Gasgoo Munich- The decline of Japanese automakers in China was inevitable — and the signs were there early on.

In 2018, Suzuki, once a "national brand" thanks to the Alto and Swift, sold its stake in Changan Suzuki for just 1 yuan, ending a 34-year run in the country. By 2023, Mitsubishi had dissolved its joint venture with GAC, becoming another Japanese marque to crash out of China. Both exits stemmed from a fundamental misjudgment of market shifts.

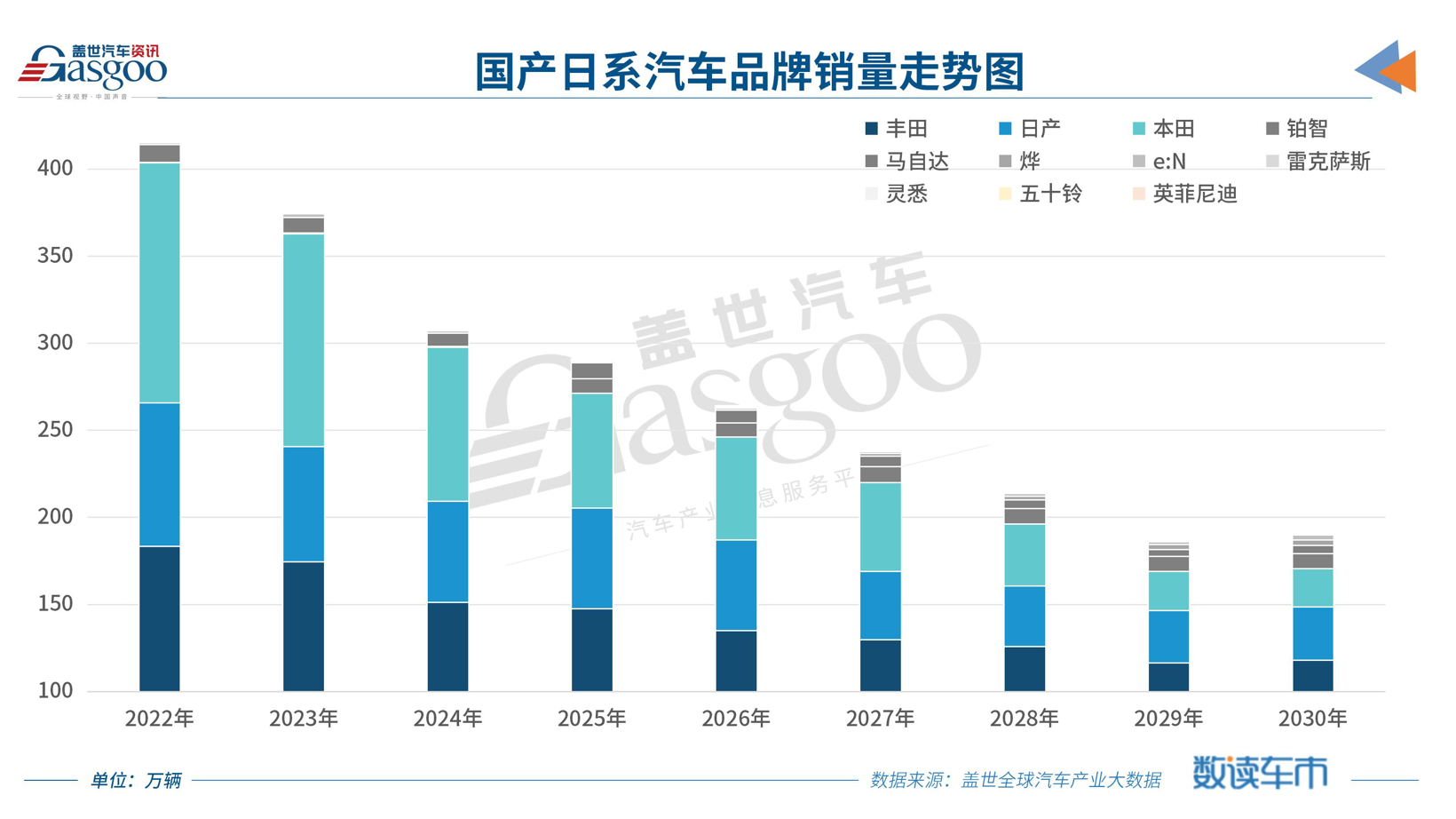

Leaving aside Subaru, whose annual sales in China barely cover recall volumes, and the near-invisible Mazda, data from Gasgoo Global Industry Big Data shows Honda and Nissan sales have plummeted by over 40% compared to 2022. Toyota, while still moving nearly 1.5 million units a year, has seen its own tally shrink by a fifth.

The going is getting undeniably tough for Japanese brands in China.

