Car and City: Beijing tops other cities in China by July registrations of locally-made new energy passenger vehicles

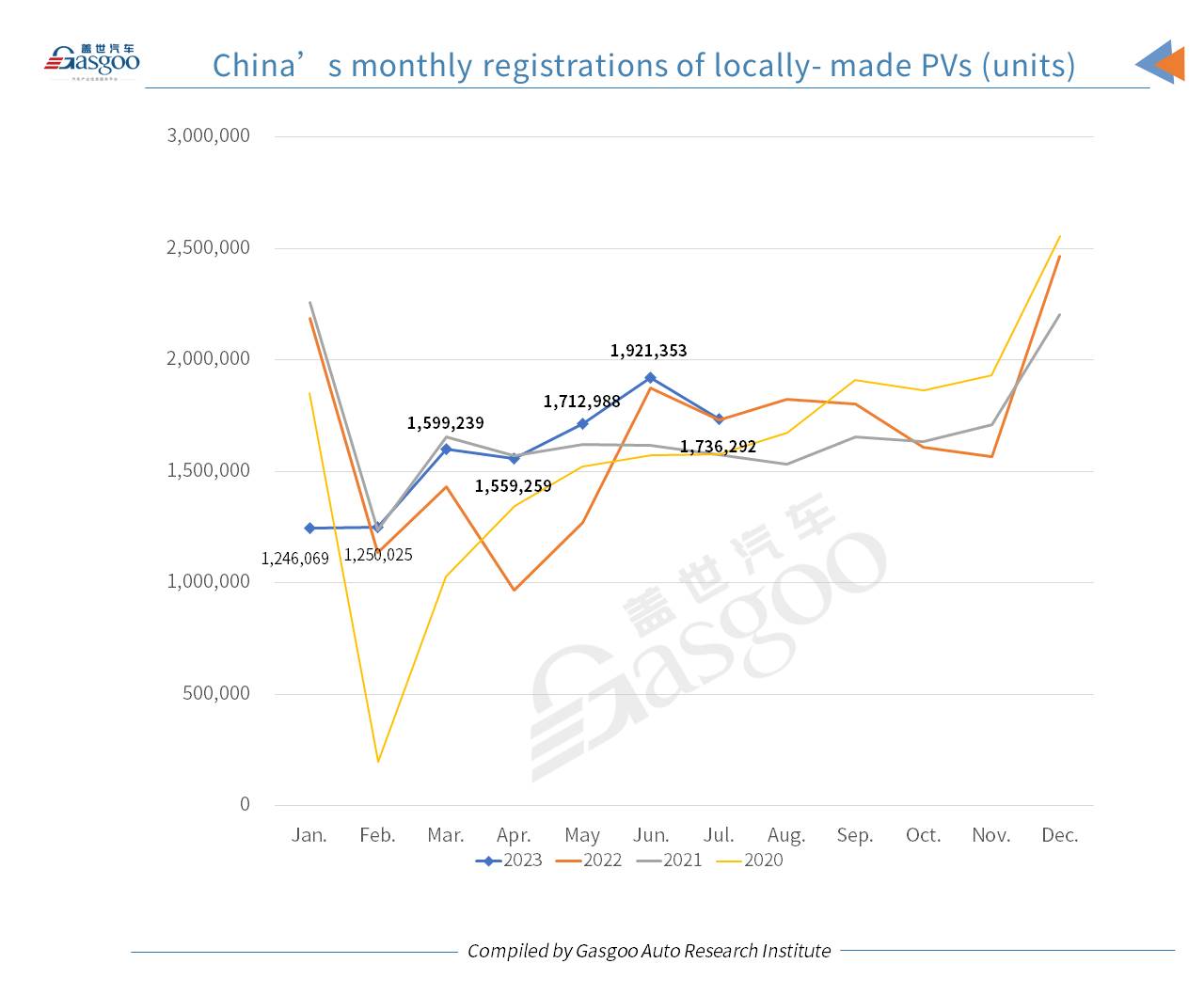

China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,736,292 units in July 2023, edging up 0.41% from the previous year, but falling 9.63% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

July's registration figures hit the second-highest monthly level so far this year, despite the traditional trend of July being a slack season for car shopping. The month showcased a moderate decline from June's peak.

With July marking the beginning for the implementation of China's VI-b emission standards, the rapid ascent of the price cut spree witnessed in the first half of the year has tapered off. The auto market entered a subdued growth period in July, with an overall slight reduction in sales promotion intensity.

At the national level, guiding policies have been frequently introduced to boost and expand consumer automobile purchases. Initiatives such as the "Hundred-City Coordination" Auto Festival and the "Thousands of Counties and Ten Thousands of Towns" New Energy Vehicle Consumption Season, which promote the use of new energy vehicles, have yielded positive outcomes. Diverse promotional activities like regional auto shows and consumer voucher distribution, coupled with manufacturers' stronger efforts in the semi-annual sprint, have collectively boosted consumer confidence.

