355 units installed, 9.2% market share

BYD Semiconductor: 1,180,924 units installed, 8.5% market share

DENSO: 1,149,668 units installed, 8.2% market share

ZF: 961,792 units installed, 6.9% market share

Baolong Automotive: 907,583 units installed, 6.5% market share

Freetech: 782,955 units installed, 5.6% market share

Veoneer: 575,535 units installed, 4.1% market share

Ofilm: 553,235 units installed, 4.0% market share

Tesla: 533,900 units installed, 3.8% market share

In January–November 2025, Bosch remained the front-runner in China's forward-facing camera market with 1,893,118 units installed (13.6% share), slightly down from 14.0% in January–October. China's local suppliers are gaining momentum: Sunny Smartlead ranked second with 9.2%, and BYD Semiconductor reached 8.5%, together accounting for nearly one-fifth of the market. Although foreign Tier-1s such as Bosch, Denso, and ZF still occupy the top tier, the entry of more Chinese players—like Baolong and Ofilm—signals that local manufacturers are steadily closing the gap in technology, cost control, and scale production. With China's local share continuing to rise, the foward-facing camera supply chain is moving toward faster localization and stronger competition.

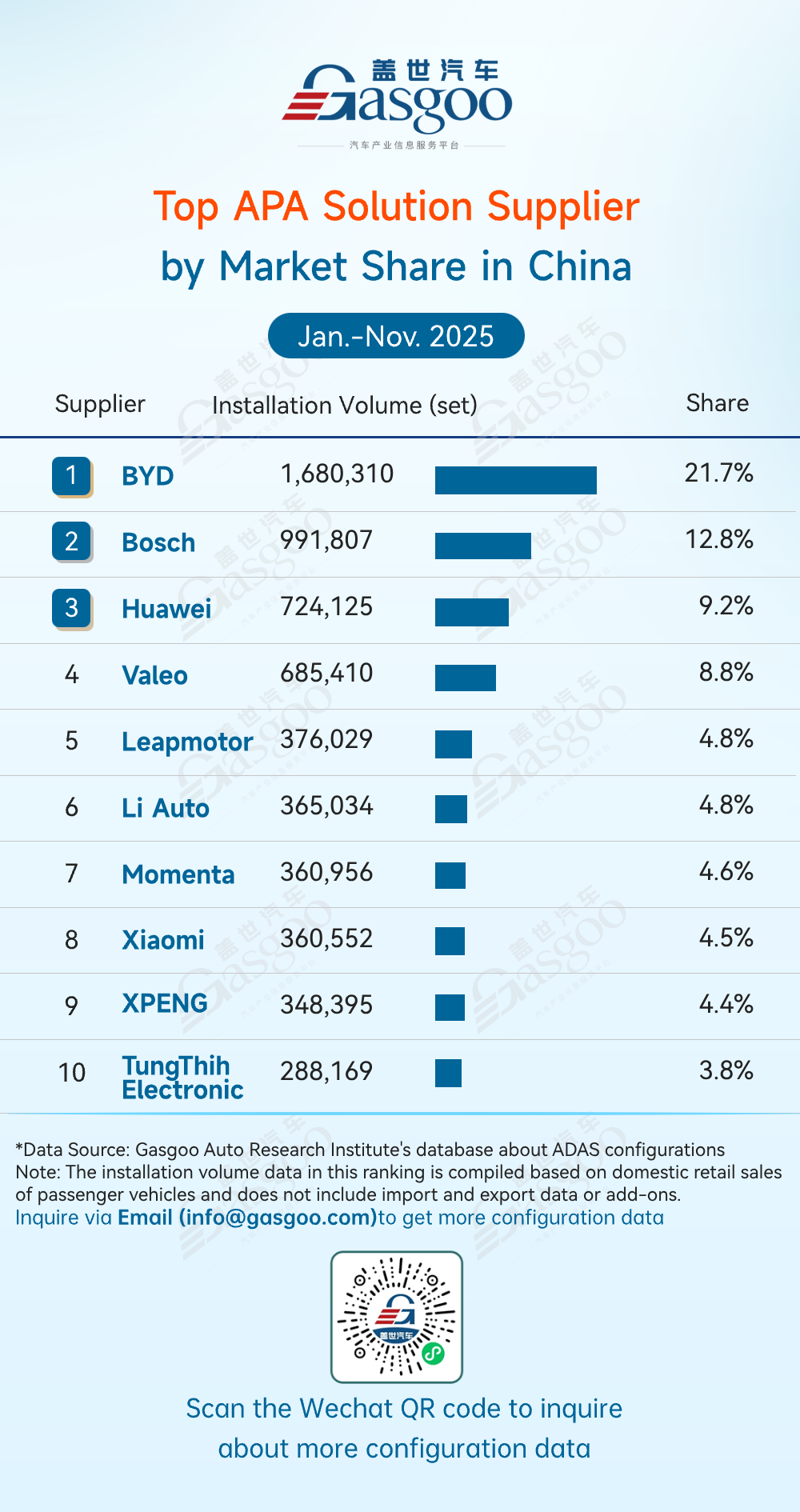

Top APA solution suppliers

BYD: 1,680,310 units installed, 21.7% market share

Bosch: 991,807 units installed, 12.8% market share

Huawei: 724,125 units installed, 9.2% market share

Valeo: 685,410 units installed, 8.8% market share

Leapmotor: 376,029 units installed, 4.8% market share

Li Auto: 365,034 units installed, 4.8% market share

Momenta: 360,956 units installed, 4.6% market share

