Rankings of electrification component suppliers in China (Jan.-Oct. 2025): Market leadership consolidated

According to data compiled by the Gasgoo Automotive Research Institute, from January to October 2025, China’s new energy vehicle (NEV) passenger vehicle electrification core component supply chain showed a clear trend of high market concentration and stronger OEM self-sufficiency. In key segments such as power battery, OBC, and electrical compressor, leading suppliers continued to take a dominant share of the market. FinDreams-affiliated companies maintained leadership across multiple categories, while CATL retained a strong competitive edge in power batteries and BMS-related segments.

The localization process continues to advance. In the electric drive motor and electric motor controller segments, INOVANCE Automotive and Huawei Digital Power have become key choices for multiple automakers thanks to their strong technological versatility. Overall, leading suppliers dominate the mainstream market on the back of scale and technology advantages, while smaller players can still find opportunities by building differentiated capabilities in specific niche segments.

Industry development is also moving toward system-level integration, making cross-component technological integration capabilities increasingly critical for suppliers. Automakers are pursuing greater control over core components while continuing to collaborate with external partners, whereas suppliers compete for market share through technological strength or focused niche strategies. Together, these dynamics are shaping an ecosystem characterized by ongoing evolution, where competition and cooperation coexist.

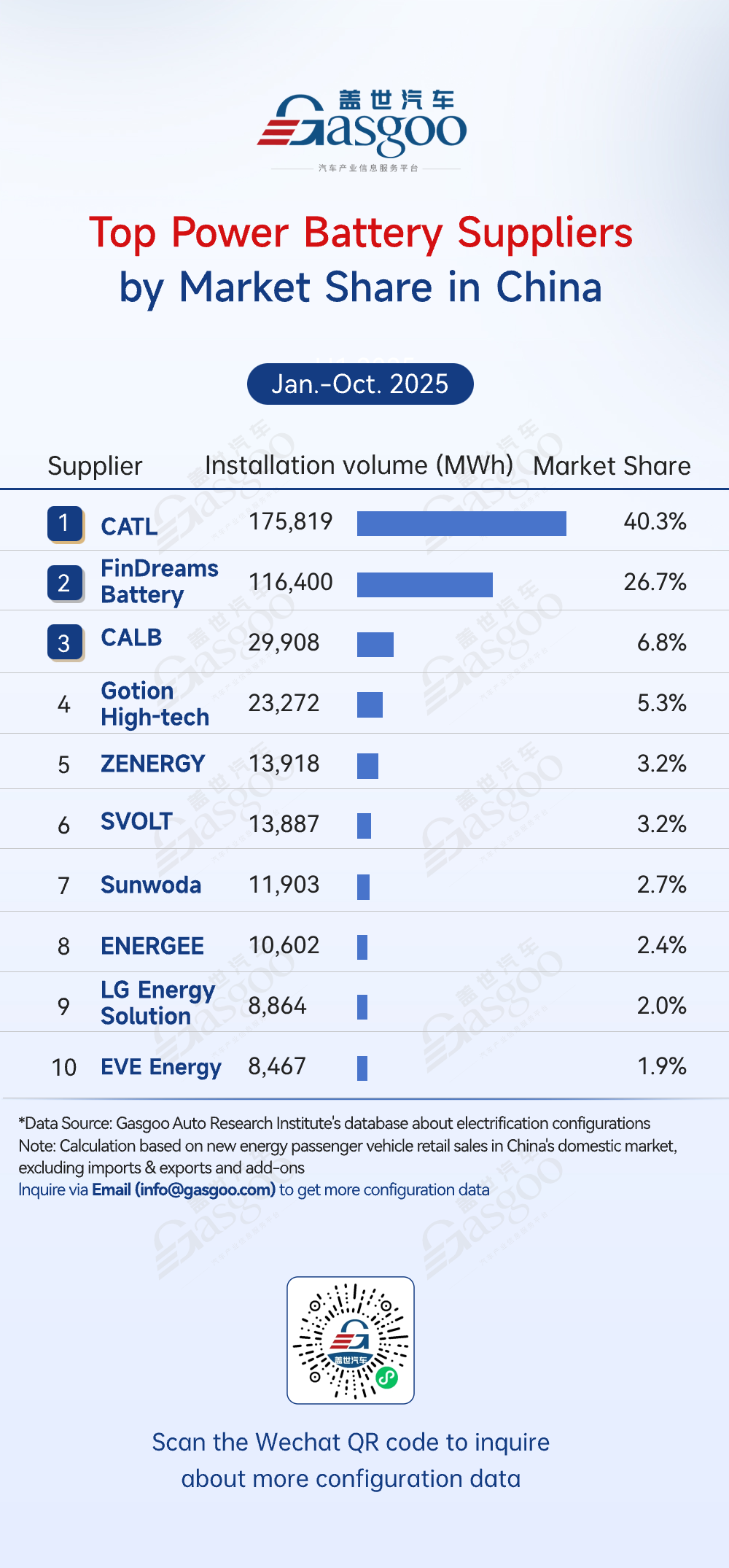

Top power battery suppliers

CATL: 175,819 MWh installed, 40.3% market share

FinDreams Battery: 116,400 MWh installed, 26.7% market share

CALB: 29,908 MWh installed, 6.8% market share

Gotion High-tech: 23,272 MWh installed, 5.3% market share

ZENERGY: 13,918 MWh installed, 3.2% market share

SVOLT: 13,887 MWh installed, 3.2% market share

Sunwoda: 11,903 MWh installed, 2.7% market share

ENERGEE: 10,602 MWh installed, 2.4% market share

LG Energy Solution: 8,864 MWh installed, 2.0% market share

EVE Energy: 8,467 MWh installed, 1.9% market share

From January to October 2025, the power battery market maintained a "top-heavy, tiered" structure. CATL led the pack with 175,819 MWh installed, holding a 40.3% market share, followed by FinDreams Battery with 116,400 MWh and 26.7%. Together, the top two accounted for nearly 67% of the market. The second tier included CALB (6.8%), Gotion High-tech (5.3%), and ZENERGY (3.2%), each holding 3–7% share. The third tier, including SVOLT (3.2%) and Sunwoda (2.7%), competed in niche segments. Overall, the top five suppliers collectively captured 82% of the market, highlighting a strong concentration trend.

