China's passenger vehicle market posts 2-digit YoY growth in both H1 2025 retail sales, wholesales

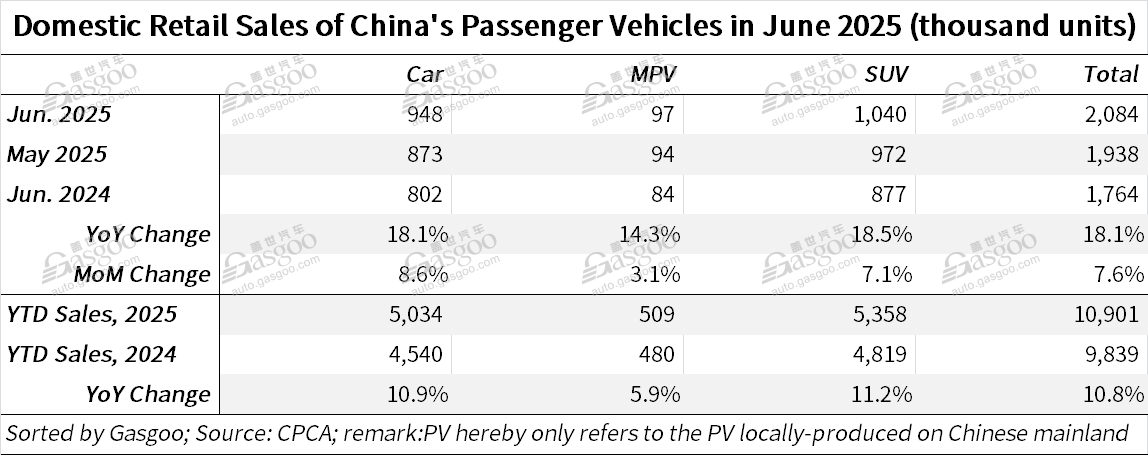

Shanghai (Gasgoo)- Retail sales of passenger vehicles (PVs) in China reached 2.084 million units in June 2025, marking an 18.1% year-on-year increase and a 7.6% rise from May, according to data from the China Passenger Car Association ("CPCA"). This brought total sales for the first half of the year to 10.901 million units, up 10.8% year-on-year.

Notably, June sales surpassed the previous record high of 1.94 million units in June 2022, reflecting exceptionally strong market growth.

For clarity, the passenger vehicles mentioned here are all locally produced on the Chinese mainland.

The surge was largely fueled by a combination of expanded government "Two New" consumption stimulus policies, which includes incentives for large-scale equipment renewals and consumer goods trade-ins. These measures created a clear "policy bonus" effect, with many consumers accelerating purchases to capitalize on limited-time offers. E-commerce platforms also moved their mid-year "6.18" sales promotions forward to mid-May, helping lift spending in adjacent sectors like home appliances—where retail growth notably outpaced the auto industry. Meanwhile, temporary pauses in local automotive subsidy programs due to funding constraints have led to a slight slowdown in consumer decision-making, with some buyers adopting a wait-and-see stance.

Unlike previous years, aggressive price cuts have been far less prevalent in 2025. In June, only 14 models were officially discounted, while May saw 12 models undergo price revisions—figures that have remained steady compared to the past two years, according to the CPCA. Promotional intensity on new energy vehicles (NEVs) edged down to a moderate 10.2%, slightly lower than in May. In contrast, discounts on traditional internal combustion engine (ICE) vehicles remained steep, with average incentives rising to 23.3%, underscoring the ongoing pressure in the ICE vehicle market.

Driven by policy support and renewed consumer interest post-Chinese New Year holiday, PV sales maintained strong momentum through June. According to China's Ministry of Commerce, cumulative applications for vehicle trade-in subsidies reached 4.12 million by the end of June, with 1.23 million applications submitted during the month alone—up 13% from May. Nearly 70% of private passenger car buyers in June were trade-in customers, signaling a dominant shift toward consumption upgrades, while first-time car buyers accounted for only 30%.

Retail sales of Chinese-brand vehicles leapt 30% year-on-year to 1.34 million units in June, securing a 64.2% domestic market share. For the first half of 2025, China's local brands commanded 64% of the market, up 7.5 percentage points year-on-year. Automakers like BYD, Geely Auto, Chery Automobile, and Changan Auto showed significant gains as they advanced their transformation into new energy vehicles and global players.

Mainstream joint ventures sold 510,000 PVs in June, a 5% year-on-year increase. However, their market shares continued to erode: German brands fell to 16.1%, down 2.4 percentage points; Japanese brands dropped to 12%, off 2.3 percentage points; and American brands declined to 5.8%.

Premium PV retail sales reached 230,000 units in China, down 7% year-on-year but up 18% from May. Their combined market share in June stood at 11%, three percentage points lower than a year ago.

