China's Premium Car Market Set for Huge Growth

China's appetite for premium cars is on the increase, with sales set to accelerate by 139% in the five years between 2010 and 2015, IHS Automotive forecasts.

Key Findings

IHS Automotive forecasts Chinese premium passenger car sales to grow by 139% in the five-year period 2010–15.

The growth rate in the premium sector will slow thereafter as a result of high base levels, although we still expect double-digit percentage growth rates in the period 2015–20.

Growth rates in the Chinese premium sector are higher than in the overall market.

Volume luxury vehicle manufacturers in China remain those with local production bases.

Growth rates are highest for super-luxury cars as these benefit from a lower base of comparison.

The average super-car buyer in China is a 25–35-year-old male.

Coastal areas remain the most important regions for luxury car sales, but dealerships are expanding into China's interior where there are higher growth rates.

China's appetite for luxury goods has grown enormously over the last decade, and it is becoming the world's largest market for premium products, including luxury cars.

In 2001 there were fewer than 10 brands in China's premium car market, with total sales of 45,313 units. In 2010 China's premium car market had 21 players with total sales of 736,151 units, according to IHS Automotive data. In 2010 sales of premium cars had thus jumped 1,550% from sales in 2001.

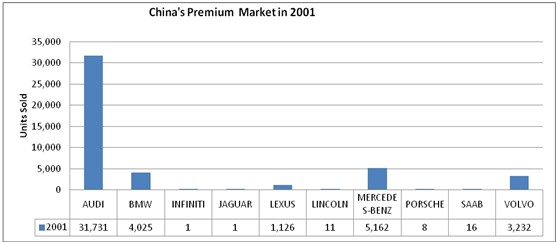

2001

In 2001 China's awareness of premium and luxury brands was only just beginning. Audi, already the market leader with local production facilities, sold 31,731 units that year. Mercedes-Benz followed with sales of 5,162 units, and in third place was BMW with sales of 4,025 units. Porsche sold 8 units that year, while Lincoln sold 11. Local production was limited. Mercedes sold 120 locally produced models in 2001, while locally produced models accounted for 30,711 of Audi's sales, or 96.78% of the brand's total Chinese sales. In 2001 BMW had no local production in China.

2005

By 2005 the scene had changed dramatically. The premium car market had 15 players, ranging from volume leaders Audi, BMW, and Mercedes to niche players such as Aston Martin, Bentley, Jaguar, and Lamborghini.

China's premium car market recorded total sales of 111,280 units in 2005, with the major players beginning to increase volume sales.

Audi continued to lead the market, followed by BMW and Mercedes, but other luxury brands began making an appearance—albeit with smaller sales volumes. Chinese consumers' awareness of luxury brands began to develop rapidly at this point too. BMW, which started local production in China in 2003, pushed its way up the charts, rising above Mercedes to second place. In 2005 Audi sold 52,424 units in China, 95.57% of which were produced locally. BMW sold 25,859 units, of which local production accounted for 67.99%, while Mercedes sold 14,232 units, of which locally produced models accounted for just 6%—a mere 138 units.

However, competition from other brands was growing. Lexus sold 5,341 units in 2005, while Cadillac and Land Rover sold just over 2,000 units each. Meanwhile, Porsche sold 857 units, up from just 8 units in 2001.

2010

By 2010 China's appetite for premium cars had reached a critical mass, which was fuelling local production and brand awareness. There were now 21 players in the segment competing to win over the newly wealthy in China. In 2010, a total of 736,151 premium cars were sold in China—a 561.5% increase compared with the 2005 figure.

The big players in the market were those with local production facilities in China—Audi, BMW, and Mercedes. However, 2010 saw significant growth of niche luxury brands. With greater awareness of ultra-luxury products, China's rich began to look for products and brands to set them apart from the "mainstream luxury" products.

