NIO Inc. Reports Unaudited First Quarter 2021 Financial Results

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer and a leading manufacturer of premium smart electric vehicles in China, today announced its unaudited financial results for the first quarter ended March 31, 2021.

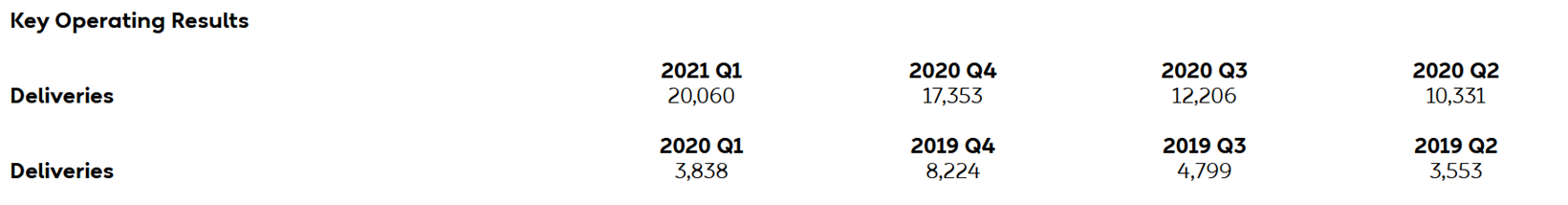

Operating Highlights for the First Quarter 2021

Deliveries of vehicles were 20,060 in the first quarter

of 2021, including 4,516 ES8s, 8,088 ES6s and 7,456 EC6s, representing

an increase of 422.7% from the first quarter of 2020 and an increase of

15.6% from the fourth quarter of 2020.

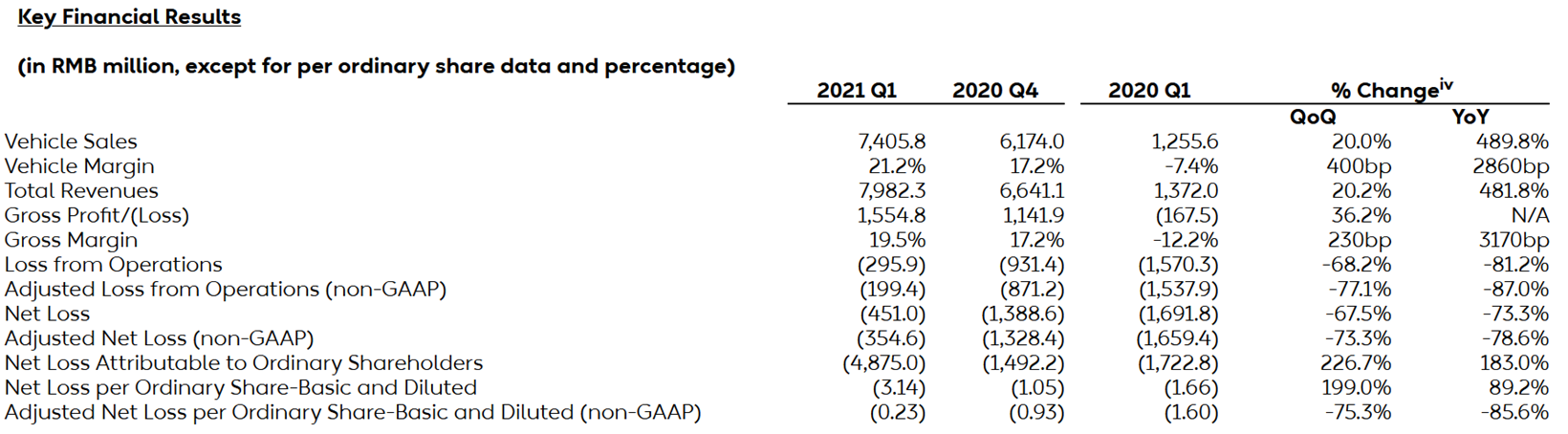

Financial Highlights for the First Quarter of 2021

Vehicle sales were RMB7,405.8 million (US$1,130.3 million) in the first quarter of 2021, representing an increase of 489.8% from the first quarter of 2020 and an increase of 20.0% from the fourth quarter of 2020.

Vehicle marginii was 21.2%, compared with negative 7.4% in the first quarter of 2020 and 17.2% in the fourth quarter of 2020.

Total revenues were RMB7,982.3 million (US$1,218.3 million) in the first quarter of 2021, representing an increase of 481.8% from the first quarter of 2020 and an increase of 20.2% from the fourth quarter of 2020.

Gross profit was RMB1,554.8 million (US$237.3 million) in the first quarter of 2021, representing an increase of RMB1,722.3 million from a gross loss of RMB167.5 million in the first quarter of 2020 and an increase of 36.2% from the fourth quarter of 2020.

Gross margin was 19.5%, compared with negative 12.2% in the first quarter of 2020 and 17.2% in the fourth quarter of 2020.

Loss from operations was RMB295.9 million (US$45.2 million) in the first quarter of 2021, representing a decrease of 81.2% from the first quarter of 2020 and a decrease of 68.2% from the fourth quarter of 2020. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB199.4 million (US$30.4 million) in the first quarter of 2021, representing a decrease of 87.0% from the first quarter of 2020 and a decrease of 77.1% from the fourth quarter of 2020.

