In early 2026, Tesla made the first move in China with a "seven-year ultra-low interest" financing plan, stretching loan terms to seven years to reduce monthly payments and stimulate demand. A week later, Xiaomi EV moved quickly to match the offer, announcing its own seven-year low-interest policy for the YU7 on January 15.

That promotional push arrived alongside two recent vehicle fire incidents—both reported by Xiaomi on the same day—creating two perspectives through which the public is now scrutinizing the automaker's standing. Although no one was hurt and Xiaomi released preliminary vehicle data within hours, the episodes have once again thrust the company's safety and reliability into the spotlight.

Looking back, "safety" has been the unavoidable question shadowing Xiaomi EV's sprint ever since the severe highway accident in March 2025.

Beyond safety lies an even deeper question: now that the hype and controversy of the debut model have faded, what will a halo-less Xiaomi EV rely on to secure lasting market trust and break through growth ceilings? The stakes go beyond the success of a single car—this is a stress test of the company's entire manufacturing model.

First Gen Rode on Hype, but Gen 2 Needs Muscle

The original SU7's success was built on favorable conditions where multiple unique factors converged. Its core driver was a sense of "disruptive anticipation": what kind of impact would a successful tech giant have on the market by entering auto manufacturing?

Lei Jun's personal influence, the suspense surrounding the Xiaomi ecosystem, and the final reveal of extreme specs and aggressive pricing combined to create a major marketing event. The SU7 attracted large numbers of "Mi Fans" and tech early adopters; data shows nearly 50% of owners are women and roughly 60% are Apple users—painting a starkly different picture from traditional car buyers.

Image Source: Xiaomi EV

More importantly, the 200,000 to 300,000 yuan pure-electric sports sedan segment that the SU7 entered was relatively open. Competitors needed time to react, buying the SU7 a precious window of opportunity.

But the glory of the "disruptor" is rarely replicable. As the new SU7 arrives, it faces a market that is far more awakened and intensely competitive. The core driver must shift from "disruptive anticipation" to the cold reality of product verification.

Consumers are asking whether the new SU7 can actually resolve the controversies that piled up around the original model: Has the reliability of its intelligent driving been thoroughly validated? Have the quality-control details that drew so much criticism been fixed?

Take the spate of safety incidents, for example. Regardless of where the final liability lies, they have subjected Xiaomi's active safety systems and battery reliability to harsh public scrutiny. Meanwhile, the expensive carbon-fiber hood option on the SU7 Ultra sparked a trust crisis among high-end owners, who felt there was a gap between the marketed functionality and the actual user experience.

Taken together, these specific doubts over quality control and long-term reliability have begun to shake some consumers' confidence in the automaker's fundamental engineering competence.

One "Mi Fan" who had closely followed the SU7 confirmed this conflicted mindset in an interview. While he viewed Xiaomi's decision to proactively release fire data as a "plus," his stance on actually buying was unequivocal: "For now, I'm not considering Xiaomi."

Addressing these trust issues will require the new SU7 to answer with solid engineering substance that goes beyond mere specs—and with a long-term user experience that proves it.

At the same time, if Xiaomi wants to push for higher sales volumes, the new SU7 must win over a much broader, more mainstream cohort of buyers. These consumers prioritize space, comfort, brand reputation, and long-term reliability—factors for which Xiaomi's ecosystem story holds far less appeal than the promise of simply being a "reliable good car."

Compounding the challenge, the market landscape facing the new SU7 has grown far harsher, shifting from a "blue ocean" to a "red ocean." Rivals like Zeekr, Luxeed, and Tesla have not only completed targeted upgrades, but the industry's battle for intelligence has also entered a white-hot phase.