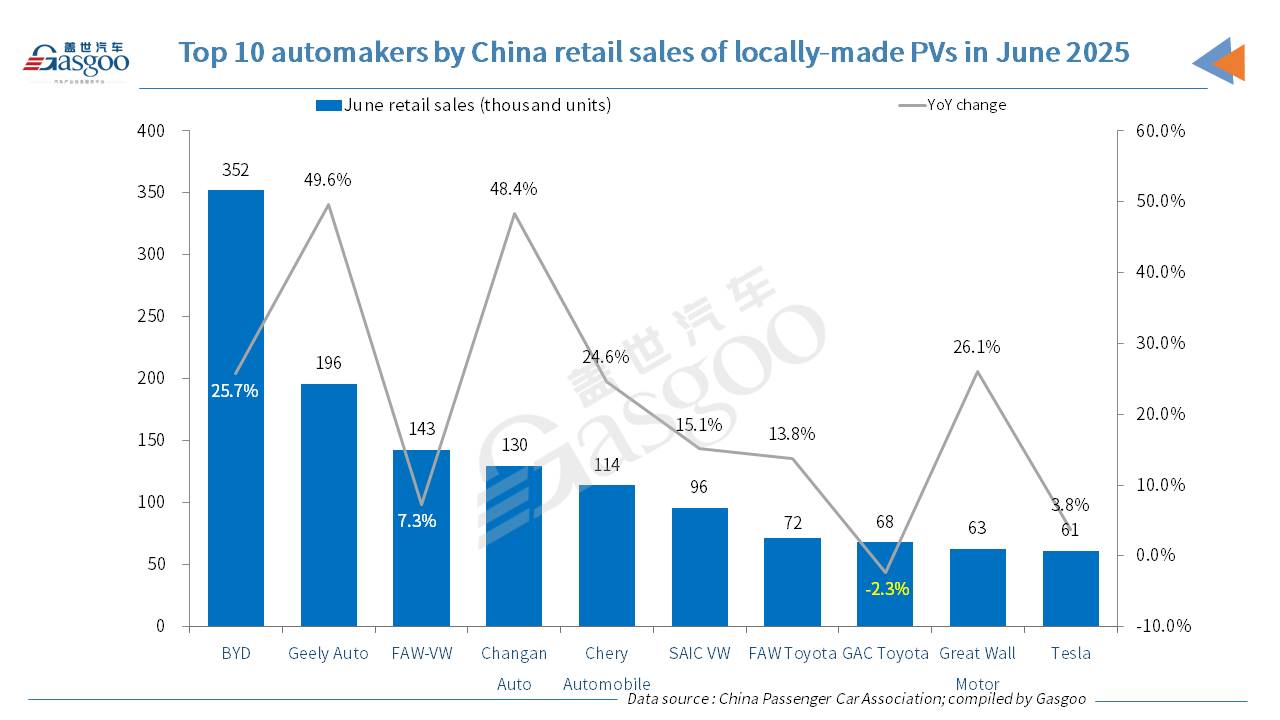

Among the top 10 automakers by domestic PV retail sales in China in June, BYD, Geely Auto, Changan Auto, Chery Automobile, SAIC VW, FAW Toyota, and Great Wall Motor all boasted a two-digit year-on-year growth, of which BYD ranked highest in terms of June sales. Tesla ranked 10th with around 61,000 China-made vehicles retailed last month.

