As 2026 began, Huawei's Shenzhen Bantian base emerged as the hottest destination in China's auto industry.

On January 5, Xiang Xingchu, chairman of JAC Group, led a delegation south. Three days later, Jia Jianxu, president of SAIC Motor, followed suit. Both leaders of state-owned automakers were there to visit the same man: Huawei founder Ren Zhengfei.

Almost simultaneously, Ren's top lieutenant—Richard Yu, a Huawei executive director and chairman of the Consumer BG Group—was making the rounds to visit partner automakers.

On January 5, Yu appeared at GAC Group's Panyu headquarters to sign a comprehensive cooperation framework agreement with Chairman Feng Xingya. By January 14, he was at Dongfeng Motor, engaging in deep discussions with senior executives on topics ranging from the HarmonyOS ecosystem to AI technology.

"Ultimately, it all comes down to boosting sales." That line from Cui Dongshu, secretary-general of the China Passenger Car Association, cuts to the heart of the real motive driving this mutual courtship between Huawei and automakers.

Auto Sector vs. Huawei

By rough count, at least eight top automaker executives traveled to meet face-to-face with Ren Zhengfei between early 2025 and early 2026.

In February 2025, XPENG founder He Xiaopeng was first to knock on the door. By June, GAC Chairman Feng Xingya had traveled to Shenzhen for an extended conversation on industry trends and governance reform—a meeting insiders viewed as a pivotal moment for accelerating GAC's partnership with Huawei.

The "visit wave" accelerated noticeably in the second half of the year. In August, Zhu Huarong, chairman of the newly established China Changan Automobile Group, visited alongside General Manager Zhao Fei. September saw the highest-profile delegation yet: Dongfeng Chairman Yang Qing arrived with Vice Presidents You Zheng and Zhou Feng, while Huawei's side was represented by Ren Zhengfei, Xu Zhijun, and Richard Yu. In October, Li Auto founder Li Xiang made a low-key visit, mentioning it only on personal social media; around the same time, Chery Chairman Yin Tongyue also completed his trip to Shenzhen.

Image Source: JAC Group

The momentum only grew more urgent as 2026 arrived. On January 5, JAC Chairman Xiang Xingchu led a delegation to visit; in the group photo, Ren Zhengfei held a model of the Maextro S800. Three days later, SAIC President Jia Jianxu made his second trip to Shenzhen, with discussions centering squarely on the "Shangjie" brand.

The weight of this visitor list speaks for itself. From central state-owned giants Dongfeng and Changan to regional players like SAIC, GAC, Chery, and JAC, and finally to new-force representatives like XPENG and Li Auto, it encompasses half of China's automotive landscape.

These meetings all centered on strategic dialogue regarding specific partnerships. Jia Jianxu's return visit, for instance, focused on "deepening Shangjie brand cooperation," signaling a clear strategic pivot by SAIC toward Huawei. It wasn't long ago that SAIC was famous for insisting on keeping its "soul"—its proprietary technology. Now, the company has not only fully embraced Huawei but has also become the "fifth world" in the HarmonyOS Intelligent Mobility ecosystem.

Meanwhile, Richard Yu's schedule was just as packed. In December 2025, he convened the leaders of the "Five Jies"—AITO, Luxeed, Stelato, Maextro, and Shangjie—in Shanghai to announce a comprehensive deepening of strategic cooperation. As 2026 began, Yu frequently visited partners. This high-frequency interaction underscores Huawei's strategic path: systematically embedding its HarmonyOS ecosystem and AI capabilities into partner automakers.

In terms of content, the discussions have clearly moved beyond simple technology procurement. They now extend into deeper realms like product definition, ecosystem co-creation, and enterprise digital transformation.

Take Dongfeng and Huawei: after signing a comprehensive strategic cooperation agreement in May 2025, they established a joint innovation laboratory in September, expanding their collaboration from individual products to a full-stack technology system.

Image Source: Feng Xingya's Social Media

The partnership between GAC and Huawei is particularly representative. In January 2025, GAC invested 1.5 billion yuan to establish the GH project company. By March, Huawang Automotive was founded, and by September, the premium smart brand "Qijing" was officially announced. At its peak, Huawei stationed over 800 R&D personnel in Guangzhou, covering the entire chain from product definition and development to marketing and promotion.

Zhang Xiang, secretary-general of the International Intelligent Vehicle Engineering Association, notes that such mutual visits are a standard way for parties to explore collaboration and align on technology and strategy. Visiting Huawei allows automakers to communicate directly with senior executives, including Ren Zhengfei, and to inspect Huawei's layout and achievements in the smart vehicle sector firsthand. It is, fundamentally, a routine industry exchange.

