55% is the portion of booths Chinese firms hold in the CES 2026 humanoid-robot zone; 39% is AgiBot' share of the global humanoid market in 2025.

Together, they point to a simple truth: the global robotics contest is being quietly reshaped by a full-stack ecosystem rising out of China's supply chain.

At this year's CES, Chinese companies showed more than dancing or sparring bots. From sensors and compute platforms to critical actuators, and on to end-to-end solutions spanning factory floors, homes and logistics, they laid out a maturing robotics ecosystem with system-level competitiveness.

From "single-product shows" to "cluster displays"

For the global tech community, CES is not just a consumer-electronics spectacle; it's a prism that refracts the industry's balance of power.

What stood out this year: Chinese robotics firms, through unprecedented scale and depth, took center stage.

Show data put it plainly. Of 598 robotics-related exhibitors, 149 were Chinese—nearly a quarter. In the humanoid core zone, the most cutting-edge section, 21 of 38 exhibitors were from China, more than half.

Image source: Booster Robotics

Leading players including Unitree, AgiBot, Noetix Robotics, Galbot, Leju Robotics, Booster Robotics, ENGINEAI Robotics, Fourier Intelligence and ROBOTERA, among others, brought their latest humanoids to the CES stage.

Even appliance giant Hisense joined the humanoid race, unveiling its first commercial humanoid, Harley (Chinese name: 哈利). On site, Harley performed, guided visitors around the booths and pitched Hisense's tech, creating an immersive tour-like experience.

Hisense plans to position Harley as a commercial service humanoid focused on greeting and guided sales. It will roll out first into Hisense stores, then expand to hotels, venues and tourism sites.

Image source: Hisense

China's humanoid track had already attracted a raft of players: pure-play tech firms focused on general-purpose humanoids such as AgiBot, Unitree and UBTECH, and cross-industry heavyweights extending from their home turfs — carmakers including XPENG, GAC and Chery. Hisense's entry adds another layer of diversity to the competition.

Notably, beyond sheer presence at the show, Chinese humanoid makers are also ahead globally on the path to mass production.

A recent Omdia report, Embodied General-Purpose Robots Market Radar, estimates global humanoid shipments at 13,000 units in 2025. AgiBot, Unitree and UBTECH rank in the top three; their shipments last year were roughly 5,100, 4,200 and 1,000 units, translating to shares of 39%, 32% and 7%—nearly 80% combined.

Behind that momentum, Gasgoo Auto Research Institute sees four drivers. First, AI foundation models are reaching robot control, with VLM and VLA enabling multimodal understanding and task planning. Second, 16-DOF dexterous hands paired with end-to-end imitation learning are taking "getting the job done" from concept to visible reality. Third, mass-production capability is the industry's watershed: Chinese makers are already shipping in the thousands and have reserves for tens of thousands annually. Finally, business models are shifting from pure hardware sales to subscriptions and bundled delivery—RaaS (Robotics-as-a-Service) lowers adoption hurdles.

Within China's vast robotics ecosystem, humanoids were only one of the show's core highlights.

In fact, the breadth of Chinese exhibits extended from cutting-edge humanoids down into almost every automatable end-use scenario. Nowhere was this clearer than in home service robots, where the embodied-intelligence shift was on full display.

Image source: Roborock

Take robot vacuums. They used to rely on a "smart brain" for path planning. This year, many have grown "legs"—even "wings"—to tackle vertical cleaning.

On the floor, Roborock unveiled G-Rover, the world's first wheel-legged vacuum, whose twin-wheel–leg architecture climbs stairs—taking home cleaning from a 2D plane into 3D space.

Dreame showed Cyber X, a bionic tracked stair-climbing vacuum that cleans across floors autonomously and can scale steps up to 35 cm.

MOVA's Pilot 70 flight module coordinates drones with vacuums to literally lift them into the air and reach balconies, attics or sunroom roofs—delivering true whole-home automation.

These long-legged, winged vacuums signal a shift: Chinese robotics development is moving beyond single-metric races toward deep fusion with embodied AI to crack tougher, real-world system problems.

While many overseas peers are still iterating in labs, Chinese teams are tracking demand closely and pushing out products tailored to real use. That's not mere catch-up; it's an efficiency revolution with the market as the finish line.

