From January to November, China's passenger vehicle exports to global markets displayed a core pattern of "NEVs leading, top players dominating, divergent growth, and competition between established and emerging forces." In Europe, SAIC PV maintained a leading position, while emerging players like Leapmotor achieved multiple-fold growth. In Southeast Asia, BYD dominated the market, with its NEV products nearly doubling in volume thanks to technological and channel advantages. Most automakers expanded in parallel, though a few experienced notable declines.

The North American market showed a clear split between NEVs and traditional vehicles, with BYD Auto surging over 160% YoY and Changan Auto making strong gains. In Central and South America, BYD Auto and Chery Auto led, while Great Wall Motor and Jiangling Motor grew over 60%, driving expansion. In the Middle East, top players dominated but growth was polarized: Chery Auto fell slightly, while BYD Auto, Great Wall Motor, and Southeast Auto doubled volumes through NEVs. Overall, the rise of Chinese brands overseas reflects strengths in products, supply chains, and local operations, as regional competition enters a more refined, differentiated stage.

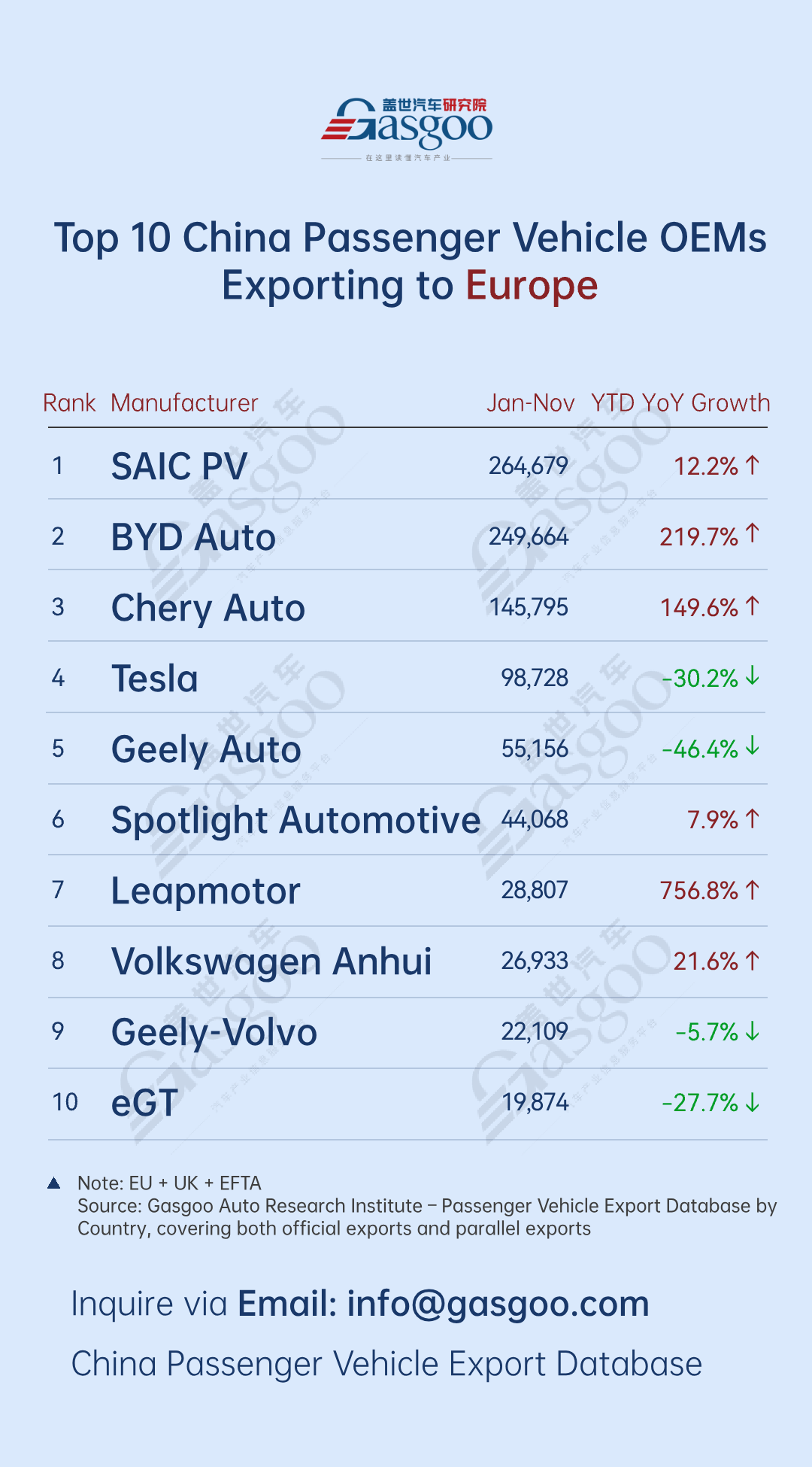

Top 10 Chinese automakers by passenger vehicle exports to Europe

SAIC PV: 264,679 units, up 12.2% year-on-year

BYD Auto: 249,664 units, up 219.7% year-on-year

Chery Auto: 145,795 units, up 149.6% year-on-year

Tesla: 98,728 units, down 30.2% year-on-yearGeely Auto: 55,156 units, down 46.4% year-on-