Xiaomi EV: 360,552 units installed, 4.5% market share

XPENG: 348,395 units installed, 4.4% market share

TungThih Electronic: 288,169 units installed, 3.8% market share

In Jan.–Nov. 2025, China's APA solution market is clearly dominated by local suppliers. BYD took the lead with 1,680,310 units (21.7% share), benefiting from deep integration between its APA system and vehicle lineup. Huawei and Momenta followed closely, competing with OEM self-developed solutions from Leapmotor and Li Auto. The most notable trend is the diversification of Chinese APA solutions: both in-house OEM systems and third-party platforms have achieved large-scale deployment, proving that China's local APA technology has matured in adaptability and user experience.

Top HD map suppliers

AutoNavi: 1,175,989 units installed, 52.1% market share

Tencent: 295,667 units installed, 13.1% market share

Langge Technology: 281,557 units installed, 12.5% market share

NavInfo: 133,358 units installed, 5.9% market share

Others: 370,708 units installed, 16.4% market share

In Jan.–Nov. 2025, AutoNavi dominated China's HD map market with 1,175,989 units installed (52.1% share), making it the undisputed leader. Tencent, Langge Technology, and others followed, but each held less than 15%, forming a "one superpower, multiple strong contenders" pattern. The entry of emerging players like Langge indicates the market is not fully locked, and competition may shift to niche scenarios. Overall, AutoNavi's dominance is unlikely to be challenged in the short term, and future competition will focus more on map update efficiency and compatibility with assisted-driving functions.

