China's automotive industry is undergoing a profound transformation: the very definition of a car has shifted from a transportation tool to a smart home on wheels. This evolution is far more than a simple accumulation of features—it represents a fundamental rewrite of the industry's underlying logic, engineering architecture, supply chain ecosystem, and service model.

In this edition of Tina's Talk, we explore a central question: What does this new definition of the "smart home on wheels" truly mean for the automotive industry?

And more importantly, what new, certain opportunities will it unlock for the supply chain and service ecosystem?

1. The Logic of Automotive Product Design Has Been Completely Rewritten

The traditional logic of automotive product development has always been straightforward: everything revolves around the vehicle's core functional performance—primarily focusing on powertrain, chassis, safety, NVH, electrification systems, and intelligent driving capabilities.

However, once the concept of the "smart home on wheels" enters the equation, the criteria for evaluating a car undergo a structural shift. It is no longer just about "how well the car drives," but increasingly about "how well the car supports a better life."

This shift in mindset brings about three fundamental directions for product reconstruction:

(1) From a "Driver-Centric" to a "Space-Centric" Paradigm

The new core evaluation criteria are no longer power and handling. Instead, they revolve around questions such as:

Is the spatial layout expansive and comfortable?

Is the second row more important than the first?

Can the cabin function as a true "family space"?

Can the seats support scenarios like sleeping, working, caring for children, or relaxing?

This shift means that design priorities move forward into the cabin:

space becomes the first principle, and materials, structural engineering, and NVH systems must all be reimagined around the goal of creating a comfortable, livable interior environment.

(2) From a "Collection of Functions" to a "System of Integrated Scenarios"

Traditional automotive features—air conditioning, audio systems, seats, displays, and more—have always existed as discrete functions.

Today, they must be orchestrated as a unified system, working together at the scenario level:

Movie Mode = (display + sound field + ambient lighting + seat recline)

Nap Mode = (fully flat seat + climate adjustment + shading + noise-reduction algorithm)

Camping Mode = (external power supply + rooftop lighting + rear-compartment extensions)

Shower Mode (as seen in IM Motors) = (water system + heat pump + drainage + private enclosure)

For the first time, cars must be developed with a "space and scenario" mindset, rather than through the traditional method of feature accumulation.

Li L7; photo source: Li Auto

(3) From "Engineering Definition" to "Lifestyle Definition"

The role of the car in China is becoming more diversified. It is no longer just about mobility, but about expanded use cases and experiences—particularly in a replacement-driven market, where consumers are increasingly looking for a better way to use and live with their cars.

In China, intelligent electric vehicles are no longer merely the end product of mechanical engineering—they have become the starting point of a lifestyle. Outdoor activities, camping, micro–getaways in the city, working inside the car, socializing, entertainment, resting or lying flat, traveling with family—all these have become legitimate usage scenarios for a car.

This requires automakers to rethink a fundamental question:"Users are not just using the car—they are living in it." And this shift marks the true beginning of the supply chain revolution.

2. A Shift from Component Manufacturing to a "Space-Centric Industry"

As cars evolve into "smart home on wheels," the supply chain is seeing structural opportunities at a scale never before observed. The following section outlines five major directions where growth is both clear and highly predictable.

(1) Home-like Cabin Design: Furniture and Home Décor Industries Enter the Automotive Supply Chain

For the first time, the vehicle interior is being "decorated like a home."

The transformation includes: extensive soft-touch surfaces, premium textiles and eco-friendly leather, furniture-grade tactile materials and matte finishes, ambient lighting inspired by home décor, concealed light sources and soft-glow panels, furniture-style surface treatments (wood grain, stone texture, woven patterns).

This marks a significant shift: the home furnishing and interior décor industries are becoming new and important contributors to the automotive supply chain. More recently, hospitality groups such as Huazhu have begun engaging more intensively with automotive companies, signaling growing interest in cross-sector collaboration and integration.

All-New NIO ES8; photo source: NIO

(2) Seats — Upgrading from "Components" to a Full "Space Engineering System"

In the next phase of electric vehicles, the highest-value—and potentially highest-cost—elements may no longer be batteries, but how space is designed, structured, and experienced, starting with the seats.

The seat evolves from something you sit on to something you live in. Its functions now include: full flat recline (180° lie-flat mode), rotation, zero-gravity posture, mother-and-infant mode, elder-friendly configurations, pneumatic massage, thermal regulation, headrest audio, health monitoring, and more.

As a result, traditional seat suppliers will move from Tier 2 to Tier 1, and some may even become holistic "space solution providers."

These new functions also create new opportunities across the supply chain, including: rotation mechanisms, advanced rail systems, ergonomic comfort algorithms, headrest audio modules, multifunctional armrests, modular spatial structures. This segment of the supply chain is expected to see the fastest growth in the next three years. Moreover, as the imagination around in-vehicle space continues to expand, more solutions will be integrated into vehicles, creating new growth opportunities for the industry.