Net loss was RMB451.0 million (US$68.8 million) in the first quarter of 2021, representing a decrease of 73.3% from the first quarter of 2020 and a decrease of 67.5% from the fourth quarter of 2020. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB 354.6 million (US$54.1 million) in the first quarter of 2021, representing a decrease of 78.6% from the first quarter of 2020 and a decrease of 73.3% from the fourth quarter of 2020.

Net loss attributable to NIO’s ordinary shareholders was RMB4,875.0 million (US$744.1 million) in the first quarter of 2021, representing an increase of 183.0% from the first quarter of 2020 and an increase of 226.7% from the fourth quarter of 2020. In the first quarter of 2021, NIO purchased 3.305% equity interests in NIO China from the minority strategic investors and recorded an amount of RMB4.4 billion (US$671.6 million) in accretion on redeemable non-controlling interests to redemption value. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB354.5 million (US$54.1 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB3.14 (US$0.48) in the first quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB0.23 (US$0.04).

Cash and cash equivalents, restricted cash and short-term investment were RMB47.5 billion (US$7.3 billion) as of March 31, 2021.

“NIO started the year of 2021 with a new quarterly delivery record of 20,060 vehicles in the first quarter, representing a strong growth of 422.7% year over year,” said William Bin Li, founder, chairman and chief executive officer of NIO. “The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortage. In light of the strong momentum under a volatile macro environment, we expect to deliver 21,000 to 22,000 vehicles in the second quarter of 2021.”

“In April, we celebrated the 100,000th production vehicle rolling off the line together with our users and partners. Meanwhile, we started to deploy our Power Swap stations 2.0, which could significantly boost the service capacity of each station to maximum 312 times per day by shortening the battery swapping time to under three minutes. In addition, to improve the swapping and charging experience of underserved users in North China, we announced the Power North plan at the Shanghai Auto Show. We have always been committed to providing a superior holistic EV experience to our users with better products and services.

“At the same time, we have also accelerated the research and development of new products and technologies. To ensure sufficient production capacity for our upcoming products, together with our partners, we have kicked off the planning and building of a new plant in Xinqiao Industrial Park in Hefei,” concluded Mr. Li.

“We have achieved another great quarter with strong financial performance in the first quarter of 2021. Mainly driven by higher deliveries and solid average selling price, our vehicle margin reached 21.2% in the first quarter. Moreover, we continued to achieve positive cash flow from operating activities for the first quarter of 2021,” added Steven Wei Feng, NIO’s chief financial officer. “Going forward, we will continue to invest in new products and core technologies, as well as in our service and power network expansion, particularly battery swapping and charging facilities.”

Financial Results for the First Quarter of 2021

Revenues

Total revenues

in the first quarter of 2021 were RMB7,982.3 million (US$1,218.3

million), representing an increase of 481.8% from the first quarter of

2020 and an increase of 20.2% from the fourth quarter of 2020.

Vehicle sales in the first quarter of 2021 were RMB7,405.8 million (US$1,130.3 million), representing an increase of 489.8% from the first quarter of 2020 and an increase of 20.0% from the fourth quarter of 2020. The increase in vehicle sales over the first quarter of 2020 was mainly attributed to higher deliveries achieved from more product mix offered to our users, the expansion of our sales network since 2020, and the slow-down of vehicle sales in the first quarter of 2020 due to COVID-19 pandemic in China. The increase in vehicle sales over the fourth quarter of 2020 was mainly due to higher deliveries and higher average selling price.

Other sales in

the first quarter of 2021 were RMB576.5 million (US$88.0 million),

representing an increase of 395.3% from the first quarter of 2020 and an

increase of 23.4% from the fourth quarter of 2020. The increase in

other sales over the first quarter of 2020 was in line with the

incremental vehicle sales in the first quarter of 2021. The increase in

other sales over the fourth quarter of 2020 was mainly due to the

increased revenues derived from 100kWh battery permanent upgrade service

provided since December 2020, partially offset by sales of automotive

regulatory credits in the fourth quarter of 2020.

Cost of Sales and Gross Margin

Cost of sales

in the first quarter of 2021 was RMB6,427.5 million (US$981.0 million),

representing an increase of 317.5% from the first quarter of 2020 and

an increase of 16.9% from the fourth quarter of 2020. The increase in

cost of sales over the first quarter of 2020 and the fourth quarter of

2020 was in line with revenue growth, which was mainly driven by the

increase of vehicle delivery volume in the first quarter of 2021.

Gross Profit in

the first quarter of 2021 was RMB1,554.8 million (US$237.3 million),

representing an increase of RMB1,722.3 million from a gross loss of

RMB167.5 million in the first quarter of 2020 and an increase of 36.2%

from the fourth quarter of 2020.

Gross margin

in the first quarter of 2021 was 19.5%, compared with negative 12.2% in

the first quarter of 2020 and 17.2% in the fourth quarter of 2020. The

increase of gross margin compared to the first quarter of 2020 and the

fourth quarter of 2020 was mainly driven by the increase of vehicle

margin in the first quarter of 2021.

