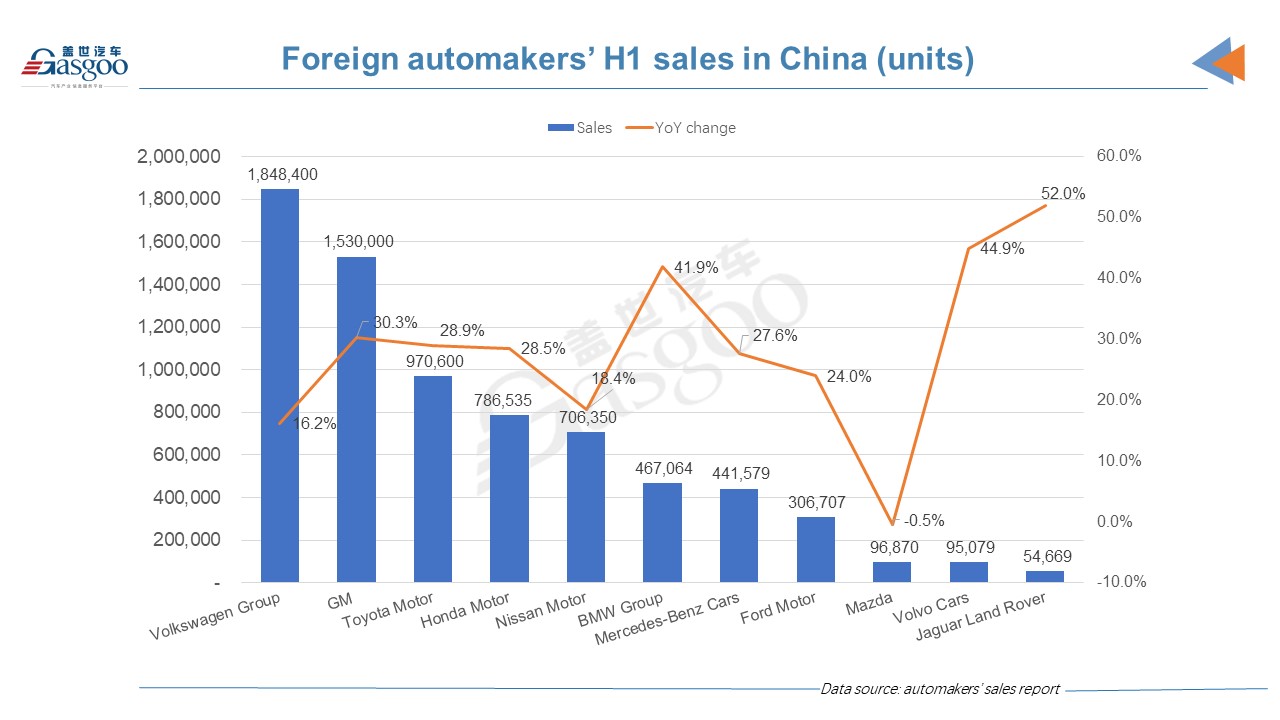

Most major foreign automakers achieved double-digit growth in their first-half sales in China, and Volkswagen Group (VW Group) and General Motors (GM) still had obvious lead over other players.

Among all the major automakers, VW Group and GM each sold more than 1.5 million new vehicles in the biggest auto market, and Toyota Motor was a distant third. Jaguar Land Rover reported the highest year-on-year growth rate while Mazda was the only one whose sales saw a decline from a year ago.

Besides, the year-on-year change of three automakers, including Mazda, was lower than that of the overall passenger vehicle market, which, according to the China Association of Automobile Manufacturers (CAAM), was 27%.

VW Group is one of the three. Compared with the same period of last year, when the market was negatively affected by COVID-19, the group’s first-half sales in China increased by 16.2%, nearly 11 percentage points less than the overall rate.

VW brand remained the main sales contributor, which, along with its JETTA sub-brand, delivered over 1,331,900 vehicles (+14.0%) during the first half of 2021, remaining the number one choice for Chinese car buyers. Skoda, another mainstream brand from the group, sold 44,000 vehicles in the period. In the premium segment, both Audi and Porsche set new sales records, achieving their highest ever H1 sales.

GM also said luxury and premium vehicles were main sales drivers in the second quarter. First-half deliveries of its premium brand, Cadillac, grew nearly 42% year on year to nearly 121,000 units. Wuling, the maker of the Hongguang MINIEV, sold a total of 693,000 vehicles in the period.

Apart from the above luxury vehicle brands, other brands on the list Gasgoo compiled achieved substantial growth rate. BMW Group (BMW and MINI brands) won the segment’s champion with an increase of 41.9% versus the same period of last year, higher than that of Mercedes-Benz Cars (27.6%).

Among those luxury brands, Lincoln’s year-on-year growth was up to 111.4% with 42,295 vehicles sold in the first half. And that is the best-ever first-half sales results since the brand’s entry in the country.

Because all those major luxury brands had outstanding sales performance in the first six months, the whole luxury vehicle segment outpaced the entire passenger vehicle market in terms of sales. Data from the CAAM showed that sales of luxury vehicles brands jumped 41.5% from a year ago to 1.658 million vehicles in the period, 14.5 percentage points more than that of the passenger vehicle market.

There were also some challenges facing the whole industry, such as the shortage of automotive chips and surging material prices. Foreign automakers were no exception. VW China said that chip shortage made it unable to match production and higher customer demand. Ford China also said that due to the shortage challenge, its sales in the second quarter of this year fell 3.6% year on year.

Despite those foreign automakers’ first-half sales growth, their market shares in China all declined versus the same period of last year, except that of French brands, which was only 0.4%. Share of Germany brands dropped to 22.7%, Japanese brands to 22%, American brands to 9.1% while that of Chinese passenger vehicle brands increased 5.7 percentage points to 42%.