year

Spotlight Automotive: 44,068 units, up 7.9% year-on-year

Leapmotor: 28,807 units, up 756.8% year-on-year

Volkswagen Anhui: 26,933 units, up 21.6% year-on-year

Geely-Volvo: 22,109 units, down 5.7% year-on-year

eGT: 19,874 units, down 27.7% year-on-year

From January to November, Europe's market continued to show high concentration among top players and significant divergence in growth. SAIC PV led the pack with over 264,679 units and 12.2% YoY growth. BYD Auto followed closely with 249,664 units, posting a 219.7% YoY increase that further narrowed the gap with the leader. Chery Auto ranked third with 145,795 units and 149.6% growth, reflecting its deepening presence and sustained product competitiveness in the European market.

Emerging players delivered even stronger performances. Leapmotor exported 28,807 units, surging 756.8% YoY and standing out as a benchmark among new Chinese entrants to Europe. Volkswagen Anhui (up 21.6% YoY) and Spotlight Automotive (up 7.9% YoY) also achieved steady growth, supported by their more established market presence.

Meanwhile, market polarization continued to intensify. Tesla exported 98,728 units to Europe, down 30.2% YoY, while Geely Auto saw exports fall to 55,156 units, a sharp 46.4% YoY decline. Geely Volvo and eGT also recorded YoY decreases of 5.7% and 27.7%, respectively. These fluctuations likely reflected a combination of intensified competition from the influx of Chinese brands, the accelerating electrification push of European incumbents, and adjustments in companies' own product cycles.

Overall, Chinese brands continued to gain traction in the European market, with a pattern of "stable leaders alongside breakthrough newcomers" jointly driving export growth to the region. At the same time, the wide divergence in growth rates among automakers underscored intensifying competition in Europe. Going forward, product competitiveness, supply chain resilience, and localized operations are set to become the key determinants of success in the European market.

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia

BYD Auto: 143,705 units, up 193.5% year-on-year

Chery Auto: 83,029 units, up 147.3% year-on-year

Geely Auto: 65,830 units, up 28.9% year-on-year

Changan Auto: 31,336 units, up 59.1% year-on-year

Great Wall Motor: 20,093 units, up 51.1% year-on-year

Tesla: 18,756 units, up 37.8% year-on-year

Jiangsu Yueda Kia: 15,274 units, down 12.2% year-on-year

Jiangling Motor: 14,871 units, up 10.9% year-on-year

SAIC PV: 13,685 units, down 46.0% year-on-year

SAIC-GM-Wuling: 12,672 units, down 41.9% year-on-year

From January to November, the Southeast Asian market maintained strong momentum, characterized by a pattern of "leaders at the top, broad-based expansion, and selective declines." BYD Auto ranked first with exports of 143,705 units, up 193.5% YoY, underscoring its product strength and channel advantages in the region. Chery Auto followed with 83,029 units, posting a 147.3% YoY increase, while Geely Auto ranked third with 65,830 units, maintaining steady growth of 28.9%. Meanwhile, Changan Auto, Great Wall Motor, Tesla, and Jiangling Motor all recorded positive growth, with Changan Auto and Great Wall Motor delivering particularly strong performance, achieving YoY increases of 59.1% and 51.1%, respectively.

Notably, a small number of automakers saw declining performance. Jiangsu Yueda Kia recorded a YoY decrease of 12.2%, while SAIC PV and SAIC-GM-Wuling experienced more pronounced drops, down 46.0% and 41.9% YoY, respectively.

Overall, Chinese brands continued to increase their market penetration in Southeast Asia. New energy models remained the core driver of export growth, enabling leading players to further consolidate their positions through technological strengths and well-established distribution networks. At the same time, export declines among some automakers signaled that the Southeast Asian market was accelerating its shift from a phase of volume expansion to one of more refined operations. Going forward, precise product-market fit and deeper localization capabilities were set to become the key factors shaping competition in the region.

Top 10 Chinese automakers by passenger vehicle exports to North America

BYD Auto: 116,198 units, up 160.7% year-on-year

SAIC-GM-Wuling: 99,013 units, up 12.3% year-on-year

Geely Auto: 42,679 units, up 87.6% year-on-year

SAIC PV: 40,320 units, down 25.0% year-on-year

Chery Auto: 34,458 units, up 25.3% year-on-year

SAIC-GM: 33,569 units, down 44.9% year-on-year

Changan-Ford: 33,228 units, down 22.8% year-on-year

Jiangsu Yueda Kia: 31,121 units, up 13.4% year-on-year

Changan Auto: 19,543 units, up 152.6% year-on-year

GAC Trumpchi: 13,959 units, up 16.9% year-on-year

From January to November, the North American market showed a clear pattern of strong momentum from new energy players alongside adjustments among traditional automakers. BYD ranked first with exports of 116,198 units, posting a sharp YoY increase of 160.7%. SAIC-GM-Wuling followed in second place with 99,013 units and steady growth of 12.3% YoY. Geely Auto ranked third with 42,679 units, delivering a robust 87.6% YoY increase, reflecting solid expansion momentum. Changan Auto stood out with a surge of 152.6%, while Chery Auto and Jiangsu Yueda Kia also recorded positive growth to varying degrees.

