Based on data from the Gasgoo Automotive Research Institute, from January to November 2025, China's NEV passenger car electrification supply chain continued to show the characteristics of high concentration among leading players, solid dominance of domestic suppliers, and a deepening trend toward automaker self-control. Across key segments such as power batteries, battery PACKs, BMS, drive motors, and power devices, leading suppliers captured the core market share through comprehensive strengths.

Among them, FinDreams-affiliated companies stood out, taking leading positions across multiple segments.The China's local substitution process has delivered notable results, with Chinese suppliers in areas such as power devices and drive motors surpassing some foreign brands and emerging as core market players. Meanwhile, self-developed components from automakers including Tesla, Leapmotor, and NIO Power Technology have entered the top 10 across multiple categories, underscoring the continued deepening of automakers' push toward self-controlled development of core components.

Overall, leading suppliers dominated the market by leveraging advantages in production scale, R&D capabilities, and supply chain integration, while small and mid-sized players need to focus on niche scenarios and build differentiated strengths. At the same time, the trend toward system-level integration is becoming increasingly pronounced, with automakers' in-house development and collaboration with external suppliers progressing in parallel—shaping a dynamic industry landscape where competition and cooperation coexist.

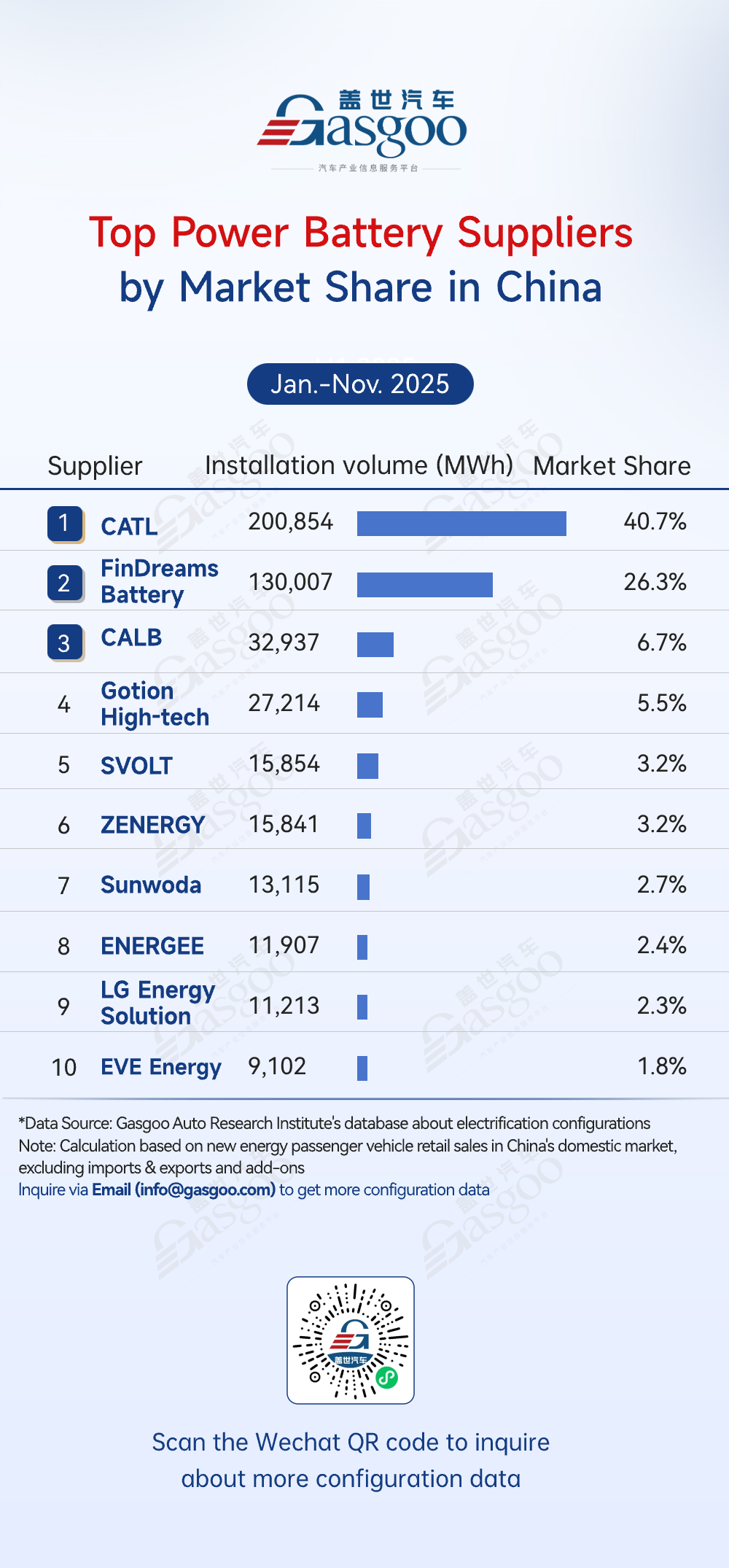

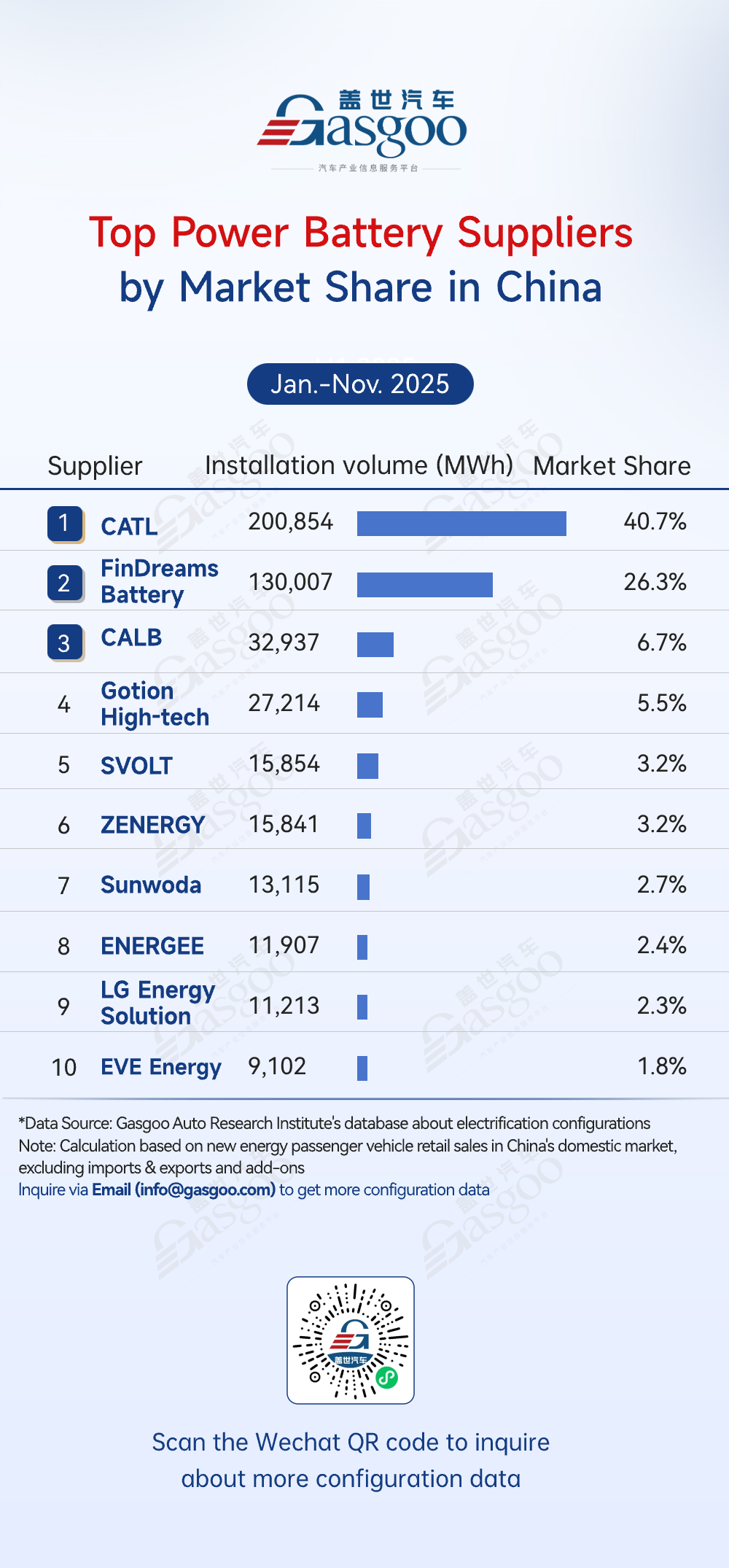

Top power battery suppliers

CATL: 200,854 MWh installed, 40.7% market share

FinDreams Battery: 130,007 MWh installed, 26.3% market share

CALB: 32,937 MWh installed, 6.7% market share

Gotion High-tech: 27,214 MWh installed, 5.5% market share

SVOLT: 15,854 MWh installed, 3.2% market share

ZENERGY: 15,841 MWh installed, 3.2% market share

Sunwoda: 13,115 MWh installed, 2.7% market share

Jiyao Tongxing: 11,907 MWh installed, 2.4% market share

LG Energy Solution: 11,213 MWh installed, 2.3% market share

ENERGEE: 9,102 MWh installed, 1.8% market share From January to November 2025, the ranking of power battery suppliers by installed capacity shows a competitive landscape characterized by high concentration among leading players and dominance by China's local suppliers.CATL led the market with an installed capacity of 200,854 MWh (40.7% share), maintaining a solid leading position. FinDreams Battery followed in second place with 130,007 MWh (26.3% share). Together, the two accounted for over 67% of the market and were the main drivers of overall market growth. CALB and Gotion High-Tech each held 5%–7% of the market, remaining key supporting players despite a noticeable gap with the top two. SVOLT and ZENERGY tied for fifth with 3.2% each, while a third tier including Sunwoda and ENERGEE competed mainly through partnerships with specific automakers and differentiated technology routes.