After the Halo Fades, the 'Manufacturing Marathon' Has Just Begun

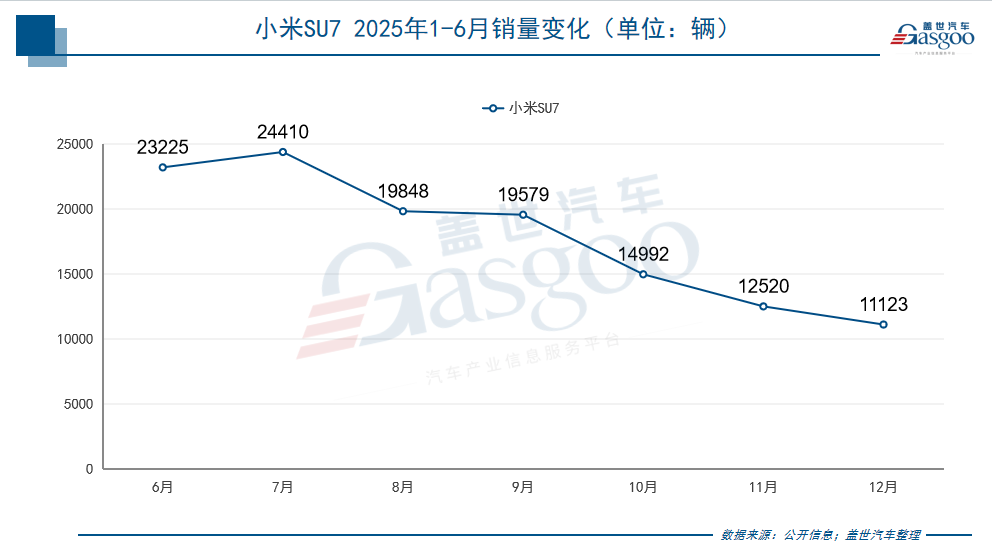

As the novelty wears off, bottlenecks in Xiaomi EV's sales growth are surfacing. This isn't just the cyclical cooling of product hype; it touches on the "iron laws of manufacturing" that Xiaomi—as a cross-industry player—must confront, and on the validation of its business model itself.

Although Xiaomi EV delivered an "over-achievement" in 2025—hitting over 410,000 annual deliveries against a target of 300,000—its push for 550,000 in 2026 faces significant headwinds.

Since deliveries began in April 2024, Xiaomi EV posted rapid growth rates: it took just seven and a half months to hit the first 100,000-unit milestone, then only four months to notch the second 100,000.

Entering the second half of 2025, that exponential growth began to show signs of slowing—though this was partly attributed to the production ramp-up of the YU7.

Regardless, the first-mover advantage driven by the debut model's explosive popularity is fading. To leap to an annual volume of 550,000 units—requiring over 34% year-on-year growth on a 2025 base of 410,000—Xiaomi must consistently deliver around 46,000 cars a month. That is a significant challenge.

First, Xiaomi is facing the backlash of "hype dependency." The original SU7 rode a wave of marketing heat generated by Lei Jun's celebrity and the crossover narrative, maxing out expectations in record time. But that approach also burned through novelty quickly and led to volatile public sentiment.

Even more daunting is the iron law of auto manufacturing. Behind the sales figures lies a brutal test of fundamental capabilities: production capacity, quality consistency, and supply chain management.

Since starting production in 2024, Xiaomi EV has achieved a rapid capacity climb. Through line optimization at its Beijing plant's Phase 1 and 2, it stabilized monthly deliveries at over 40,000 units in 2025 and pushed toward 50,000—providing the foundation for last year's 410,000-plus deliveries. But as more models roll out, the production system faces a critical test in transitioning from supporting a single hit model to sustaining a multi-model lineup.

To meet its goals, Xiaomi is aggressively expanding capacity. Beijing Plant Phase 3 and a new Wuhan facility are slated to come online in 2026 to support an ambitious plan for annual production exceeding 1 million units. Yet rapid expansion brings its own severe tests. New factories need time to ramp up, and a high-intensity production pace puts extreme pressure on supply chains and quality control systems.