Market Share Collapse

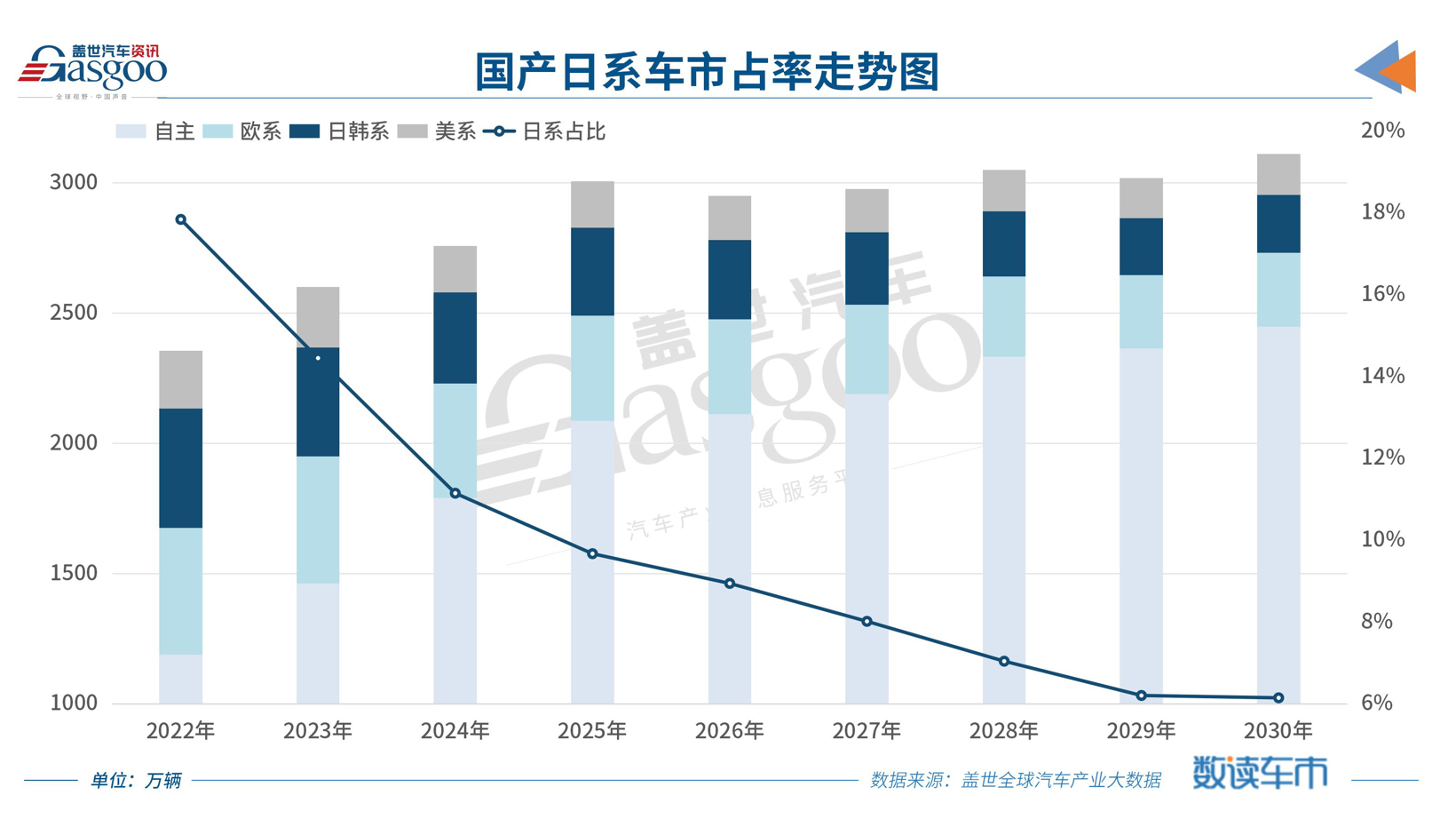

Roll back to 2020, and Japanese cars held a 23.1% share of the Chinese market, dominating internal combustion engine vehicles with a 35% share. In just five years, that figure has narrowed to 9.67% in 2025, according to Gasgoo data — a perilous level.

Early market feedback for 2026 suggests this downward trend hasn't been effectively checked.

Under the shock of the electrification wave, joint ventures as a whole face a triple bind: losing ground in internal combustion engines, lagging in new energy, and falling behind in intelligence. The Japanese ICE foundation is eroding; even with aggressive promotions involving 8.2% price cuts, they can't stop the slide in market share.

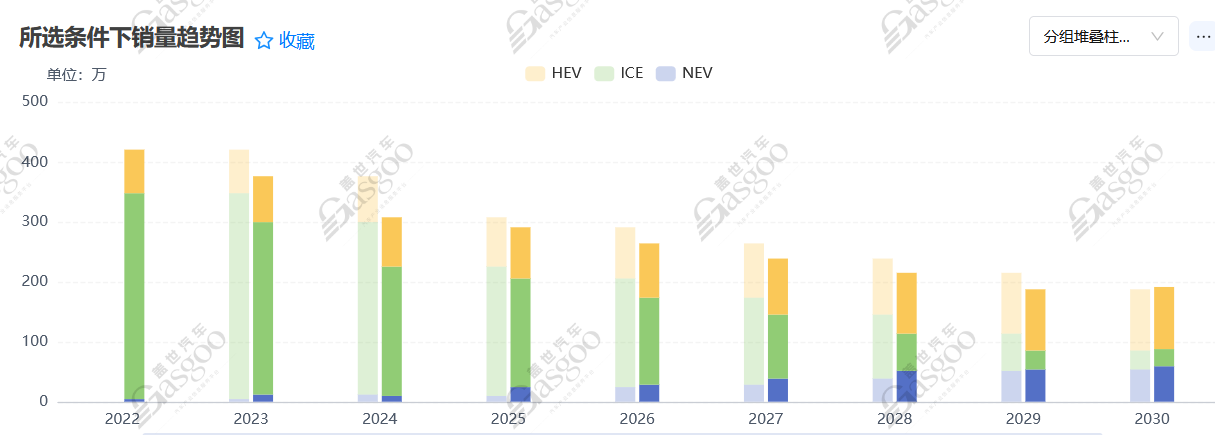

More fatal is the sluggish shift to electrification. During the 2020–2023 boom in China's new energy market, most Japanese automakers hesitated, watching from the sidelines with flawed strategies. Gasgoo data shows the penetration rate of Japanese new energy vehicles in China barely scraped past 1% in 2022. By the time they woke up, domestic brands had built formidable technological and ecological barriers, leaving little room for the Japanese players.

The Japanese camp, which once commanded a quarter of the Chinese market, is now enduring unprecedented growing pains.

A deeper issue is insufficient localization. Most Japanese automakers insist on "headquarters centralization," leaving Chinese teams without R&D or decision-making power, making it hard to respond to market shifts. Honda relies on imported core components, and its models are disconnected from Chinese consumer demand.

Recall the 2023 Shanghai Auto Show, where a senior executive from a leading Japanese automaker admitted to Gasgoo that he had repeatedly invited headquarters leaders to visit China and witness the new energy boom firsthand, hoping to accelerate strategic adjustments. Sadly, it never happened.

Those with long memories might note that this was the first time in Chinese auto history that so many European executives flooded in to observe, yet Japanese executives were conspicuously absent.