From January to November 2025, the ranking of power battery suppliers by installed capacity shows a competitive landscape characterized by high concentration among leading players and dominance by China's local suppliers.CATL led the market with an installed capacity of 200,854 MWh (40.7% share), maintaining a solid leading position. FinDreams Battery followed in second place with 130,007 MWh (26.3% share). Together, the two accounted for over 67% of the market and were the main drivers of overall market growth. CALB and Gotion High-Tech each held 5%–7% of the market, remaining key supporting players despite a noticeable gap with the top two. SVOLT and ZENERGY tied for fifth with 3.2% each, while a third tier including Sunwoda and ENERGEE competed mainly through partnerships with specific automakers and differentiated technology routes.

From January to November 2025, the ranking of power battery suppliers by installed capacity shows a competitive landscape characterized by high concentration among leading players and dominance by China's local suppliers.CATL led the market with an installed capacity of 200,854 MWh (40.7% share), maintaining a solid leading position. FinDreams Battery followed in second place with 130,007 MWh (26.3% share). Together, the two accounted for over 67% of the market and were the main drivers of overall market growth. CALB and Gotion High-Tech each held 5%–7% of the market, remaining key supporting players despite a noticeable gap with the top two. SVOLT and ZENERGY tied for fifth with 3.2% each, while a third tier including Sunwoda and ENERGEE competed mainly through partnerships with specific automakers and differentiated technology routes.

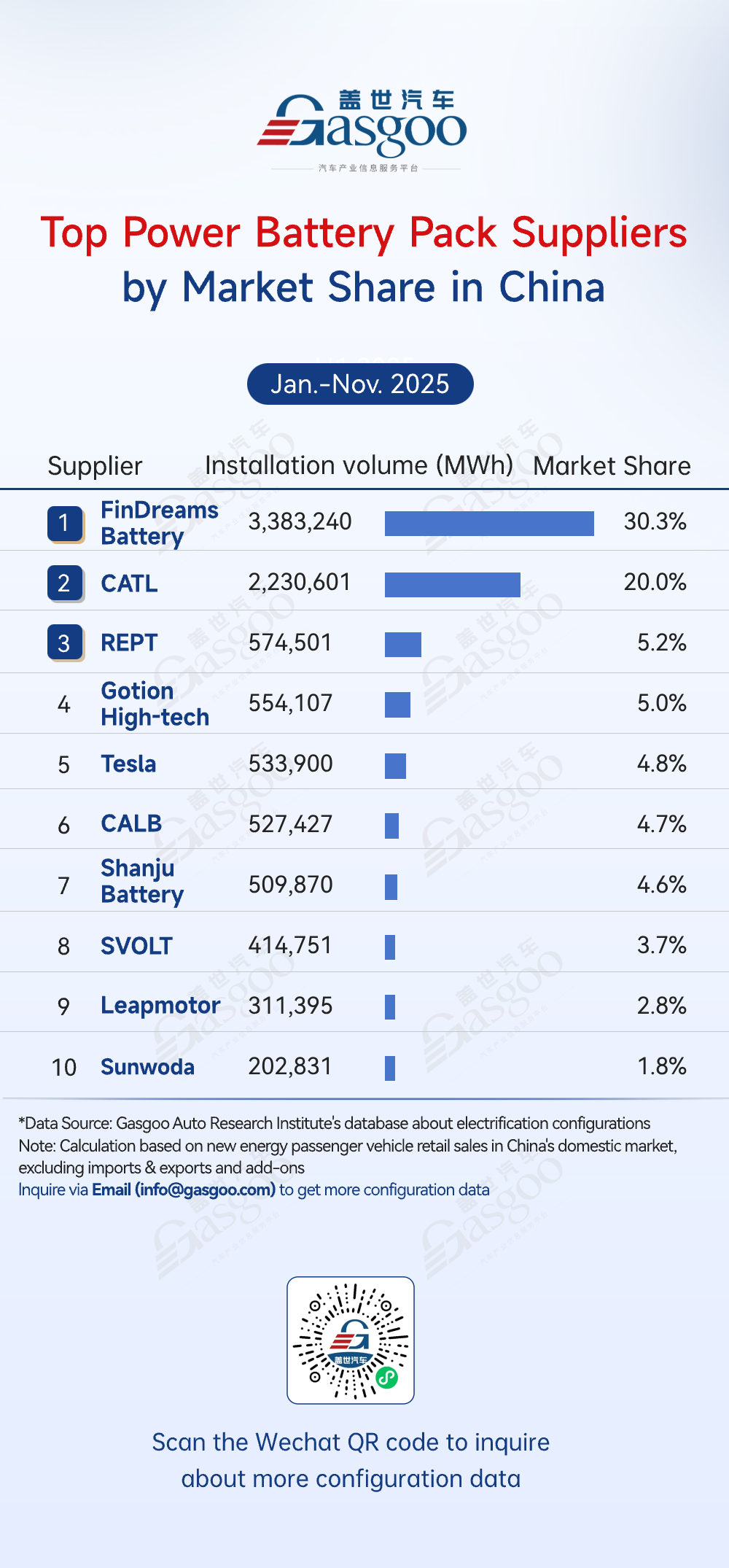

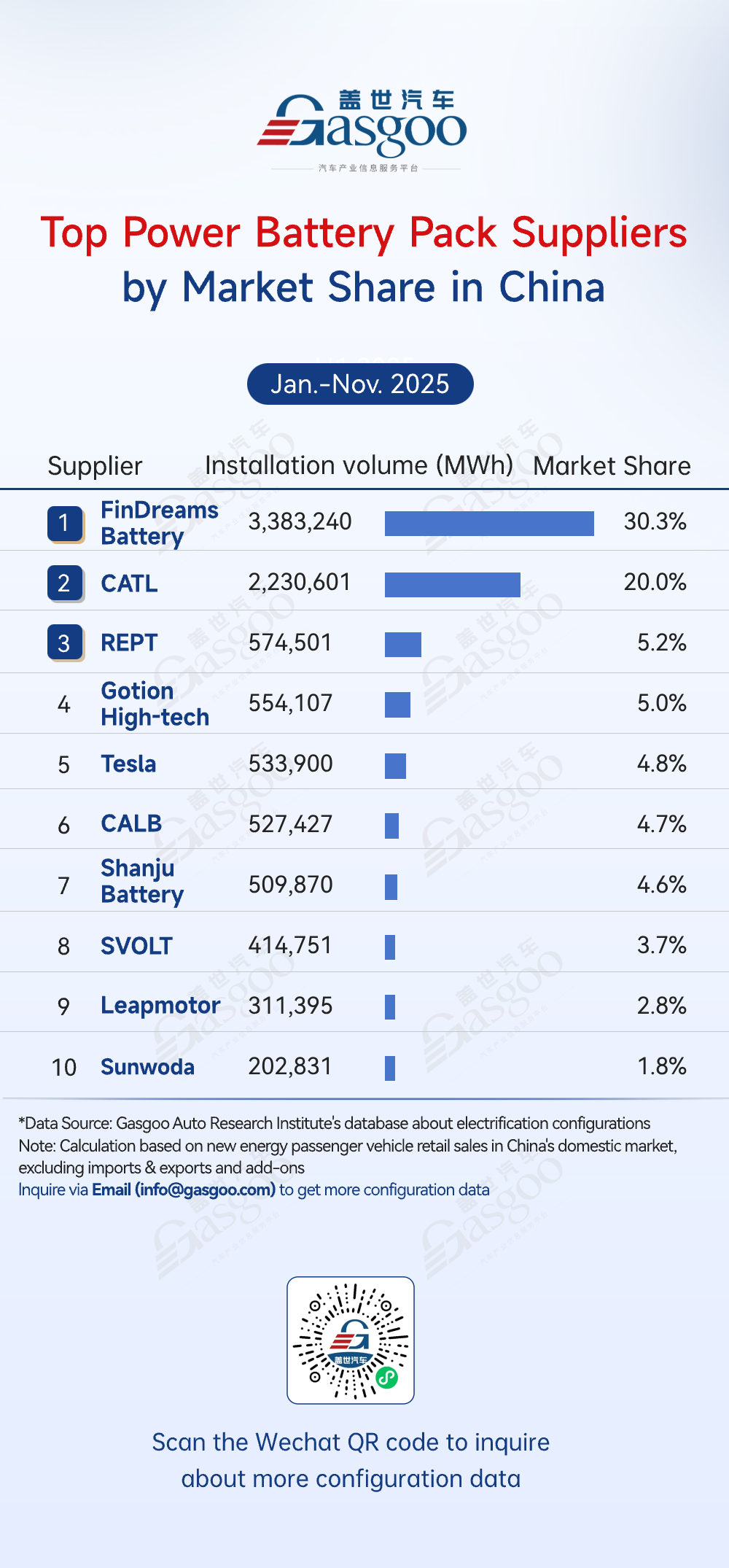

From January to November 2025, the ranking of power battery suppliers by installed capacity shows a competitive landscape characterized by high concentration among leading players and dominance by China's local suppliers.CATL led the market with an installed capacity of 200,854 MWh (40.7% share), maintaining a solid leading position. FinDreams Battery followed in second place with 130,007 MWh (26.3% share). Together, the two accounted for over 67% of the market and were the main drivers of overall market growth. CALB and Gotion High-Tech each held 5%–7% of the market, remaining key supporting players despite a noticeable gap with the top two. SVOLT and ZENERGY tied for fifth with 3.2% each, while a third tier including Sunwoda and ENERGEE competed mainly through partnerships with specific automakers and differentiated technology routes.Top power battery pack suppliers

FinDreams Battery: 3,383,240 sets installed, 30.3% market share

CATL: 2,230,601 sets installed, 20.0% market share

REPT: 574,501 sets installed, 5.2% market share

Gotion High-tech: 554,107 sets installed, 5.0% market share

Tesla: 533,900 sets installed, 4.8% market share

CALB: 527,427 sets installed, 4.7% market share

Shanju Battery: 509,870 sets installed, 4.6% market share

SVOLT: 414,751 sets installed, 3.7% market share

Leapmotor: 311,395 sets installed, 2.8% market share

Sunwoda: 202,831 sets installed, 1.8% market share From January to November 2025, automakers' in-house PACK production accounted for over 50% of the market. FinDreams Battery led with 3.383 million sets installed (30.3%), followed by CATL with 2.231 million sets (20.0%). Together, they held over half of the market. The second tier included REPT, Gotion High-tech, Tesla, CALB, and Shanju Battery, each with 2.8%–5.2% share, while SVOLT, Leapmotor, and Sunwoda held smaller shares. This tiered structure reflects a mix of specialized suppliers and automaker self-produced packs competing through different partnerships and technology routes.

