For years, "full-stack in-house development" has been the go-to strategy for leading humanoid robot firms looking to build a defensive moat. From the decision-making "brain" and the motor-control "cerebellum" down to the dexterous hand that executes tasks, these companies have sought to master the entire technology stack.

Yet, as the sector moves into a new phase focused on achieving scale, the efficiency limits of this development model are facing fresh scrutiny.

Recently, Zhiyuan Robot spun off its dexterous hand business to establish an independent subsidiary, "Critical Point" — a move widely seen as a significant signal. It raises a fundamental question for the industry: under the dual pressures of technology and commerce, has the "do-it-all" full-stack model finally hit an inflection point?

Zhiyuan Spins Off Dexterous Hand Business

Shanghai limiting Point Innovation Intelligent Technology was recently established with a registered capital of 5 million yuan. The actual controller is Deng Taihua, who also serves as chairman and CEO of Zhiyuan Robot.

The core team at new company also includes Director Wang Chuang — a partner, senior vice president, and president of the general business division at Zhiyuan Robot.

According to multiple sources at Gasgoo, the new company is effectively a spin-off of Zhiyuan's dexterous hand unit, designed to accelerate technological iteration and market expansion through independent operation. The new venture is helmed by Xiong Kun, a robotics veteran and former head of Tencent's Robotics X lab. It has already closed its first round of funding, marking the start of a new phase of specialized operations.

Zhiyuan has a long history in the dexterous hand field, having built a comprehensive portfolio spanning patented technologies, product lines, and application scenarios. Its OmniHand series comes as standard equipment on the company's self-developed robots, completing a closed loop from R&D to commercial deployment.

Image Source: Zhiyuan Robot

In August 2025, Zhiyuan Robot unveiled six core product lines: the Yuanzheng A2 series, Lingxi X2 series, Jingling G1, OmniHand dexterous hand series, the D1 quadruped series, and the C5 commercial cleaning robot. All went on sale simultaneously via the Zhiyuan Store and JD.com.

The OmniHand lineup includes the "Agile" variant, designed for interactive services, and the "Professional" variant, focused on specialized tasks. This allows for differentiated configurations to suit various robotic scenarios.

The OmniHand "Agile" prioritizes a compact, lightweight design for fluid, safe interaction. Measuring just 180mm and weighing 500g, it fits a wide range of humanoid models. It features 16 degrees of freedom (DoF) for human-like gestures, covering standard interactions, and includes an innovative touch-sensitive back-of-hand function. With over 400 tactile force-control points and an anti-pinch design to ensure safety, it is well-suited for shopping malls, home companionship, campus education, and exhibitions.

The OmniHand "Professional," meanwhile, emphasizes human-scale dimensions, versatile operation, and advanced perception. Weighing 750g with a 19-DoF anthropomorphic design, it delivers a maximum single-finger force of 20N and multimodal sensing precision down to 0.1N. This makes it an ideal R&D platform for research institutions and a fit for precision manufacturing in sectors like consumer electronics and automotive assembly.

Image Source: Zhiyuan

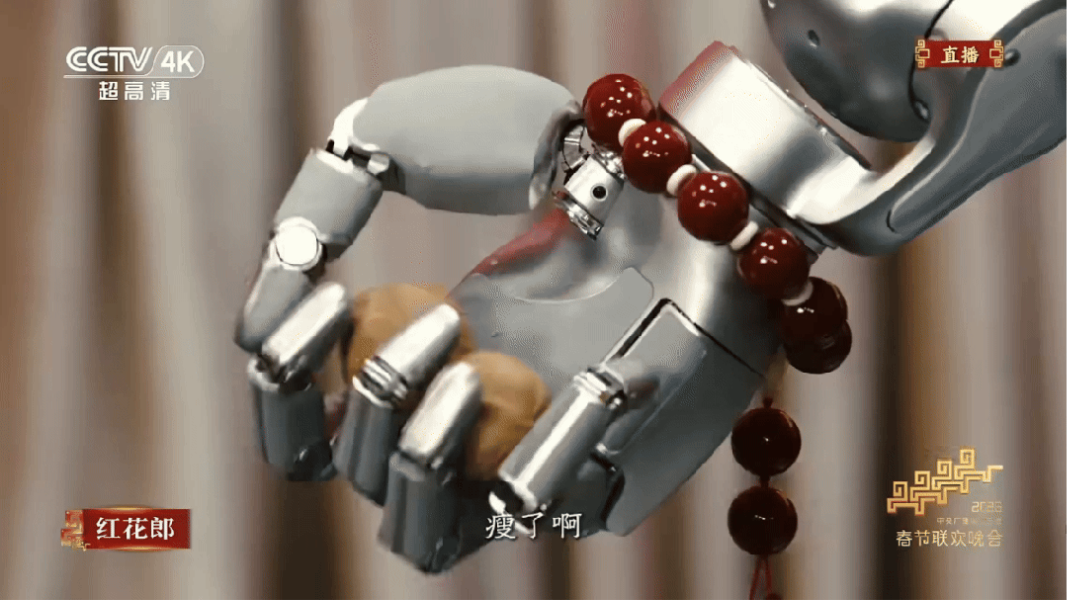

At a recent CES 2026 showcase, Zhiyuan displayed its OmniHand series. As an end-effector for fine manipulation, the hand achieves human-like dexterity and adaptability through its multi-joint flexibility and advanced perception systems. Together with Zhiyuan's full robot lineup, it forms a comprehensive ecosystem covering motion, interaction, and task execution.