Besides, taking into account such factors as an earlier-than-usual Spring Festival, the ebb and flow of anticipated stimulus policies, the surge in sales promotion for China VI-a car inventories, and the lower base for the year-ago period, the cumulative PV registrations for the Jan.-Jul. period in China rose 4.05% from a year earlier to 11,025,225 million units.

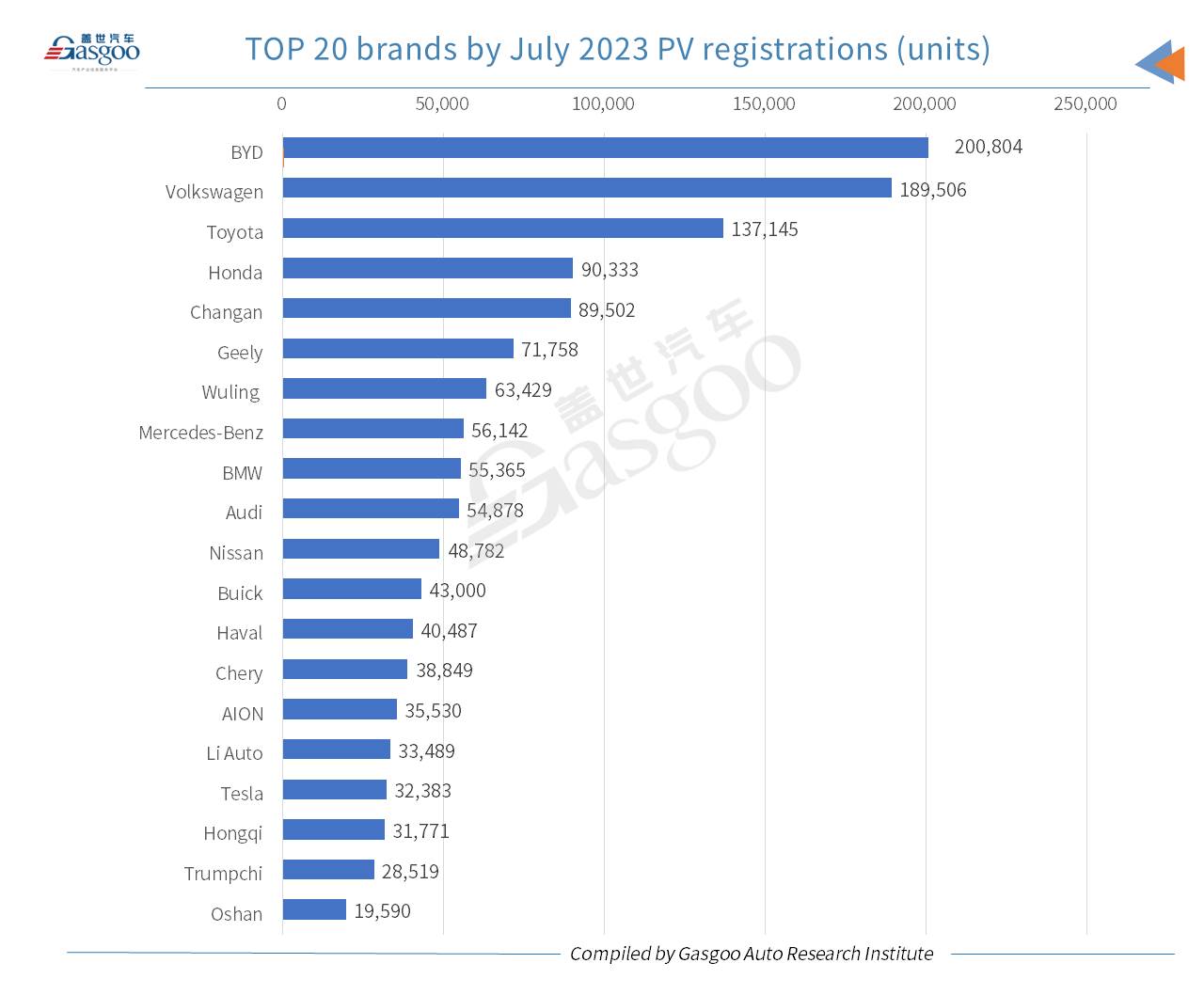

In July 2023, three brands saw their monthly PV registrations in China exceed 100,000 units, namely, BYD, Volkswagen, and Toyota, the same as that of the previous month. Of them, BYD was the only one to get over 200,000 PVs registered.

In addition, Changan, Geely, and Wuling, the three of the main Chinese indigenous brands, occupied the fifth to seventh spots in terms of July PV registrations. They were closely followed by the “Germany’s Big Three”, namely, Mercedes-Benz, BMW, and Audi.

Tesla, with only two China-made battery electric vehicle (BEV) models available for sale, took the 17th spot with 32,383 vehicles registered, sliding 10th places from the previous-month ranking. It was outdone by AION and Li Auto, two of the major Chinese local new energy vehicle (NEV) makers.