From January to November 2025, automakers' in-house PACK production accounted for over 50% of the market. FinDreams Battery led with 3.383 million sets installed (30.3%), followed by CATL with 2.231 million sets (20.0%). Together, they held over half of the market. The second tier included REPT, Gotion High-tech, Tesla, CALB, and Shanju Battery, each with 2.8%–5.2% share, while SVOLT, Leapmotor, and Sunwoda held smaller shares. This tiered structure reflects a mix of specialized suppliers and automaker self-produced packs competing through different partnerships and technology routes.

From January to November 2025, automakers' in-house PACK production accounted for over 50% of the market. FinDreams Battery led with 3.383 million sets installed (30.3%), followed by CATL with 2.231 million sets (20.0%). Together, they held over half of the market. The second tier included REPT, Gotion High-tech, Tesla, CALB, and Shanju Battery, each with 2.8%–5.2% share, while SVOLT, Leapmotor, and Sunwoda held smaller shares. This tiered structure reflects a mix of specialized suppliers and automaker self-produced packs competing through different partnerships and technology routes.

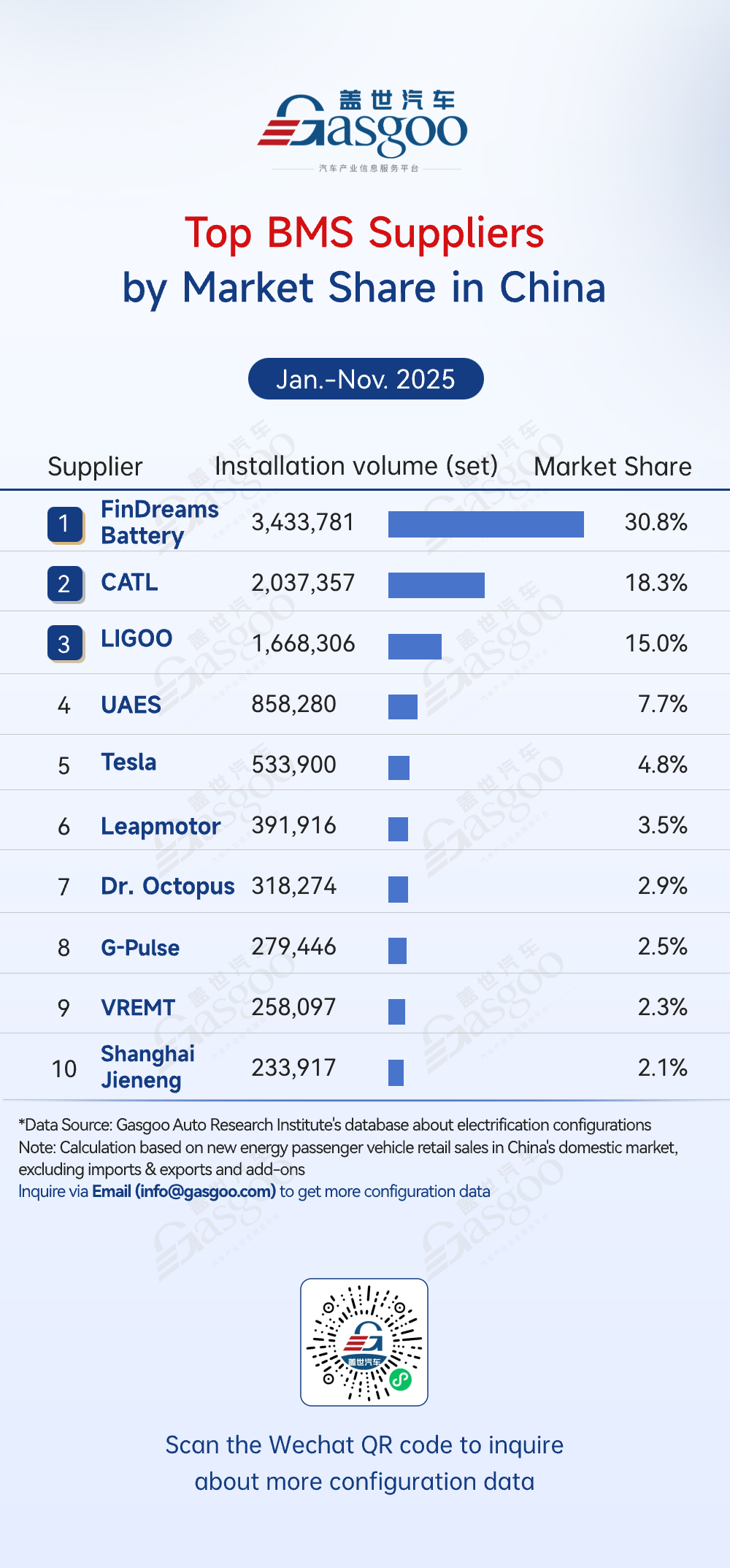

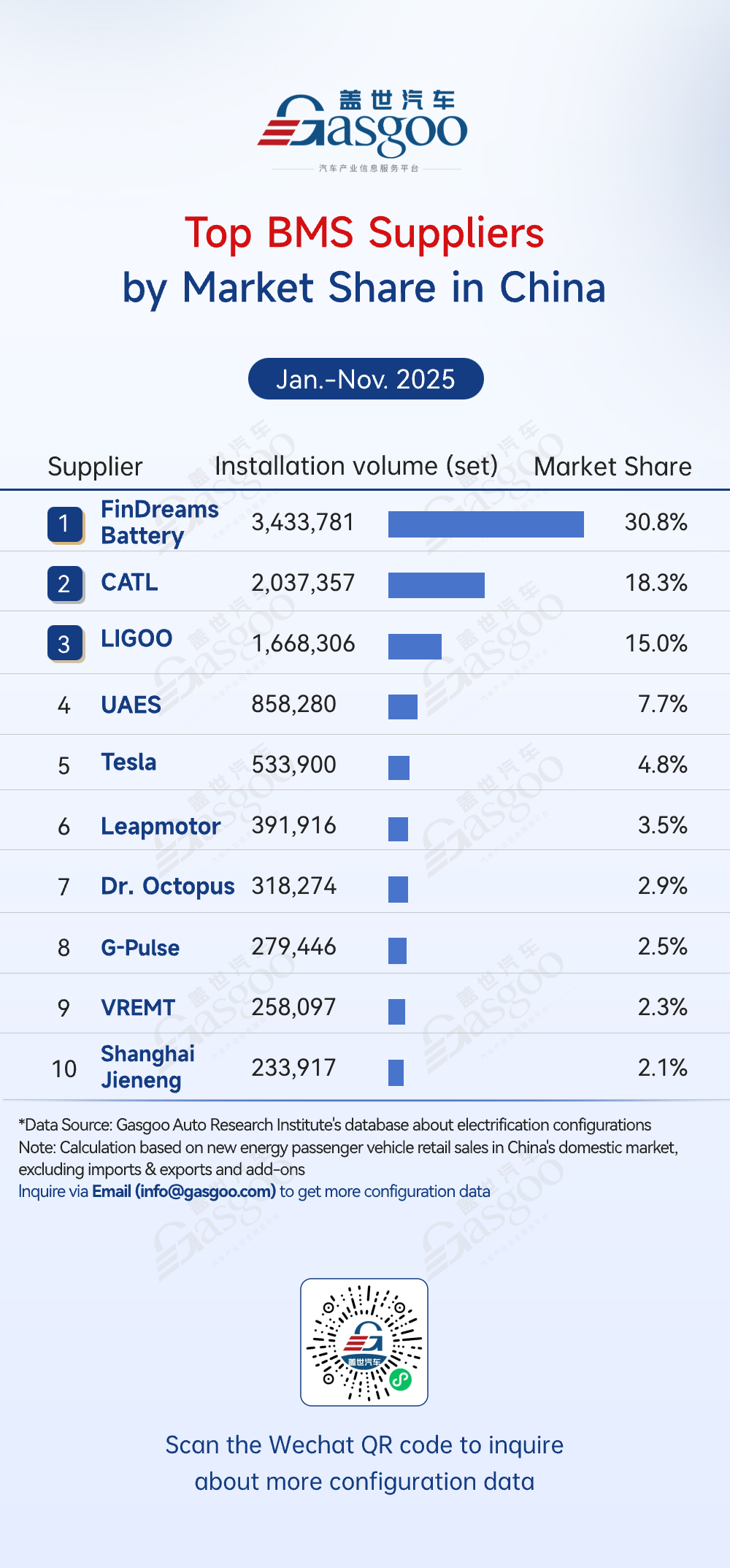

From January to November 2025, automakers' in-house PACK production accounted for over 50% of the market. FinDreams Battery led with 3.383 million sets installed (30.3%), followed by CATL with 2.231 million sets (20.0%). Together, they held over half of the market. The second tier included REPT, Gotion High-tech, Tesla, CALB, and Shanju Battery, each with 2.8%–5.2% share, while SVOLT, Leapmotor, and Sunwoda held smaller shares. This tiered structure reflects a mix of specialized suppliers and automaker self-produced packs competing through different partnerships and technology routes.Top BMS suppliers

FinDreams Battery: 3,433,781 sets installed, 30.8% market share

CATL: 2,037,357 sets installed, 18.3% market share

LIGOO: 1,668,306 sets installed, 15.0% market share

UAES: 858,280 sets installed, 7.7% market share

Tesla: 533,900 sets installed, 4.8% market share

Leapmotor: 391,916 sets installed, 3.5% market share

Dr. Octopus: 318,274 sets installed, 2.9% market share

G-Pulse: 279,446 sets installed, 2.5% market share

VREMT: 258,097 sets installed, 2.3% market share

Shanghai Jieneng: 233,917 sets installed, 2.1% market share From the BMS installation data from January to November 2025, automakers' pursuit of BMS self-control has become increasingly evident. FinDreams Battery ranked first with 3.434 million sets installed (30.8% market share), while in-house BMS products from Tesla, Leapmotor, and other automakers also made it into the top 10. FinDreams Battery and CATL leveraged their integrated "battery + BMS" solutions to secure customer binding. LIGOO entered the top 3 through its broad technical compatibility and multi-brand partnerships, becoming a leading third-party supplier. The market share of ranks four to ten ranged from 2.1% to 7.7%, showing a significant gap with the top tier.