Looking back, long delivery times have been a persistent headache for customers and sales alike. According to the Xiaomi EV app, the YU7 Max has a delivery cycle of 28 to 31 weeks, while the SU7's wait time once stretched to around 40 weeks. That not only tries buyers' patience but also hands competitors a clear opening.

Photo by Gasgoo at Xiaomi Store

A Xiaomi sales representative told Gasgoo that the old SU7 has indeed been discontinued, and current inventory is entirely the new model. The new SU7 is now accepting "advance orders" (small deposits). The representative noted that customers who lock in an advance order will likely enjoy priority and exclusive benefits once the car launches, adding that those who previously ordered the older model can switch their orders to the new SU7.

Echoing Lei Jun's comments in a recent livestream, sales staff confirmed to Gasgoo that the new car is expected to arrive at dealerships in March or April, after the Lunar New Year.

Additionally, rapid scaling puts immense pressure on quality control. Even a minuscule failure rate gets magnified across a massive production volume, creating potential risks to brand reputation. The strength of this "behind-the-scenes" groundwork will determine whether Lei Jun's 550,000-unit delivery target for 2026 can become reality.

From Specs to Systems: How Does Xiaomi SU7 Fight Its Market Breakout?

Besieged by market headwinds, a crisis of trust, and fading hype, the launch of the new SU7 cannot be a simple annual refresh. It must be a calculated, systemic breakout.

On product performance, the original SU7 set a benchmark but also revealed shortcomings. The new model responds decisively: it comes standard with LiDAR, 4D millimeter-wave radar, and a 700TOPS computing platform, making "top-spec hardware standard" across the lineup. The powertrain also gets an upgrade, with the SU7 Max moving to an 897V silicon carbide high-voltage platform. For ride quality, the Pro and Max trims now feature closed-loop double-chamber air springs and CDC dampers as standard.

Amid industry cost pressures and intensifying competition, the new SU7's starting price has edged up from 215,900 yuan to 229,900 yuan. Getting consumers to accept that hike hinges on whether they clearly perceive the value of the added features. Xiaomi is reshaping its definition of "value for money"—shifting from "lowest price for the same specs" to "highest value at the same price point."

Regarding the pre-launch price, Lei Jun stated that the increase was driven by extensive product upgrades and rising supply chain costs, making it impossible to offer "more for the same money," and asked for customer understanding. However, the sales representative suggested a price cut at launch is "very likely—that's Lei Jun's style," though noting the final move depends on market conditions.

In the 200,000 to 300,000 yuan pure-electric sedan red ocean, rivals are battling fiercely on three fronts: high-voltage fast charging, high-end intelligent driving hardware, and luxury comfort features. The Tesla Model 3's strength lies in its brand power and the long-term potential of its FSD vision-based system, while the XPeng P7i leans on its reputation for mature intelligent driving and an 800V platform.

Facing these rivals, the new SU7's strategy is to democratize the hardware that was previously reserved for mid- and high-trim levels, pushing it down to become standard equipment. It aims to build a perceptual advantage through standard high-end intelligent driving hardware, an 897V high-voltage platform, and double-chamber air suspensions on higher trims.

With rivals circling, whether consumers will continue to pay for this "technical luxury" will be a direct test of Xiaomi's ability to command a premium.

For Xiaomi, reconstructing brand perception is critical. The company urgently needs to shift public image from a "tech company skilled at marketing" to a "reliable automaker." Xiaomi is already taking action to signal that shift to the market.

Image Source: @LeiJun

The most striking example came in early 2026, when Lei Jun hosted a multi-hour livestream from the factory floor. The core event wasn't a car launch but a live teardown of a YU7, laying bare over 7,000 components—including the body structure, battery pack, and braking system—to the audience.

To address the marketing tactics that have drawn criticism, Xiaomi is making tangible adjustments. When the new SU7 was revealed, one fan joked to Gasgoo that Xiaomi's current promotional posters are "all big text"—a sign of a shift in style.