The growth in sales among the premium car brands has been astronomical over the past half-decade. Audi's sales increased 350.74% from 2005 to 236,294 units in 2010; BMW's sales rose 539% to 165,248 units; and Mercedes posted a massive acceleration of 1,005.72% to 157,366 units. Lexus, Land Rover, Porsche, Rolls-Royce, and Lamborghini also witnessed very high sales growth in the five-year period.

Total 736,151 n/a

2010–15: Growth Set to Continue

Premium brands in China are set to register higher growth rates than those seen in the mainstream market over the next five years. Indeed, IHS Automotive forecasts triple-digit percentage sales growth rates for premium passenger cars during the period between 2010 and 2015 as mainstream Chinese consumers aspire to own premium products amid growing safety and reliability concerns. Higher up the brand spectrum, high-net-worth individuals will look to ultra-premium products and brands, often to show off their personal wealth and make a statement. China's government is also playing a big role in the expansion of the sector. Government fleet purchases are limited to locally produced models, but the list of approved vehicles includes models made by Mercedes, Audi, and BMW. Depending on the status of the government official involved, purchases of these premium-brand models are allowed.

By 2015, Chinese premium car sales are forecast to have accelerated by 139.5% from 2010, reaching over 1.7 million units. IHS Automotive includes premium sedans, sport utility vehicles (SUVs), and multi-purpose vehicles (MPVs) in this segment. From 2015 to 2020, this growth rate is expected to slow, with sales forecast to rise by 29% between 2015 and 2020.

In 2010, premium passenger car sales increased 77% year-on-year (y/y) from the 415,590 units sold in 2009. In the first half of 2011, this high growth rate continued, boosting the size of the sector and encouraging a sudden flurry of activity from players keen to exploit its potential.

Last year, the highest volume-selling division among premium cars was the E1 sedan segment, whose sales rose to 270,502 units, up 43% y/y. The D2 segment followed with volumes of 144,792 units, up 65.9% y/y. Sales of premium SUVs followed, with the SUV-E segment posting sales of 99,887 units, up 74% y/y, while the SUV-D segment saw sales rocket by 524.7% y/y to 78,220 units. The two SUV segments recorded combined sales of 178,107 units in 2010, a sharp increase of 154.8% y/y from the 69,893 units sold in 2009.

At current growth rates, China will become the main market for most of the top luxury carmakers. The volume leaders—Audi, BMW, and Mercedes-Benz—all have production bases in China, having formed joint ventures (JVs) with Chinese partners. These local production bases now account for a significant percentage of sales in China. As the high rates of growth for premium car sales continue, a wide range of luxury carmakers are looking to expand in China. For some, this means an increase in the number of dealerships in the country, while for others critical decisions on whether to introduce more locally produced models are being brought forward in a bid to capture the growing number of consumers.

Premium Players Expanding in China

In a bid to garner greater sales volumes in China, luxury premium carmakers are ramping up production capacity and strengthening their penetration of the market with dealerships spanning the length and breadth of the country, combined with strong marketing and advertising campaigns.

The main volume sellers—Audi, BMW, and Mercedes—are all investing in expanding their production bases in China in an effort to meet ambitious growth targets.

China is already Audi's largest global premium market. In 2010, China accounted for 236,294 of Audi's sales, followed by Germany with 226,872 sales and the UK in third with sales of 99,828 units. Audi is the most established foreign premium brand in China, with its locally produced models dating back to 2001, giving it "first mover" advantage and high brand awareness. Audi sold 140,700 units in China during the first half of 2011, up 28% y/y, and aims to sell 1 million units cumulatively in the period 2011–13. This year the automaker is targeting sales of 280,000 units, up from a previous target of 230,000 units, while in 2012 it aims to sell 360,000 units. Audi has this year expanded its plant in Changchun to produce 300,000 units per annum (upa), with the option of producing up to 400,000 upa. The German premium carmaker has over 180 dealerships in over 100 cities across China. Audi cars are currently built at the FAW-Volkswagen (VW) plant in Changchun but a new plant will begin production in Foshan in Guangdong province in the next few years, and Audi models are slated to be produced there alongside other VW vehicles.