From the BMS installation data from January to November 2025, automakers' pursuit of BMS self-control has become increasingly evident. FinDreams Battery ranked first with 3.434 million sets installed (30.8% market share), while in-house BMS products from Tesla, Leapmotor, and other automakers also made it into the top 10. FinDreams Battery and CATL leveraged their integrated "battery + BMS" solutions to secure customer binding. LIGOO entered the top 3 through its broad technical compatibility and multi-brand partnerships, becoming a leading third-party supplier. The market share of ranks four to ten ranged from 2.1% to 7.7%, showing a significant gap with the top tier.

From the BMS installation data from January to November 2025, automakers' pursuit of BMS self-control has become increasingly evident. FinDreams Battery ranked first with 3.434 million sets installed (30.8% market share), while in-house BMS products from Tesla, Leapmotor, and other automakers also made it into the top 10. FinDreams Battery and CATL leveraged their integrated "battery + BMS" solutions to secure customer binding. LIGOO entered the top 3 through its broad technical compatibility and multi-brand partnerships, becoming a leading third-party supplier. The market share of ranks four to ten ranged from 2.1% to 7.7%, showing a significant gap with the top tier.

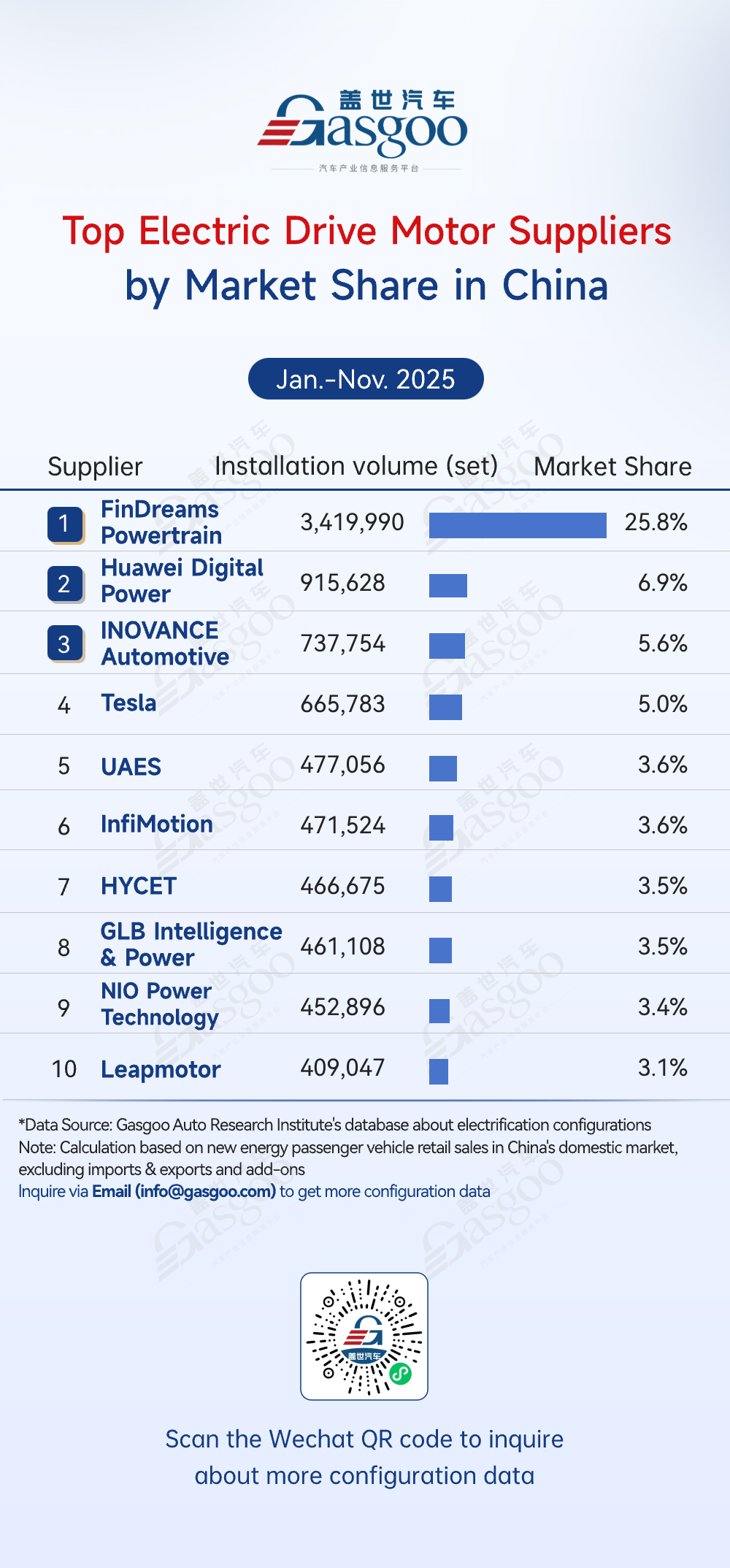

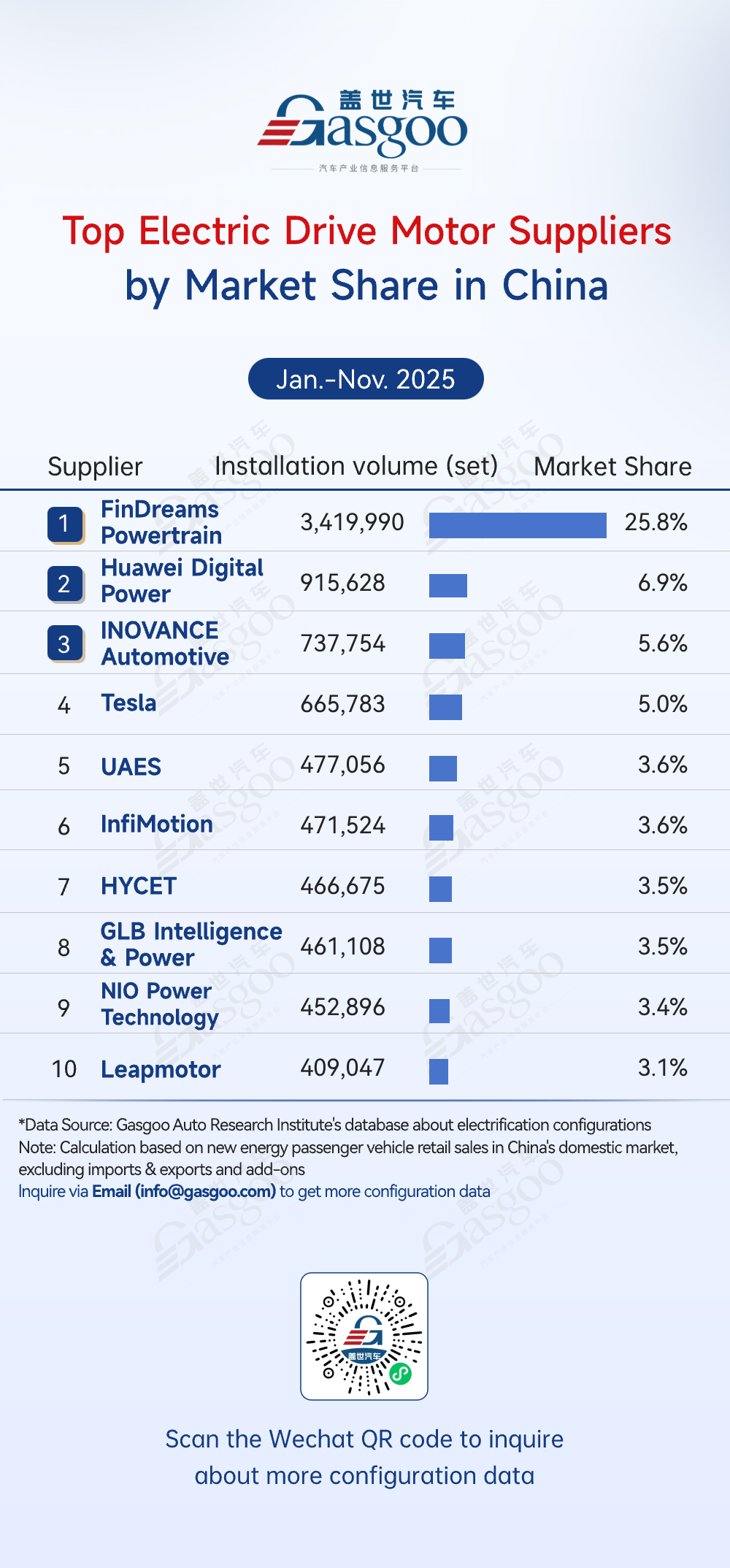

From the BMS installation data from January to November 2025, automakers' pursuit of BMS self-control has become increasingly evident. FinDreams Battery ranked first with 3.434 million sets installed (30.8% market share), while in-house BMS products from Tesla, Leapmotor, and other automakers also made it into the top 10. FinDreams Battery and CATL leveraged their integrated "battery + BMS" solutions to secure customer binding. LIGOO entered the top 3 through its broad technical compatibility and multi-brand partnerships, becoming a leading third-party supplier. The market share of ranks four to ten ranged from 2.1% to 7.7%, showing a significant gap with the top tier.Top electric drive motor suppliers

FinDreams Powertrain: 3,419,990 sets installed, 25.8% market share

Huawei Digital Power: 915,628 sets installed, 6.9% market share

INOVANCE Automotive: 737,754 sets installed, 5.6% market share

Tesla: 665,783 sets installed, 5.0% market share

UAES: 477,056 sets installed, 3.6% market share

InfMotion: 471,524 sets installed, 3.6% market share

HYCET: 466,675 sets installed, 3.5% market share

GLB Intelligence & Power: 461,108 sets installed, 3.5% market share

NIO Power Technology: 452,896 sets installed, 3.4% market share

Leapmotor: 409,047 sets installed, 3.1% market share From the installed capacity ranking of drive motor suppliers from January to November 2025, FinDreams Powertrain topped the list with 3.41999 million sets installed and a 25.8% market share, far ahead of second-place Huawei Digital Power (6.9%). Huawei Digital Power and INOVANCE Automotive ranked second and third, but together they held only 12.5% of the market. Tesla and the remaining suppliers each held less than 5%, with small gaps between them. The list includes both automaker self-developed players such as FinDreams Powertrain and Tesla, as well as professional suppliers like Huawei Digital Power and INOVANCE Automotive, reflecting a dual model of "automakers in-house systems + third-party external supply" in the drive motor sector.