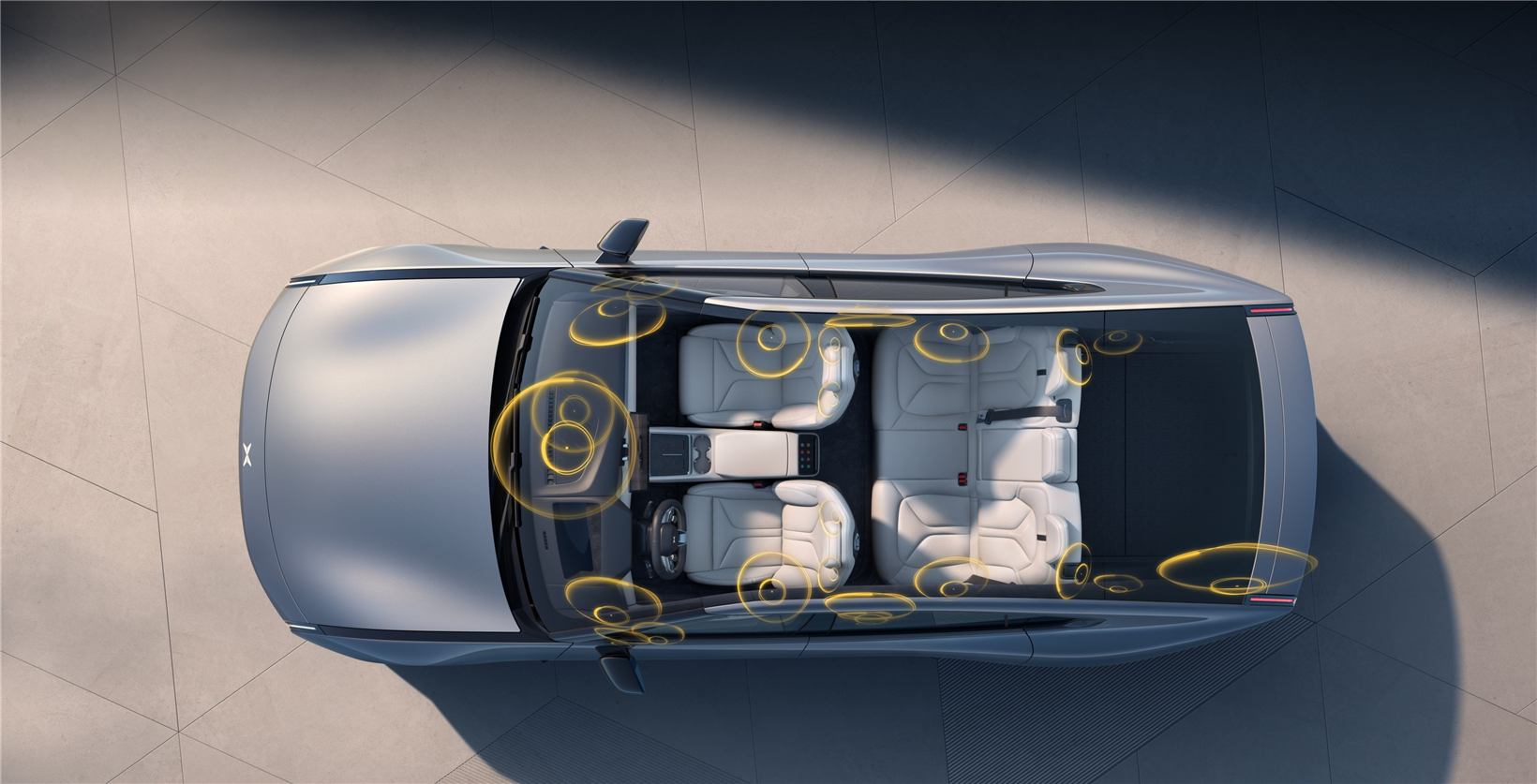

(3) Audio & Acoustics: Upgrading from "Listening to Music" to an "Immersive Spatial Experience"

Acoustics have become a new core battleground for cabin competitiveness.

Where 6–8 speakers once defined a premium system, 20 to 30+ speakers are now becoming standard.

Accordingly, the supply chain is expanding far beyond traditional audio hardware providers to include: hardware and driver manufacturers, acoustic algorithm companies, suppliers of invisible or integrated speaker structures, spatial sound–tuning service providers.

As in-home entertainment did before it, in-car acoustics are poised to produce China's own "Dolby + Harman" combination, creating enormous industry opportunity.

Looking at recent consumption trends in China, it is clear that concerts have gained growing popularity. Many people are drawn to live performances because immersive music offers a powerful way to respond to inner emotions or express devotion to their idols.

However, high costs, overcrowded venues, and less-than-ideal on-site experiences have also become clear constraints. Against this backdrop, future integration between in-car experiences and concerts—bringing immersive music and interactive content into the vehicle—could emerge as a more efficient and appealing alternative.