Whether proactively disclosing the two fire incidents, issuing OTA recalls to eliminate risks, or offering data-driven, transparent clarifications for individual vehicle anomalies, Xiaomi is striving to build a reputation for "reliability."

However, the Mi Fan tracking the SU7 views these efforts—transparent communication, factory teardowns, OTA recalls—with a cooler eye, dismissing them as "more like a forced response." In his view, the real path to breaking through lies in more substantive action: "Ultimately, it comes down to practical moves—like launching a genuinely sincere car and delivering comprehensive end-to-end service."

Profitability, Volume, and R&D—None Can Be Missing

Zoom out from the new SU7 itself, and it becomes clear that its success or failure means far more than the sales figures of a single model. It is, in fact, a pivotal piece in Xiaomi EV's vast strategic game.

First, it involves balancing profit with scale. Auto manufacturing is a classic scale economy, yet expanding scale doesn't automatically guarantee profit.

Starting from a 1.8 billion yuan loss in the second quarter of 2024, Xiaomi EV narrowed its losses through continuous cost control and production scaling—down to 500 million yuan in the first quarter of 2025 and 300 million yuan in the second. By the third quarter of 2025, the automotive division turned its first quarterly operating profit, logging 700 million yuan. Meanwhile, gross margins hit a high of 25.5%. That was driven partly by deliveries of high-margin models like the SU7 Ultra and partly by falling component costs and economies of scale.

Yet, even as the dawn of profitability breaks, challenges remain. In a brutal price war, how can Xiaomi boost sales toward the 550,000 target while maintaining—or even improving—margins to fund Lei Jun's pledged 200 billion yuan in R&D over the next five years? That remains a critical financial question for the automaker's long-term survival.

Xiaomi Group President Lu Weibing already forecast on the 2025 third-quarter earnings call that automotive gross margins may decline in 2026 due to intensifying competition and shifting subsidy policies. Consequently, the new SU7's pricing strategy, cost control, and profit contribution will face a stress test even more critical than the original model did.

Second, the new SU7 bears the heavy responsibility of paving the way for the entire product matrix. Xiaomi's ambitions extend far beyond the SU7 sedan. Its first SUV, the YU7, launched and began deliveries in June 2025, while models based on a range-extender platform are in the pipeline and slated for mass production in the first half of 2026.

The new SU7's market performance will directly shape the confidence, channel enthusiasm, and brand premium surrounding those future launches. If the SU7 can consolidate and elevate Xiaomi's standing in the smart EV market, subsequent models will benefit. But if the SU7 stumbles, the entire product matrix could face a rough road ahead.

Ultimately, this all points to a long-distance technology race. Competition in the auto industry comes down to endurance in core technologies—be it solid-state batteries, autonomous driving algorithms, or next-generation electronic and electrical architectures.

Sales and R&D must form a virtuous cycle: better products drive higher sales, and higher sales fund faster tech iteration. Only by closing that loop can Xiaomi EV keep pace in this marathon and truly evolve from a "cross-industry player" into a "long-term builder."

Conclusion:

So, when we ask whether the new Xiaomi SU7 can break through its sales bottleneck, the answer doesn't lie in whether it can replicate the "sold-out sensation" of the original launch. This kind of phenomenon-level hype is the product of a rare convergence of timing, opportunity, and momentum.

The real answer lies in whether it can successfully complete the metamorphosis from a "viral hit" to an "enduring brand."

For Xiaomi, the new SU7 represents a critical juncture that will determine whether its massive gamble on carmaking can advance to the next stage. Its market feedback will answer the question on everyone's mind: just how far can a tech giant go in the deep waters of the automotive industry?

![[Gasogo News] Porsche dealers in China expected to shrink by 30% this year; Shangjie H5 cumulative deliveries exceed 30,000 units](https://gascloud.gasgoo.com/production/2026/01/aa8f4758-dccb-4cb7-8671-c889760090db-1769612430.png)