From the installed capacity ranking of drive motor suppliers from January to November 2025, FinDreams Powertrain topped the list with 3.41999 million sets installed and a 25.8% market share, far ahead of second-place Huawei Digital Power (6.9%). Huawei Digital Power and INOVANCE Automotive ranked second and third, but together they held only 12.5% of the market. Tesla and the remaining suppliers each held less than 5%, with small gaps between them. The list includes both automaker self-developed players such as FinDreams Powertrain and Tesla, as well as professional suppliers like Huawei Digital Power and INOVANCE Automotive, reflecting a dual model of "automakers in-house systems + third-party external supply" in the drive motor sector.

From the installed capacity ranking of drive motor suppliers from January to November 2025, FinDreams Powertrain topped the list with 3.41999 million sets installed and a 25.8% market share, far ahead of second-place Huawei Digital Power (6.9%). Huawei Digital Power and INOVANCE Automotive ranked second and third, but together they held only 12.5% of the market. Tesla and the remaining suppliers each held less than 5%, with small gaps between them. The list includes both automaker self-developed players such as FinDreams Powertrain and Tesla, as well as professional suppliers like Huawei Digital Power and INOVANCE Automotive, reflecting a dual model of "automakers in-house systems + third-party external supply" in the drive motor sector.

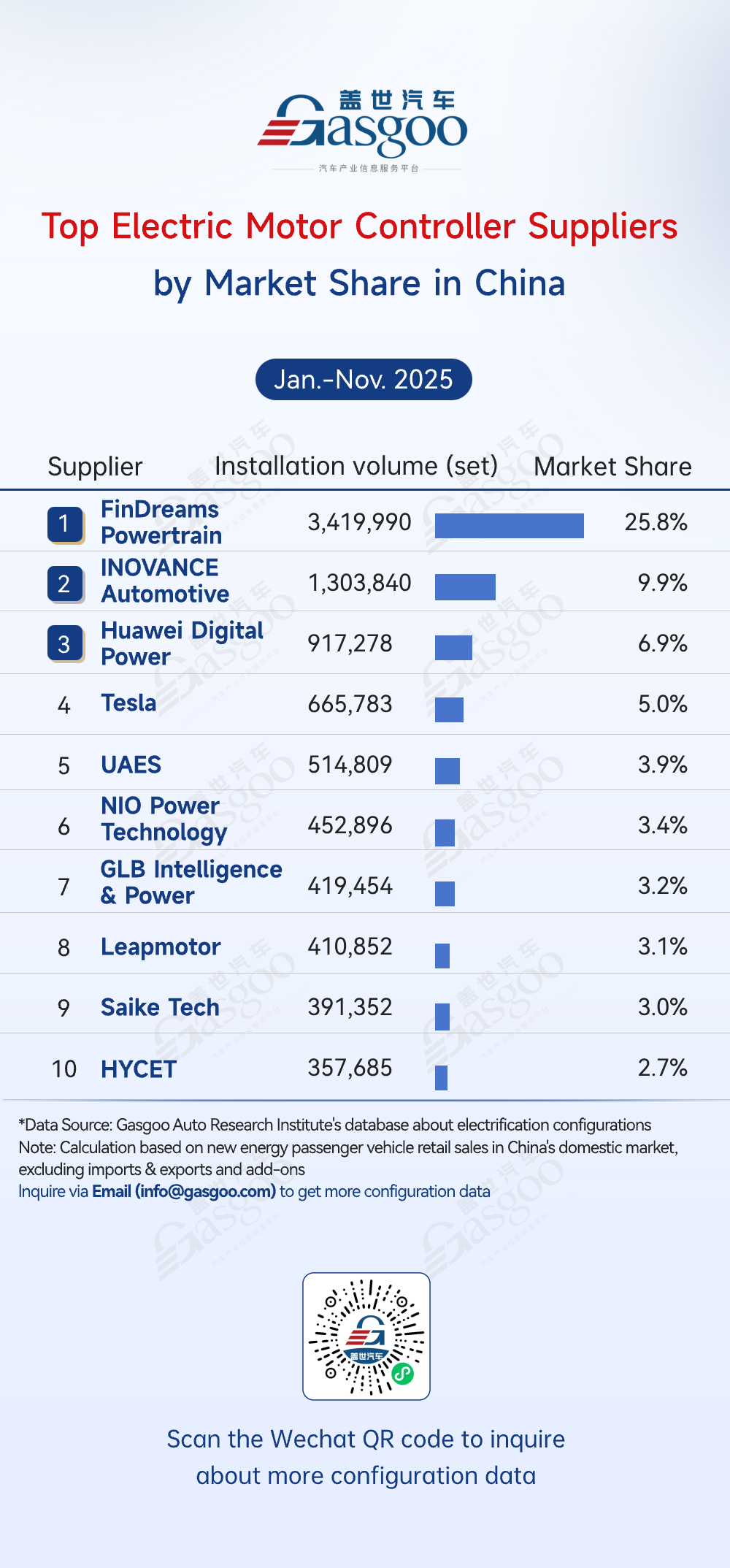

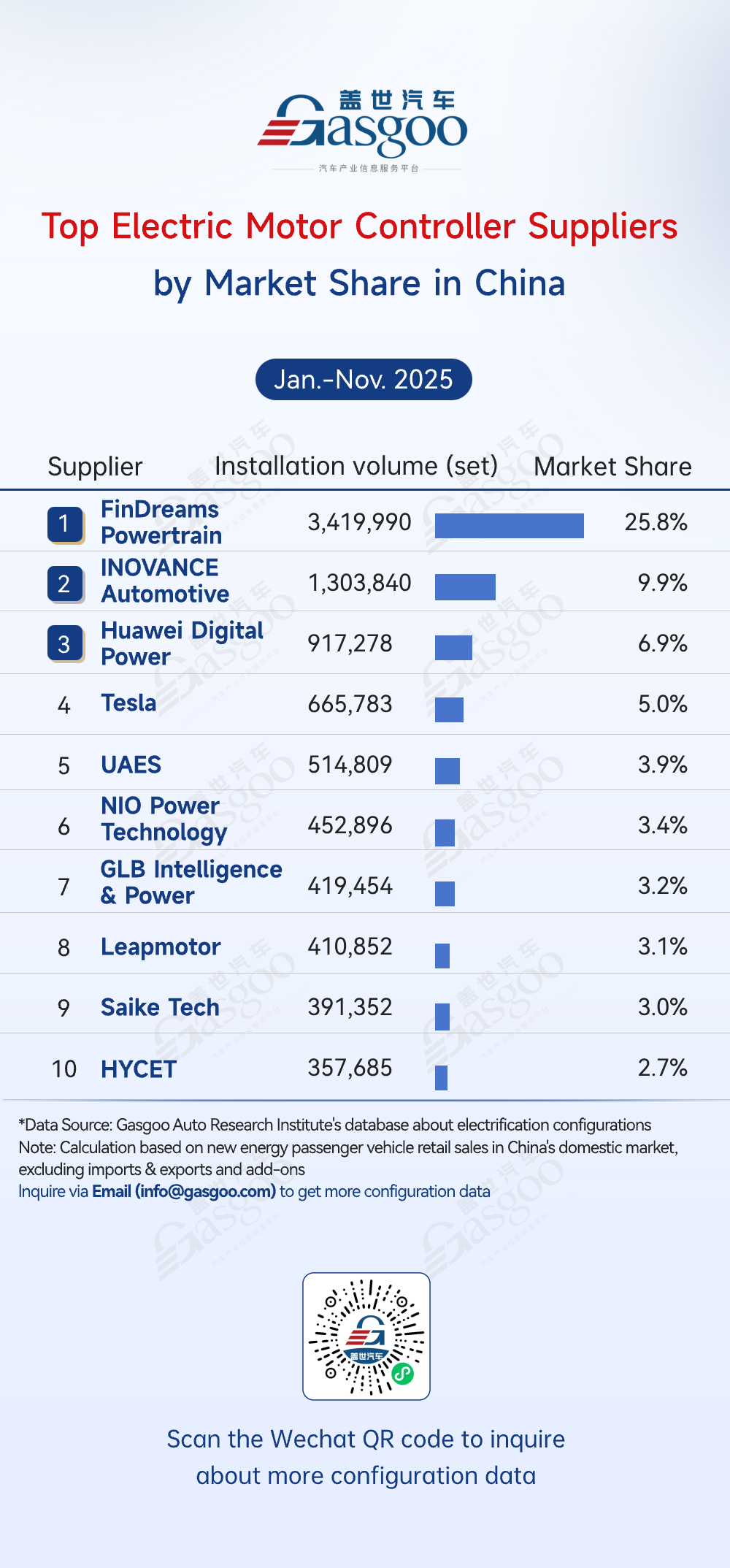

From the installed capacity ranking of drive motor suppliers from January to November 2025, FinDreams Powertrain topped the list with 3.41999 million sets installed and a 25.8% market share, far ahead of second-place Huawei Digital Power (6.9%). Huawei Digital Power and INOVANCE Automotive ranked second and third, but together they held only 12.5% of the market. Tesla and the remaining suppliers each held less than 5%, with small gaps between them. The list includes both automaker self-developed players such as FinDreams Powertrain and Tesla, as well as professional suppliers like Huawei Digital Power and INOVANCE Automotive, reflecting a dual model of "automakers in-house systems + third-party external supply" in the drive motor sector.Top electric motor controller suppliers

FinDreams Powertrain: 1,474,313 sets installed, 24.5% market share

Tesla: 533,900 sets installed, 8.9% market share

GLB Intelligence & Power: 461,108 sets installed, 7.7% market share

INOVANCE Automotive: 313,307 sets installed, 5.2% market share

Leapmotor: 298,843 sets installed, 5.0% market share

UAES: 280,699 sets installed, 4.7% market share

NIO Power Technology: 280,520 sets installed, 4.7% market share

CRRC Times Electric: 250,478 sets installed, 4.2% market share

Quzhou Jidian: 199,271 sets installed, 3.3% market share

DEEPAL: 177,775 sets installed, 3.0% market share In the motor controller market from January to November 2025, FinDreams Powertrain led with a 25.8% share. In-house products from Tesla, NIO Power Technology, and Leapmotor also made the top 10, directly confirming the industry trend that automakers' self-developed motor controllers now account for more than half of the market. Self-development not only improves system integration with the vehicle but also strengthens automakers' technological barriers.From a tiered competition perspective, FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power together held 42.6% of the market, forming the first tier. FinDreams Powertrain led in installations thanks to high sales of its own vehicle models, while INOVANCE Automotive and Huawei Digital Power served multiple brands as professional suppliers. The market shares of ranks four to ten were concentrated between 2.7% and 5.0%, with only small gaps between them. Overall, the motor controller market has reached a high level of localization, and automakers' in-house development is gradually squeezing the market space for third-party suppliers.

