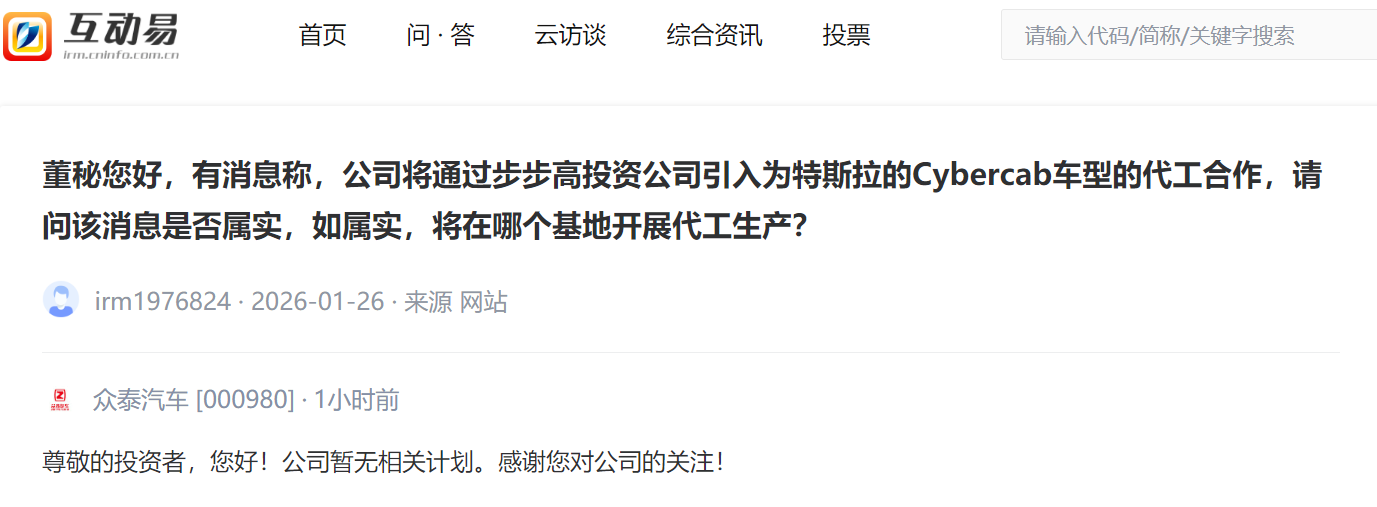

Gasgoo Munich- On February 11, Zotye Auto responded to investor queries about reports it would partner with BBK Investment to manufacture Tesla's Cybercab. The company stated on an investor platform that it has no such plans.

Image source: Screenshot from official website

Zotye Auto filed for bankruptcy liquidation in 2020 due to insolvency. A court accepted its restructuring petition in June 2021, naming Jiangsu Shenshang Holding Group as the investor in October. However, sluggish progress and a liquidity crunch have prolonged the stagnation of its vehicle assembly operations.

On January 28, Zotye released its earnings forecast for 2025, projecting a net loss attributable to shareholders of 281 million to 417 million yuan. This represents a narrowing of 58.32% to 71.91% compared to the 1 billion yuan loss recorded a year earlier.

Zotye's core operations remain suspended. The company must bear fixed costs to maintain its basic operational framework and push for a production restart. While cost-cutting has narrowed losses, Zotye has yet to find a viable path to restoring its main business.

The causes of Zotye's persistent losses are various. The company cited legacy issues that have halted its vehicle assembly sector as the primary cause. It continues to incur necessary fixed costs, such as management and financial expenses, to maintain its corporate structure and facilitate a restart.

This "suspended but maintained" state has placed Zotye in a dilemma: it cannot generate revenue without active operations, yet it cannot avoid the fixed costs that drain its cash.

For the first three quarters of 2025, Zotye generated 419 million yuan in revenue, while net profit attributable to shareholders was a negative 223 million yuan.

Despite operational losses, financial reports show positive indicators. Zotye estimates shareholders' equity at the end of the period will be between 97 million and 145 million yuan. This indicates the company's net assets have not turned negative, preserving room for future asset restructuring and business recovery.

To address this situation, Zotye is actively pushing to resume production. The company has repaid nearly 400 million yuan in debt ahead of schedule to branches of the Bank of China and China Construction Bank in Yongkang. It has also launched a large-scale recruitment drive covering design, research and development, legal affairs, and procurement.