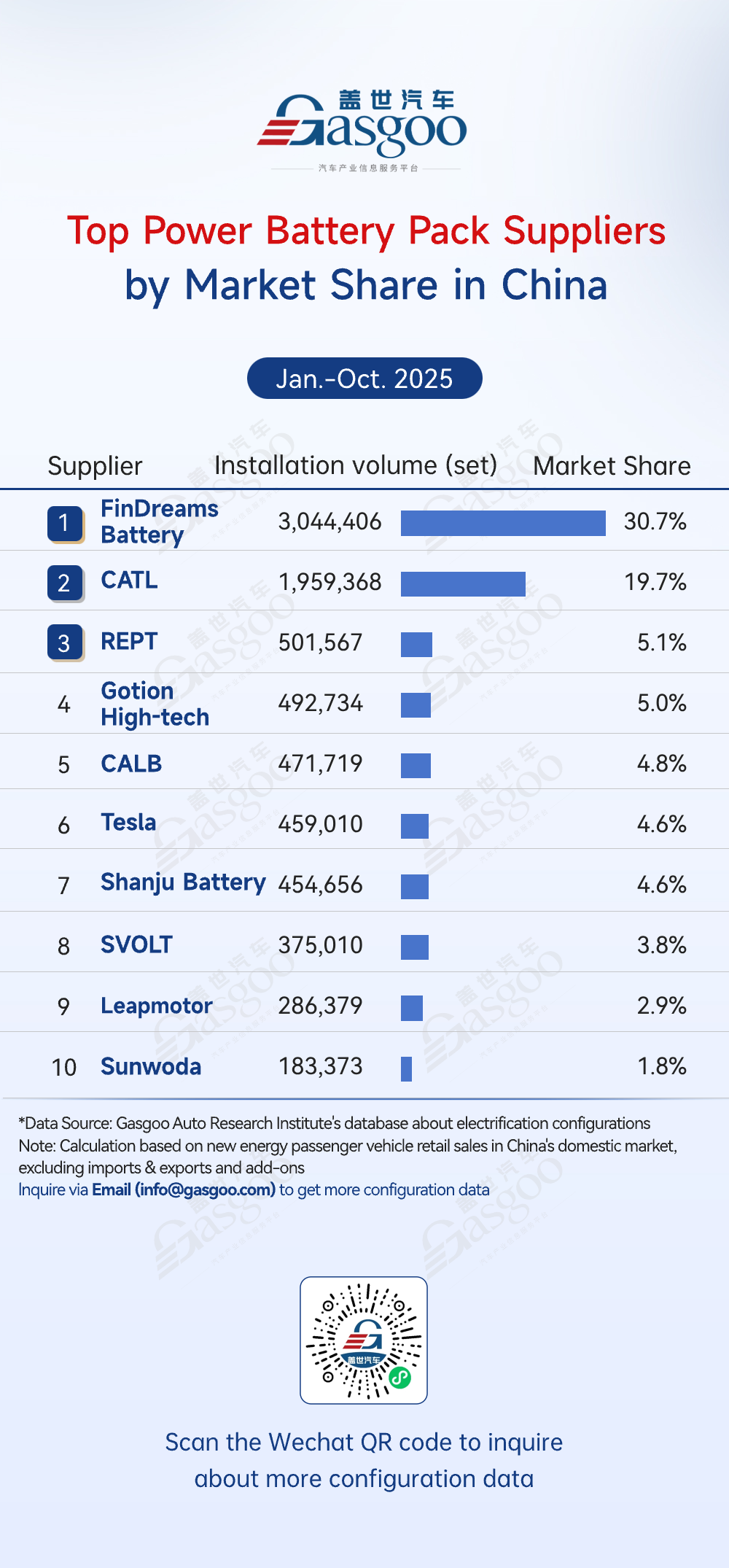

Top power battery pack suppliers

FinDreams Battery: 3,044,406 sets installed, 30.7% market share

CATL: 1,959,368 sets installed, 19.7% market share

REPT: 501,567 sets installed, 5.1% market share

Gotion High-tech: 492,734 sets installed, 5.0% market share

CALB: 471,719 sets installed, 4.8% market share

Tesla: 459,010 sets installed, 4.6% market share

Shanju Battery: 454,656 sets installed, 4.6% market share

SVOLT: 375,010 sets installed, 3.8% market share

Leapmotor: 286,379 sets installed, 2.9% market share

Sunwoda: 183,373 sets installed, 1.8% market share

From January to October 2025, vehicle OEMs' self-produced power battery packs dominated the market. FinDreams Battery led with 3,044,406 sets installed, holding a 30.7% market share, while Tesla entered the top 6. Together, FinDreams Battery and CATL accounted for 50.4% of the market. FinDreams leveraged BYD's production scale for high installations, whereas CATL maintained its position through multi-brand partnerships. Tiered competition was evident: mid- and small-sized suppliers, including REPT and Gotion High-tech, captured 1.8–5.1% each, forming a clear second tier alongside manufacturer-linked suppliers such as Shanju Battery and Leapmotor.