In the motor controller market from January to November 2025, FinDreams Powertrain led with a 25.8% share. In-house products from Tesla, NIO Power Technology, and Leapmotor also made the top 10, directly confirming the industry trend that automakers' self-developed motor controllers now account for more than half of the market. Self-development not only improves system integration with the vehicle but also strengthens automakers' technological barriers.From a tiered competition perspective, FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power together held 42.6% of the market, forming the first tier. FinDreams Powertrain led in installations thanks to high sales of its own vehicle models, while INOVANCE Automotive and Huawei Digital Power served multiple brands as professional suppliers. The market shares of ranks four to ten were concentrated between 2.7% and 5.0%, with only small gaps between them. Overall, the motor controller market has reached a high level of localization, and automakers' in-house development is gradually squeezing the market space for third-party suppliers.

In the motor controller market from January to November 2025, FinDreams Powertrain led with a 25.8% share. In-house products from Tesla, NIO Power Technology, and Leapmotor also made the top 10, directly confirming the industry trend that automakers' self-developed motor controllers now account for more than half of the market. Self-development not only improves system integration with the vehicle but also strengthens automakers' technological barriers.From a tiered competition perspective, FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power together held 42.6% of the market, forming the first tier. FinDreams Powertrain led in installations thanks to high sales of its own vehicle models, while INOVANCE Automotive and Huawei Digital Power served multiple brands as professional suppliers. The market shares of ranks four to ten were concentrated between 2.7% and 5.0%, with only small gaps between them. Overall, the motor controller market has reached a high level of localization, and automakers' in-house development is gradually squeezing the market space for third-party suppliers.

In the motor controller market from January to November 2025, FinDreams Powertrain led with a 25.8% share. In-house products from Tesla, NIO Power Technology, and Leapmotor also made the top 10, directly confirming the industry trend that automakers' self-developed motor controllers now account for more than half of the market. Self-development not only improves system integration with the vehicle but also strengthens automakers' technological barriers.From a tiered competition perspective, FinDreams Powertrain, INOVANCE Automotive, and Huawei Digital Power together held 42.6% of the market, forming the first tier. FinDreams Powertrain led in installations thanks to high sales of its own vehicle models, while INOVANCE Automotive and Huawei Digital Power served multiple brands as professional suppliers. The market shares of ranks four to ten were concentrated between 2.7% and 5.0%, with only small gaps between them. Overall, the motor controller market has reached a high level of localization, and automakers' in-house development is gradually squeezing the market space for third-party suppliers.Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 3,415,561 sets installed, 25.8% market share

CRRC Times Semiconductor: 1,695,954 sets installed, 12.8% market share

United Nova Technology: 1,193,425 sets installed, 9.0% market share

Silan Microelectronics: 1,067,792 sets installed, 8.1% market share

Infineon: 903,037 sets installed, 6.8% market share

StarPower Semiconductor: 863,775 sets installed, 6.5% market share

UAES: 688,233 sets installed, 5.2% market share

STMicroelectronics: 682,912 sets installed, 5.2% market share

AccoPower Semiconductor: 301,961 sets installed, 2.3% market share

MACMIC: 188,631 sets installed, 1.4% market share From January to November 2025, the power device (drive) market was dominated by domestic suppliers and highly concentrated at the top. BYD Semiconductor led with 3,415,561 sets installed and a 25.8% share, driven by deep integration with BYD's vehicle ecosystem. The top five suppliers together held 63% of the market, with four China's local companies (BYD Semiconductor, CRRC Times Semiconductor, ChipLink Integrated, and Silan Micro) in the top five, showing strong progress in domestic substitution. Foreign players Infineon and STMicroelectronics held 6.8% and 5.2%, respectively, trailing behind the leading domestic firms.

From January to November 2025, the power device (drive) market was dominated by domestic suppliers and highly concentrated at the top. BYD Semiconductor led with 3,415,561 sets installed and a 25.8% share, driven by deep integration with BYD's vehicle ecosystem. The top five suppliers together held 63% of the market, with four China's local companies (BYD Semiconductor, CRRC Times Semiconductor, ChipLink Integrated, and Silan Micro) in the top five, showing strong progress in domestic substitution. Foreign players Infineon and STMicroelectronics held 6.8% and 5.2%, respectively, trailing behind the leading domestic firms.

AccoPower Semiconductor: 301,961 sets installed, 2.3% market share

MACMIC: 188,631 sets installed, 1.4% market share

From January to November 2025, the power device (drive) market was dominated by domestic suppliers and highly concentrated at the top. BYD Semiconductor led with 3,415,561 sets installed and a 25.8% share, driven by deep integration with BYD's vehicle ecosystem. The top five suppliers together held 63% of the market, with four China's local companies (BYD Semiconductor, CRRC Times Semiconductor, ChipLink Integrated, and Silan Micro) in the top five, showing strong progress in domestic substitution. Foreign players Infineon and STMicroelectronics held 6.8% and 5.2%, respectively, trailing behind the leading domestic firms.

