Gasgoo Munich- On February 12, the State Administration for Market Regulation issued its "Compliance Guidelines on Price Behavior in the Auto Industry." "Malicious price wars" were formally written into regulatory red lines.

That same day, Cui Dongshu, secretary-general of the China Passenger Car Association (CPCA), released his summary of the January market: "No opening boom. The pressure is greater than expected."

The convergence of these two events on the same day is no coincidence. On one side, regulators are revealing their bottom line after three years of price warfare; on the other, consumers are holding onto their cash, while manufacturers tread carefully between the fear of cutting prices and the necessity of selling inventory.

Even more intriguing is that less than two weeks before the Guidelines were released, the first wave of price cuts at the start of 2026 hit a record high for the period. CPCA data shows that in January, 17 models announced price cuts in the domestic passenger car market—more than double the eight from the same period in 2025 and a surge of over three times compared to the four in December 2025. Against the backdrop of 177 price-cut models in all of 2025 (averaging just 14.75 per month), the scale of cuts this January alone reached 115% of last year's monthly average. The momentum at the start of the year is fiercer than any analyst predicted.

This is perhaps the most subtle moment the Chinese auto industry has seen in recent years: having finally resolved to bid farewell to "loss-making scale," we find ourselves standing in the center of a far more complex battlefield.

Ending the Price War, or Ending the Survivors?

Of the Guidelines' 28 articles, it is Articles 10 and 20 that are keeping the industry awake at night.

These two rules are categorical: whether it is automakers selling to dealers or dealers selling to consumers, using discounts or subsidies to set the actual factory or sales price below production or purchase costs carries significant legal risks.

This means that "selling cars at a loss" has shifted from a business choice to a regulatory forbidden zone.

What has the Chinese auto industry been used to over the past three years? It was the chain reaction following Tesla's aggressive price cuts in late 2022, the sales logic of "cut the price by 10,000 yuan, double the orders," and a pricing model where launch-day incentives were maximized immediately, making consumer protests a standard feature.

CPCA data shows that from January to November 2025, the average price of new energy vehicles was 204,000 yuan, with an average price cut of 24,000 yuan—a drop of 11.7%. Conventional internal combustion engine vehicles saw an average cut of 16,000 yuan, a drop of 9%. More than 170 models saw price reductions.

Yet, this price war did not end in 2025. The latest CPCA data reveals that in January 2026, 17 models in the domestic passenger car market saw price cuts—that figure alone is glaring enough, but what truly makes one gasp is the comprehensive escalation in the intensity of cuts.

First, look at the scale: the absolute number of 17 models has already surpassed last year's monthly average. But what warrants more caution is the structure—internal combustion vehicles have become the absolute main force of this round of cuts. Traditional fuel vehicles, once considered "immune to price wars," are abandoning their last reserve.

The cost has long been clear.

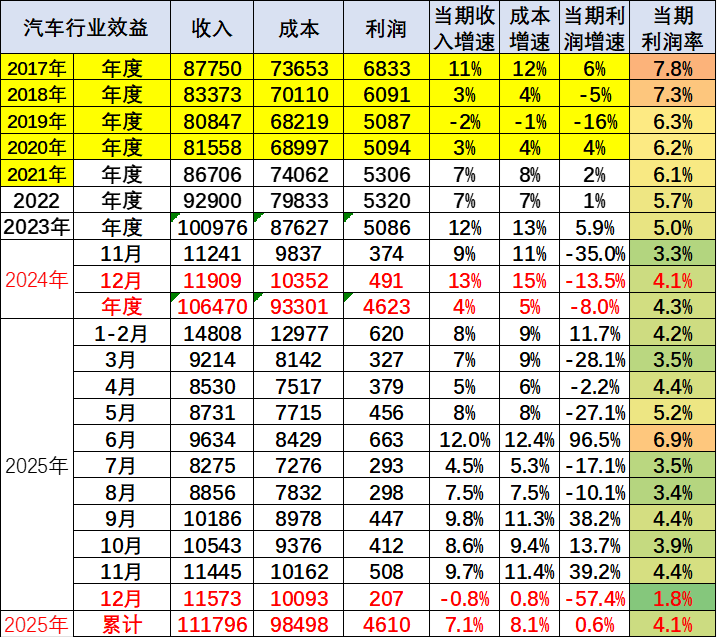

CPCA data indicates that from January to December 2025, the auto industry generated revenue of about 11.18 trillion yuan, up 7.1% year-on-year. But costs grew faster, reaching 8.1%. Final profit stood at 461 billion yuan, a mere 0.6% increase, with the profit margin locked at 4.1%.

