SAIC Motor Corp. Ltd. released its first monthly production and sales report of the year on February 2, 2026. The data shows that in January 2026, SAIC Group's vehicle sales climbed to 327,400 units — a 23.94% year-on-year increase — marking a strong start with growth in both production and sales. Yet, while the headline numbers are impressive, the profound shifts within the internal structure offer a clearer picture of where China's automotive giant stands amid sweeping industry change.

Three Engines Driving Growth

Unlike the past, when growth relied heavily on joint ventures, the sales data for January 2026 clearly indicates a significant shift in SAIC's power sources. Self-owned brands, new energy vehicles, and overseas business are emerging as the three engines driving SAIC's production and sales growth, pulling the entire group through its transformation.

First, self-owned brands are moving from an "important component" to the "backbone."

According to the announcement, sales of SAIC's self-owned brands hit 214,000 units in January — a surge of 39.6% year-on-year — bringing their share of total group sales to 65.3%. This means that for every three SAIC vehicles sold, more than two come from the self-owned segment, signaling a clear shift in the group's operational focus and market identity toward its own brands.

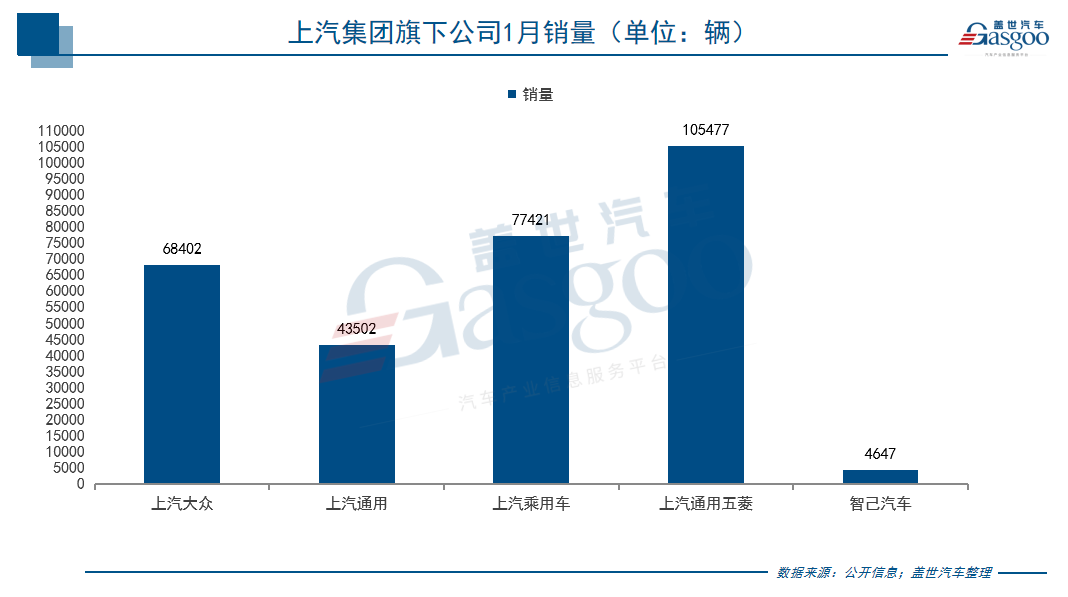

Within the self-owned camp, various sub-sectors are collaborating to demonstrate competitiveness across different tiers. SAIC Motor Passenger Vehicle Co. sold 77,421 units in January, jumping 53.78% to become one of the group's fastest-growing core units. SAIC-GM-Wuling contributed nearly half of the self-owned segment's volume with 105,477 units, up 36.98%. IM Motors, focused on high-end new energy vehicles, also posted growth, with sales reaching 4,647 units — a 65.96% increase.

Second, new energy vehicles are shifting from a "strategic reserve" to the "main track for growth." SAIC Group's NEV sales in January reached 85,400 units, climbing 39.73% year-on-year — a pace far outstripping overall sales growth and highlighting the speed and depth of its transition. Furthermore, this growth shows signs of blooming across multiple fronts.

On one hand, the growth is widespread. Not only are emerging NEV brands like IM Motors advancing rapidly, but traditional mainstays are also delivering solid performances. SAIC Motor Passenger Vehicle Co.'s NEV sales hit 28,000 units in January; SAIC GM sold 6,000 NEVs; and SAIC-GM-Wuling moved 36,000 units.

Additionally, overseas markets have evolved from a "nice-to-have" bonus into an indispensable "pillar."

In January, SAIC Group's overseas sales — including exports and overseas production bases — reached 104,500 units, surging 51.68% to become the fastest-growing segment among the three engines. Overseas volume now consistently accounts for nearly one-third of total group sales, a ratio that ranks among the highest for global mainstream automakers.

Image Source: SAIC MG

The success of overseas operations is not merely an export of sales volume, but a global validation of brand value and systemic capability. The MG brand surpassed Ford and Hyundai in the UK market last December to secure the No. 2 spot for monthly sales, and maintained that momentum in Europe this January. This proves that Chinese automotive brands are fully capable of gaining a foothold in mature, competitive developed markets and winning recognition from mainstream consumers.

Transformation and Challenges Coexist

This impressive "good start" sets a positive tone for SAIC Group's 2026, yet the data also reflects the complex challenges the company faces as it navigates the deep waters of transformation. SAIC's current state is a microcosm of China's large traditional automotive groups at this historical turning point.

Image Source: SAIC Volkswagen

While self-owned brands are advancing rapidly, the joint venture sector — once the group's "cash cow" — is showing significant divergence and pressure. In January, SAIC Volkswagen's sales fell 8.98% to 68,402 units, while production dropped 30.34%. Although SAIC GM achieved a 29.31% year-on-year sales increase, it is an indisputable fact that the joint venture sector as a whole faces market compression.

How quickly SAIC can adjust the product strategies, electrification pace, and operational efficiency of its joint ventures to adapt to China's rapid market changes is a critical issue the company must navigate. Underlying this pressure is the sustained shrinking of the internal combustion engine vehicle market and the fading halo of joint venture brands.

Although SAIC's NEV growth is notable, it must be clearly recognized that the entire new energy vehicle market has become a fiercely competitive "red ocean." Top players like BYD and Tesla hold firm positions, while startups like Li Auto, NIO, and AITO are launching aggressive attacks in niche markets. The entry of tech giants like Huawei and Xiaomi has further intensified the competition. SAIC's 39.73% growth is an achievement built on its own base, but to vie for industry leadership, it must continue striving for breakthroughs in technologies such as solid-state batteries and intelligent driving, as well as the creation of hit models. Elevating the IM brand and sustaining the success of Wuling's best-sellers are two critical, yet challenging, paths.

Regarding globalization, SAIC Group's rapid growth in overseas markets is encouraging, but the accompanying challenges are complex. As China's vehicle export volume ranks first in the world, uncertainties in the international trade environment, potential trade barriers, the deepening of localized production and operations, and adaptation to different market cultures and regulations are all issues SAIC must address systematically. Moving from simple product exports to the export of technical standards, the establishment of brand value, and localized ecosystem operations, SAIC's globalization journey has entered a "second half" that tests its comprehensive strength.

Conclusion

SAIC has defined 2026 as the "year of tackling key tasks in comprehensively deepening reform."

The "good start" in January provides confidence and a buffer for SAIC's 2026. However, the tests remain. Whether SAIC can translate the market share advantage of its self-owned brands into sustained profitability and brand premium, whether it can convert its NEV technology layout into a decisive market victory, and whether it can build its globalization first-mover advantage into an impregnable systemic barrier are all subjects the company must face in the future.