From "building the device" to "owning the whole chain"

If this were just about device makers, the shock might have stayed superficial. What turned heads across the supply chain was a first systematic showcase of China's end-to-end robotics stack—from base hardware to top-layer applications.

In robotics, a complex system, owning a controllable, complete supply chain means not just cost and efficiency advantages but also the right to define architectures and standards. On CES 2026 booths, Chinese firms sketched that ecosystem in full.

Image source: RoboSense

On perception: RoboSense's AC-series sensors and lidars; Hesai's compact high-performance JT-series 3D lidars; and Orbbec's binocular 3D cameras—all feed precise 3D spatial data to humanoids, quadrupeds, vacuums and lawn mowers.

RoboSense's "delivery buddy" robot, for instance, carried both AC1 and AC2 "robot eyes". Roughly ten new lawn-mowing robots from brands including MOVA, Dreame, Nexlawn, KEENON and Hookii adopted Hesai's JT-series 3D lidars.

For the "brain" that sets capability, Black Sesame Technologies made its overseas debut with SesameX, a multi-dimensional embodied-intelligence compute platform—an open, scalable, production-ready base aimed at common challenges across compute, algorithms and data.

Horizon Robotics' Digua Robotics showed RDK X5 and RDK S100P compute platforms, already deployed across multiple robot bodies.

On execution, dexterous hands—the physical foundation for fine manipulation—were a focal point.

Gasgoo's tally shows core component suppliers such as ZHAOWEI Machinery & Electronics, ENCOS, DexRobot, Linkerbot, Xynova and AAC Technologies, alongside body makers including AgiBot, ROBOTERA and PaXini, all showcased novel dexterous-hand solutions.

Beyond traditional component makers, a deeper signal emerged: consumer-electronics manufacturing giants are crossing over in force.

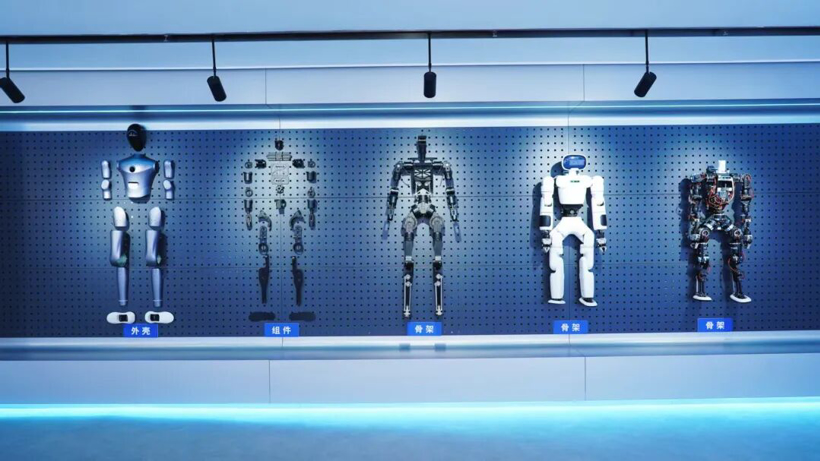

Lingyi iTech, for one, showed a full-chain matrix from core parts and hardware manufacturing to scenario deployment—spanning device frames, CNC precision parts, 3D-printed prototypes, die-cast structures, joint modules and general humanoid chassis.

Image source: Lens Technology

Lens Technology, meanwhile, debuted high-DOF bionic dexterous hands and head assemblies for humanoids. The company now covers the full chain—from advanced materials and core components to key modules, final assembly and secondary software development.

In practice, that means a robot can go from blueprint to line-off almost entirely within China's supply chain—proof of industrial strength, and of hard efficiency and cost advantages.

Strategically, cities are building dense clusters. In Shanghai, supply-chain experts estimate that for all key hardware components and software algorithms needed for humanoids, the support rate hits 100% within a 150 km radius of the city center; even within Shanghai proper, it's around 80%.

Such a highly integrated, quick-responding one-stop ecosystem lowers startup barriers dramatically and speeds commercialization to the extreme.

As with the rise of smart EVs, the decisive breakthroughs began not with whole vehicles but with batteries, power electronics and cockpits. Once those were independent and leading, global competitiveness in the car followed.