Image Source: Cui Dongshu

The most shocking figure is the auto industry's profit margin dropping to 1.8% in December. This number means that for every 100 yuan in sales revenue, only 1.8 yuan in profit was generated. Compared to 4.1% in the same period last year, this is effectively a halving. Total profit for the month was 20.7 billion yuan, a plunge of 57.4% year-on-year.

“Lose a few thousand on every sale, fill the hole with after-sales rebates.” This has been the reality for frontline sales staff over the past two years.

According to a CPCA survey, regarding the sales targets issued by manufacturers for 2026, dealers are cautious: 41.0% expect targets to be lowered, 33.3% believe they will be raised, and the remaining 25.7% predict they will remain basically flat.

The Guidelines aim to end this inertia of "short-sighted strategies." From pricing strategies to rebate policies, from clearly marked prices to gift conversion, from paid unlocks to low-price alerts on platforms, the five chapters and 28 articles have essentially combed through every "gray area" of pricing that automakers have utilized in the past. In particular, regulations targeting dealer behaviors such as "under-invoicing," "adding premiums over the listed price," and automakers bundling slow-moving inventory strike directly at the transmission chain of the price war.

But once the red line is drawn, a larger problem surfaces: if selling at a loss is forbidden, how do you sell the cars?

In an interview, Cui Dongshu put it plainly: "Many of our basic manufacturing industries are stronger than others because of our comprehensive cost advantage; we are now in a state of being unrivaled." The implication is clear—it's not that we want to compete aggressively, but we must to survive.

However, times have changed. DRAM prices have surged 180% in three months, directly increasing the intelligent driving cost per vehicle by 1,300 yuan; lithium carbonate prices have reached a trough and rebounded, with battery makers preparing to raise prices; and on the policy front, the purchase tax exemption for new energy vehicles is tapering off, with the 5% tax point being borne entirely by consumers.

At the start of 2026, automakers face not a question of "wanting to compete," but of "being unable to."

Costs are rising, prices cannot fall, and regulators forbid losses. This triangular dilemma ensures there will be no comfortable players in the 2026 auto market.

But looking at it from another angle, regarding this intense wave of price cuts at the start of the year, Cui Dongshu offered a calm assessment: "This wave of cuts is mainly due to the adjustment of taxable prices at the beginning of the year. As inventory clears, new products launch, and industry guidelines take effect, the intensity of cuts will fall significantly, with prices trending high early and low later—a normal decline."

In other words, the introduction of the Guidelines at this precise moment may not be about putting "constraints" on automakers, but rather pulling them back from the brink of collapse. As upstream raw materials and intelligent driving chip prices visibly erode profit margins, continuing to dump products at low prices is no longer a tactical choice, but a strategic mistake. By drawing a boundary now, regulators have objectively given the entire industry a reason to turn around collectively: it's not that we dare not cut prices, it's that we are not allowed to.

Cui Dongshu sees this clearly: “We need to shift the competition from price to quality. In the long run, this is a major positive.”

However, switching from a price war to a value war means navigating a difficult “wait-and-see” period in between.

How to Address Consumers Conditioned by Price Wars?

The report card submitted by the auto market in January was weak: passenger car retail sales reached 1.544 million units, a year-on-year decline of 13.9% and a massive month-on-month plunge of 31.7%.

The China Association of Automobile Manufacturers attributes this to policy tapering and early release of demand. But Cui Dongshu offered another, more intriguing explanation: “Consumers are waiting for the habitual price cuts that happen every January. You say 'price cut,' and everyone buys. Whether the price actually drops isn't the point, but if you don't say it and the price cut doesn't happen, they get anxious.” And this “price cut,” in Cui's words, has to be a “floor price,” a “rock-bottom price,” or even a “bargain-basement price.”

The subtlety of this remark lies in how it reveals a consumer psychology heavily influenced by price wars—the price cut itself has become part of the purchasing decision.