There is also the benefit of traffic and brand exposure. As a figure with immense public influence, Ren Zhengfei naturally draws significant media and public attention when he interacts with automakers, generating marketing value for them. These visits do not always translate immediately into signed contracts; often, they are best viewed as strategic interactions and image-building exercises.

What Signals Are Being Sent?

The interaction between automaker executives and Huawei is about more than warming up relations; it is a choice born of necessity. As competition intensifies and product cycles accelerate, the decision by some automakers to tie their fate deeply to Huawei amounts to a systematic reconstruction of their own "survival efficiency." Put simply: everyone wants to be the first to launch with Huawei's latest technology architecture.

After all, Huawei's capabilities in intelligent driving have been market-tested. According to the "2025 City NOA Research Report" by the China Association of Automobile Manufacturers, Huawei's HI model accounts for nearly 20% of third-party suppliers. Its Qiankun ADS holds a staggering 53% share in the luxury market priced above 350,000 yuan. This means that partners with deep cooperation gain a generational advantage in product competitiveness by prioritizing access to the latest technology.

Image Source: Huawei Intelligent Automotive Solutions

This advantage runs through the entire product development chain. Deeply integrated partners gain priority access to more mature and faster-evolving technology systems, creating a generational gap in both launch speed and experience stability.

Consider the GAC-Huawei partnership. The companies front-loaded resources for R&D, design, software, and marketing, with teams working side-by-side to ensure high synergy from product definition to mass production. In September 2025, the jointly developed GAC-Huawei Cloud Infotainment system took just 20 days to go from announcement to over-the-air installation—a speed nearly impossible to replicate in traditional automotive development cycles.

The depth of technical collaboration continues to intensify. Through initiatives like the "Tiangong Plan," Huawei has invested 1 billion yuan to bolster the HarmonyOS AI ecosystem. Deeply partnered automakers are given clear priority in accessing frontier capabilities such as AI large models and intelligent agents.

When the first batch of over 80 intelligent agents went live in 2025, the advantages of related models in semantic understanding, scenario execution, and continuous interaction quickly widened. The gap between these vehicles and their competitors is no longer about whether they have a feature, but how well it works.

More than one industry insider has told Gasgoo that Huawei's Qiankun ADS offers a top-tier driving experience. Its WEWA architecture leverages the synergy of a "Cloud World Engine" and a "Vehicle World Behavior Model" to efficiently handle complex, shifting long-tail scenarios. Compared to the modular architectures of traditional automakers, this integrated algorithm delivers smoother, more refined vehicle control, amplifying brand reputation in the retail market.

Meanwhile, the evolution of the partnership model signals that the two sides have become a community of shared interests. From SAIC's Shangjie to JAC's Maextro, Huawei is now deeply involved in the entire process, from product definition to channel sales.

Image Source: SAIC Motor

With over 5,000 stores nationwide, Huawei offers not only foot traffic in prime locations but also a standardized service system. This saves partner automakers billions in channel construction costs and significantly shortens the incubation period for premium brands. The AITO series' achievement of selling one million units would not have been possible without the empowerment of Huawei's channels.

For Huawei, deep integration with automakers on mature vehicle platforms provides access to massive amounts of real-world driving data, which continuously feeds back into algorithm optimization. In 2025, AITO pushed over 300 functional improvements via over-the-air updates, evolving roughly twice a month. This flywheel effect—where data drives experience, and experience drives sales—is widening the gap between leaders and followers.

As overall industry growth slows and product homogeneity intensifies, the value of this technological bond with Huawei becomes increasingly clear. Viewed through this lens, the frequent presence of auto executives in Shenzhen's Bantian district looks less like a courtesy call and more like a strategic alignment.

A Win-Win for Both

If technological integration determines product competitiveness, then sales and financial performance are the most direct measures of a partnership's success.