XPENG P7i; photo source: XPENG

(4) The "Home Appliance–ization" of Vehicles: Household Appliance Supply Chains Entering Automotive Standards

In the past, vehicle electronics = driving functions.

Today, vehicle electronics = household living functions.

A large number of home appliance companies have entered the automotive supply chain. Some are transferring their capabilities into automotive electronics, while others are directly adapting existing products for in-vehicle applications.

Typical examples include: in-car refrigerators (now mainstream), in-car water purification and hot-water systems, in-car air purification and sterilization systems, emerging in-car cooking modules, oxygen generation and supplemental oxygen devices.

This means companies like Haier, Midea, Hualing, and even medical-device manufacturers may gain entry into the Tier 1 ecosystem of automakers. Simultaneously, related supply chains such as water systems, thermal management modules, drainage systems, insulation materials, and small appliance modules will also be pulled into the automotive ecosystem.

(5) Scenario-Module Supply Chain: A "Vehicular IKEA" Opportunity

From the perspective of intelligent space, the creation of various scenario-based modes requires supporting peripherals and hardware. Whether it is for napping, watching movies, working, camping, overnight stays in the car, children's entertainment, elderly comfort, or pet-friendly travel, each scenario—when examined closely—depends on dedicated external modules working in coordination.

This opens up demand for a wide range of incremental, modular components supplied by specialized vendors, such as fold-out tables, storage drawers, rear-end kitchen modules, camping lighting systems, compact washing modules, and expandable sleeping platforms.

These scenario-driven, modular hardware solutions represent one of the most suitable and promising entry points for startups within the evolving automotive ecosystem.

3. Three New Value Chains in the Service Ecosystem: The Next Profit Engines for OEMs

A "mobile home" is not a one-time product sale — it represents the long-term operation of a living space. Under this paradigm, automakers gain far greater room for imagination in their business models.

Below are a few preliminary thoughts to spark further discussion.

(1) Scenario-Based Subscription Services (Likely a Core Profit Model of the Future)

From a long-term development perspective, the hardware cost of automobiles is likely to become increasingly transparent, while software systems may emerge as one of the key future sources of monetization.

In recent years, there has been widespread discussion around charging for intelligent driving services—often citing Tesla's FSD as a reference. In practice, however, many automakers have bundled such capabilities as free benefits at vehicle launches to drive sales. As intelligent driving solutions continue to converge and mature, costs will keep declining, and these functions are likely to become standard features—making it increasingly difficult to charge for them separately.

If we look to the smartphone industry for comparison, hardware has largely converged, yet the value differentiation lies in software ecosystems. Each phone runs different apps, with numerous small features available for paid unlocking.

A similar evolution can be envisioned for vehicles. Through continuous OTA updates, cars could unlock a wide range of scenario-based software packages—such as a lunchtime rest enhancement package, sleep optimization algorithms, immersive audio upgrades, family care modes, camping extension packages, or winter thermal management bundles. For the first time, automakers may be able to charge directly for lifestyle and experiential value.

This mirrors the core logic of internet monetization: low unit prices, high frequency of use, and services that are both constantly used and continuously refreshed.

IM LS9; photo source: IM Motors

(2) Soft-Furnishing and Personalized Space Services

Once a car becomes a "home," personalization becomes an inevitable trend.

This will create demand for: soft-furnishing upgrade packages, interior décor panels inspired by home design, themed ambient-lighting packages, fragrance-system subscriptions, customized spatial-design services.

In this model, we may see the emergence of a business format akin to "an automotive IKEA combined with a Tesla/NIO Store."

(3) Integrated Car × Home × Outdoor Services

The car has already become the "mothership of outdoor living."

This opens opportunities for a wide range of integrated services, such as: partnerships with camping sites, bundled outdoor gear packages, car-based lodging services, portable kitchen kits for vehicle use, home–energy integration packages (e.g., V2H systems).

In the future, automakers will increasingly operate as "mobile lifestyle platforms."

A good example is the current ecosystem development of Chery's Jetour brand, which has pioneered a distinctive model connecting car owners, outdoor lifestyles, and tailored product–service bundles.

4. From Building Cars to Building Spaces — Chinese OEMs Are Leading the Global Frontier

Once the automobile is redefined as a "mobile home," the automotive industry is no longer merely a branch of mechanical engineering. It becomes a super–intersection of industries: spatial design × home décor × home appliances × outdoor living × digital ecosystems.

Over the next five years, the greatest growth dividends in China's automotive sector will not come from powertrains. They will come from spatial engineering, home-like cabin experiences, scenario-based modules,

in-vehicle appliances, acoustics and lighting systems, cross-industry supply chain integration, and scenario-based service subscriptions.

Whoever understands lifestyle will understand the future of the automobile.

Whoever can make the car feel more like a home will win the next generation of users.

Written by Xiaoying Zhou — CEO and Editor-in-Chief, Gasgoo International