Over the past three years, automakers have conditioned consumers to two things: first, there's no rush to buy a new car at launch; benefits will inevitably increase in three months. Second, if there's no price cut, it's not the end of the month yet. Once this expectation takes hold, reversing it is far harder than fighting a price war.

And so we witness the situation of the 2026 opening: on one side, manufacturers are doubly constrained by the Guidelines and rising costs, with room for price cuts almost eliminated; on the other, consumers hold onto their cash, staring intently at showroom screens, waiting for a “limited-time offer” that never seems to arrive.

This is not a supply-demand imbalance; this is a psychological challenge.

Even trickier is a layer of specific policy anxiety in 2026. Trade-in subsidies are in an annual transition, with local details not yet fully settled; the new energy vehicle purchase tax has shifted from full exemption to a half reduction, and consumers have calculated the costs—buying a month later means paying thousands more. Add to that the approaching milestones of solid-state batteries and L3 autonomous driving, and “waiting a bit longer” has never had more justification.

From late 2025 to early 2026, leading domestic brands have been aggressively launching new cars equipped with City NOA in the 100,000 to 150,000 yuan market. Their pricing strategies have been extremely restrained, with a unified external message of “fixed pricing.” This avoids compliance risks from frequent adjustments and also regains the initiative in the conversation with consumers.