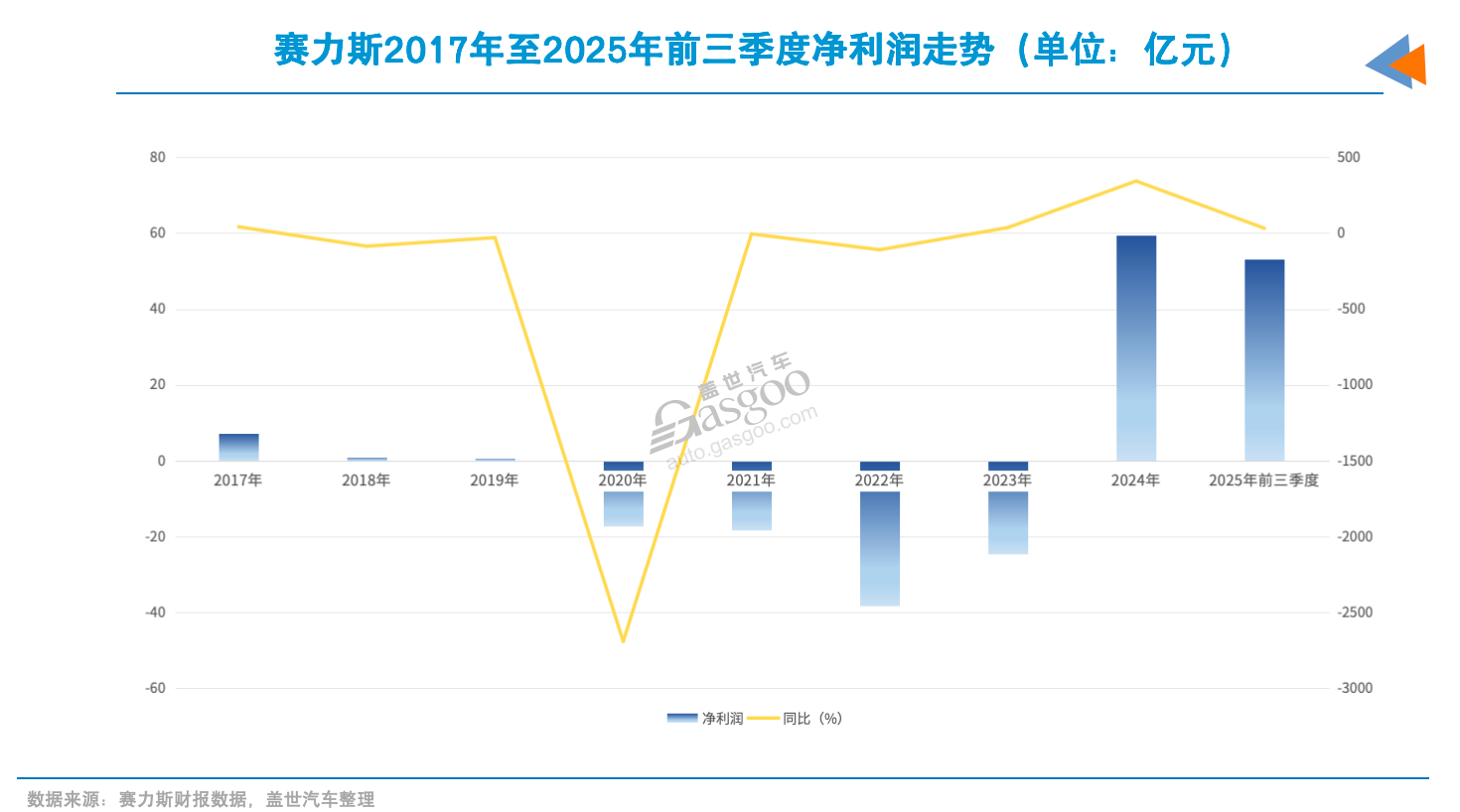

Seres is the most representative case study. In the first three quarters of 2025, the company generated 110.5 billion yuan in revenue and 5.31 billion yuan in net profit attributable to shareholders—a 31.6% year-on-year increase. Its gross margin approached 30%, surpassing the industry average. With both new forces and traditional automakers under pressure, Seres' performance stands out.

This improvement did not come from cost-cutting but was built on sustained high investment. Data shows that in the first half of 2025 alone, Seres paid nearly 20 billion yuan to Huawei for procurement. Based on AITO's sales of 147,000 units during the same period, the per-vehicle cost for technology and systems comes to roughly 140,000 yuan. Since the partnership entered mass delivery, Seres has paid Huawei a cumulative total exceeding 75 billion yuan.

The core driver is the success of high-end models. In January 2026, the 1 millionth AITO vehicle rolled off the assembly line—just 46 months after launch. In terms of product mix, the brand has secured a firm foothold in the mid-to-high-price market. The AITO M9 has been the best-seller in the 500,000 yuan class for over 20 consecutive months, with cumulative deliveries exceeding 260,000 units. This structure—high average selling prices combined with large sales volume—is the engine powering the "win-win" dynamic between Huawei and automakers.

A similar logic applies to other partners. Voyah's entire lineup is deeply integrated with Huawei's driver assistance and cockpit systems, driving deliveries to 150,000 units in 2025. The company has also signaled profitability, becoming one of the few high-end new energy brands owned by a central state-owned enterprise to achieve positive cash flow.

