Data from the China Passenger Car Association (CPCA) shows that the auto industry's sales profit margin fell to 4.1% in 2025, a record low, dropping to just 1.8% in December. Against this backdrop of widespread industry pressure, the used car market cannot remain unscathed; practitioners admit that profits have "pretty much hit rock bottom." Luo Lei, vice president of the China Automobile Dealers Association (CADA),noted that the current average profit margin in the used car sector is hovering around4%.

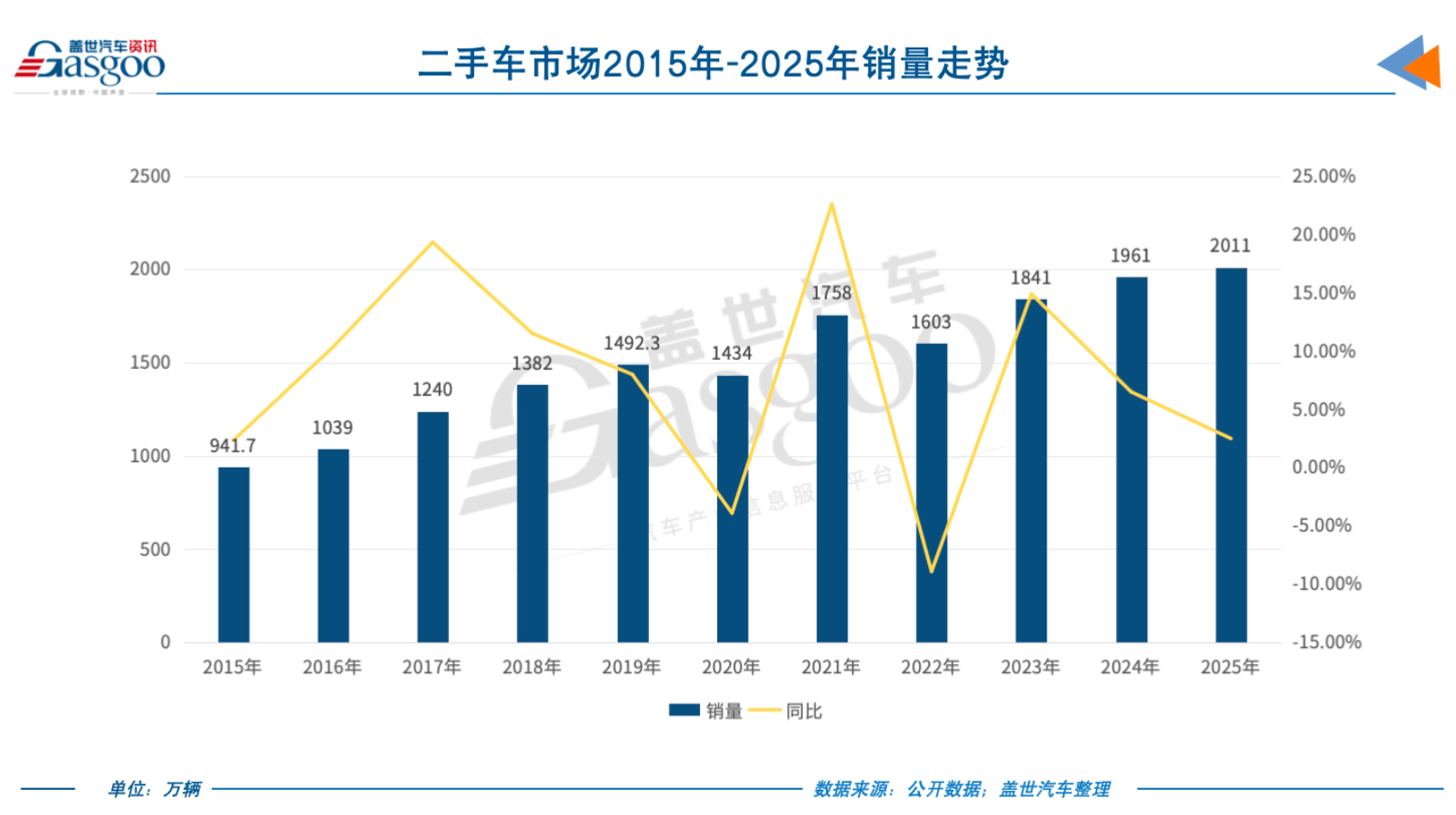

Yet, the flip side of the coin is a steady climb in transaction volume, which has grown for nine consecutive years. In 2025, the cumulative volume of used car transactions in China broke the 20 million mark for the first time, reaching 20.108 million units—a 2.52% year-on-year increase. The total transaction value hit 1.28979 trillion yuan.