BMW, which sold 113,169 BMW-brand cars in the first half of 2011 (up 59% y/y) is investing EUR1 billion in China to expand production capacity. It is building a new plant in Shenyang that will add 100,000 units initially to its current 75,000-unit annual capacity. By 2013, BMW will have the capacity to produce 300,000 upa in China. BMW has over 180 dealerships based in over 100 cities in China. Although BMW was a relatively late player in China compared with Audi, the brand has enjoyed soaring growth rates in the last five years. According to a Financial Times interview with Eric Mao, chief executive of Shanghai Bowdex, which owns nine BMW dealerships in eastern China, demand for foreign luxury cars has exploded since import controls were eased in 2004. Less than 20 years ago, "No one even knew what a Baoma was", said Mao, referring to the Chinese name for BMW that means "precious horse". Mao said that many of his customers are first-time buyers with little personal knowledge of cars. "In China, so many people have got rich—so many—but they don't have that much experience, so they just follow what other people say", he said. "If their friend has a BMW 7 Series and they do not, they can lose face." Decisions about optional extras, too, are about showing off, he said. "They want things they can see; if they can't see it, they don't want it", he said, listing leather seats and in-car television sets as favoured options.

The third main player in the market, Mercedes-Benz, sold 95,030 units in China during the first six months of 2011, an increase of 59% y/y. The S-Class sold 16,095 units, up 75% y/y, while the C-Class sold out completely, its sales up 10.4% y/y. A new-generation C-Class was launched in China during July. Mercedes' SUVs continued to see growth in the first half of the year, their sales coming in at 12,175 units, up 203% y/y. "We are continuing to see double-digit growth in line with our own market forecast, as more customers become part of the Mercedes-Benz family throughout China", said Klaus Maier, president and CEO of Mercedes-Benz China. Daimler will invest EUR3 billion in China over the next few years, it said in a statement sent to IHS Automotive detailing expansion plans, new plants, and new products. Daimler will build a new engine plant for passenger cars and expand local production capacity for passenger cars and vans. Daimler will also introduce local production of several models in China, thereby increasing the number of products on offer in the country. Dieter Zetsche, chairman of the board of management of Daimler and head of Mercedes-Benz Cars, said: "With this framework agreement, we are laying the essential strategic foundations for our long-term and significant participation in the growth of the key market China." Daimler will invest in a new 4-cylinder gasoline (petrol) engine plant that will have an annual production capacity of up to 250,000 engines for use in Mercedes cars and vans in China. Production will commence in 2013. Daimler will also increase the current annual local production capacity of 80,000 units for the C- and E-Class long sedan versions in China. The automaker will expand its line-up of cars produced in China beginning with the GLK SUV this year, followed by the introduction of three premium compact cars starting from 2013. "We are resolutely switching to attack mode with the local production of our new compacts", Zetsche said. Daimler will also build a new research and development (R&D) centre in China to focus on vehicle testing and the adaptation of vehicles for the local market, as well as supplier development.

