According to Gasgoo's global automotive industry big data map, Tianjin's automotive cluster has matured into a sophisticated ecosystem. Anchored by core automakers, it features deep integration across the supply chain and coordinates resources across regions, highlighting a pattern of industrial agglomeration and collaborative growth.

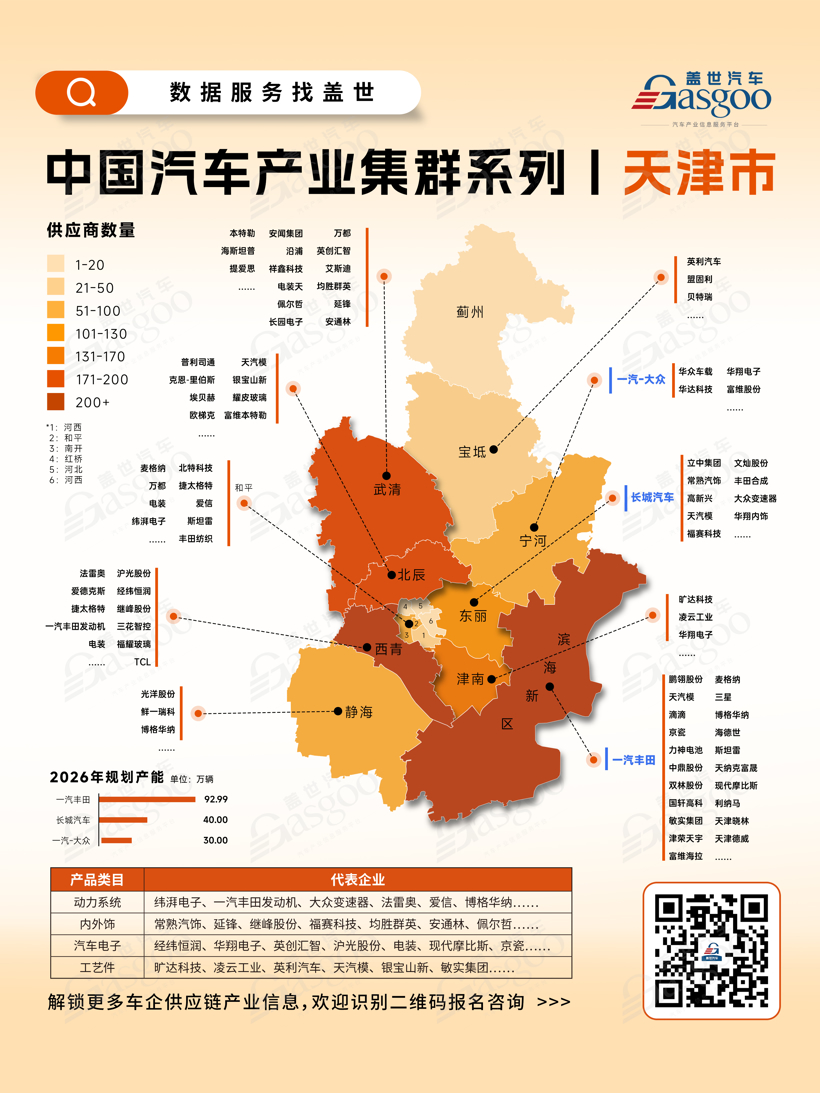

Geographically, the industry displays a pattern of "core agglomeration with layered radiation." Anchored by automakers like FAW Toyota, FAW-Volkswagen, and Great Wall Motor, and bolstered by key suppliers in power systems and automotive electronics, the cluster boasts strong agglomeration effects and significant driving power. Dongli, Ninghe, and the Binhai New Area constitute the core development zones; surrounding these, districts like Xiqing, Beichen, and Wuqing form a collaborative support layer, while Jizhou and Baodi are emerging as key sites for capacity expansion and industrial transfer. This layout of "core-driven, layered collaboration" not only ensures efficient supply chain coordination but also fuels balanced regional development.

In terms of capacity planning, the city is adopting a "leader-led, diversified synergy" approach. Looking ahead to 2026, FAW Toyota plans capacity approaching 1 million units, solidifying its position as the absolute pillar. Great Wall Motor and FAW-Volkswagen are targeting 400,000 and 300,000 units respectively, jointly building a production system that runs traditional internal combustion engines alongside new-energy vehicles. The scale effects of these leaders are driving capacity expansion among suppliers, laying a solid foundation for the local industry to weather market volatility and accelerate its shift toward electrification.

Structurally, the industry has established a comprehensive supply system spanning power systems, interiors, exteriors, automotive electronics, and technical components. In power systems, companies like Vitesco Technologies, FAW Toyota Engine, and Volkswagen Transmission have built local capabilities ranging from core components to complete assemblies. For interiors and exteriors, firms such as CAIP, Yanfeng, and Jifeng Group provide efficient support to automakers. Meanwhile, in automotive electronics and technical components, players like Hirain Technologies, KSHG, Lingyun, and Yingli have accumulated robust technical expertise through deep industry engagement, supporting high-quality supply chain development. On the whole, Tianjin boasts a complete industrial chain with standout supporting capabilities, making it a vital manufacturing and supply base in northern China.

Tianjin's automotive cluster is currently navigating a critical phase of "consolidating scale while shifting growth drivers." Moving forward, the city must amplify the technological spillover effects of its core zones and guide supporting areas like Jinghai and Ninghe to foster innovation, transforming industrial transfer into a "quality upgrade." At the same time, leveraging its existing foundation, Tianjin should increase investment in new-energy core components and intelligent connected technologies. This will help the cluster evolve from a purely "manufacturing advantage" to a dual "technology-plus-manufacturing" strength, securing its status as a northern hub amid the global automotive transformation.