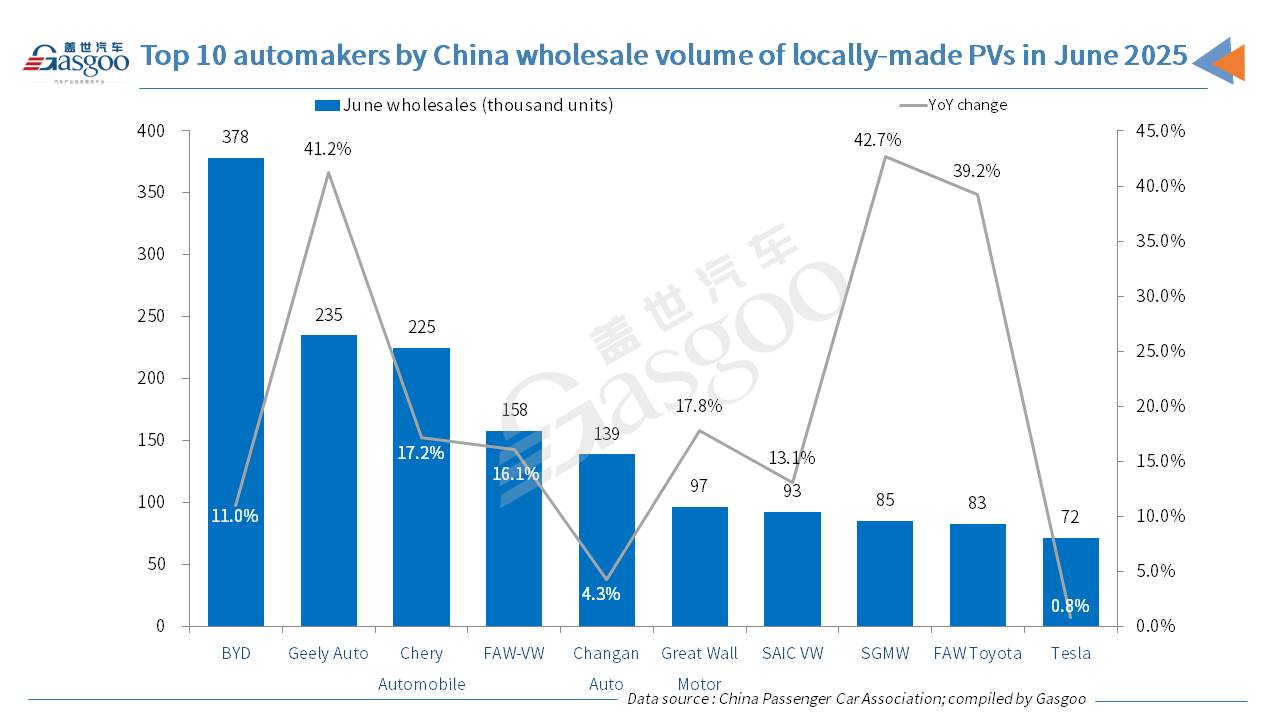

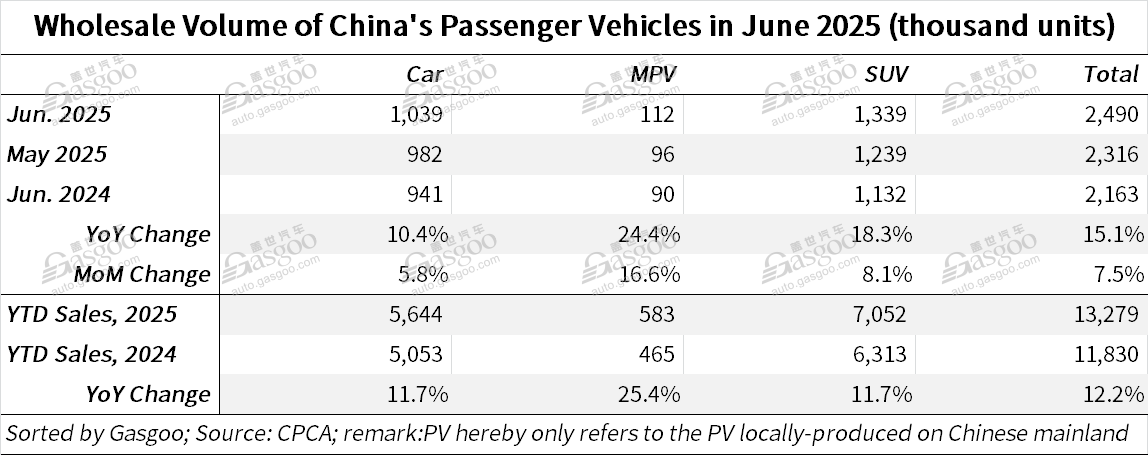

On the wholesale side, June passenger vehicle shipments reached a monthly record of 2.49 million units, up 15.1% year-on-year and 7.5% month-on-month. For the first half of the year, China's PV wholesale volume hit 13.279 million units, a year-on-year increase of 12.2%. Indigenous brands accounted for 1.67 million units in June, up 19% year-on-year, while joint-venture brands rose 11% from a year earlier to 553,000 units. Premium brands, however, saw a 3% year-on-year dip with a wholesale volume of 256,000 units.

The industry's wholesale landscape continues to evolve, with signs of emerging strength from smaller players. In June, only five automakers surpassed 100,000 units in monthly sales—on par with May and last year—collectively capturing 45% of the market.

Production remained robust, totaling 2.419 million units in June—up 13.3% year-on-year and 6.1% over May. Cumulative output for the first half of 2025 reached 13.246 million units, representing a 13.5% increase year-on-year and surpassing the previous record set in June 2022 by 200,000 units.

Production by Chinese brands rose 20% year over year, joint ventures gained a 9% year-on-year growth, while premium brands declined 15% year-on-year.

According to the CPCA's data, exports also delivered strong performance, with 480,000 PVs (referring to both complete vehicles and CKDs) shipped abroad in June—a 23.8% year-on-year increase and 7.3% higher than May. NEVs made up 41.1% of the export total, up 17 percentage points from a year ago. Chinese-brand PV exports grew 28% from a year earlier to 410,000 units, while the combined exports of joint ventures and premium brands fell 9% over the year-ago period to 62,000 units.

Total PV exports for the first half of the year amounted to 2.479 million units, up 6.8% over a year ago.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.