Top Two Extend Dealership Networks

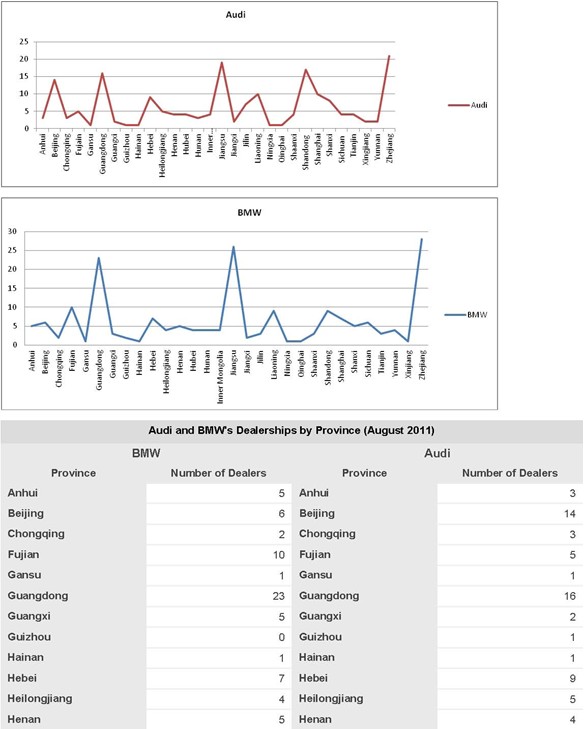

Both Audi and BMW have dealerships across the length and breadth of China, but the provinces of Jiangsu and Zhejiang have the highest concentration. Cities such as Shanghai, Beijing, and Guangzhou also have high numbers of dealerships. However, there is currently a movement to expand into China's western regions, further away from the coast. These western areas have not developed as fast as the rich coastal provinces and there are therefore a limited number of dealerships for premium cars in comparison with cities on the coast. It is these interior areas where high growth rates are expected, mainly stemming from a low base of comparison, coupled with the gradual development and expansion of the economies of the interior provinces.

The high concentration of premium car dealerships located in areas of eastern China such as Zhejiang and Jiangsu provinces extends to other premium brands, including those without local production bases. In the coastal areas—specifically Zhejiang and Jiangsu provinces—higher disposable wealth has led to consumption levels for premium products that are far higher than those in less-developed areas, inevitably leading to a higher concentration of premium car dealerships in cities in coastal provinces.

Audi and BMW's Chinese Dealerships

Zhejiang and Jiangsu provinces are near Shanghai and are coastal provinces. These areas have recorded strong growth in the last few years, resulting in a concentration of wealth. The inflow of foreign direct investment (FDI) is interesting to illustrate wealth growth in different provinces across China. FDI is often associated with development projects and the establishment of new industry, often funded by foreign players keen to be present in China.

In the first quarter of 2011, FDI in China amounted to USD30.3 billion, an increase of 29.4% y/y, mainly driven by a 36.4% y/y surge in FDI in the services sector, including real estate, distribution, and transport, among others. In terms of geographic distribution, Jiangsu, Guangdong, Liaoning, Shanghai, and Zhejiang were the top destinations for FDI during the period, while western China reported the fastest FDI growth rate—a stunning 84.1% y/y. Sichuan was the largest recipient of FDI among western regions, accounting for 35% of the total in the west, while Hunan was the number-one destination in central China, accounting for 24% of the total for central provinces. This is in line with China's push to expand the western regions of the country as well as the interior central areas. China's coastal regions have seen rapid growth and acceleration of wealth in the last decade, and the other regions are now looking to catch up.

In the premium car sector, new dealerships are being added in these regions as demand for premium cars rises as wealth grows. For China's premium carmakers the trend is interesting as it shows a sudden acceleration in western China and in provinces such as Sichuan. Porsche, for example, will open its second franchised dealership in Sichuan's capital city, Chengdu, as growth here accelerates.

Zhejiang province has the highest number of premium dealerships—BMW has 28 in the province, while Audi has 21. Jiangsu province follows—BMW has 26 dealers here, while Audi has 19. In Zhejiang province the cities of Hangzhou and Wenzhou stand out with the largest number of dealerships. BMW and Audi have four dealerships each in Hangzhou and three each in Wenzhou.

Shanghai, Beijing, and Tianjin are special zones and therefore treated independently and not as part of a province.

Case Study One: Porsche

Luxury carmaker Porsche, which sold 12,267 units in China during the first six months of 2011, is on an expansion spree, adding approximately 10 new dealerships in the country annually. In an interview with IHS Automotive, Helmut Bröker, Porsche China CEO, said that, "We target record sales in China this year of 20,000 units. We will have new dealerships in Taizhou, Haikou, Zhengzhou, and a second Porsche centre in Chengdu this year. We plan to have 10 new dealerships each year."

