2025 is shaping up to be a breakout year for humanoid robots.

Global shipments of humanoid robots approached 18,000 units last year, surging roughly 508% year-on-year to generate about $440 million in sales, according to the latest data from IDC. Over the same period, cumulative orders topped 35,000 units, laying the groundwork for sustained delivery and market expansion.

While the rapid ascent of humanoid robots is undoubtedly fueled by emerging startups like AgiBot, Unitree, and UBTECH, it is equally dependent on the aggressive positioning and increased investment by listed companies.

Leveraging deep reserves of capital, technology, mass production capabilities, and operational management expertise, numerous listed companies in the auto components and precision manufacturing sectors are actively advancing into the humanoid robotics space, emerging as a force to be reckoned with.

Giants Enter the Fray, Each With a Different Playbook

On February 9, Minth Group announced to the Hong Kong Stock Exchange that it had reached a framework agreement with Leader Harmonious on core terms for a proposed joint venture in the United States. The JV will target the North American market, focusing on the design, manufacturing, and commercialization of humanoid robot joint module assemblies—aiming straight for the core of the North American robotics supply chain.

Image source: Minth

As a leading global auto parts supplier, Minth specializes in the R&D, production, and sales of automotive components and tooling molds. Its core portfolio includes metal trim, plastic parts, aluminum components, and battery boxes. With a comprehensive global footprint spanning R&D, production, and sales, the company has built up substantial industrial capabilities and global operational expertise.

Building on this foundation, Minth has proactively expanded into new frontiers such as artificial intelligence, robotics, the low-altitude economy, and smart mobility, aiming to leverage its existing strengths to forge a second growth curve. The joint venture with Leader Harmonious marks a critical step in Minth's strategy to secure a foothold in core humanoid robot components.

As a domestic leader in harmonic reducers, Leader Harmonious possesses deep expertise in precision transmission technology. This complements Minth's mass production capabilities, global supply chain management, and North American market channels, creating a synergy that promises to unlock new revenue streams for both parties.

Minth is far from alone in the auto components sector. Before this move, companies including Tuopu Group, Ningbo Huaxiang, WBTL, and Joyson Electronics had already actively expanded their humanoid robotics operations.

Ningbo Huaxiang, for instance, established a subsidiary called Huaxiang Qiyuan as early as June 2025 to deepen its robotics footprint. That same month, Huaxiang Qiyuan signed a commissioned production agreement with Shanghai AgiBot New Creation Technology, confirming it would manufacture select full-sized bipedal robots for AgiBot over the next three years to meet the startup's production needs.

Beyond setting up a dedicated subsidiary, Ningbo Huaxiang also entered the dexterous hand sector at the end of 2025. Through Huaxiang Qiyuan, it signed a strategic cooperation agreement with DH-Robotics.

WBTL also anchored its position in humanoid robotics early on. At the end of 2025, it announced plans to invest 35 million yuan in AiMOGA, a subsidiary of Chery, aiming to bolster its sustainable operational capabilities.

As auto parts makers race to cross over, precision manufacturing giants from the consumer electronics sector are also making their move, launching a massive "capability migration." By repurposing the extreme precision, massive production capacity, and global service networks honed over years in consumer electronics, they aim to quickly seize control of the mass production segment.

Image source: LY iTECH

The partnership between LY iTECH and MagicLab stands as a prime example of this model. Recently, LY iTECH's subsidiary, Lingyi Robotics, signed a strategic cooperation agreement with MagicLab to collaborate deeply on robot manufacturing services, industrial implementation, production line expansion, and overseas growth.

Specifically, MagicLab will prioritize sourcing core components such as structural parts, servo motors, and reducers, as well as supporting solutions for charging and thermal management from LY iTECH, aiming to boost efficiency and cut costs. Looking ahead, the two plan to co-develop industrial bases and coordinate overseas efforts, leveraging LY iTECH's global network of 80 production and delivery centers to advance MagicLab's "Embodied AI + X" strategy worldwide.

As a leader in global precision manufacturing, LY iTECH offers robot clients worldwide a one-stop solution spanning process engineering, core components, and OEM/ODM whole-machine assembly. By November 2025, it had completed hardware and assembly services for more than 5,000 humanoid robots, serving over 20 leading enterprises and a prominent North American AI client. Its product coverage extends to key areas such as complete units, dexterous hands, and joint modules.

Everwin Precision, another titan in consumer electronics manufacturing, also achieved a major leap in its humanoid robotics business in 2025. The company's precision components division progressed rapidly, generating approximately 100 million yuan in revenue for the year, primarily from overseas clients. In terms of volume, Changying delivered about 690,000 precision humanoid robot component units in 2025, with roughly 80% going to foreign customers.