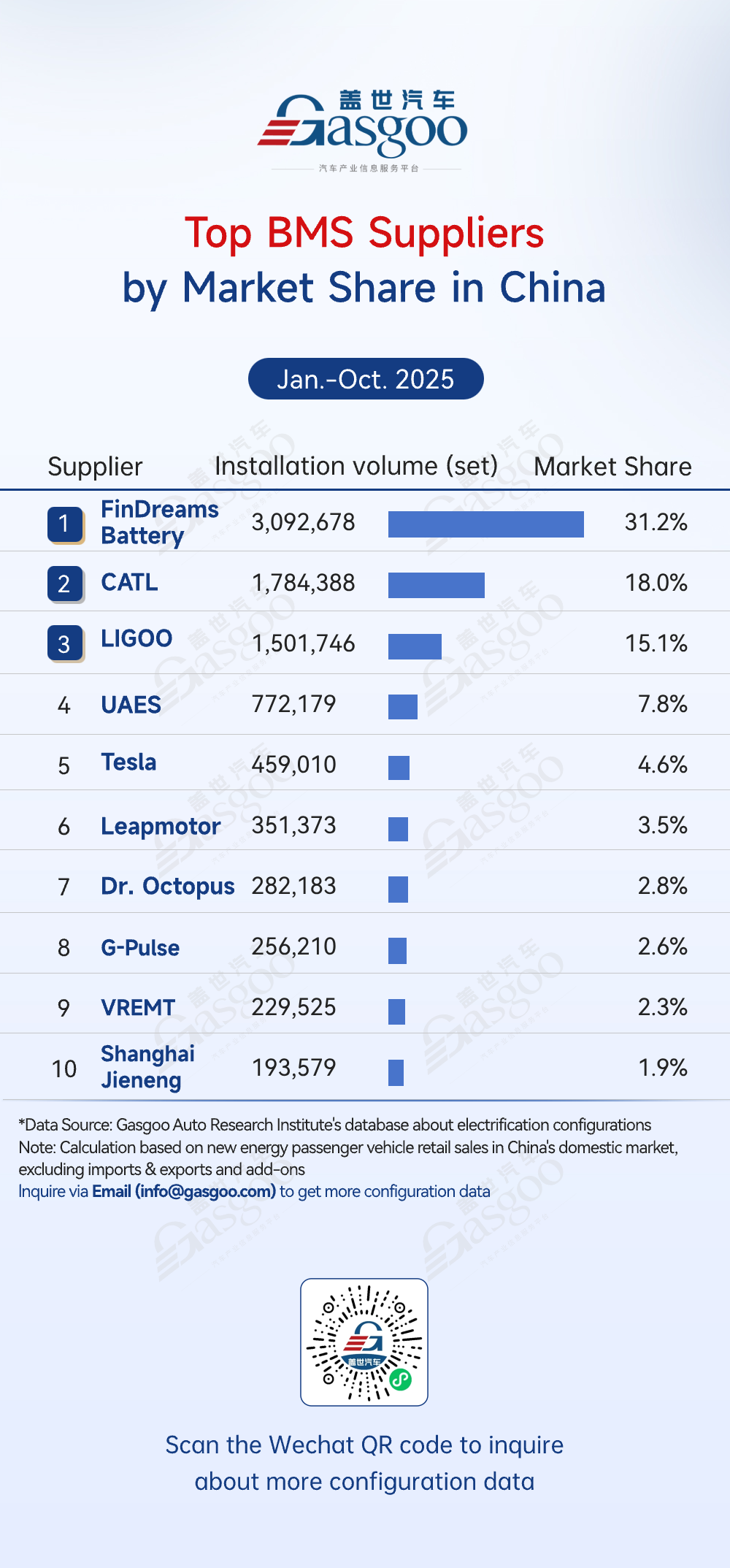

Top BMS suppliers

FinDreams Battery: 3,092,678 sets installed, 31.2% market share

CATL: 1,784,388 sets installed, 18.0% market share

LIGOO: 1,501,746 sets installed, 15.1% market share

UAES: 772,179 sets installed, 7.8% market share

Tesla: 459,010 sets installed, 4.6% market share

Leapmotor: 351,373 sets installed, 3.5% market share

Dr. Octopus: 282,183 sets installed, 2.8% market share

G-Pulse: 256,210 sets installed, 2.6% market share

VREMT: 229,525 sets installed, 2.3% market share

Shanghai Jieneng: 193,579 sets installed, 1.9% market share

From January to October 2025, FinDreams Battery led the BMS market with a 31.2% share. OEMs such as Tesla and Leapmotor also entered the top 10 with self-developed BMS, reflecting a trend of manufacturers taking technological control through in-house solutions. FinDreams and CATL leveraged integrated "battery + BMS" capabilities to secure key clients, while LIGOO's versatile technology and multi-brand partnerships positioned it as the leading third-party supplier. The fourth to tenth ranked suppliers held 1.9–7.8% each, highlighting a pronounced tiered structure.