Porsche opened its 32nd dealership in China on 27 May 2011. The 3,000-square-metre dealership in Taizhou became the fifth Porsche dealership in Zhejiang province. Zhejiang is a major Porsche stronghold within mainland China and in 2010 the company's sales in the province totalled 2,721 units, 19% of the 14,785 units Porsche sold in mainland China, Hong Kong, and Macau that year, with mainland China accounting for almost 93% of this total.

This year marks a significant milestone for Porsche in China. The luxury brand first entered China 10 years ago in 2001. To celebrate its decade in China, the automaker created 10 unique 911 special anniversary models, available only to buyers in the Chinese market. "All ten have sold", said Bröker.

China is fast becoming an extremely important market for Porsche, helping the automaker to increase its global sales rapidly. In China, Porsche sells four models: the Boxster/Caymen, the 911, the Cayenne, and the Panamera. "After the Panamera model was introduced in 2009, this model has been well accepted by Chinese customers—and we believe China will be the number-one market for the Panamera this year", Bröker said. In the first half of 2011, 3,789 Panamera cars were sold in China, accounting for 30.89% of Porsche's total sales of 12,267 units in the country during the period.

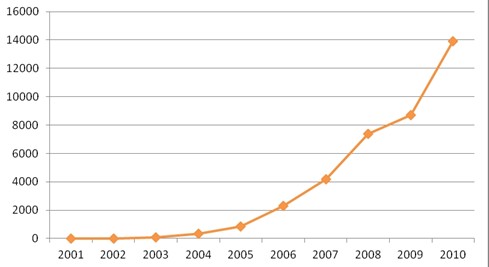

Porsche's Sales in China: 2001–10

Source: IHS Automotive data

"China is the second largest market for Porsche globally, and the largest market for the Cayenne", said Bröker. By the time the new Cajun is introduced, China may be Porsche's largest global market, he said. "Ten years ago, we opened our first Porsche Centre in Beijing with anticipation for what the market would hold. Today, we can say with absolute certainty that China has become a true success story for Porsche globally", he added.

In 2001, a Porsche Centre in Beijing was opened. Since then, Porsche has achieved tremendous sales growth, from 27 cars sold in 2002 to 13,856 units sold in 2010 in mainland China alone.

In 2008 Porsche opened an official Porsche China subsidiary, allowing the carmaker greater flexibility to meet the demands of local customers. In September 2010 Porsche China opened its first Porsche Centre directly operated by Porsche AG in China. The centre is located in Shanghai, and is considered crucial to new sales and marketing strategies for Porsche China.

Earlier this year, Porsche China sold its 50,000th vehicle in China. "For the tenth anniversary of Porsche China, I am proud of the many milestones we have achieved so far", said Bröker, speaking at an event to mark Porsche's decade in China. "The successful expansion of our Porsche Centre network has brought flawless and consistent service closer to our customers across China. As a result of these great efforts, we welcomed the 50,000th Porsche customer in this market this year. With this growing community of Porsche enthusiasts, Porsche has been credited with bringing sports car culture to this emerging market...We have shared in China's great prosperity, and together we look forward to many more decades of outstanding accomplishment for Porsche in China", Bröker added.

Porsche Dealerships

Porsche dealerships are spread across China, with new outlets still in the process of being added. The carmaker is currently adding 10 new franchised dealerships per year across the country. In 2007, when Bröker started his role in China, there were around 12 Porsche dealerships in the country; now there are 32.

With strong growth in Tier-Two and Tier-Three cities, in addition to Tier-One cities such as Shanghai and Beijing, the luxury carmaker is adding dealerships deep in China's interior. Chengdu, the capital city of Sichuan province, is a good example. Three years ago Porsche sold just 20 cars a month in the city; today it sells over 80 a month. As a result, Porsche is adding a second Porsche dealership in the city this year.