Notably, both models are designed to be compatible with robots from other manufacturers. This suggests Zhiyuan's ambition to spin off its dexterous hand business and enter the open market may have been in the cards for some time.

Zhiyuan's expanding production volume provides continuous, real-world validation for its dexterous hands under complex tasks. This, to a certain extent, lays a solid foundation for the unit to compete independently in the marketplace.

As Zhiyuan's dexterous hand unit formally upgrades into a market entity with its own legal status, brand, and financing channels, it signals that "Critical Point" will likely expand beyond serving Zhiyuan's internal R&D. The new entity is expected to open supply to the broader Zhiyuan ecosystem and even external robotics companies.

In-House Dexterous Hands Development: A Tech Obsession or Strategic Necessity?

In the humanoid robot sector, full-stack in-house development of core components like dexterous hands is a key battleground for top players building technological moats and vying for industry influence. So why is Zhiyuan now choosing to push this "technological lifeline" into the open market?

To answer that, we first need to understand the industry's obsession with in-house development.

The obsession stems from two non-negotiable core logics. First, the dexterous hand is the performance bottleneck that determines a robot's ceiling of value.

Image Source: Tesla

As the "last centimeter" of delicate, flexible interaction between the robot and the physical world, the dexterous hand's performance dictates whether a robot can evolve from a mechanical arm executing fixed programs into a general-purpose agent capable of handling diverse scenarios.

In terms of cost, the dexterous hand represents a significant portion of value, accounting for roughly 17% to 18% of the total robot cost.

Yet, building one is a multidimensional challenge. Engineers must balance gripping force against precision, degrees of freedom against reliability, and the speed of the perception-execution loop. These interlocking technical barriers must be conquered as a unified system.

Consequently, there is a consensus that software-hardware synergy is the only path to high-performance dexterous hands. Developing a hand isn't just about manufacturing a mechanical end-effector; its true value lies in deep coupling with the robot's "brain" and "cerebellum" across command, control, and feedback. In this context, off-the-shelf standardized components often act as "black boxes," where interfaces, data formats, and latency can become performance bottlenecks.

Some in the industry even go so far as to say, "Half the difficulty of building a humanoid robot lies in the dexterous hand."

Second, in-house development is a long-term play for technological sovereignty and industry standards.

As a technology-intensive hub integrating precision mechanics, novel actuation, advanced sensing, and complex control algorithms, in-house development yields more than just patents. It generates the deep engineering know-how hidden in the details — tacit knowledge that is difficult to replicate and forms a company's deepest moat.

Furthermore, in the early stages of an unsettled industry landscape, choosing a technological path for the dexterous hand is effectively a vote on the future paradigm. By developing in-house, top players are not just solving their own product challenges; they are vying for the power to define the future "rules of the game."

Thus, in-house development of dexterous hands by leading players is essentially a race to secure a future position. Currently, this "obsession with self-development" is widespread across the industry.

Image Source: ROBOTERA

According to Gasgoo, besides Zhiyuan, other robot makers like Unitree, Fourier Intelligence, MagicLab, and other companies have also chosen to develop their own dexterous hands.

Unitree's Dex5 hand boasts 20 degrees of freedom per hand, approaching the 27 DoF of a human hand and laying the physical groundwork for human-level dexterity.

More critically, the Dex5 is densely packed with up to 94 high-precision tactile sensors in key areas like fingertips and finger pads. This enables robots equipped with the Dex5 to perform extreme tasks requiring real-time object perception and subtle force feedback adjustments — such as playing cards, solving a Rubik's cube with one hand, or flipping pages — rather than just basic gripping.

Fourier Intelligence has taken a different path, focusing directly on commercial deployment. Its FDH-6 dexterous hand launched at just 4,999 yuan, lowering the price barrier for high-end hands by an order of magnitude.

PaXini Tech has pursued a more distinct route, starting with multi-dimensional tactile sensors. Its proprietary high-precision sensors can analyze 15 dimensions of information — including softness, roughness, and material — in real time, providing the dexterous hand with more precise and comprehensive environmental perception.