Clearly, the dilemma of "higher revenue but lower profit" has become an unavoidable pain for the used car market.

Transaction Volume: Nine Years of Growth

The used car market has now expanded for nine straight years.

Policy relaxation has been the primary driver of this steady growth in transaction volume. For a long time, restrictions on cross-regional circulation acted as a critical bottleneck constraining the development of the used car market.

Since 2016, the state has continuously advanced institutional reforms. The General Office of the State Council issued the "Opinions on Promoting Convenient Transactions of Used Cars," laying the foundation for standardized industry development. In 2022, the nationwide removal of restrictions on the import of small non-operating used cars meeting National V emission standards substantially broke down regional barriers.

In 2025, relevant policies deepened further. Many regions promoted facilitation measures such as "reverse invoicing" for used car sales and cross-region transaction registration, while guiding a transition from the traditional brokerage model to a dealership model.

The effects of these policies are gradually appearing. In December 2025, the national transfer rate for used cars rose to 34.9%, an increase of 4.7 percentage points year-on-year. Analysts believe that active cross-regional circulation has not only improved the efficiency of vehicle allocation nationwide but also alleviated inventory pressure in local markets to some extent.

Secondly, the massive vehicle parc provides a continuous and stable source of supply for the used car market. Data from the Ministry of Public Security shows that by the end of 2025, China's automobile ownership had reached 360 million units. Industry consensus holds that the average replacement cycle is about 6 to 8 years, and with China's current average vehicle age approaching 8 years, existing vehicles are entering a concentrated replacement window.

Meanwhile, the new car market remains at high levels. In 2025, both production and sales broke through 34 million units, continuously feeding new supply into the used car market.

Furthermore, shifting consumer attitudes are driving demand release. Young consumers represented by the post-90s and post-00s generations have become a new force in the market. A report jointly released by China Automotive Information Technology and DCar indicates that used cars are becoming the first vehicle for some young people; their consumption philosophy is shifting from seeking the lowest initial price to pursuing the best total value over the vehicle's life cycle. Increased market information transparency and the development of e-commerce platforms have alleviated concerns about opaque vehicle conditions and lack of after-sales guarantees, further unleashing latent demand.

Moreover, the internal structure of the used car industry is accelerating its adjustment. Past issues of being "small, scattered, and weak" with extensive management are gradually improving, with business entities concentrating towards scale and branding. More dealers are enhancing turnover efficiency by shortening inventory cycles and strengthening fund management, while introducing digital tools for vehicle management and channel operations.

Image Source: Guazi Used Cars

Online-offline integration has become the mainstream model. Trading platforms and dealers generally provide integrated services covering inspection, display, transaction, and after-sales. Taking DCar as an example, its "National Buy" model allows consumers to complete vehicle viewing and ordering online; in 2025, about 40% of transactions were completed through this model.

The growth of new energy used car transactions has injected new increment into the market. In 2025, the transaction volume of new energy used cars reached 1.6 million units, accounting for 7.9% of total used car transactions, an increase of 2.2 percentage points from the previous year. Although the current share remains limited, the growth rate is rapid.

Profit Margins: A Continuous Decline

Contrasting with the continuous expansion of transaction volume is the constant probing of industry profit margins lower. In 2025, the overall sales profit margin of the auto industry fell to a historical low of 4.1%, even dropping below 2% in some months. This pressure was rapidly transmitted downstream, impacting the used car market as well.

According to Luo Lei's survey, more than half of dealers have profit margins below 4%, while those above 6% to 8% are a minority, and situations reaching 10% or more are now very rare. From an industry perspective, the profit margin of the current used car market is indeed in a low range.

Da Ming (a pseudonym), who has operated in the used car market for many years, recalls that during boom times, the profit margin on a single used car could once reach around 10%. Currently, however, it has generally fallen back to 5% to 8%. Some models have even experienced an inversion where the purchase price is higher than the final sale price, meaning the transaction itself implies a loss.

Thanks to his good reputation, Da Ming adopts a "one-car-one-price" business model, resulting in high capital turnover and the ability to maintain positive profitability. "The used car market is relatively stable now because those who were going to lose money have already lost it," Da Ming said. In the past two years, some used car dealers suffered heavy losses and went bankrupt due to broken cash flows.

Image Source: Autohome

Luo Lei stated that the current predicament of the used car market is closely related to the significant volatility in new car prices. In 2025, the new car price war continued and intensified, especially in the mainstream consumption segment below 150,000 yuan, where terminal discounts kept expanding and transaction prices continued to dip. The terminal prices of hot-selling fuel vehicles like the Volkswagen Lavida and Nissan Sylphy have dropped to around 70,000 yuan.