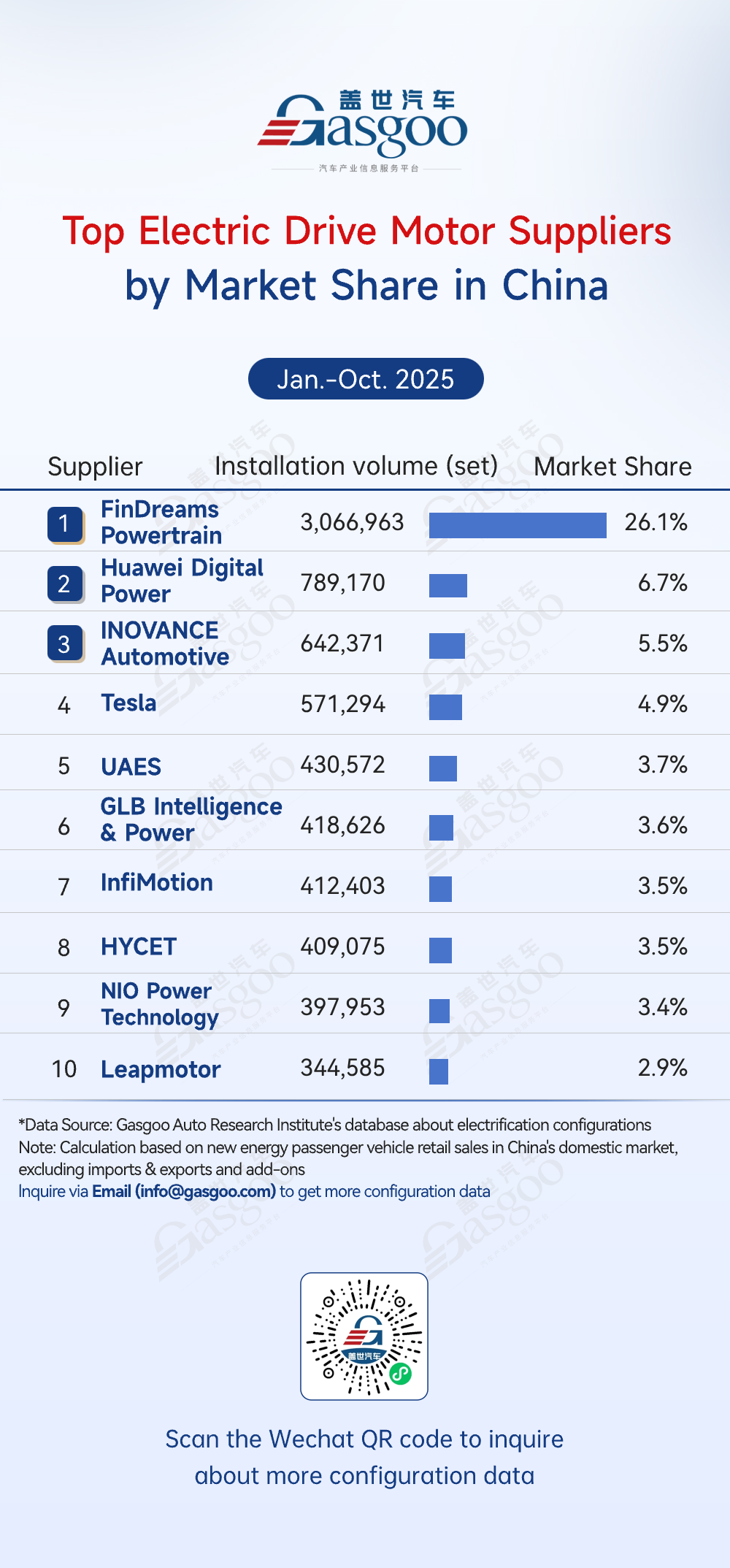

Top electric drive motor suppliers

FinDreams Powertrain: 3,066,963 sets installed, 26.1% market share

Huawei Digital Power: 789,170 sets installed, 6.7% market share

INOVANCE Automotive: 642,371 sets installed, 5.5% market share

Tesla: 571,294 sets installed, 4.9% market share

UAES: 430,572 sets installed, 3.7% market share

GLB Intelligence & Power: 418,626 sets installed, 3.6% market share

InfiMotion: 412,403 sets installed, 3.5% market share

HYCET: 409,075 sets installed, 3.5% market share

NIO Power Technology: 397,953 sets installed, 3.4% market share

Saike Tech: 344,585 sets installed, 2.9% market share

From January to October 2025, FinDreams Powertrain established a clear lead in the drive motor market, holding a 26.1% share—far ahead of second-ranked Huawei Digital Power with 6.7%. Huawei Digital Power and INOVANCE Automotive formed the second tier, but their combined share was only 12.2%. Tesla, UAES, and other players each held less than 5%, with minimal differences among them. The ranking includes both OEM in-house developers, such as FinDreams Powertrain, Tesla, and NIO Power Technology, and specialized suppliers like Huawei Digital Power and INOVANCE Automotive, reflecting the dual model of "OEM self-supply plus open external sourcing" in the drive motor sector.