Leveraging this core technology, PaXini developed the DexH13 dexterous hand. Its standout feature is the integration of 1,140 PaXini multi-dimensional tactile sensing units. Combined with an eye-in-hand camera, it achieves ultra-fine perception of objects, enabling the hand to precisely perform high-difficulty tasks such as handling eggs, screwing in light bulbs, and assembling precision instruments — resulting in smoother, smarter manipulation.

It is clear that the new company of Zhiyuan is entering a dexterous hand market characterized by divergent technological paths and diverse competitive dimensions. The choices made by these companies collectively affirm the strategic value of the dexterous hand as a core component.

Division of Labor Revolution: Is "Limiting Point" the Start?

While robot makers are focusing intently on tackling the challenges of in-house development, another force is rising rapidly: third-party dexterous hand companies.

These firms are not vying for the market for complete robots; instead, they position themselves as core component suppliers within the supply chain. By focusing R&D on a single domain and adopting flexible commercial strategies, they have quickly gained traction.

For instance, LinkerBot, with its Linker Hand series, has consistently surpassed monthly deliveries of 1,000 units and secured follow-on investments from investors including Ant Group. Notably, Lingxin is one of the few companies globally to achieve mass production of high-DoF dexterous hands at the thousand-unit level, commanding over 80% of this specific global niche market.

Image Source: Inspire Robots

Through continuous technical iteration and manufacturing system development, Inspire Robots has also achieved scalable delivery of its dexterous hand products. In 2025 alone, the company delivered over 10,000 units in total.

As third-party dexterous hand manufacturers spring up and reach mass production, a sharp question emerges: Is it still necessary for robot makers to pour massive capital into in-house development?

Zhiyuan's decision to spin off its dexterous hand business offers the industry a potential new reference point.

While the trend toward specialization in the humanoid robot sector is becoming clearer, "in-house" and "outsourcing" are not simple binary opposites — a fact already proven in the smart automotive industry.

Early smart car manufacturers tended toward full-stack in-house development, attempting to control everything from chips and algorithms to vehicle assembly. However, as industry scale expanded and technological complexity increased, division of labor became the norm. In autonomous driving, for example, most automakers now partner with specialized solution providers while retaining in-house capabilities for core algorithms, resulting in a hybrid model of "in-house development plus outsourcing."

This approach allows companies to leverage external expertise to quickly fill gaps while maintaining control over core technologies to ensure product differentiation and long-term competitiveness.

For humanoid robots, the dexterous hand is a core actuator, and its performance directly impacts operational capability and scenario expansion. If robot makers rely entirely on outsourcing, they risk being held hostage by core technologies, facing slower iteration speeds, and struggling to control costs. Conversely, stubborn adherence to full in-house development could lead to missed market opportunities due to scattered resources and lengthy R&D cycles.

Image Source: AAC Technologies

"Looking at the trajectory of consumer electronics and the automotive industry, we believe the robotics sector will also move toward specialized division of labor," a representative from AAC Technologies told Gasgoo. "As industry standards form and the supply chain matures, relying on professional suppliers will become a more efficient and economical choice. This allows OEMs to focus on system integration and scenario innovation, driving rapid industry scaling."

Specifically for dexterous hands, the representative believes that as technological paths converge, differences in top-level architecture will diminish. Competition will increasingly shift to the continuous iteration of underlying technologies — such as component performance, craftsmanship, materials, cost, durability, and electronic control — areas where upstream precision manufacturers like AAC excel.

Of course, in certain high-end or highly customized scenarios, in-house development by OEMs will likely persist. But overall, collaborative supply chain relationships where each player leverages their strengths are expected to become the mainstream trend.

This suggests that going forward, robot makers will likely adopt flexible strategies for dexterous hand development based on their strategic positioning and technical reserves. The goal will be to build core moats while optimizing R&D resource allocation and accelerating time-to-market — all without sacrificing product competitiveness.

For top-tier companies with deep technical reserves and ambitious visions, maintaining tight control over dexterous hand technology will likely remain a long-term moat.

Zhiyuan's approach offers a new paradigm between "fully in-house" and "fully outsourced." It allows the dexterous hand business greater flexibility to focus on innovation and market expansion, while enabling the parent company to concentrate on integrating and optimizing the complete humanoid robot system. It achieves an organic fusion of "in-house" and "outsourced."

For the majority of startups and companies focused on specific scenarios, however, purchasing mature, market-tested third-party dexterous hands will likely prove the most efficient choice. Lingxin's orders from giants including Samsung, Siemens, Foxconn, and BYD serve as clear market validation of the value of this specialized division of labor.

Conclusion

Zhiyuan's spin-off of its dexterous hand business is a strategic exploration that balances foresight with risk — an innovative attempt to reshape the industry's division of labor.

Whether this path will succeed and evolve from a one-off case into a mainstream model remains to be seen. After all, in the early stages of an industry where technology is unproven and competition is fierce, every strategic move is a gamble on vision and courage.