In 2025, the penetration rate of domestic Japanese passenger new energy vehicles was less than 9%, a stark contrast to the over 60% rate for Chinese brands, per Gasgoo data. On the critical track of electrification, Japanese cars seem to have missed their best window.

The market's harsh choice is reflected not just in sales data, but in consumer perception. Once-powerful reputations like "unbreakable Toyota" or "technological Honda" seem to have lost their luster in the new context of electrification and intelligence.

During visits to multiple Japanese brand dealerships, sales staff consistently reported a dual challenge: a lack of intelligent features and weak channel layout, putting continuous pressure on market competitiveness.

Especially now that rivals are building brand familiarity through direct sales in shopping malls, Japanese brands remain tethered to the 4S dealership model. A salesperson in the Yangtze River Delta told Gasgoo that foot traffic consists mostly of returning customers for maintenance, with low reach for new clients. "Aside from old customers bringing friends, almost no one comes in. It's a huge difference from the experience stores in downtown malls."

Diverging Paths for the Big Three

The Japanese "Big Three" are showing a dramatic divergence in China. Toyota is the only one to post growth in 2025, while Honda and Nissan are mired in years of decline.

As the only grower, Toyota sold 1.78 million vehicles in China in 2025, a slight increase of 0.225%, successfully ending a slump that began in 2022. This is mainly due to strong brand reputation, a robust joint venture system, and price cuts on internal combustion and mild-hybrid models.

Its two joint ventures performed particularly well: FAW Toyota sold 377,800 vehicles in the first half, up 16% year-on-year, while GAC Toyota reached 344,800 units, up 2.58%. GAC Toyota's pure electric SUV, the Bozhi 3X, made a strong entrance, delivering over 70,000 units for the year. It firmly topped sales among joint venture new energy models, marking the first bright spot in the Japanese electrification transition.

Lexus contributed 183,800 units, maintaining positive growth as the only imported luxury brand to see sales rise.

Image source: GAC Honda

Honda's situation is starkly different. 2025 sales in China totaled just 645,300 units, a plunge of 24.28%, marking the fifth consecutive year of decline. While mainstays like the CR-V and Accord retain some volume, and multiple new energy models have been launched, a lack of localized intelligent features and designs tailored to Chinese needs meant they failed to meet core demands for driving feel, comfort, and intelligence. Overall market performance fell short of expectations.

Honda's electrification attempts are stumbling. It launched seven pure electric models, but all met with a cold reception due to obvious "converted-from-ICE" origins, lagging intelligence, and inflated pricing. In 2025, the company cut electrification investment by 30% and scrapped a large pure electric SUV project, revealing a wavering strategy.

Nissan's position is even more precarious. Cumulative 2025 sales were around 653,000 units, down 6.26% year-on-year. Long reliant on "swapping volume for price" to hold market share, the brand has seen its premium pricing power steadily erode.

Image source: Dongfeng Nissan

As an early pure EV pioneer, the Leaf saw global success but remained dormant in China for over a decade. The pure electric sedan N7, launched in 2025, delivered 45,382 units thanks to localized features, but a single model couldn't fill the gaps in the lineup. Monthly sales fluctuated wildly, dropping below 2,000 in December. This has driven sales down from 1.564 million units in 2018 to 653,000 today — a near-60% collapse as market size continues to shrink.

From a profit perspective, the divergence is equally sharp. According to the latest financials, Toyota's net profit for the second quarter of fiscal 2026 (ending Sept. 30, 2025) reached 932.08 billion yen, up 62% year-on-year. The Chinese market contributed 67.1 billion yen in operating profit, remaining a key source of earnings.

Nissan expects an operating loss of 275 billion yen, its most severe financial crisis in over two decades. Honda had previously forecast a 70% plunge in profit to 250 billion yen, but revised expectations up to 550 billion yen in November 2025, though challenges remain immense.

2026: A Make-or-Break Year

Looking ahead, the divergence among Japanese automakers in China will become even more pronounced. Forecasts from the Gasgoo Automotive Research Institute suggest that by 2030, Japanese cars will still hold around 6% of the Chinese market, but this share will be highly concentrated among a few brands.