On the front of year-to-date performance, BYD was the first brand to see its cumulative registrations exceed 1 million units this year. Volkswagen was claimed the runner-up with 984,064 PVs registered.

Among main Japanese brands, both Toyota and Honda appeared on the top 10 brands list by Jan.-Jul. figures, while Nissan stood at the 11th spot.

Apart from BYD, there were still 9 China's wholly-owned members among the top 20 brands by Jan.-Jul. PV registrations, namely, Changan, Geely, Wuling, Haval, Chery, AION, Trumpchi, Li Auto, and Hongqi.

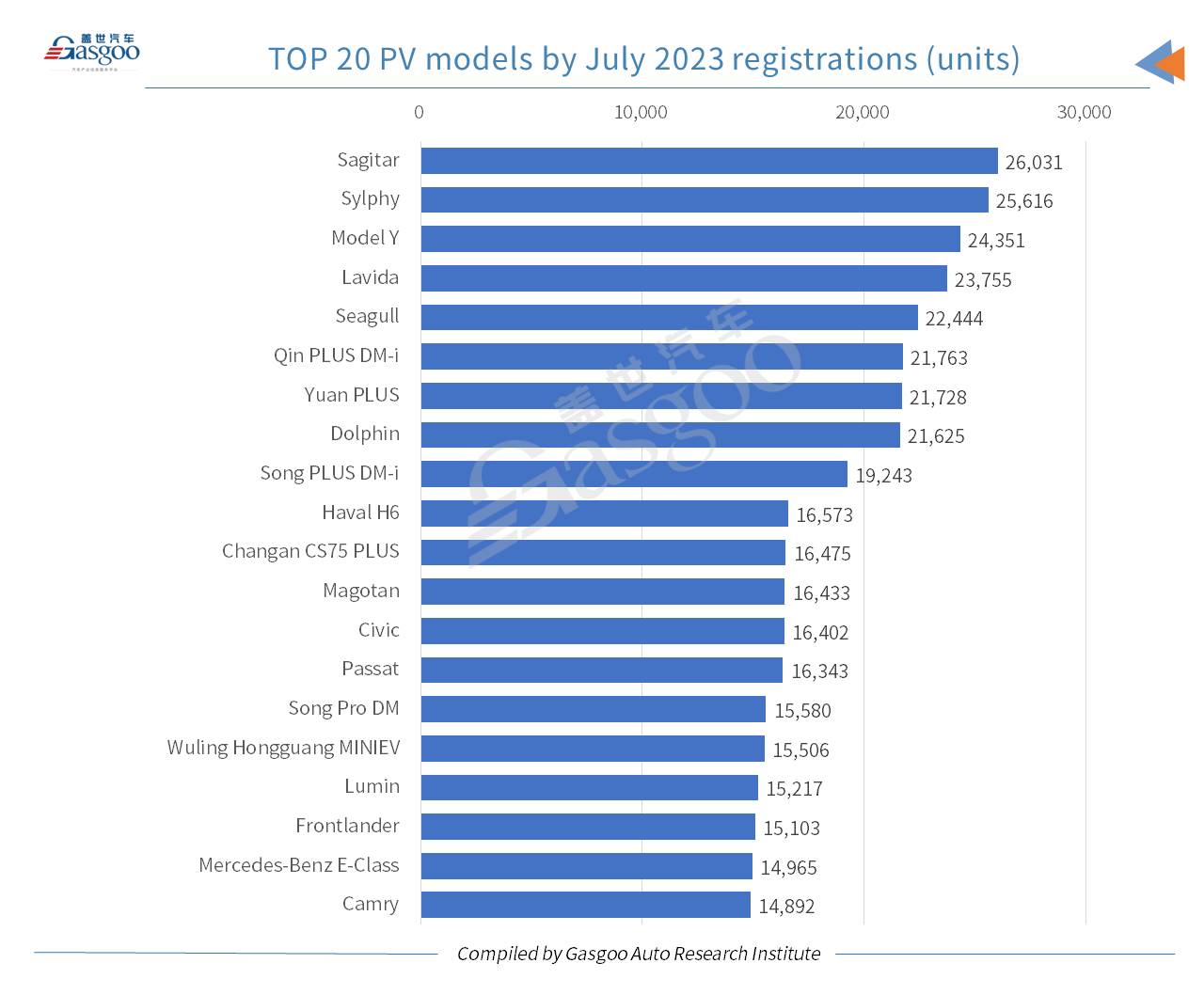

Among all China-made PV models, the Sagitar and the Sylphy held the first two places regarding July registrations, and both of them are oil-fueled vehicles. The Model Y dropped to the third place, but it was still the best-performing new energy vehicle (NEV) model.