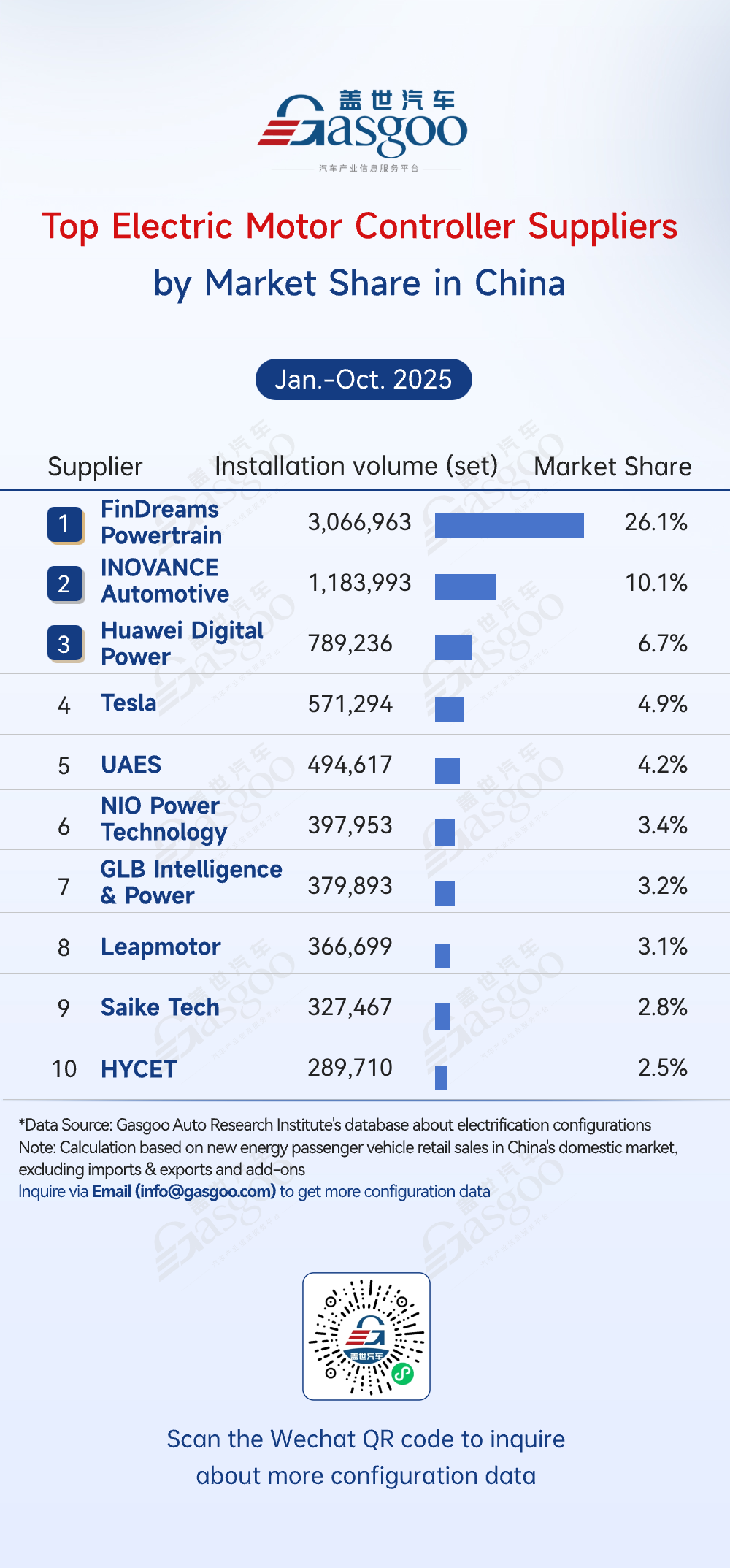

Top electric motor controller suppliers

FinDreams Powertrain: 3,066,963 sets installed, 26.1% market share

INOVANCE Automotive: 1,183,993 sets installed, 10.1% market share

Huawei Digital Power: 789,236 sets installed, 6.7% market share

Tesla: 571,294 sets installed, 4.9% market share

UAES: 494,617 sets installed, 4.2% market share

NIO Power Technology: 397,953 sets installed, 3.4% market share

GLB Intelligence & Power: 379,893 sets installed, 3.2% market share

Leapmotor: 366,699 sets installed, 3.1% market share

Saike Tech: 327,467 sets installed, 2.8% market share

HYCET: 289,710 sets installed, 2.5% market share

FinDreams Powertrain led the electric motor controller market for the Jan.–Oct. 2025 period with a 26.1% share. Tesla, NIO Power Technology, and Leapmotor also entered the top 10, reflecting OEMs' push for self-developed controllers to boost system compatibility and tech barriers. FinDreams, INOVANCE, and Huawei Digital Power together held 42.9%, forming the first tier, while ranks 4–10 each held 2.5%–4.9%. Overall, OEM self-sufficiency is high, limiting space for third-party suppliers.

Top suppliers of power semiconductor device (dedicated to e-drive)

BYD Semiconductor: 3,063,224 sets installed, 26.1% market share

CRRC Times Semiconductor: 1,553,524 sets installed, 13.2% market share

United Nova Technology: 1,041,674 sets installed, 8.9% market share

Silan Microelectronics: 953,536 sets installed, 8.1% market share

Infineon: 806,848 sets installed, 6.9% market share

StarPower Semiconductor: 731,945 sets installed, 6.2% market share

UAES: 594,674 sets installed, 5.1% market share

STMicroelectronics: 586,800 sets installed, 5.0% market share

AccoPower Semiconductor: 278,039 sets installed, 2.4% market share

MACMIC: 175,114 sets installed, 1.5% market share

BYD Semiconductor led the power semiconductor device (dedicated to e-drive) market for the Jan.–Oct. 2025 period with a 26.1% share, driven by its deep integration with BYD vehicles, highlighting OEMs' demand for vertical supply chain control. China's local suppliers CRRC Times Semiconductor, United Nova Technology, and Silan Microelectronics joined the top 5 with a combined 30.2% share, reflecting significant progress in local substitution. Traditional foreign players Infineon and STMicroelectronics held 6.9% and 5.0%, respectively.