The year 2026 is viewed as a critical "do-or-die" moment for Japanese automakers in China. How each company plans its next moves will determine its trajectory.

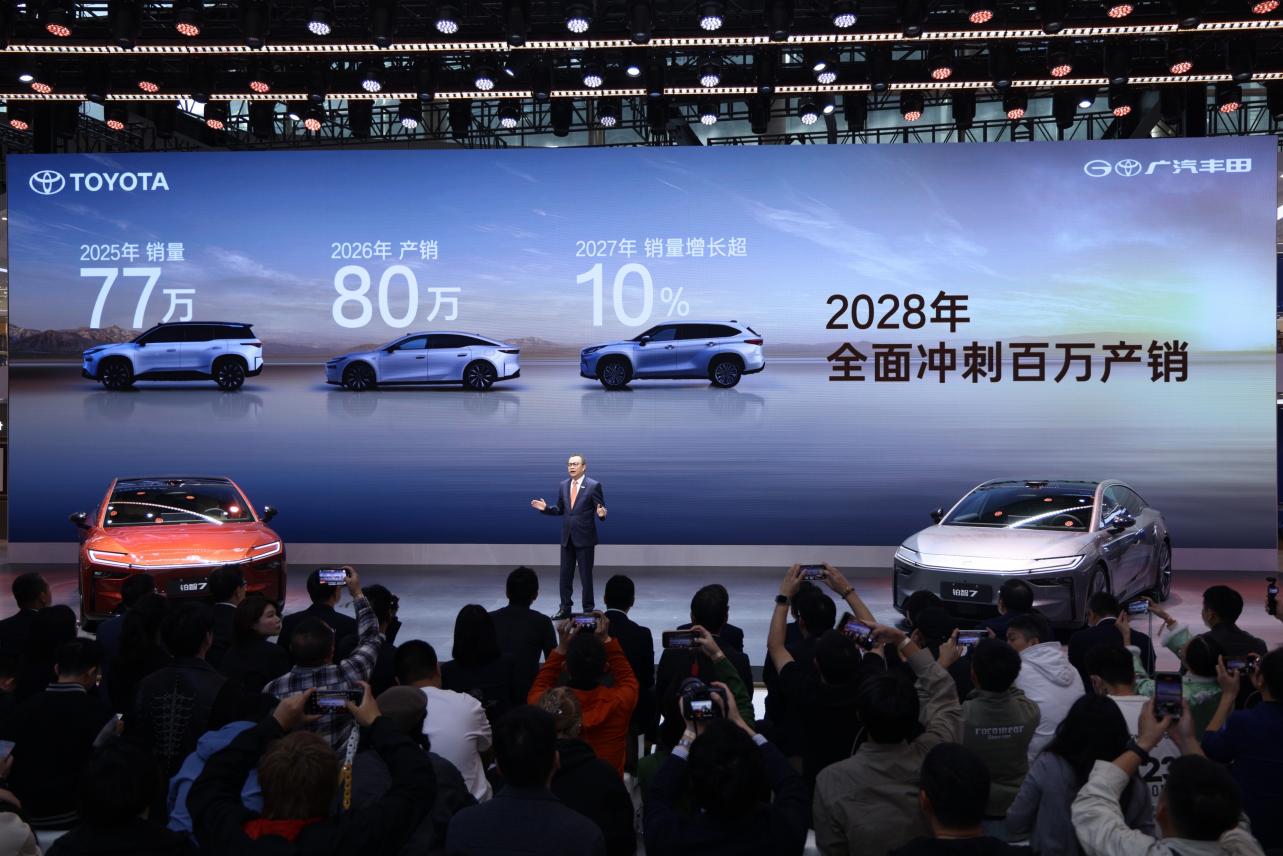

Toyota has written "China First" into its global KPIs.

Source: GAC Toyota

Over the past two years, Toyota quietly merged its three R&D bodies — FAW Toyota, GAC Toyota, and BYD Toyota — into "ONE R&D." For the first time, the Chinese team has full authority over styling, configuration, and pricing. The development cycle has been compressed from 48 to 28 months, localization of parts raised to over 95%, and costs cut by another 15%–20%.