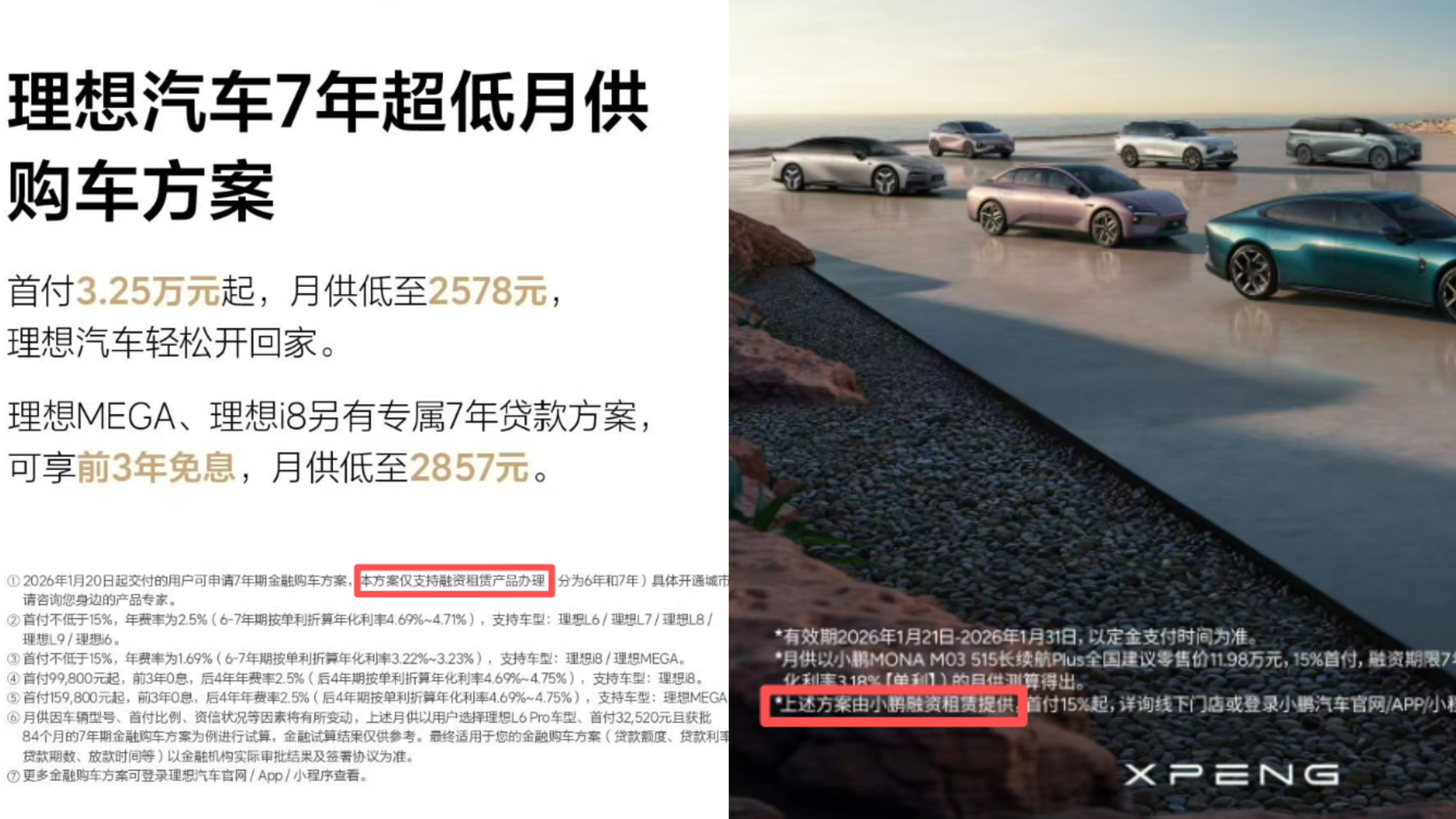

In early January, Tesla initiated a new round of market competition with an official announcement. It introduced an ultra-low-interest loan scheme of up to seven years for its core Model 3/Y models, with annual rates as low as about 0.98%. For a moment, the slogan “Drive away a Tesla for 1,918 yuan a month” circulated widely.

Image Source: Li Auto, XPENG

Within just half a month, mainstream automakers like Xiaomi, Li Auto, XPENG, and Geely quickly followed suit, launching their own “seven-year ultra-long-term low-interest” products. The focus of competition in the auto market, after regulators curbed disorderly price wars, has shifted from a “price war” to a more subtle and complex “financial war.”

But the market has not given positive feedback. January sales data have already raised concerns: wholesale sales of A0-class pure electric passenger vehicles reached 142,000 units, accounting for a 28% share of the pure electric market, up 6.5 percentage points year-on-year; A-class electric vehicles sold 92,000 units, accounting for an 18% share, down 2.5 percentage points.

In Cui Dongshu's analysis, “the growth of affordable electric vehicles is sustainable; only the widespread adoption of affordable EVs can truly drive incremental growth in the auto market.”

But conversely, B-class electric vehicles saw wholesale growth of 15% year-on-year, accounting for a 39% share of the pure electric market, an increase of 5.9 percentage points from last year. This shows that consumers do not lack purchasing power; they are simply reassessing whether it is “a good value.”

The so-called “value war” is essentially a restoration of confidence—making consumers believe that the price you set is not because you are unable to cut it, but because it is genuinely worth that amount.

This requires systematic support in product definition, technological innovation, and user service, but even more so, the return of pricing power. Over the past three years, pricing power was ceded to competitors' discount strategies, to the negotiation tactics of dealerships, and to the collective hesitation of consumers who “wait and see.” Now, the Guidelines provide a window of opportunity for automakers to take pricing power back into their own hands.

Of course, this does not mean prices will not fluctuate, but rather that fluctuations must be reasonable, promotions must follow rules, and costs must have a bottom line. As the Guidelines emphasize, enterprises should establish six internal mechanisms, including price decision-making, risk control, and compliance training. Moving from “arbitrary price cuts” to “systematic pricing” is itself a required course for automakers on the path to maturity.

Closing Remarks

No one wants to return to the “fierce competition” of pricing seen in 2023. Dealers don't, suppliers don't, and even the automakers that started the price wars fall silent when facing 4.1% profit margins during earnings season.

But no one believes easily that a 28-article guideline will make consumers drop their wait-and-see approach, make competitors stop testing boundaries, or make cost pressures disappear.

The price war is a symptom, not the cause.

The real causes are market valuation anxiety under homogeneous competition, the uncertainty of technological routes, and the survival logic where “staying alive” is more urgent than “living well.”

The Guidelines have drawn a clear boundary, but the path above that line must be navigated by the automakers themselves.

When we stop agonizing over being “3,000 yuan cheaper than others” and start calculating “why we are 3,000 yuan more expensive,” the Chinese auto industry will have truly completed its critical transition from confidence in price to confidence in value.

This road will not be smooth, but it is worth pursuing.

![[Gasgoo Briefs] Auto Industry Price Behavior Compliance Guide Released; Wingtech Comments on Nexperia Case Ruling](https://gascloud.gasgoo.com/production/2026/02/2c12fa82-f27c-4aa3-a2d5-de96589089a3-1771080406.png)