Map of Porsche Dealerships in China (August 2011) Source: Porsche China

"The achievement of Porsche in mainland China has been a significant factor in the success of Porsche across the world in the last ten years. With our ongoing commitment to this market, we will continue to expand our network of Porsche Centres", said Bernhard Maier, Porsche president, sales and marketing.

Case Study Two: Lamborghini

For luxury carmaker Lamborghini, China is now its largest global market.

"As of July 2011, China has already overtaken the US to become [Lamborghini's] largest market in the world", Wilson Lee, head of operations at Automobili Lamborghini China (ALC), told IHS Automotive. In July, Lamborghini sold 28 units in China, bringing its total sales to 167 units in the first seven months of 2011.

In the first half of 2011 Lamborghini sold 138 units in China, up from just 86 units in the same period a year earlier, equating to growth of 60%. This followed on from high sales in the first quarter of the year, when Lamborghini sold 60 units, up from just 35 in the first quarter of last year—a 71% increase. However, Lamborghini expects to see higher growth rates once new models are introduced to Chinese customers.

Lamborghini currently sells just one model in China—the Gallardo—but later this year the new Aventador will hit the market. Chinese customers have already pre-ordered nearly 200 Aventadors. "Currently ALC is only delivering one model—the Gallardo—in China", said Lee. "Overall our growth will improve further when deliveries for the new V12 begin in Q4", he added, referring to the new LP 700-4 Aventador powered by a 6.5-litre V-12 engine.

Lamborghini is expanding aggressively across China with new dealerships, and as brand awareness grows, sales are rising. As of the end of 2010 Lamborghini had nine dealerships in China, according to Lee. "In 2011, ALC will end the year with 14 dealerships and for 2012 another six dealerships have been planned [for mainland China]", he said. In July, Lamborghini opened a new dealership in Macau, making it the premium brand's 15th dealership in the China region—which includes mainland China, Hong Kong, and Macau.

On the mainland, Lamborghini is posting its strongest sales growth in the Tier-One cities of Shanghai and Beijing. The automaker's customers are mainly males, with the majority (around 60%) aged between 25 and 35 years, said Lee. Around 35% are between 35 and 45 years old, while just 5% of Lamborghini buyers in mainland China are over 45 years old.

Lamborghini is targeting further sales growth this year. "Expected goal for full 2011 is about a 70% y/y increase", said Lee. By 2015 Lamborghini expects its Chinese sales to have risen above 500 units per year and by 2020 the automaker is targeting sales of over 700 units per year.

The Chinese Consumer

China is a complicated market whose dynamics are changing constantly, but the vast population and apparently unfettered embracement of luxury brands make this the stand-out global growth market for premium vehicle manufacturers. It is also clear that those premium carmakers with local JVs and production bases have the greatest chance of exploiting the predicted volume growth, thanks to lower costs and the absence of import tariffs. Although growth for these key players is relatively assured, the overall rates will slow owing to a higher base of comparison and as competition among brands intensifies. For brands not yet present on the ground in China, entry is virtually essential to obtain the price competitiveness and the economies of scale required. However, super-luxury brands are less likely to either need or require large local operations to maintain growth as their sheer exclusivity will ensure positive growth.

The Chinese consumer is also changing. Ten years ago consumer awareness in China of luxury car brands was limited. Today, media and advertising campaigns have raised awareness, and this has been combined with surging disposable incomes and a wholesale adoption of consumerism and brand culture among wealthy Chinese. This is clearly demonstrated by the downtown shopping malls in cities such as Shanghai and the propensity for wealthy Chinese to purchase foreign luxury brands, including cars. Furthermore, Chinese consumers are being driven by a desire to keep up with their friends and neighbours, a social condition that has traditionally been associated with the West.