On the top 20 PV models list by July registrations, BYD's products took 6 spots, and 5 of which successively ranked 5th to 9th. Notably, the brand's best-selling model in July was the Seagull, which hit the market on April 26 this year with a price range of 73,800 yuan to 89,800 yuan. Boasting 12 features, including four air bags, ESP, and fast charging, as standard across all trims, the affordable all-electric A0-segment car is serving a vigorous driver to BYD's continuous sales rise.

In addition, the two main battery electric city cars—the Wuling Honguang MINIEV and the Changan Lumin—ranked 16th and 17th, respectively, with over 15,000 vehicles registered in July each. The Mercedes-Benz E-Class was the only one from the "Germany's Big Three" to enter the top 20 models list.

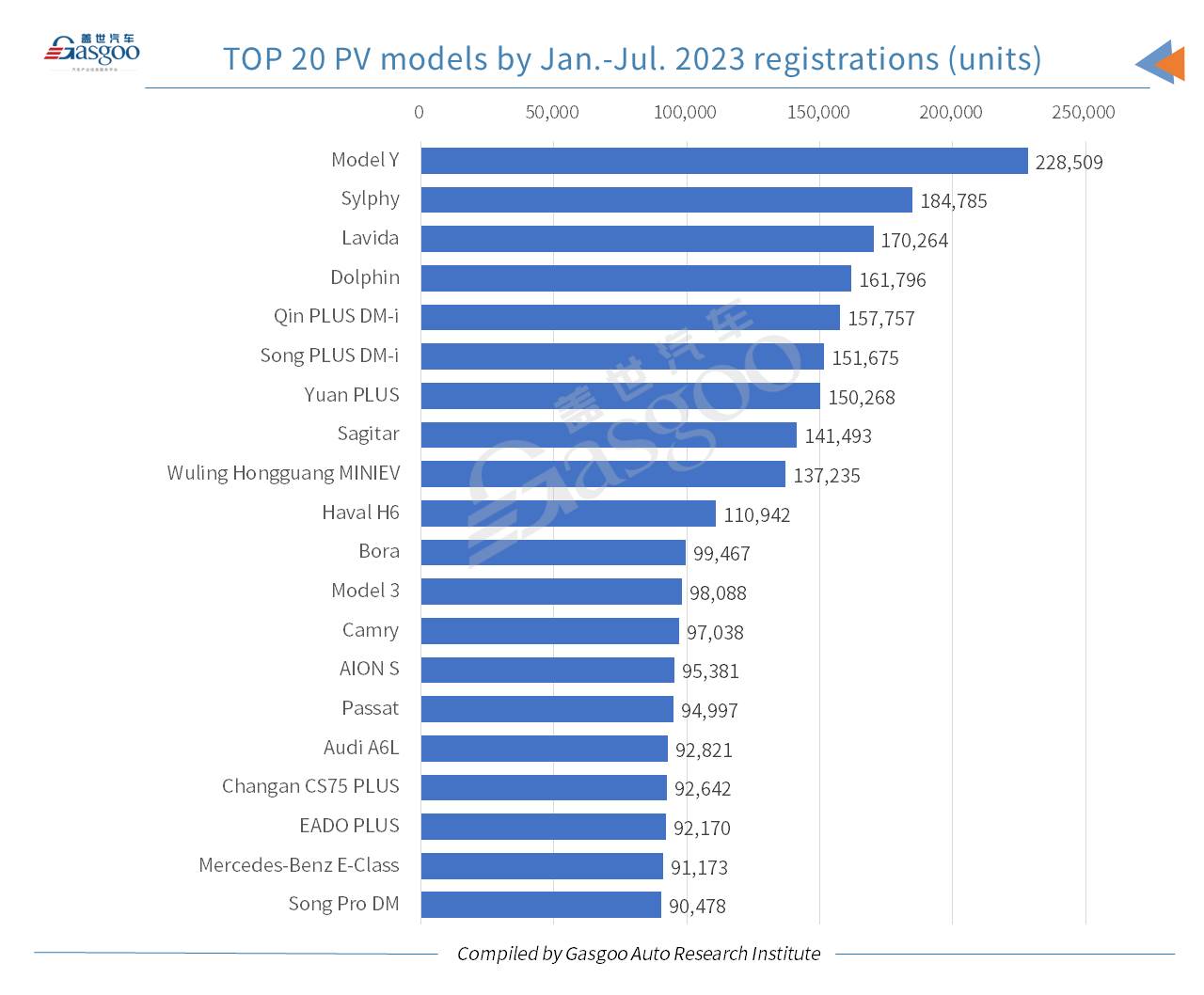

Of all locally-made PV models, the Model Y was the only one to record a year-to-date registration volume of over 200,000 units. The Sylphy and the Lavida were honored the runner-up and the second runner-up, respectively. The No.4 to No.7 spots were all obtained by BYD's vehicles, namely, the Dolphin, the Qin PLUS DM-i, the Song PLUS DM-i, and the Yuan PLUS. Great Wall Motor's Haval H6 also had over 100,000 vehicles registered in the first seven months, ranking 10th.