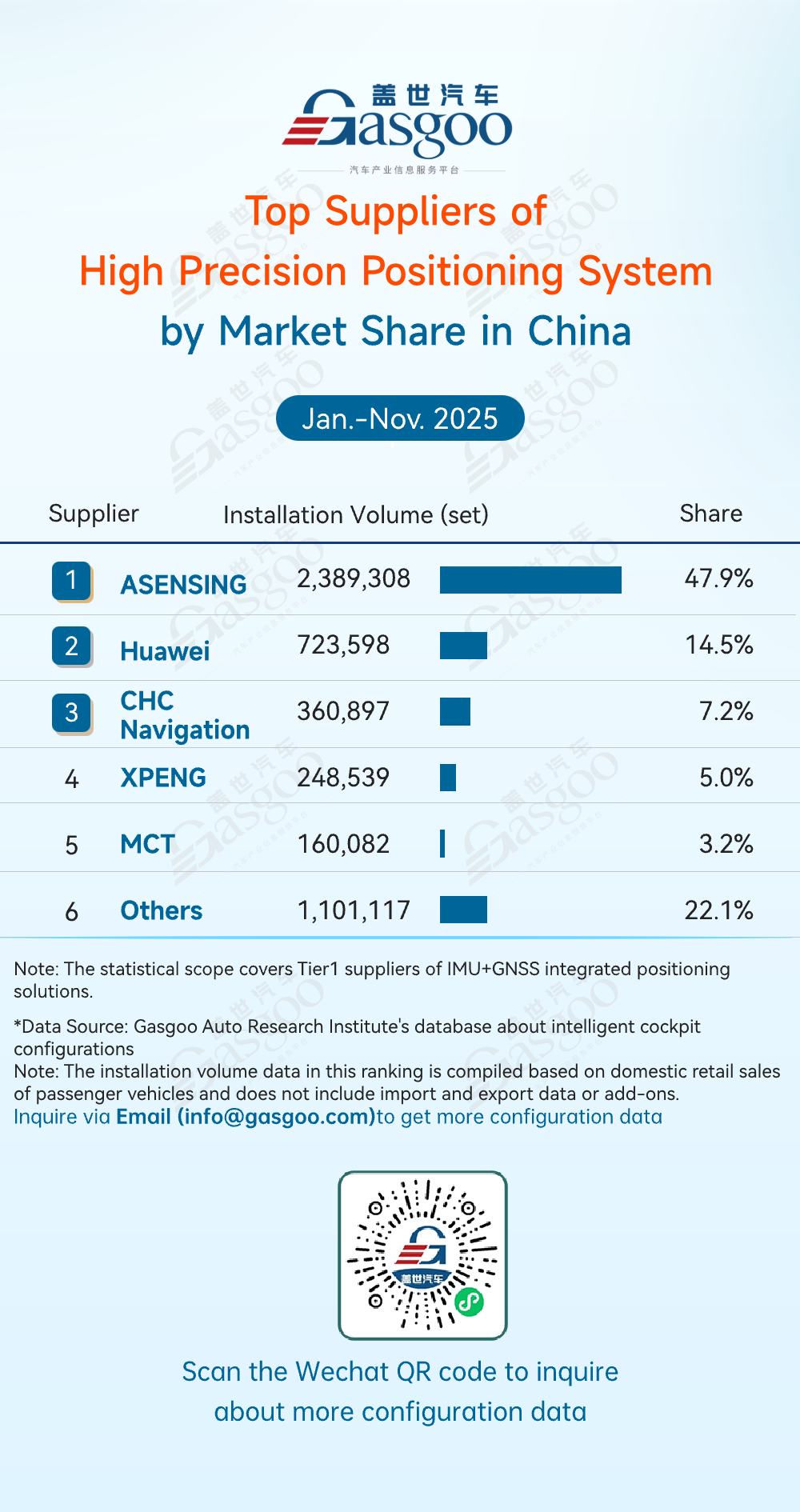

Top suppliers of high precision positioning system

ASENSING: 2,389,308 units installed, 47.9% market share

Huawei: 723,598 units installed, 14.5% market share

CHC Navigation: 360,897 units installed, 7.2% market share

XPENG: 248,539 units installed, 5.0% market share

MCT: 160,082 units installed, 3.2% market share

Others: 1,101,117 units installed, 22.1% market share

In Jan.-Nov. 2025, the Chinese high precision positioning supplier landscape showed a "dominant top player and Chinese-led" pattern: ASENSING ranked first with 2,389,308 units installed (47.9% share), accounting for nearly half of the market. Its fusion positioning solution's fast integration and strong adaptability were the core drivers behind its high share. Huawei and CHC Navigation followed closely, with Huawei ranking second at a 14.5% share, reflecting the strong commercialization capabilities of leading Chinese tech companies in the high precision positioning field. As a core hardware component of ADAS systems, high precision positioning saw Chinese supply chains achieve breakthroughs in both technology and market penetration, and subsequent competition was expected to focus on solution accuracy, cost, and scenario adaptability.