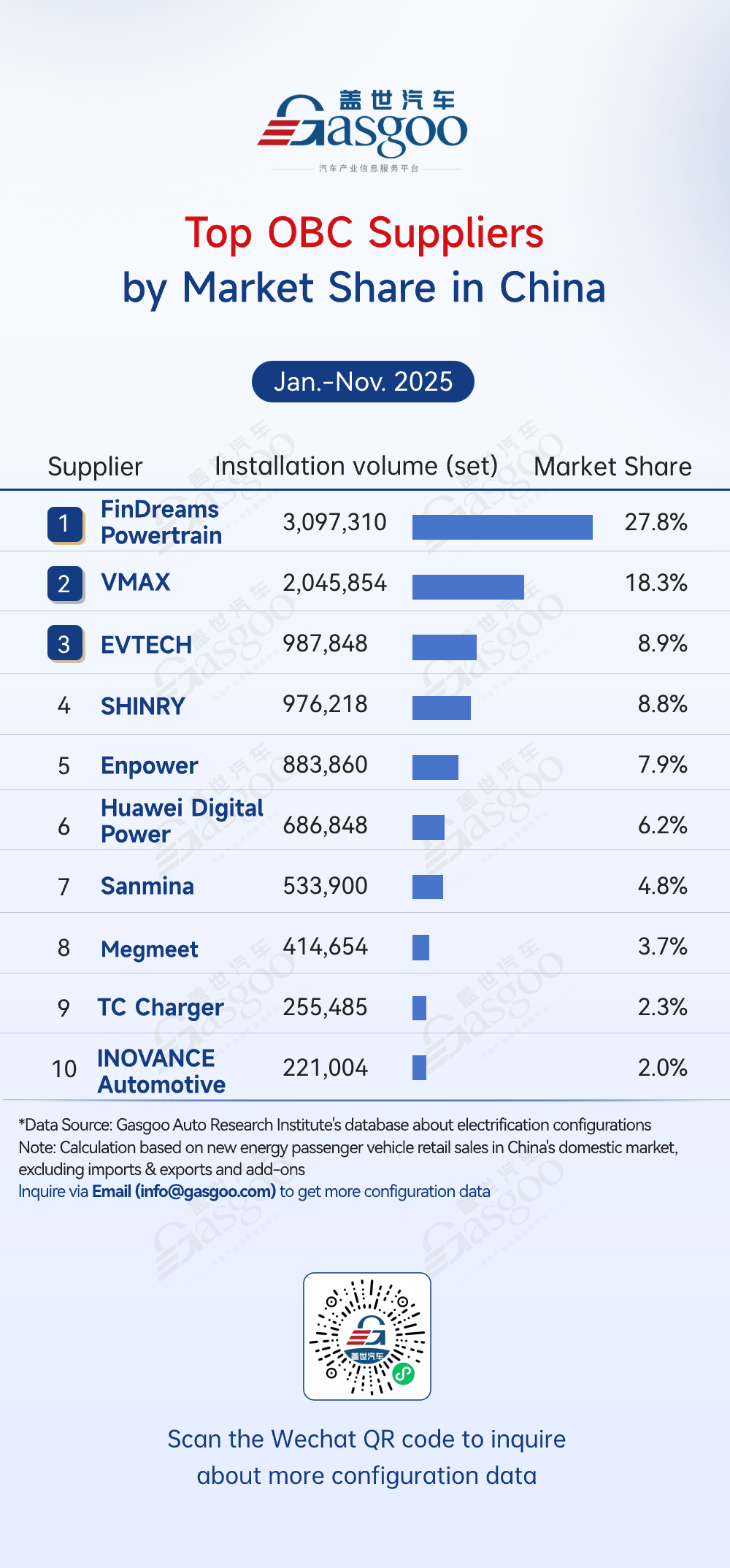

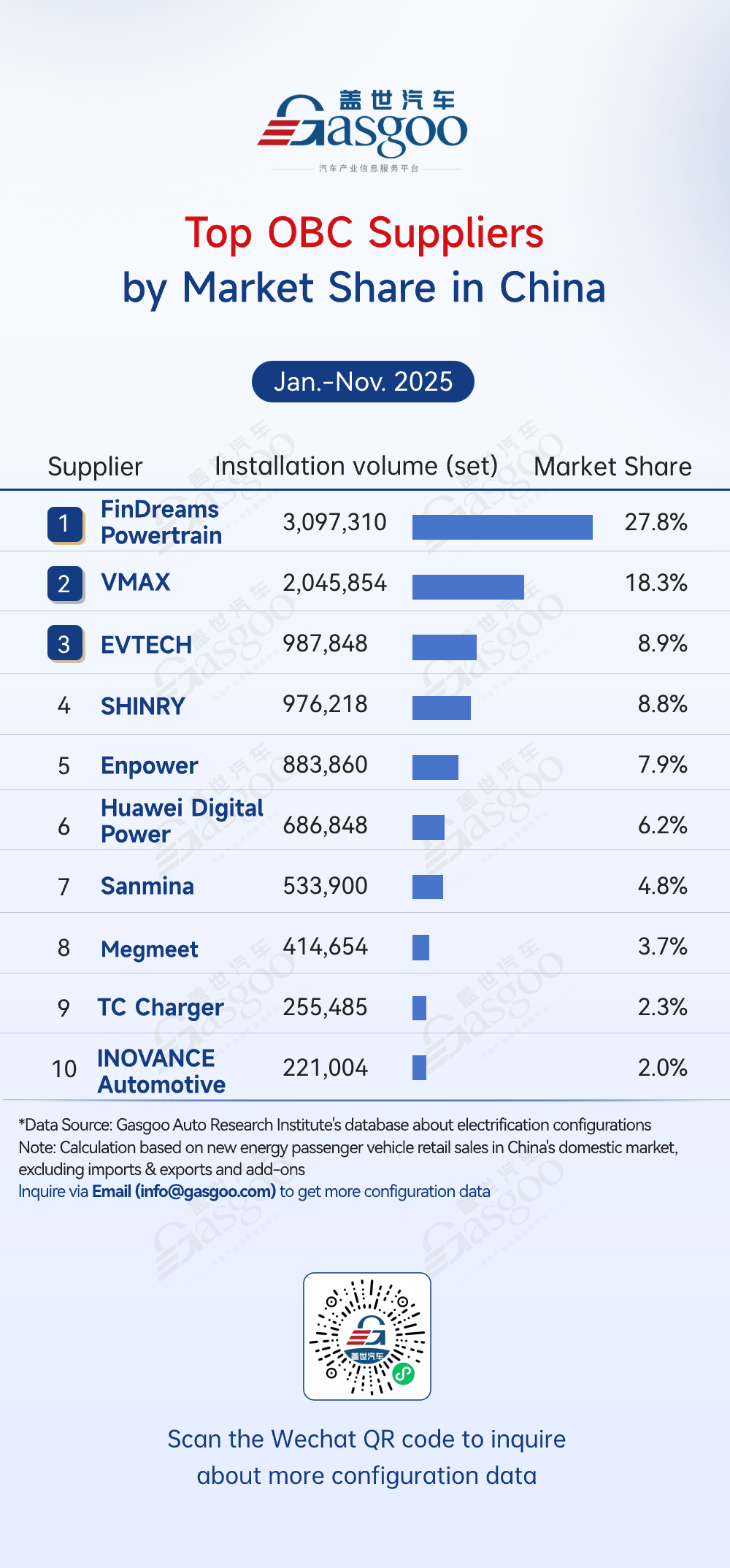

From January to November 2025, the power device (drive) market was dominated by domestic suppliers and highly concentrated at the top. BYD Semiconductor led with 3,415,561 sets installed and a 25.8% share, driven by deep integration with BYD's vehicle ecosystem. The top five suppliers together held 63% of the market, with four China's local companies (BYD Semiconductor, CRRC Times Semiconductor, ChipLink Integrated, and Silan Micro) in the top five, showing strong progress in domestic substitution. Foreign players Infineon and STMicroelectronics held 6.8% and 5.2%, respectively, trailing behind the leading domestic firms.Top OBC suppliers

FinDreams Powertrain: 3,097,310 sets installed, 27.8% market share

VMAX: 2,045,854 sets installed, 18.3% market share

EVTECH: 987,848 sets installed, 8.9% market share

SHINRY: 976,218 sets installed, 8.8% market share

Enpower: 883,860 sets installed, 7.9% market share

Huawei Digital Power: 686,848 sets installed, 6.2% market share

Sanmina: 533,900 sets installed, 4.8% market share

Megmeet: 414,654 sets installed, 3.7% market share

TC Charger: 255,485 sets installed, 2.3% market share

INOVANCE Automotive: 221,004 sets installed, 2.0% market share From January to November 2025, the OBC market showed a highly concentrated top tier, with the top five suppliers holding 72% of the market. FinDreams Powertrain led with 3.0973 million sets installed and a 27.8% share, followed by VMAX with 2.0459 million sets and 18.3%. Together, they formed the first tier. EVTECH, SHINRY, and Enpower formed the second tier, each holding 7%–9% market share. Their broad technical compatibility enabled them to serve multiple brands and act as key supplementary suppliers in the OBC ecosystem. Suppliers ranked sixth to tenth each held less than 6%, with shares gradually decreasing. The remaining market was split among various players, with smaller firms focusing on specific models or niche customers and relying on differentiated positioning to survive.

From January to November 2025, the OBC market showed a highly concentrated top tier, with the top five suppliers holding 72% of the market. FinDreams Powertrain led with 3.0973 million sets installed and a 27.8% share, followed by VMAX with 2.0459 million sets and 18.3%. Together, they formed the first tier. EVTECH, SHINRY, and Enpower formed the second tier, each holding 7%–9% market share. Their broad technical compatibility enabled them to serve multiple brands and act as key supplementary suppliers in the OBC ecosystem. Suppliers ranked sixth to tenth each held less than 6%, with shares gradually decreasing. The remaining market was split among various players, with smaller firms focusing on specific models or niche customers and relying on differentiated positioning to survive.

From January to November 2025, the OBC market showed a highly concentrated top tier, with the top five suppliers holding 72% of the market. FinDreams Powertrain led with 3.0973 million sets installed and a 27.8% share, followed by VMAX with 2.0459 million sets and 18.3%. Together, they formed the first tier. EVTECH, SHINRY, and Enpower formed the second tier, each holding 7%–9% market share. Their broad technical compatibility enabled them to serve multiple brands and act as key supplementary suppliers in the OBC ecosystem. Suppliers ranked sixth to tenth each held less than 6%, with shares gradually decreasing. The remaining market was split among various players, with smaller firms focusing on specific models or niche customers and relying on differentiated positioning to survive.

From January to November 2025, the OBC market showed a highly concentrated top tier, with the top five suppliers holding 72% of the market. FinDreams Powertrain led with 3.0973 million sets installed and a 27.8% share, followed by VMAX with 2.0459 million sets and 18.3%. Together, they formed the first tier. EVTECH, SHINRY, and Enpower formed the second tier, each holding 7%–9% market share. Their broad technical compatibility enabled them to serve multiple brands and act as key supplementary suppliers in the OBC ecosystem. Suppliers ranked sixth to tenth each held less than 6%, with shares gradually decreasing. The remaining market was split among various players, with smaller firms focusing on specific models or niche customers and relying on differentiated positioning to survive.Top suppliers of multi-in-one main drive system (dedicated to BEVs)