Robotics follows the same logic. As dexterous hands, sensors and compute platforms mature in China with twin advantages on performance and cost, the sector's global rise becomes a matter of timing, not possibility.

CES 2026 clearly mirrors that playbook—proven in smart EVs and now being fast-tracked in robotics. What's on display isn't static muscle, but a complete, fast-turning "future manufacturing" logic.

From "showing tech" to "chasing orders"

If the full-chain showcase answered what Chinese robotics can build, the scenes recreated across booths addressed for whom they build—and how they make money.

Unlike past years fixated on single gestures like folding clothes or picking items, Chinese exhibitors leaned into complete, continuous task loops and stepped into the crowd to interact—bringing tech closer to reality.

Image source: Beijing Humanoid Robot Innovation Center

Galbot demoed wheeled humanoids for retail sorting and factory logistics. ROBOTERA's L7 interacted with visitors—handing out water, carrying bags, picking up items, tossing trash, giving gifts and filming vlogs. UniX AI paired its wheeled humanoid Wanda with the biped Martian to brew tea, mix drinks and clean. The Beijing Humanoid Robot Innovation Center's Embodied Tiangong 2.0 autonomously sorted parts and engaged the audience, showcasing embodied work that is fast, precise and decisive.

Beyond lidars, RoboSense debuted a "delivery buddy" built on its self-developed hand–eye–brain coordination stack. With no human intervention, the robot autonomously packs gifts, shelves them, transports, unboxes, delivers and folds boxes for recycling—demonstrating fine, long-horizon task execution in open environments.

The move from showing a single action to solving a full problem reflects a step-change in technical maturity.

One caveat, per RoboSense executives interviewed by Gasgoo: despite demonstrating the "delivery buddy" at CES, RoboSense doesn't sell whole robots. It provides the perception stack, dexterous-hand hardware and the VTLA-3D foundation model that make such tasks possible—solutions that can be mixed and matched for different robot forms and industries, with potential across logistics, industrial operations and commercial services.

Notably, RoboSense's VTLA-3D manipulation model adds force–tactile modalities and 3D point clouds to traditional vision-only VLA—fusing vision, force–tactile and language with high-precision color point clouds from Active Camera. That richer state awareness boosts success rates in dexterous operations, while 3D structure lowers reliance on massive training sets, lifting data efficiency.

The deeper shift is commercial. CES 2026 felt less like a tech pageant and more like a brisk marketplace. Winning orders and expanding overseas has become the unspoken consensus.

Image source: Noetix Robotics

Starting at CES 2026, Noetix Robotics says 2026 will be pivotal for its push abroad and brand-building.

Co-founder Zhang Shipu told us the firm is targeting five core regions—North America, the Middle East, Europe, Southeast Asia and Japan–Korea—and aims to expand to the thousand-unit level by the second quarter this year.

To do that, Noetix Robotics will build a flexible ERP+MES-based overseas inquiry and supply system and run a product–customer success–brand loop: deploy locally with robot-specific scenario adaptation, create repeatable flagship cases, then scale regionally.

Booster Robotics likewise ditched pure concept demos. Its mantra: what you see is what you get; what you order, we deliver—turning the CES booth into a pop-up sales counter. By noon local time on Jan. 9, every robot on display had sold out.

Image source: DEEP Robotics

DEEP Robotics has also built a North American loop spanning product deployment, service support and ecosystem collaboration—designed to meet customers nearby and enable fast delivery and rollout.

The march from showing tech to selling products, and on to building service systems, marks a new phase in China's robotics expansion overseas. It mirrors the EV playbook: early battles over range and acceleration gave way to charging networks, user experience and total cost of ownership.

Chinese robot makers are sidestepping pure spec wars and moving onto a pragmatic track centered on sustainable service capability and customer success. It's not a tactical tweak; it's a strategic leap.

Conclusion

CES 2026 signals a pivot in global robotics competition—from single-point jousts to ecosystem-level contests. As machines move from lab to industry, the life cycle of standalone tech is shrinking fast; coordination across the chain will decide the future.

The curtain on scale has lifted. The shift starting in Las Vegas may mark the beginning of a redraw of the global industrial map. As innovation fuses with commercial practice, a true industrial revolution is speeding in.