Vehicle margin

in the first quarter of 2021 was 21.2%, compared with negative 7.4% in

the first quarter of 2020 and 17.2% in the fourth quarter of 2020. The

increase of vehicle margin compared to the first quarter of 2020 was

mainly driven by the increase of vehicle delivery volume, higher average

selling price, as well as lower material cost. The increase of vehicle

margin compared to the fourth quarter of 2020 was mainly attributed to

higher take-rate of NIO Pilot and 100 kWh battery package.

Operating Expenses

Research and development expenses

in the first quarter of 2021 were RMB686.5 million (US$104.8 million),

representing an increase of 31.4% from the first quarter of 2020 and a

decrease of 17.2% from the fourth quarter of 2020. Excluding share-based

compensation expenses (non-GAAP), research and development expenses

were RMB650.0 million (US$99.2 million), representing an increase of

26.4% from the first quarter of 2020 and a decrease of 19.9% from the

fourth quarter of 2020. The increase of research and development

expenses over the first quarter of 2020 was mainly attributed to less

research and development activities in the first quarter of 2020 due to

COVID-19 pandemic in China. The decrease in research and development

expenses over the fourth quarter of 2020 reflected fluctuations due to

different design and development stages of new products and core

technologies.

Selling, general and administrative expenses in the first quarter of 2021 were RMB1,197.2 million (US$182.7 million), representing an increase of 41.1% from the first quarter of 2020 and a decrease of 0.8% from the fourth quarter of 2020. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB1,140.9 million (US$174.1 million), representing an increase of 38.3% from the first quarter of 2020 and a decrease of 2.2% from the fourth quarter of 2020. The increase in selling, general and administrative expenses over the first quarter of 2020 was primarily due to the increased marketing activities as well as the increased number of employees in sales and service functions in the first quarter of 2021. Selling, general and administrative expenses remained relatively stable compared to the fourth quarter of 2020.

Loss from Operations

Loss from operations

in the first quarter of 2021 was RMB295.9 million (US$45.2 million),

representing a decrease of 81.2% from the first quarter of 2020 and a

decrease of 68.2% from the fourth quarter of 2020. Excluding share-based

compensation expenses, adjusted loss from operations (non-GAAP) was

RMB199.4 million (US$30.4 million) in the first quarter of 2021,

representing a decrease of 87.0% from the first quarter of 2020 and a

decrease of 77.1% from the fourth quarter of 2020.

Share-based Compensation Expenses

Share-based

compensation expenses in the first quarter of 2021 were RMB96.5 million

(US$14.7 million), representing an increase of 198.1% from the first

quarter of 2020 and an increase of 60.3% from the fourth quarter of

2020. The increase in share-based compensation expenses over the first

quarter of 2020 and the fourth quarter of 2021 was primarily attributed

to incremental options granted with relatively higher grant date fair

values during the period.

Net Loss and Earnings Per Share

Net loss

was RMB451.0 million (US$68.8 million) in the first quarter of 2021,

representing a decrease of 73.3% from the first quarter of 2020 and a

decrease of 67.5% from the fourth quarter of 2020. Excluding share-based

compensation expenses, adjusted net loss (non-GAAP) was RMB354.6

million (US$54.1 million) in the first quarter of 2021, representing a

decrease of 78.6% from the first quarter of 2020 and a decrease of 73.3%

from the fourth quarter of 2020.

Net loss attributable to NIO’s ordinary shareholders

in the first quarter of 2021 was RMB 4,875.0 million (US$744.1

million), representing an increase of 183.0% from the first quarter of

2020 and an increase of 226.7% from the fourth quarter of 2020. In the

first quarter of 2021, NIO purchased 3.305% equity interests in NIO

China from the minority strategic investors and recorded an amount of

RMB4.4 billion (US$671.6 million) in accretion on redeemable

non-controlling interests to redemption value. Excluding share-based

compensation expenses and accretion on redeemable non-controlling

interests to redemption value, adjusted net loss attributable to NIO’s

ordinary shareholders (non-GAAP) was RMB354.5 million (US$54.1 million)

in the first quarter of 2021.

Basic and diluted net loss per ADS in

the first quarter of 2021 were both RMB3.14 (US$0.48). Excluding

share-based compensation expenses and accretion on redeemable

non-controlling interests to redemption value, adjusted basic and

diluted net loss per ADS (non-GAAP) were both RMB0.23 (US$0.04).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB 47.5 billion (US$7.3 billion) as of March 31, 2021.

Business Outlook

For the second quarter of 2021, the Company expects:

Deliveries of the vehicles

to be between 21,000 and 22,000 vehicles, representing an increase of

approximately 103% to 113% from the same quarter of 2020, and an

increase of approximately 5% to 10% from the first quarter of 2021.

Total revenues

to be between RMB 8,146.1 million (US$1,243.3 million) and RMB8,504.5

million (US$1,298.0 million), representing an increase of approximately

119.0% to 128.7% from the same quarter of 2020, and an increase of

approximately 2.1% to 6.5% from the first quarter of 2021.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com