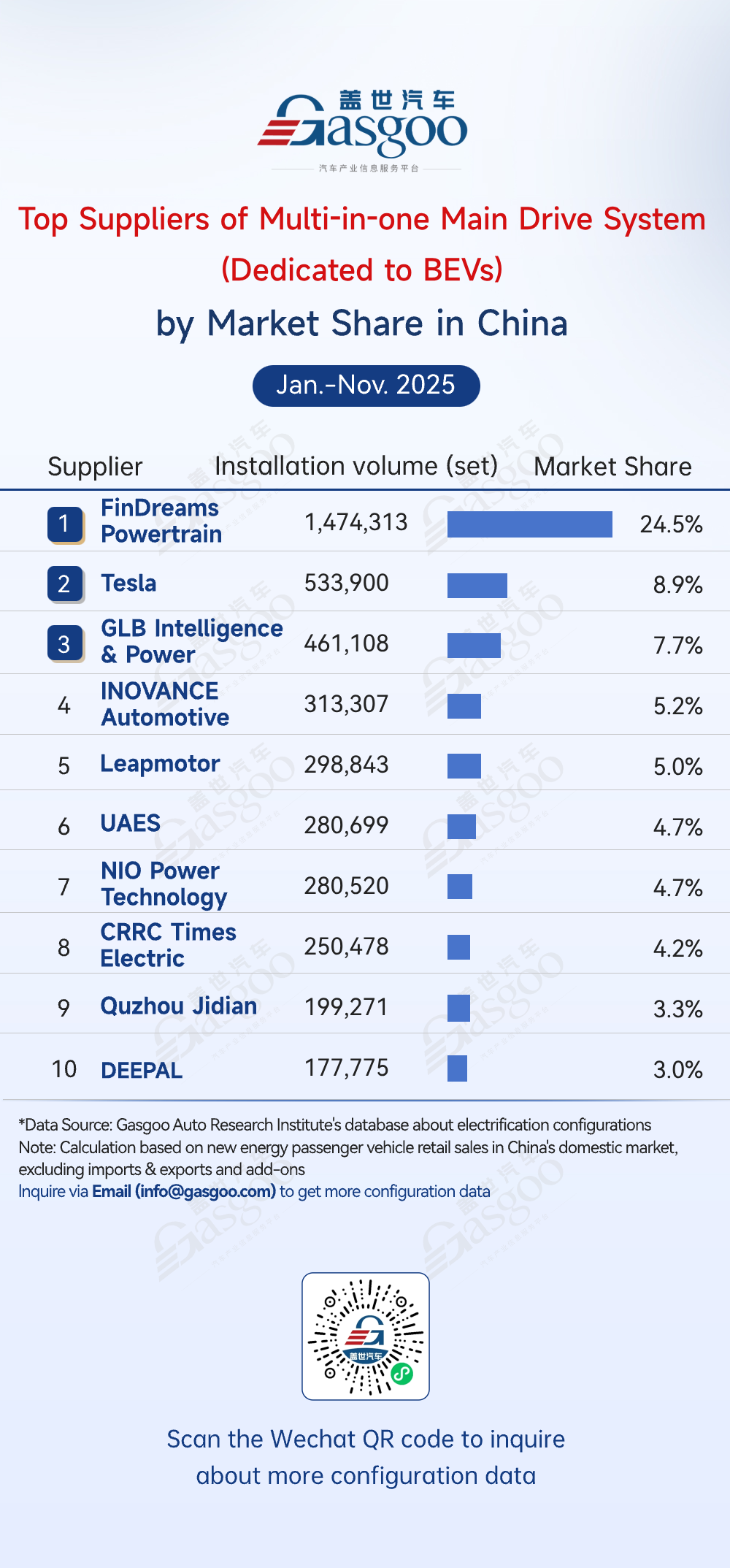

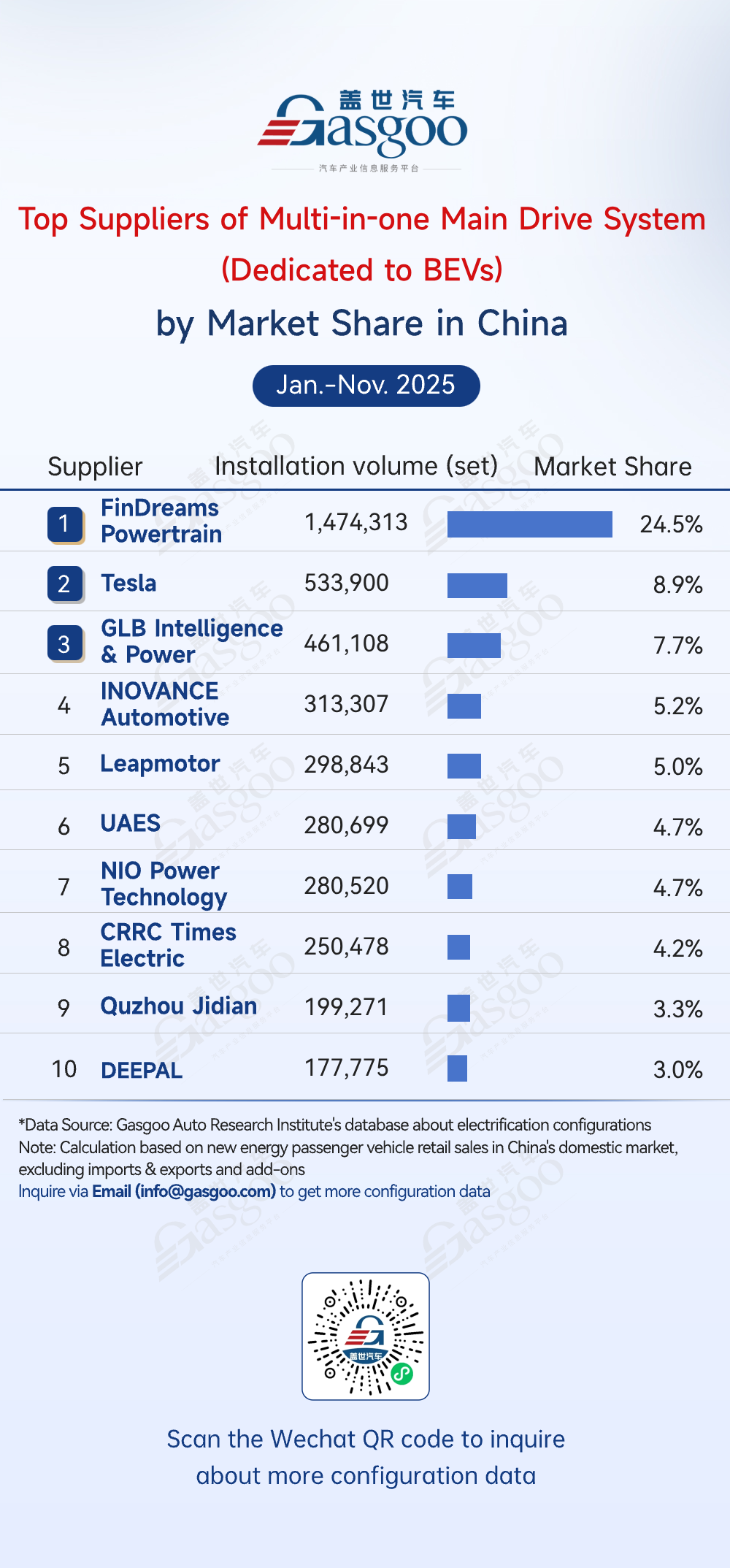

FinDreams Powertrain: 1,474,313 sets installed, 24.5% market share

Tesla: 533,900 sets installed, 8.9% market share

GLB Intelligence & Power: 461,108 sets installed, 7.7% market share

INOVANCE Automotive: 313,307 sets installed, 5.2% market share

Leapmotor: 298,843 sets installed, 5.0% market share

UAES: 280,699 sets installed, 4.7% market share

NIO Power Technology: 280,520 sets installed, 4.7% market share

CRRC Times Electric: 250,478 sets installed, 4.2% market share

Quzhou Jidian: 199,271 sets installed, 3.3% market share

DEEPAL: 177,775 sets installed, 3.0% market share

From January to November 2025, the BEV integrated main drive system market was dominated by automakers' self-supply. FinDreams Powertrain led with 1.4743 million sets (24.5%), while Tesla, Leapmotor, NIO Power Technology, and Deepal also entered the top 10. This reflects the high technical threshold of integrated drive systems and the advantage of self-development in system integration, performance, and cost control. Professional suppliers like GLB Intelligence & Power and INOVANCE Automotive supported non-self-supplied automakers, but their shares remained notably lower than those of the leading self-supply players.

From January to November 2025, the BEV integrated main drive system market was dominated by automakers' self-supply. FinDreams Powertrain led with 1.4743 million sets (24.5%), while Tesla, Leapmotor, NIO Power Technology, and Deepal also entered the top 10. This reflects the high technical threshold of integrated drive systems and the advantage of self-development in system integration, performance, and cost control. Professional suppliers like GLB Intelligence & Power and INOVANCE Automotive supported non-self-supplied automakers, but their shares remained notably lower than those of the leading self-supply players.

From January to November 2025, the BEV integrated main drive system market was dominated by automakers' self-supply. FinDreams Powertrain led with 1.4743 million sets (24.5%), while Tesla, Leapmotor, NIO Power Technology, and Deepal also entered the top 10. This reflects the high technical threshold of integrated drive systems and the advantage of self-development in system integration, performance, and cost control. Professional suppliers like GLB Intelligence & Power and INOVANCE Automotive supported non-self-supplied automakers, but their shares remained notably lower than those of the leading self-supply players.

From January to November 2025, the BEV integrated main drive system market was dominated by automakers' self-supply. FinDreams Powertrain led with 1.4743 million sets (24.5%), while Tesla, Leapmotor, NIO Power Technology, and Deepal also entered the top 10. This reflects the high technical threshold of integrated drive systems and the advantage of self-development in system integration, performance, and cost control. Professional suppliers like GLB Intelligence & Power and INOVANCE Automotive supported non-self-supplied automakers, but their shares remained notably lower than those of the leading self-supply players.Top electrical compressor suppliers

FinDreams Technology: 2,923,448 sets installed, 26.2% market share

Sanden Hasco: 1,925,303 sets installed, 17.3% market share

Aotecar: 1,472,053 sets installed, 13.2% market share

Welling: 972,447 sets installed, 8.7% market share

Highly: 862,645 sets installed, 7.7% market share

ZonCen New Energy: 822,069 sets installed, 7.4% market share

Chongqing Chaoli High-Tech: 299,420 sets installed, 2.7% market share

SANDEN: 266,950 sets installed, 2.4% market share

Welling: 972,447 sets installed, 8.7% market share

Highly: 862,645 sets installed, 7.7% market share

ZonCen New Energy: 822,069 sets installed, 7.4% market share

Chongqing Chaoli High-Tech: 299,420 sets installed, 2.7% market share

SANDEN: 266,950 sets installed, 2.4% market share

Hanon Systems: 242,625 sets installed, 2.2% market share

Wilo: 208,864 sets installed, 1.9% market share From January to November 2025, the electrical compressor market was highly concentrated, with the top five suppliers holding 73% of the market. FinDreams Technology led the pack with 2,923,448 sets (26.2%), followed by Sanden Hasco (17.3%) and Aotecar (13.2%). The remaining top suppliers each held 7%–9%, while ranks seven to ten were all below 7% and declined gradually. Overall, the market is dominated by a few large players, and smaller suppliers must rely on niche customers or technical differentiation to compete.

From January to November 2025, the electrical compressor market was highly concentrated, with the top five suppliers holding 73% of the market. FinDreams Technology led the pack with 2,923,448 sets (26.2%), followed by Sanden Hasco (17.3%) and Aotecar (13.2%). The remaining top suppliers each held 7%–9%, while ranks seven to ten were all below 7% and declined gradually. Overall, the market is dominated by a few large players, and smaller suppliers must rely on niche customers or technical differentiation to compete.

From January to November 2025, the electrical compressor market was highly concentrated, with the top five suppliers holding 73% of the market. FinDreams Technology led the pack with 2,923,448 sets (26.2%), followed by Sanden Hasco (17.3%) and Aotecar (13.2%). The remaining top suppliers each held 7%–9%, while ranks seven to ten were all below 7% and declined gradually. Overall, the market is dominated by a few large players, and smaller suppliers must rely on niche customers or technical differentiation to compete.

From January to November 2025, the electrical compressor market was highly concentrated, with the top five suppliers holding 73% of the market. FinDreams Technology led the pack with 2,923,448 sets (26.2%), followed by Sanden Hasco (17.3%) and Aotecar (13.2%). The remaining top suppliers each held 7%–9%, while ranks seven to ten were all below 7% and declined gradually. Overall, the market is dominated by a few large players, and smaller suppliers must rely on niche customers or technical differentiation to compete.