This creates a double squeeze on the used car market. For some younger used cars in good condition, the price gap with the actual landed price of new cars has narrowed significantly, weakening their cost-performance advantage and forcing dealers to cut prices to close deals. At the same time, frequent adjustments to new car prices have disrupted the original pricing logic of used cars, leaving dealers facing higher uncertainty when acquiring inventory.

Luo Lei pointed out that due to frequent fluctuations in new car prices, used car dealers dare not aggressively acquire vehicles. Even when they do buy, they tend to depress prices to hedge risks, resulting in decreased acquisition volumes, restricted market supply, and rising costs of capital occupation.

Meanwhile, increased market transparency and intensified competition are further compressing profit margins per vehicle. With the development of information channels and e-commerce platforms, used car prices have become increasingly public and transparent, allowing consumers to compare prices nationwide and significantly enhancing their bargaining power. The business model of relying on information asymmetry to obtain high spreads is no longer sustainable.

Against a backdrop of numerous business entities and obvious homogenized competition, many dealers choose to exchange volume for price to facilitate transactions and accelerate turnover, actively compressing profit space. Da Ming put it bluntly: "If you want to sell fast, you have to go for national wholesale; costs go up, so profits naturally go down."

In the process where the pricing system is constantly being broken, the added value once brought by the resale rate system is disappearing. In the past, certain brands could maintain relatively firm prices for their used cars due to high resale rates, providing dealers with stable profit expectations. But under the impact of terminal discounts on new cars, this system has almost failed.

Take Lexus, once known for its high resale value, as an example. One dealer noted, "The market situation over the past two years has completely backstabbed previous customers." Third-party platforms show that terminal discounts on the new Lexus ES exceed 40,000 yuan, and the era of "paying a premium to pick up the car" is over. According to "Three-Year Residual Value" data released by the China Automobile Dealers Association, almost no model now achieves a 70% resale rate.

Regarding the so-called resale value, Da Ming's assessment is incisive: "Used cars never retain value. Those who tell you they do are the people trying to sell you one."

Overseas Markets Are Heating Up Too

After making money at home became difficult, some used car dealers with scale and resource advantages began extending their business to overseas markets several years ago, attempting to find new growth space.

Many developing countries are in the stage of automobile popularization and have strong demand for affordable, reliable, and durable transportation. Chinese used cars, especially those with a short vehicle age and good maintenance condition, possess a comparative advantage in terms of price, configuration, and supply capacity.

From a policy perspective, relevant authorities have held an encouraging attitude toward used car exports in recent years. By improving management regulations, simplifying processes, and establishing export bases in some regions, they are promoting the standardized development of the industry through pilot programs.

Take the China (Sichuan·Shuangliu) Used Car Export Base as an example. By integrating qualification processing, vehicle sourcing, logistics, and customs clearance, the base provides relatively complete service support for enterprises, lowering the export threshold to a certain extent. Some settled enterprises have seen rapid growth in export scale, achieving a year-on-year increase of over 60% in export value in 2025.

Countries along the "Belt and Road," such as Central Asia and Africa, have become the main destinations for Chinese used car exports due to relatively weak local auto industries and stable demand for cost-effective models.

However, as more and more used car dealers set their sights on overseas markets, the competitive landscape abroad is changing. Some dealers report that certain overseas markets already distinctly feel pressure on prices and channels—"when there are more players doing it, it gets crowded."

The intensifying competition is mainly reflected in three aspects. First is the battle for vehicle sources. The models suitable for export are highly concentrated, and companies are competing to acquire them, driving up the procurement costs of high-quality used cars domestically and directly compressing export profit margins.

Second is price competition in destination markets. When large volumes of Chinese used cars enter certain countries and regions, local sales prices come under pressure. To accelerate payment recovery and reduce inventory and capital occupation risks, companies often complete transactions through price promotions, further thinning profits.

To win orders, exporters are forced to invest more in after-sales guarantees, vehicle refurbishment, and compliance certification, further compressing net profits. The channel and brand advantages established by some early entrants are being quickly eroded by latecomers using low-price strategies.

After a few years of competition, the market share of Chinese used car dealers in regions like Central Asia and the Middle East has tended toward saturation, with limited room for further improvement. Due to shrinking profit margins, some early entrants have even chosen to exit.

This time, some used car dealers are turning their sights to new markets. Luo Lei believes that new incremental markets will be countries along the "Belt and Road" such as Southeast Asia, Africa, and Eastern Europe (primarily left-hand drive countries). In these regions, the penetration rate of Chinese used cars remains low, leaving room for future expansion.

However, how to avoid falling into a new round of vicious internal competition and friction in overseas markets remains an important subject for the healthy development of the industry.