This is the backdrop that allowed the Bozhi 3X to take the crown for joint venture pure EV sales in 2025, showing Toyota the viability of "advancing ICE and EV together." Next, the flagship pure electric sedan Bozhi 7, along with extended-range versions of the Highlander and Sienna, will form a new niche matrix covering the core 200,000 to 400,000 yuan price band.

More critically, the Lexus wholly-owned Shanghai plant will be completed by mid-2026 and start production in 2027, focusing on high-end EVs. R&D staff will expand to 2,000, with localized R&D accounting for 60%. This marks the first time Toyota has placed the "brain" of its global high-end EVs in China, meaning future Lexus global models will reverse-import technology and supply chains defined in China.

Toyota's playbook is clear: use extreme localization to defend scale, and high-end electrification to defend profit. Pushing both fronts simultaneously leaves no gap for rivals to exploit "low prices for market share."

Nissan is pushing all its chips to the center of the table. By the end of 2026, Dongfeng Nissan must launch five new energy models covering BEV, PHEV, and extended-range (EREV). It aims to add 200,000 units in net annual sales, hit 1 million in total volume, and return operating margins to above 6% — these are the "hard metrics" written into Nissan China's 2026 OKRs.

Trends of domestic Japanese vehicles by fuel type; Source: Gasgoo Global Automotive Industry Big Data Platform

To deliver on this, Nissan has launched its largest ever "GLOCAL" transformation. The Chinese team now has a closed loop from market research and styling to cockpit definition and pricing, with HQ retaining only platform safety and regulatory approval. Another 10 billion yuan will be invested by 2026, and R&D staff will expand to 4,000 — equivalent to the sum of the past decade.

Nissan's path is "hit validation plus rapid iteration": first use PHEVs and EREVs to solve range anxiety, then leverage Huawei's high-end autonomous driving to highlight intelligence, and finally harvest base users with pure EVs priced under 150,000 yuan.

In 2026, Nissan has no retreat. Only by turning both sales and profit positive can it preserve its joint venture stake and channel confidence; otherwise, it faces the systemic risk of being marginalized.

Honda's strategy appears the most passive. Three years of exploration have left it at a strategic crossroads in China. While Pan Jianxin, executive deputy general manager of Dongfeng Honda, stated a commitment to "persist in ICE and hybrids while accelerating EV layout," a lack of substantive measures has left ICE models struggling to hold the line and EVs failing to gain traction.

The company tried to fight on two fronts — ICE and EV — with little success. In the ICE market, former mainstays are now reduced to the CR-V and Accord holding the fort. In new energy, despite launching pure electric models like the S7 and P7, market response has been tepid due to pricing, design, and intelligence levels, failing to effectively open up the market.

Honda has realized the severity of the problem and is expanding its "China circle of friends." The company stated it will "further deepen strategic cooperation in electrification, actively partnering with local firms like Momenta and DeepSeek on tech innovation to jointly advance the new energy industry."

But the 2026 Chinese auto market will offer no "observation period" to any company. EV penetration has breached 55%, intelligence penetration is sprinting toward 40%, supply chain costs fluctuate wildly by the quarter, and user tastes iterate rapidly by the month.

Toyota is building a dual drive with "global technology plus China speed," while Nissan bets 10 billion yuan on a "China-defined" counterattack. Honda must find its footing and start over.

Survival or extinction will be decided this year.

Conclusion:

With the Lexus Shanghai pure electric plant set to come online in 2027, Toyota's layout in China is nearing completion. Meanwhile, Dongfeng Honda is rethinking its electrification strategy, and Nissan is seeking a breakout by deeply binding itself to the Chinese market.

Walk into any Japanese dealership, and sales staff will emphasize reliability and resale value. But young consumers care more about whether the infotainment screen is smooth, what level of intelligent driving has been achieved, and whether they can get continuous updates via OTA.

The answers to these questions will determine whether Japanese automakers can find a new foothold in China, the world's largest auto market.