The German trio had two models on the top 20 models list by Jan.-Jul. registrations, namely, the Audi A6L and the Mercedes-Benz E-Class.

Among cities on the Chinese mainland, Beijing and Shanghai took the first two seats by July registrations, both of which had over 50,000 domestically-built PVs registered in the month.

As for the most popular models in major cities, the top 3 models by July registrations in Beijing were the Yuan PLUS, the Model Y, and the Song PLUS EV, all of which were all-electric ones. In the same time span, there were a number of BEV models existing in the top 10 models list in Shanghai, such as the Model Y (No.1), the Yuan PLUS (No.3), the NIO ES6 (No.5), the Dolphin (No.6), the ID.3 (No.7), the NIO ET5 (No. 8), and the Model 3 (No. 10).

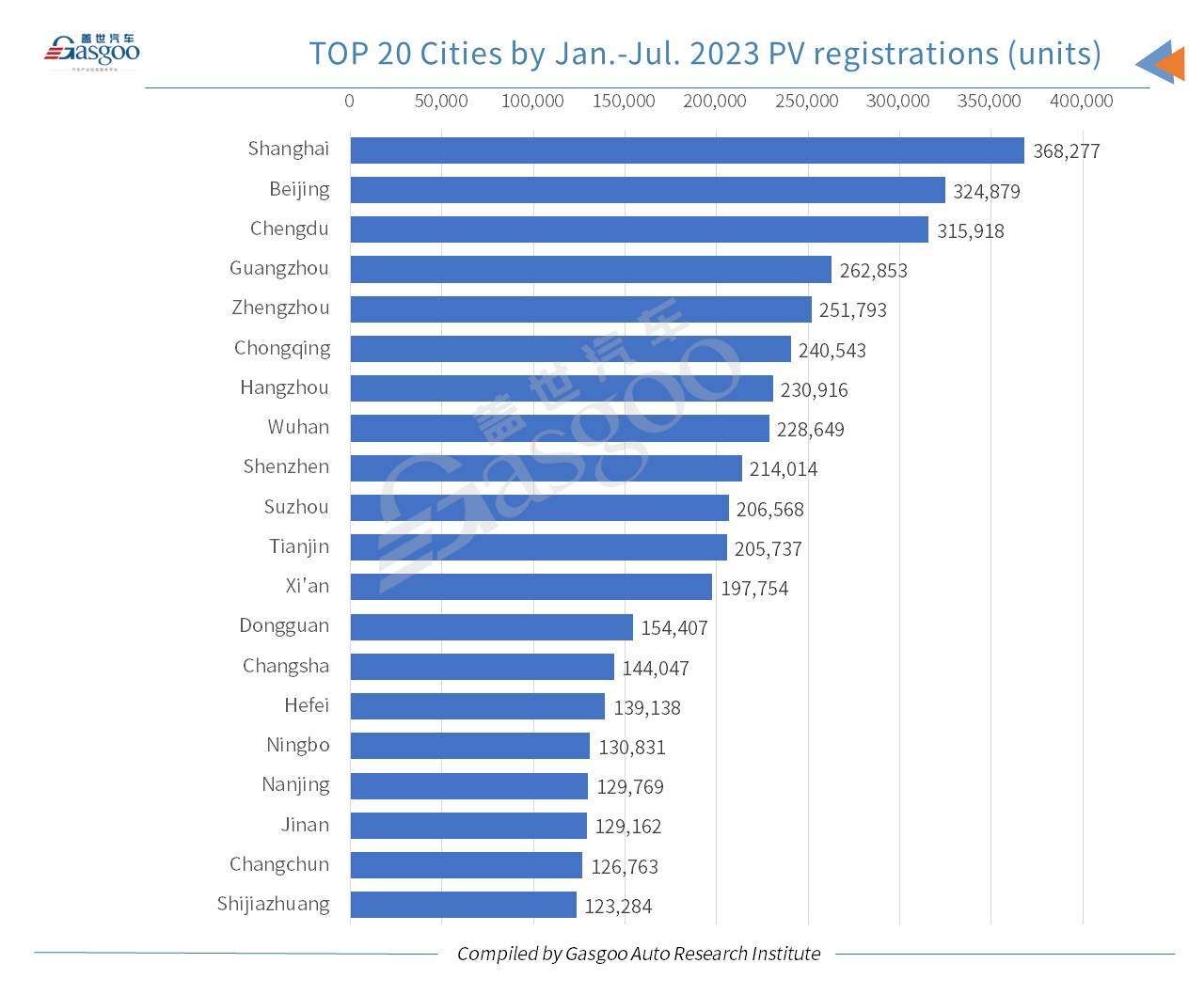

For the Jan.-Jul. period, a total of 11 cities had over 200,000 locally-made PVs registered each, three of which (Shanghai, Beijing, and Chengdu) saw their respective year-to-date registrations surpass 300,000 units.