Meanwhile, several traditional automakers saw pronounced volatility in export performance. SAIC PV exported 40,320 units, down 25.0% YoY, while SAIC-GM recorded 33,569 units with a sharp 44.9% decline. Changan Ford also posted a YoY contraction of 22.8%. These declines suggest that the product mix of such companies has become less aligned with current consumer preferences in the North American market.

Overall, Chinese automakers' exports to North America are entering a critical transition phase marked by the strong breakthrough of new-energy players and the adjustment and realignment of traditional manufacturers. Going forward, technological competitiveness in electrified products and more precise regional market execution will be the key levers reshaping the North American export landscape.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America

BYD Auto: 145,921 units, up 15.1% year-on-year

Chery Auto: 128,467 units, up 31.2% year-on-year

Great Wall Motor: 66,967 units, up 77.5% year-on-year

Jiangsu Yueda Kia: 45,455 units, down 1.9% year-on-year

Jiangling Motor: 34,266 units, up 78.9% year-on-year

Geely Auto: 27,252 units, up 22.9% year-on-year

SAIC-GM-Wuling: 25,131 units, down 11.5% year-on-year

DFSK: 23,096 units, up 64.4% year-on-year

SAIC PV: 22,508 units, up 55.0% year-on-year

Changan Auto: 20,402 units, up 11.9% year-on-year

From January to November, the Central and South American market displayed a pattern of "top players maintaining leadership, significant growth divergence, and most automakers achieving strong gains while a few lagged." At the top, BYD took the lead with 145,921 units exported, up 15.1% YoY, demonstrating the continued appeal and brand influence of its NEV portfolio in the region. Chery followed closely with 128,467 units, posting 31.2% YoY growth, leveraging its affordable models' alignment with regional demand and deep local channel penetration to steadily narrow the gap with the leader.

Several automakers became strong drivers of regional export growth. Great Wall Motor, Jiangling Motors, and DFSK all posted rapid YoY increases exceeding 60%, with Jiangling's 78.9% growth particularly notable, highlighting the strong alignment of its commercial and passenger vehicles with Central and South American demand. SAIC PV also steadily expanded, up 55.0% YoY, reflecting sustained product competitiveness, while Changan Auto maintained positive growth at 11.9%, demonstrating market resilience. However, some companies faced headwinds: Jiangsu Yueda Kia exports dipped slightly by 1.9% YoY, and SAIC-GM-Wuling declined 11.5%, indicating that their regional strategies and product portfolios still require further optimization.

Overall, competition in the Central and South American market has entered a "precision-focused deployment" phase. Automakers need to execute strategically on product differentiation, deeper localized operations, and the pace of technological upgrades. Only by aligning closely with regional energy trends, consumer preferences, and other core market demands can sustained growth breakthroughs be achieved.

Top 10 Chinese automakers by passenger vehicle exports to Middle East

Chery Auto: 263,679 units, down 18.1% year-on-year

BYD Auto: 115,688 units, up 109.7% year-on-year

SAIC PV: 90,232 units, down 3.2% year-on-year

Changan Auto: 78,194 units, up 40.6% year-on-year

Jiangsu Yueda Kia: 74,928 units, up 14.5% year-on-year

Geely Auto: 70,572 units, down 6.3% year-on-year

FAW-Toyota: 66,011 units, up 64.1% year-on-year

Great Wall Motor: 46,845 units, up 108.8% year-on-year

Southeast Auto: 44,356 units, up 142.0% year-on-year

Beijing Hyundai: 39,337 units, up 46.0% year-on-year

From January to November, the Middle East market maintained a pattern of top players leading while growth diverged sharply. At the top, Chery Auto exported 263,679 units, remaining the largest exporter, but cumulative exports fell 18.1% YoY due to a high prior-year base and accelerated competition in the region. BYD Auto followed closely with 115,688 units, posting a strong 109.7% YoY increase. Its NEVs, well aligned with local energy transition trends and rising consumer demand, served as the key driver of this leap in growth, further narrowing the gap with the leader.

Some automakers faced growth challenges: SAIC PV declined slightly by 3.2% YoY, while Geely Auto fell 6.3%, indicating that their product portfolios or regional strategies need faster iteration to keep pace with market changes. In contrast, several companies demonstrated strong momentum: Changan Auto (40.6%), Jiangsu Yueda Kia (14.5%), FAW-Toyota (64.1%), and Beijing Hyundai (46.0%) all achieved steady expansion, while Southeast Auto and Great Wall Motor posted explosive growth exceeding 100%, becoming key drivers of regional market growth.

Overall, the Middle East has become a core strategic market for Chinese passenger vehicle exports. The pace of new energy deployment and the ability to differentiate products have become key levers for driving growth. Traditional leading automakers need to accelerate strategy adjustments to better align with regional demand, while high-growth players must further strengthen localized channels and core product competitiveness to solidify their market presence and achieve sustainable long-term expansion.