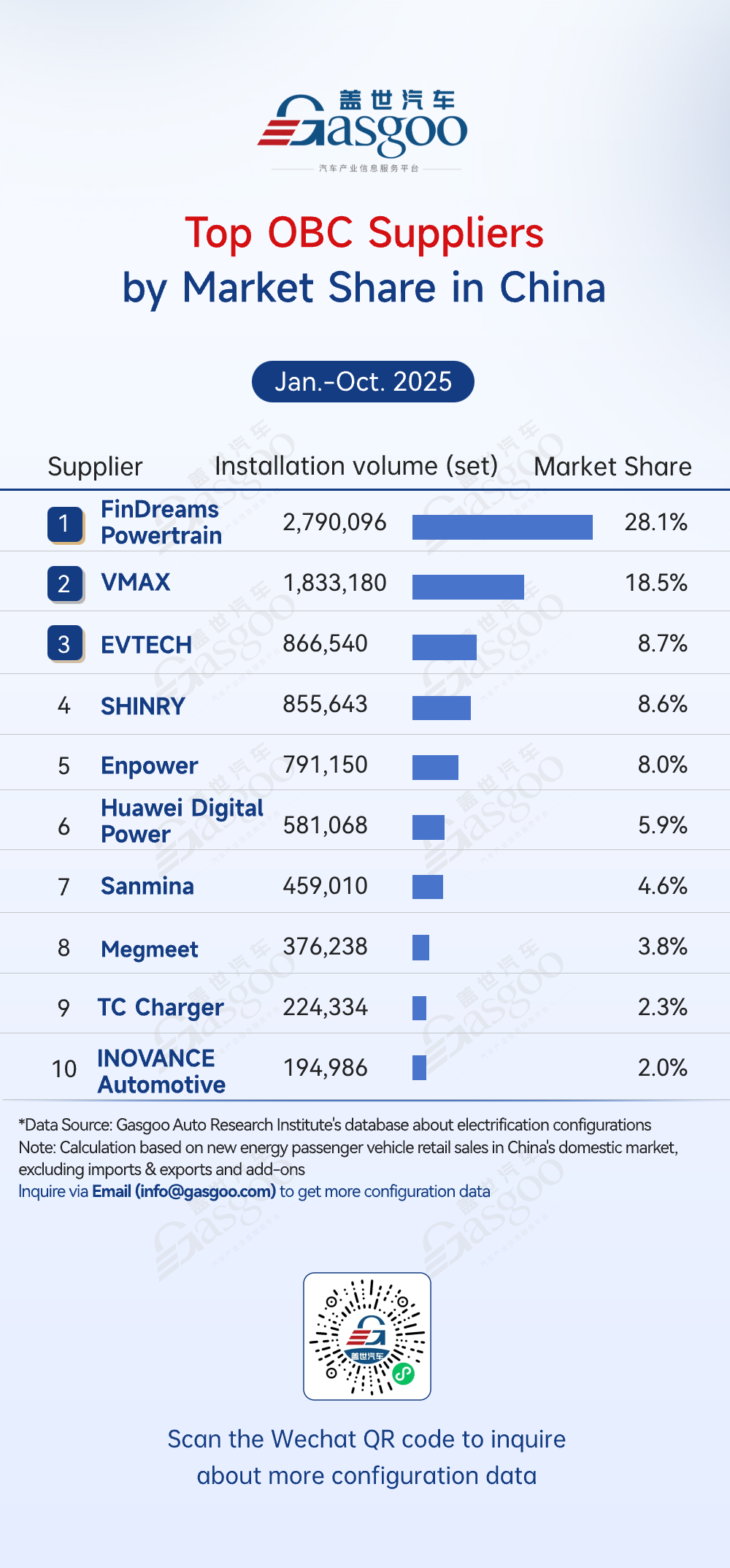

Top OBC suppliers

FinDreams Powertrain: 2,790,096 sets installed, 28.1% market share

VMAX: 1,833,180 sets installed, 18.5% market share

EVTECH: 866,540 sets installed, 8.7% market share

SHINRY: 855,643 sets installed, 8.6% market share

Enpower: 791,150 sets installed, 8.0% market share

Huawei Digital Power: 581,068 sets installed, 5.9% market share

Sanmina: 459,010 sets installed, 4.6% market share

Megmeet: 376,238 sets installed, 3.8% market share

TC Charger: 224,334 sets installed, 2.3% market share

INOVANCE Automotive: 194,986 sets installed, 2.0% market share

The OBC market in China showed a "dual-leader dominance with high concentration" pattern for the Jan.–Oct. 2025 period, with the top 5 suppliers accounting for 72% of total installations. FinDreams Powertrain led the pack with 2.79 million sets installed (28.1% share), followed by VMAX at 18.5%. Specialized suppliers such as EVTECH and SHINRY ranked next, leveraging technology versatility to serve multiple OEMs and acting as key complementary players. Suppliers ranked sixth to tenth each held less than 6%, indicating that the remaining market is fragmented and largely focused on specific models or niche customers.