In July 2023, China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 602,946 units, jumping 37.32% year on year, but dipping 6.62% month on month.

For the first seven months of this year, the cumulative NEPV registrations across the Chinese mainland leapt 39.07% over the prior-year period to 3,517,387 units.

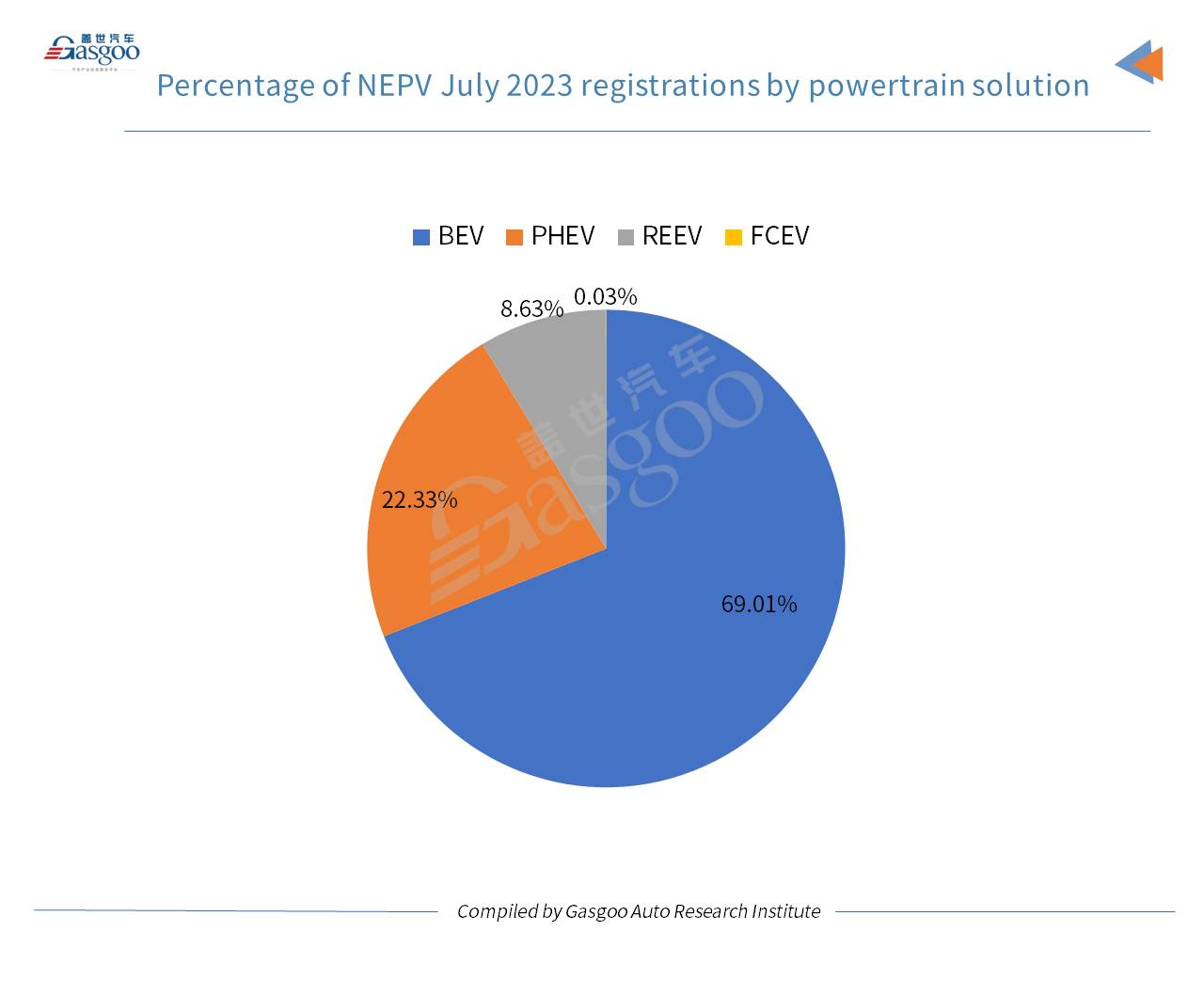

By specific powertrain solutions, the BEV sector logged a registration volume of 416,088 units in July, accounting for 69.01% of the country's total NEPV registrations. The plug-in hybrid electric vehicle (PHEV) registrations reached 186,662 units, which included 52,008 range-extended electric vehicles (REEVs).

There were 196 fuel cell electric vehicles (FCEVs) registered on the Chinese mainland in July, making up a tiny 0.03% of China's NEPV registrations.

Of the NEPVs registered in Jan.-Jul. 2023, 68.56% were contributed by BEVs. Meanwhile, the FCEV sector posted a year-to-date registration volume of only 263 units.

With respect to the NEPV registrations in July, BYD still took a remarkable lead over other brands. It had 200,783 NEPVs registered in the month, which were even more than the sum of the No.2-No.8 occupants. GAC Group's AION was credited the runner-up, while Li Auto and Tesla ranked 3rd and 4th, respectively.