In early 2026, Voyah signed a deepening agreement with Huawei Yinwang, moving the partnership from "technology supply" to "joint To-C software operations." This means the two sides are now working together to unlock software value throughout the vehicle's entire lifecycle.

JAC's Maextro brand demonstrates Huawei's pull in the million-yuan luxury market. The Maextro S800 surpassed 4,000 units in its first month of delivery. Achieving stable volume so quickly has established an initial presence in the high-end market. More importantly, the brand's roadmap extends beyond a single model to include a series layout of sedans, MPVs, and SUVs, signaling the partners' confidence in the model's sustainability.

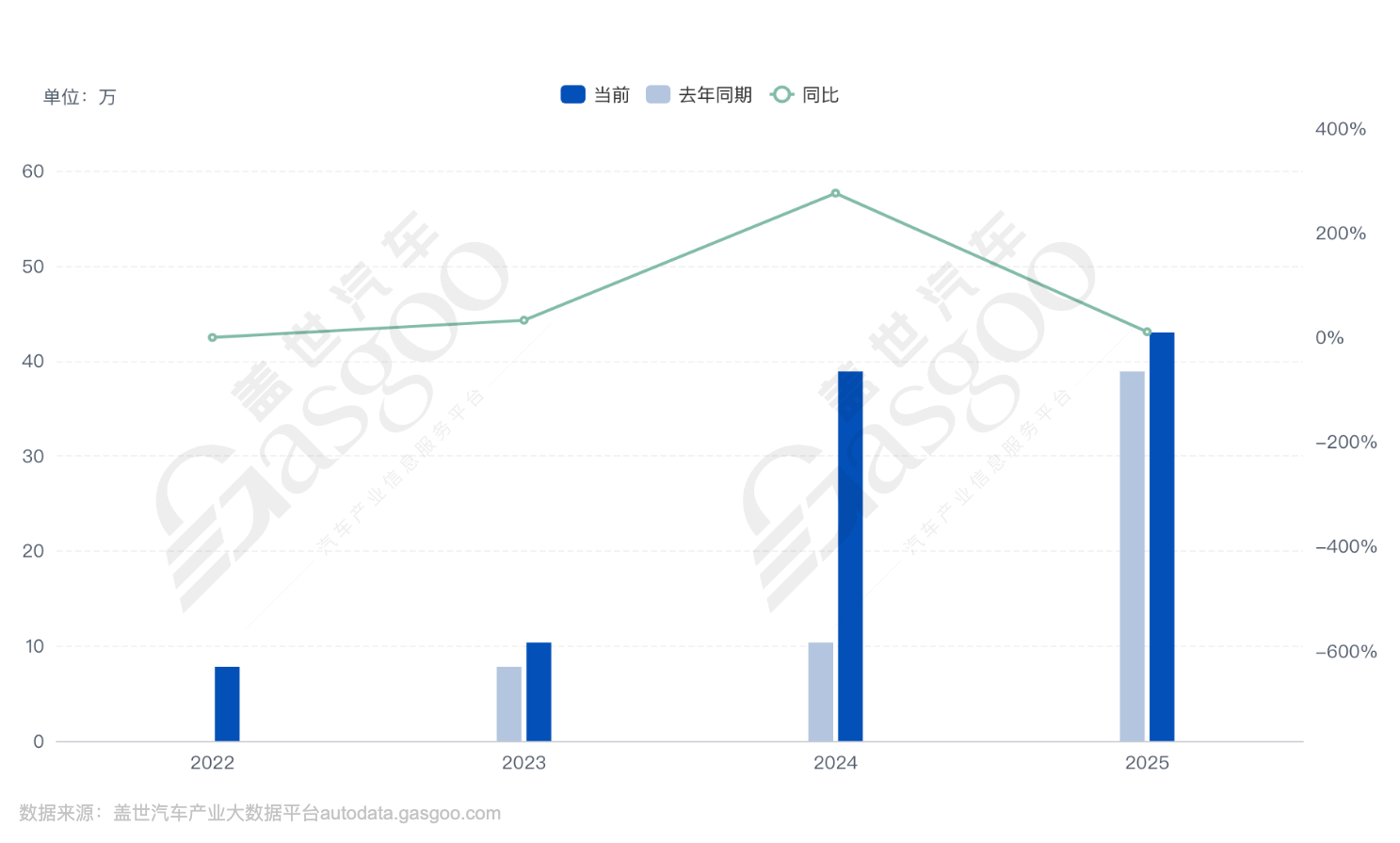

In terms of sales contribution, models partnered with Huawei have become the core growth engine for these automakers. Seres sold 472,000 vehicles in 2025, with AITO accounting for 90%. Voyah's entire lineup features Huawei technology; Dongfeng's eπ brand is set to launch two new models equipped with Huawei's full suite in 2026, which are expected to become sales pillars.