In this regard, Luo Lei believes that the used car export business requires clearer division of labor and specialized collaboration: large institutions and platforms should undertake heavy-asset links such as overseas channel construction and trade system setup; small and medium dealers can focus on vehicle supply and obtain stable returns within the industrial chain. "Only by sticking to one's own duties and collaborating can the used car export business be done more long-term and solidly."

New Year Goal: "Just Survive"

Where will the used car market go in 2026?

Facing this question, Da Ming said bluntly, "Honestly, just surviving is enough." This sentence reflects the realistic mindset of practitioners in the current low-profit environment: amidst uncertainty, ensuring survival is put first.

But in Luo Lei's view, the overall situation in 2026 will be better than in 2025. On one hand, having experienced severe fluctuations over the past two or three years, used car dealers have developed a certain "immunity" and their business strategies tend to be more cautious. On the other hand, some small and medium dealers with weak risk resistance have already been eliminated, enhancing the industry's overall resilience.

At the same time, the policy level has begun to release signals of "anti-involution." Relevant authorities' intervention against disorderly price competition will help the market gradually return to rationality. Additionally, automakers have generally lowered their sales expectations for 2026, setting more pragmatic targets. This is also conducive to reducing price pressure on dealers, thereby promoting the stabilization of the price system. The used car market will also benefit from this.

More critically, the scale of used car transactions will continue to rise. Luo Lei pointed out that from historical data, the long-term trend of the used car market is upward; years with actual declines in transaction volume are very rare and mainly concentrated during the pandemic years. "Rising is the norm, falling is an accident."

Looking at international experience, with a vehicle parc of about 285 million units, the United States sees an annual used car transaction volume of about 40 million units. From this perspective, China's used car market still has significant room for improvement.

On this basis, Luo Lei expects that the national used car transaction volume in 2026 is expected to reach between 21 million and 22 million units, maintaining mild year-on-year growth. He believes the used car market will not see a rapid, volume-based rebound, but rather a process of gradual repair. Da Ming also believes there is great room for growth in the scale of used car transactions.

However, regarding a profit recovery, Da Ming believes, "In the short term, it feels like it won't warm up." Another practitioner also believes, "Profits in the parts sector will continue to decline." The reason is that the external conditions squeezing used car profits have not yet fundamentally changed.

Image Source: Beijing Used Car Trading Network

This has formed a seemingly contradictory but quite realistic situation: the total market volume is still expanding, but the profit space distributable to individual operators is difficult to improve significantly in the short term. Under this new normal of "rising volume and thin profits," how to seek development on the basis of survival has become the core issue facing used car dealers.

The industry consensus is that the extensive model of the past, relying on information asymmetry and blind hoarding, is no longer sustainable. The future rules of survival will revolve around efficiency, professionalism, and integrity.

The foremost priority is improving operational efficiency and inventory turnover. Through refined inventory management, data-driven price judgment, and strict inventory cycle control, dealers can compensate for insufficient single-vehicle profits with scale effects while reducing the risk of price volatility. As one dealer summarized, "Those who are still doing well are those who have increased their turnover rate and operate on thin margins and quick turnover; the others have been eliminated."

It is also necessary to strengthen specialization and differentiation capabilities. As the proportion of new energy used cars continues to rise, dealers need to patch their inspection and assessment capabilities for key components such as power batteries and electronic control systems to reduce operational risks. At the same time, focusing on specific brands, models, or price segments to form experience and reputation in niche fields can establish a relatively stable customer base.

The fundamental way out lies in actively adapting to the trend of market transparency and transforming standardized operations and integrity construction into competitive advantages. Xiao Zhengsan, president of the China Automobile Dealers Association, stated publicly that an imperfect integrity system is a chronic ailment of the industry. Some companies are also extending their business into testing, finance, and after-sales services through branded and chain operations to enhance customer stickiness.

In short, during 2026 and the period beyond, China's used car market will run on two parallel tracks: first, transaction volume will continue to climb steadily toward the unknown "ceiling" driven by the massive vehicle parc and policy support; second, the industry as a whole will enter a low-profit consolidation period with the realistic goal of "survival," and the recovery of profit margins will lag behind market expansion.

For every practitioner, only by surviving can they have the opportunity to witness and participate in that future—where annual used car transaction volumes could potentially reach 40 million or even 50 million units.

![[Gasgoo Express] Focusing on three types of vehicle data outbound behaviors, eight departments jointly issue security guidelines; Avatr 06T wagon officially announced](https://gascloud.gasgoo.com/production/2026/02/d908df62-2a9c-40c4-8ef5-47688f96a0c5-1770230673.png)