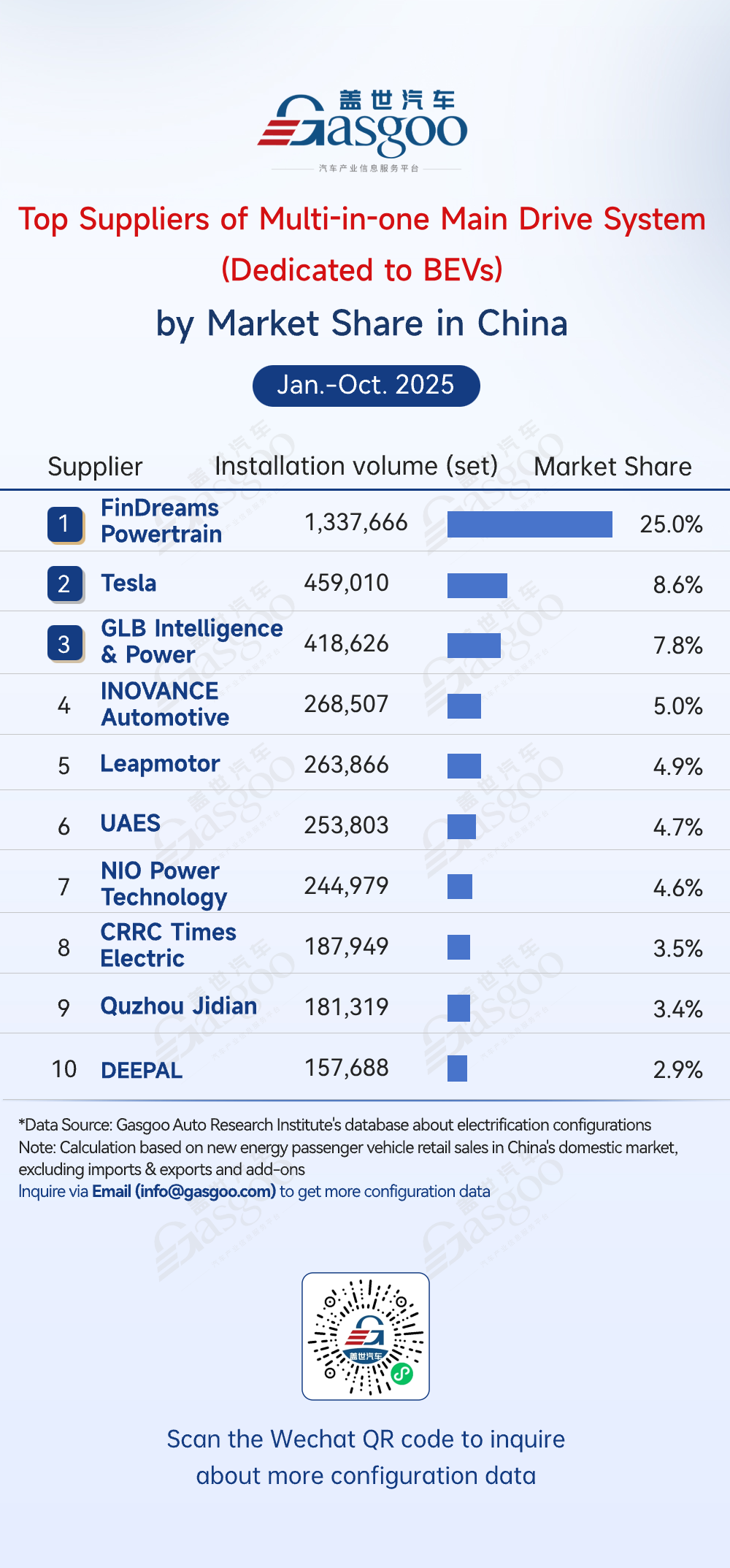

Top suppliers of multi-in-one main drive system (dedicated to BEVs)

FinDreams Powertrain: 1,337,666 sets installed, 25.0% market share

Tesla: 459,010 sets installed, 8.6% market share

GLB Intelligence & Power: 418,626 sets installed, 7.8% market share

INOVANCE Automotive: 268,507 sets installed, 5.0% market share

Leapmotor: 263,866 sets installed, 4.9% market share

UAES: 253,803 sets installed, 4.7% market share

NIO Power Technology: 244,979 sets installed, 4.6% market share

CRRC Times Electric: 187,949 sets installed, 3.5% market share

Quzhou Jidian: 181,319 sets installed, 3.4% market share

DEEPAL: 157,688 sets installed, 2.9% market share

The multi-in-one main drive system (dedicated to BEVs) market in China was highly concentrated and dominated by OEM self-supply for the Jan.–Oct. 2025 period. FinDreams Powertrain took the leaf with a 25.0% share, while Tesla, Leapmotor, and NIO Power Technology also ranked in the top 10, reflecting OEMs' preference for in-house development to control performance and cost. Specialized suppliers such as GLB Intelligence & Power and INOVANCE Automotive followed, but with significantly smaller shares.

Top electrical compressor suppliers

FinDreams Technology: 2,633,496 sets installed, 26.5% market share

Sanden Hasco: 1,659,918 sets installed, 16.7% market share

Aotecar: 1,323,093 sets installed, 13.3% market share

Welling: 875,046 sets installed, 8.8% market share

Highly: 712,439 sets installed, 7.2% market share

ZonCen New Energy: 607,714 sets installed, 6.1% market share

Chongqing Chaoli High-Tech: 256,742 sets installed, 2.6% market share

SANDEN: 229,505 sets installed, 2.3% market share

Hanon Systems: 212,872 sets installed, 2.1% market share

Wilo: 193,574 sets installed, 1.9% market share

From January to October 2025, the electrical compressor market remained highly concentrated, with the top 5 suppliers accounting for 73% of total installations. FinDreams Technology led the market with a 26.5% share, driven by strong volumes from BYD models and reflecting the advantages of OEM vertical integration. Professional suppliers such as Sanden Hasco and Aotecar ranked among the top players, leveraging mature technologies and multi-OEM partnerships. Suppliers ranked sixth to tenth each held less than 7% share, highlighting a long-tail market structure. Overall, entry barriers at the top are well established, and smaller players will need technological differentiation or closer ties with emerging OEMs to secure growth opportunities.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com