AITO Series Sales Changes 2022-2025

Huawei, of course, is also a clear beneficiary. Although it does not manufacture cars directly, the HarmonyOS Intelligent Mobility alliance's annual sales of 590,000 units, combined with over 900,000 installations of Huawei's Qiankun solution, have provided the company with extremely stable cash flow and a wealth of real-world driving data.

The deeper value lies in ecosystem implementation and the creation of a data loop. The automobile is the core carrier of Huawei's "Human-Vehicle-Home" all-scenario smart life strategy. Through deep cooperation with mainstream automakers, Huawei's hardware, software, and cloud services are validated, iterated, and optimized on mature vehicle platforms, forming a complete commercial closed loop.

Where Is the Partnership Headed in 2026?

By 2026, the question of whether Huawei should partner with automakers is moot. What truly matters is how this collaboration will evolve as intelligentization enters a mass-market phase, and what impact it will have on automakers and the industry as a whole.

For Huawei, managing differentiation between partners remains a long-term challenge. As Cui Dongshu noted, the "degree" of cooperation varies between automakers and Huawei. This difference is not simply a matter of depth; it stems from differing goals, role divisions, and strategic paths.

On this point, Zhang Xiang notes that Huawei has not adopted a one-size-fits-all approach. Instead, it has implemented clear strategic stratification through two models: Harmony lntelligent Mobility Alliance and Qiankun Intelligent Driving. This layering is designed to accommodate the varying needs of different automakers while solidifying Huawei's own industry status and technical authority during its expansion.

Image Source: FAW-Audi

According to data disclosed by Jin Yuzhi, CEO of Huawei's Intelligent Automotive Solutions BU, in early 2026, the number of models equipped with Huawei Qiankun ADS will exceed 80, with cumulative installations surpassing 3 million vehicles. That scale alone is enough to exert a substantial influence on the industry's underlying logic.

Based on this reality, Gasgoo offers several projections on how the Huawei-automaker partnership might evolve in 2026.

First, the value of the partnership will extend beyond technical support to provide systematic assistance in operational efficiency. As intelligentization scales up, the importance of individual technological advantages is waning, replaced by the need for system synergy and engineering efficiency.

Huawei's R&D management system, platform capabilities, and resource scheduling expertise—honed over decades in the ICT sector—are being increasingly absorbed and adopted by partner automakers. In 2026, this influence will likely manifest in faster internal R&D cycles, improved cross-departmental collaboration, and compressed product iteration timelines.

Second, scale effects will amplify the importance of safety and stability, creating a de facto standard for the industry. As the number of vehicles running Huawei's solutions grows, technical performance is no longer just experimental data or small-sample statistics; it is being repeatedly validated in real-world road conditions. By 2026, safety and stability may cease to be selling points and instead become part of the barrier to entry.

Third, the focus of competition will shift from "individual models" to a clash of "systemic capabilities." As intelligent configurations converge, the market will pay closer attention to an enterprise's capacity for continuous evolution—including system update frequency, ecosystem compatibility, and consistency across different scenarios.

Image Source: Huawei Intelligent Automotive Solutions

Huawei's strength lies in its cross-device, cross-scenario system capabilities, which enable partner automakers to achieve tighter integration between vehicles, the cloud, and user terminals. By 2026, the gap between automakers may be defined less by a single hit model and more by whether they possess a complete, sustainable intelligent ecosystem.

Fourth, the spillover effects of these partnerships will extend to international markets, influencing how Chinese automakers compete globally. In the global arena, intelligence and software capabilities are gradually becoming critical metrics for measuring automotive value.

Huawei's accumulated expertise in telecommunications, cloud services, and global compliance systems offers certain Chinese automakers a lower barrier to entry into high-standard markets. In 2026, these partnerships could help Chinese automakers enhance their technical credibility and brand recognition overseas.

In 2026, the core change in the Huawei-automaker dynamic will not be the form of cooperation itself, but the visible impact on the industry's underlying rhythm. This partnership will not directly determine who wins, but it is redefining the basic conditions of competition through scale, safety, efficiency, and systemic capability.

![[Gasgoo Express] Chery to acquire Nissan's South African plant](https://gascloud.gasgoo.com/production/2026/01/cca16aa8-3e64-45cb-acd0-f41dea55a071-1769472828.png)