Image source: Lens Technology

Furthermore, major "Apple supply chain" players like Lens Technology, Luxshare Precision, and Goertek are accelerating their infiltration of the humanoid robotics sector. Leveraging core competencies in precision manufacturing, supply chain management, and mass production, they aim to replicate—or even surpass—their past successes in this new industrial revolution.

Positioning for the Future: An Ecosystem War They Can't Afford to Lose

On the whole, auto parts makers are focusing on repurposing automotive-grade development experience and technology, while consumer electronics manufacturers are concentrating on transferring their precision manufacturing capabilities and production capacity.

Yet, despite their different paths, the underlying logic is identical: faced with slowing growth in traditional businesses, these companies are scrambling to secure a position in the next potential trillion-dollar market, using their existing strengths to carve out a new growth curve.

The golden decade of consumer electronics is over, and the wave of automotive electrification is gradually leveling off. By comparison, humanoid robots—poised to fundamentally reshape human production and lifestyle—are widely regarded as the next disruptive terminal following the PC, the smartphone, and the smart EV. The market potential is immense.

According to the latest forecast from Morgan Stanley, sales of humanoid robots in China are expected to jump 133% year-on-year in 2026 to reach 28,000 units—double the firm's previous prediction of 14,000. From there, sales are projected to grow exponentially, reaching 262,000 units by 2030 and climbing further to 2.6 million by 2035.

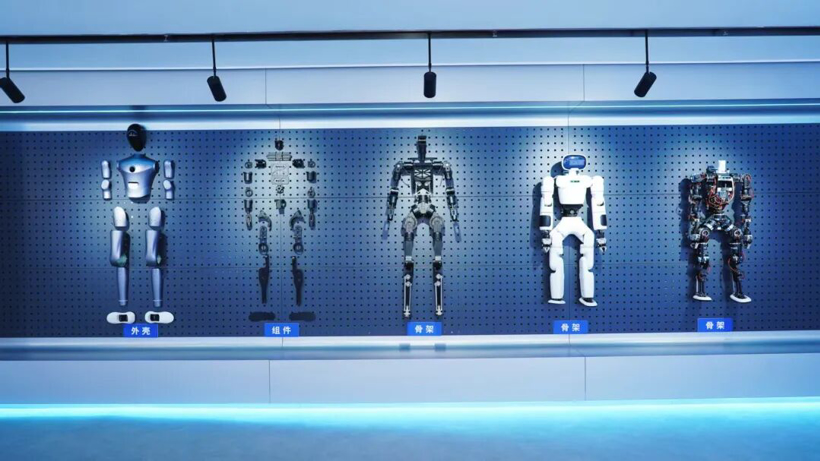

Image source: AgiBot

Looking further ahead, Morgan Stanley and Citi estimate that humanoid robots could generate a market value of $5 trillion to $7 trillion.

Driven by this vast potential, the rush by listed companies into humanoid robotics is about more than simply expanding a business unit. It is a critical maneuver to seize the entry point to a trillion-dollar track and lock in future growth.

Still, while the market opportunity is massive, the risks of crossing over into a new sector cannot be ignored.

The biggest uncertainty lies in the market itself. It remains unknown when humanoid robots will bridge the chasm between cost and practical application to achieve mass commercialization. This means the massive investments being made today could face a long road to returns.

A more immediate challenge stems from internal competition. As numerous industry giants flood in based on similar logic, sectors like structural components and basic transmission parts risk quickly sliding into homogenous competition.

The National Development and Reform Commission (NDRC) has already noted that with emerging capital accelerating its entry, China now boasts more than 150 humanoid robotics companies—a figure that keeps rising. However, over half of these are startups or cross-sector entrants. While this encourages innovation, the NDRC warns of risks such as a "swarm" of highly similar products hitting the market and the compression of R&D space.

Moreover, drawing lessons from the smart EV sector, the ultimate barrier in humanoid robotics may not be hardware. As manufacturing becomes standardized, the core of competition is likely to shift toward software algorithms, data accumulation, and ecosystem building. This presents a fresh challenge for manufacturing giants accustomed to a hardware-centric mindset.

Therefore, the current crossover frenzy led by listed companies holds significance far beyond simply opening a new line of business. At its core, it represents an active "value revaluation" and "capability liberation" by a mature industrial system at the turning point of a technology cycle. In the short term, this is a story of growth anxiety and strategic positioning; in the long run, it is a battle for ecosystem dominance—and for who holds the power in the future industrial chain.

Conclusion

The race in humanoid robotics is, at its core, a marathon.

The collective entry of listed companies brings capital, technology, and mass manufacturing capabilities that promise to greatly accelerate product iteration and real-world application. Yet this does not signal the approach of the finish line—rather, it likely marks the beginning of an even more brutal phase of competition.