Li Auto was the top-performer among Chinese NEV startups. The company made up 64.39% of the country's total REEV registrations in July, demonstrating the high attractiveness of its L series models to family users.

Wuling served as the No. 5 brand with 31,542 NEPVs registered in July, including 15,506 Hongguang MINIEV cars and 14,611 Binguo cars. Changan still occupied the 6th place with the Changan CS75 PLUS as its best-selling model. The Geely brand dropped 5 spots from the previous month to the 15th in July, while Galaxy, the NEV range Geely Automobile launched earlier this year, ranked 18th with only one production model, the Galaxy L7, now for sale.

In terms of the year-to-date NEPV registrations, the top five brands—BYD, Tesla, AION, Wuling, and Li Auto—all witnessed their cumulative registration volume surpass 100,000 units.

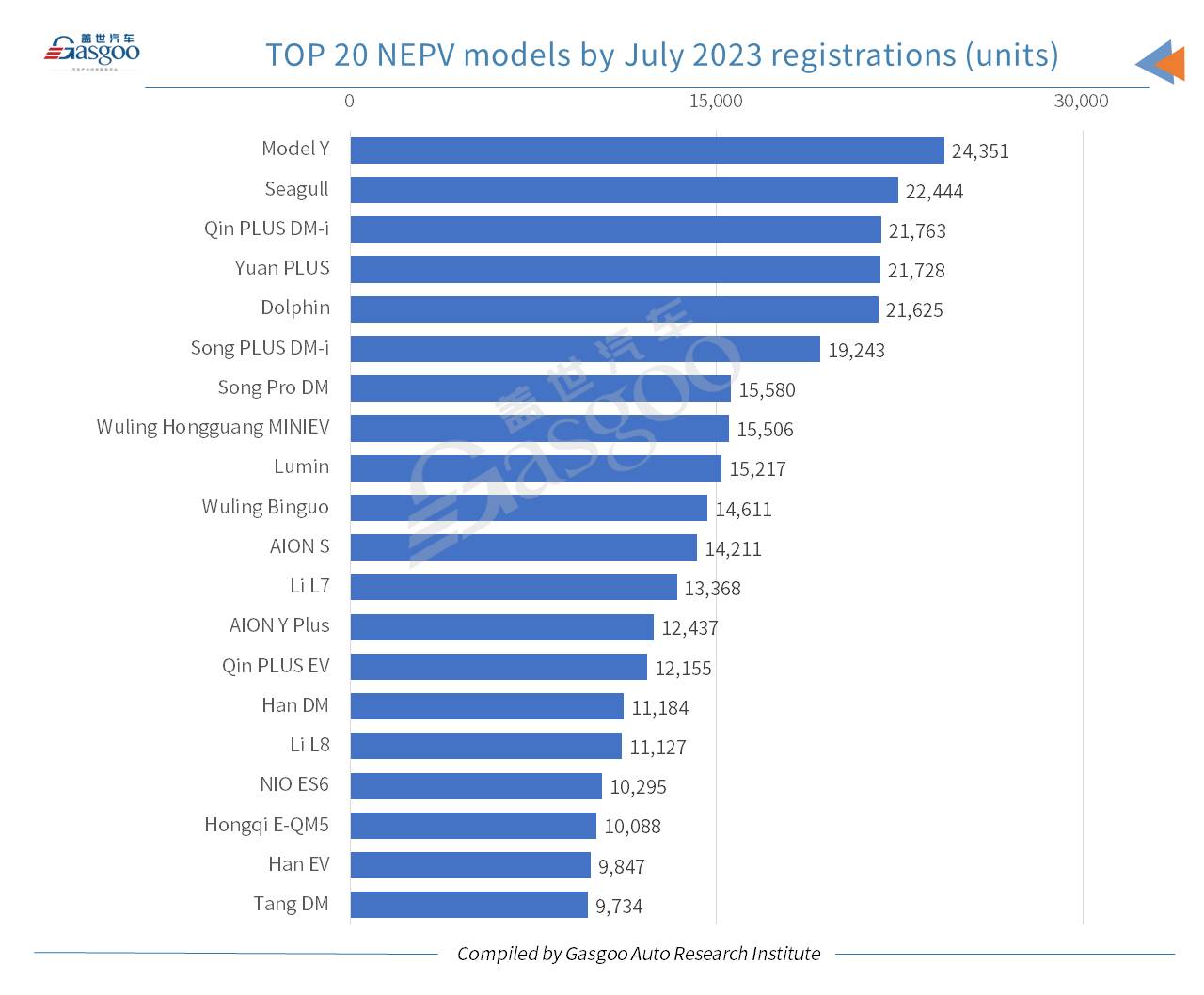

With regard to July registrations, the Model Y still topped other homemade NEPV models. Six BYD-branded models—the Seagull, the Qin PLUS DM-i, the Yuan PLUS, the Dolphin, the Song PLUS DM-i, and the Song Pro DM—took the 2nd to 7th spots among all domestically-built NEPV models.

