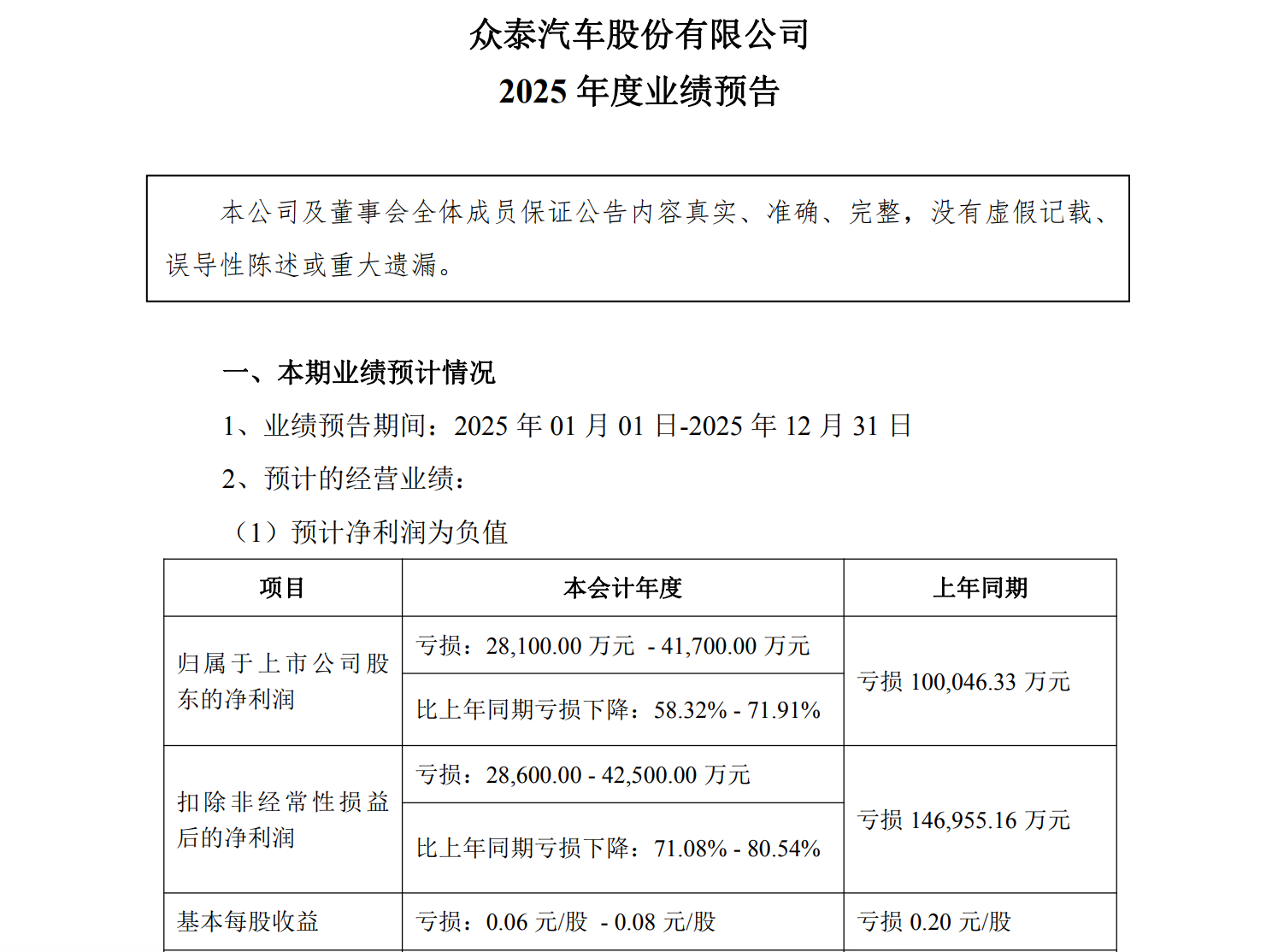

Gasgoo Munich- Zotye Auto released its 2025 performance forecast on Jan. 28, projecting a net loss attributable to shareholders of between 281 million yuan and 417 million yuan.

While the company remains in the red, the deficit has narrowed significantly compared with the 1 billion yuan loss recorded in the same period last year—a reduction of 58.32% to 71.91%.

Image source: Zotye Auto announcement

Still, Zotye’s core operations remain suspended, and the company continues to shoulder rigid costs to keep its basic structure intact and push for a production restart. This captures Zotye’s current predicament: it has narrowed losses by slashing expenses, but it has yet to find a viable path to reviving its main business.

The reasons behind Zotye’s persistent losses are complex. The filing notes that the vehicle assembly sector has largely ground to a halt due to legacy issues—identifying this as the primary driver of the deficit.

Production has been stalled since 2022 under the weight of historical burdens like debt problems and supplier disputes—issues that remain unresolved to this day.

At the same time, the automaker must continue absorbing necessary rigid fixed costs, including administrative and financial expenses, to preserve its corporate framework and facilitate a return to work.

This state of suspended operations with mandatory maintenance has trapped the company in a dilemma: it cannot generate revenue without active business, yet it is forced to pay fixed costs, perpetuating the losses.

Financial data highlights the strain: in the first three quarters of 2025, Zotye generated just 419 million yuan in revenue, while net profit attributable to shareholders came to a negative 223 million yuan.

Despite the ongoing losses in its main business, Zotye’s financial report offers a few positive signals. The company estimates that owners’ equity attributable to shareholders will sit between 97 million yuan and 145 million yuan by the end of the period. This means Zotye’s net assets have not yet turned negative, preserving some room for future asset restructuring and business recovery.

Facing these losses, Zotye is currently pushing to resume production. Recently, the automaker made early repayments on nearly 400 million yuan of debt to the Bank of China’s Yongkang branch and China Construction Bank’s Yongkang branch. Simultaneously, it has launched a large-scale recruitment drive covering design, R&D, legal affairs, and procurement.

![[Gasgoo Express] Xiaomi EV releases first Vision GT supercar concept](https://gascloud.gasgoo.com/production/2026/03/05414465-1cec-4d23-a308-c90908f26ea1-1772534888.png)