Outlook and Implications

As Chinese consumers' tastes grow more varied, the market will see a wider range of luxury and super-luxury models on offer. This is apparent from the significant increase in imported vehicles. Chinese vehicle imports in the first five months of this year were up substantially, data from the China Association of Automobile Manufacturers (CAAM) show, by 21.68% y/y to 389,300 units. Imports of sedans accounted for 165,400 units, up 20.15% y/y, while SUV imports rose 14.08% y/y to 163,000 units. Total vehicle imports amounted to just over USD16 billion in the first five months.

China's premium car market will continue to see growth, but the rates will vary. IHS Automotive foresees triple-digit percentage growth rates for the five-year period between 2010 and 2015 for the luxury premium segment but this growth rate will then slow to double digits from 2015 onwards. As more Chinese consumers choose premium cars, total market volumes will rise. In 2010 IHS Automotive data show that less than 1 million luxury cars were sold in China. By 2015 this number will have risen to almost 2 million units. As total volumes increase, the rate of growth will start to slow. "We expect premium car market sales to reach 1.75 million units by 2015 in China, driven by the expansion of the Chinese customer base, and also the efforts from the supply side, especially the progressive localisation plans of some major players", says Bin Zhu, IHS Automotive's premium vehicle analyst based in Shanghai.

Meanwhile, the changing consumer tastes in China will dictate demand for different products. As tastes diversify further, niche luxury brands are expected to see high growth rates and will steal share from volume luxury carmakers. "Yes, in this fast developing economy, for people who have owned premium brand cars, it's natural to choose higher-specification cars when they buy new ones, and these luxury brands' cars are becoming more accessible to them, thanks to the dealer expansions and faster new model launches", says Zhu.

Chinese consumers are looking for that "wow" factor and buyers of luxury and super-luxury models are keen to impress. However, Chinese consumers want to touch and feel models before they buy. Automakers are aware of this, and premium manufacturers are bringing in more models to entice the "super rich". A common trend at the last couple of motor shows in China has been for consumers to buy luxury models directly from automakers displaying them at the show. The uniqueness of the model contributes to its "wow" factor and this is important in China's luxury market. "'Unique' plays a key role in purchasing decisions, as a luxury brand car is now one of the social symbols to show wealth, status and highlight individual personalities", says Zhu, adding that volume luxury sellers will increasingly need to find the right balance between sales volumes and maintaining that exclusive image.

The majority of super-luxury cars in China are sold to young males between 25 and 35 years old, who are looking for unique models. Growth in the super-luxury segment may still rise sharply owing to low base levels. Aston Martin, for example, sold 48 units in China in 2010, according to IHS Automotive data. By 2015, Aston Martin sales will have grown from this level by 243%. Maserati meanwhile sold less than 500 cars in China last year; by 2015 its sales will have grown 182%, our forecasts show. The premium-segment volume sellers will look to garner high growth rates by introducing super-luxury models in their imported product line-ups while sticking to the high-volume luxury models for local production—such as long-wheelbase sedans and premium SUVs.

Overall growth rates in the premium car segment will be above those for the passenger vehicle market as a whole. Coastal areas of China remain the main markets for super-luxury models, while high growth rates for premium luxury cars are expected in China's interior areas where there is a low base level. Premium and super-premium carmakers are expanding dealerships fast to provinces across China in a bid to raise brand awareness—but the highest concentration of premium dealerships remains in the coastal provinces of Zhejiang and Jiangsu, along with Tier-One cities such as Beijing, Shanghai, and Guangzhou. The main buyers of luxury and super-luxury cars are increasingly younger consumers who are becoming more confident in their choices. "Generally speaking, premium and luxury carmakers in China are facing a customer base that is younger, more willing to spend, and more confident to show themselves", says Zhu.

Analyst Contact Details: Namrita Chow

Created on 05 Apr 2012 for the exclusive use of Annabelle Tok Reproduction in whole or in part prohibited except by permission. All Rights Reserved Information has been obtained by sources believed to be reliable. However, because of the possibility of human or mechanical errors by our sources, IHS Automotive does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. http://www.ihs.com/

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.