The three brands-Wuling, AION, and Li Auto—all had two models on the top 20 NEPV models list by July registrations.

Judging from the Jan.-Jul. performance, there were 6 NEPV models in total whose respective cumulative registrations all exceeded 100,000 units. Of them, the Model Y was the only one to surpass the 200,000-unit mark.

On the top 20 NEPV models list by Jan.-Jul. registrations, BYD held 10 spots in total (including the DENZA D9). Li Auto saw its three L series models all enter the top 20 rankings (18th-20th).

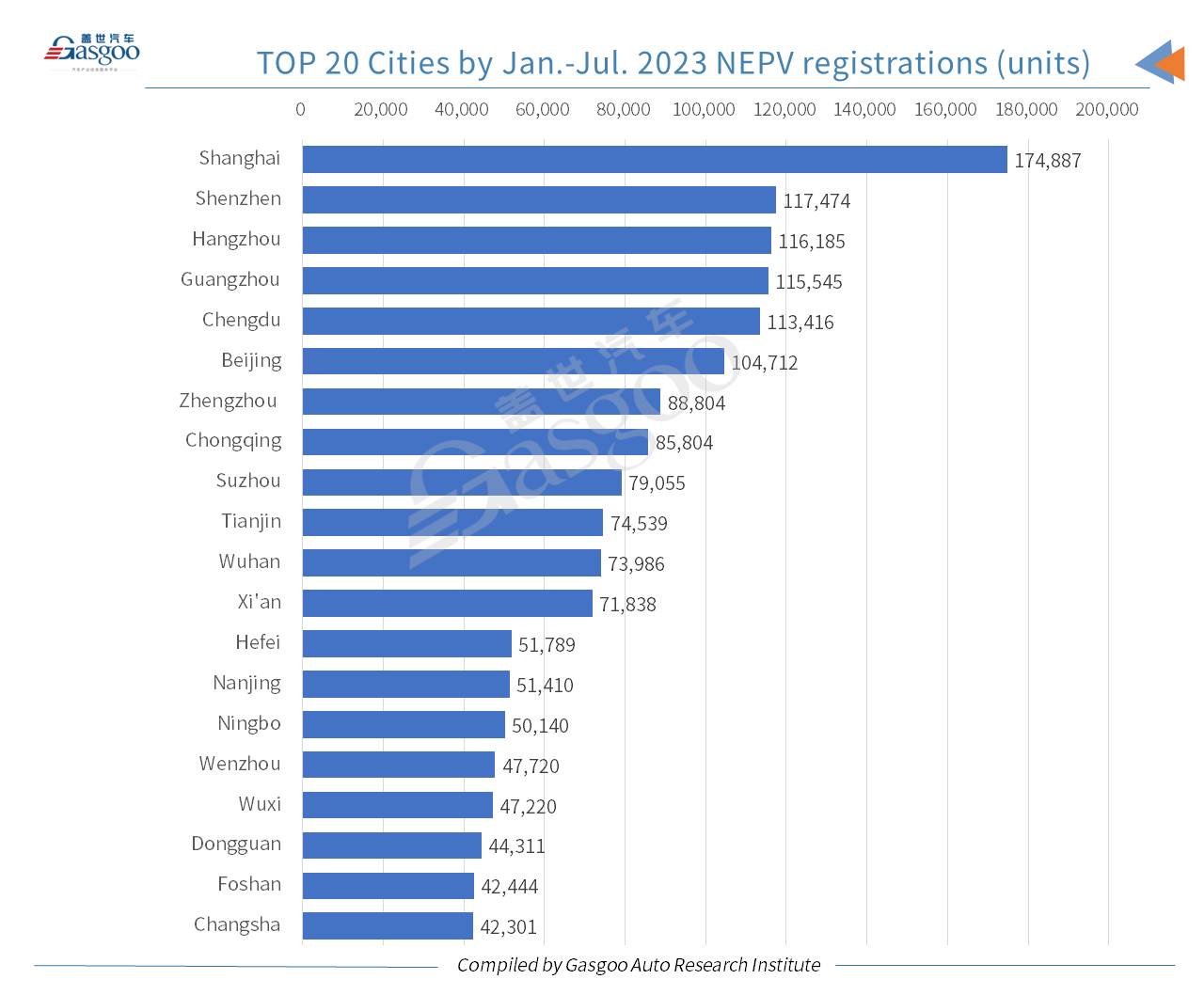

In July 2023, Beijing outdid other cities with 24,531 homemade NEPVs registered, outselling the runner-up Shanghai by only 447 units. Guangzhou moved up to the third place with over 20,000 NEPVs registered as well.

During this year's first seven months, there were 6 cities on the Chinese mainland with over 100,000 domestically built NEPVs registered each.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.