Rankings of ADAS component suppliers in China (Jan.-Oct. 2025): Clear divergence across sub-sectors

From January to October 2025, China's passenger vehicle ADAS market showed accelerated domestic breakthroughs, strengthening head concentration, and growing divergence across segments. In key areas such as air suspension system, LiDAR, APA solution, HD map, and high precision positioning system, Chinese suppliers continued to gain market influence through technological advances, cost control, and faster local integration, driving the large-scale adoption of high-end intelligent automotive components.

Meanwhile, market reshaping across ADAS segments continues. China's local suppliers are gaining ground in air suspension, the LiDAR market is highly concentrated with the top 3 players taking over 90% share, while driving-dedicated ADAS and forward-facing camera show a mixed landscape led by global players with accelerating local breakthroughs. Overall, Chinese suppliers are rapidly moving from followers to competitors—and in some areas, leaders—accelerating localization and marking a shift toward domestically driven, high-quality growth in intelligent automotive components.

Top air suspension system suppliers

Tuopu Group: 339,343 sets installed, 36.4% market share

KH Automotive Technologies: 290,541 sets installed, 31.2% market share

Baolong Automotive: 195,633 sets installed, 21.0% market share

Vibracoustic: 78,337 sets installed, 8.4% market share

Continental: 25,615 sets installed, 2.7% market share

Others: 2,510 sets installed, 0.3% market share

From January to October, China's local suppliers continued to strengthen their dominance in China's air suspension system market. Tuopu Group, KH Automotive Technologies, and Baolong Automotive ranked as the top 3 players, together accounting for over 88% of the market. In contrast, global brands such as Vibracoustic and Continental held only 8.4% and 2.7% shares, while other players remained below 0.3%. This structure highlights the strong competitiveness of China's local suppliers in technology, cost control, and local response capabilities, while also accelerating the mass adoption of air suspension systems in China's passenger vehicle market and underscoring the rapid rise of China's auto components industry in high-end segments.

Top LiDAR suppliers

Huawei Technologies: 962,210 units installed, 41.8% market share

Hesai Technology: 784,789 units installed, 34.1% market share

RoboSense: 421,928 units installed, 18.3% market share

Seyond: 134,865 units installed, 5.9% market share

Others: 202 units installed

From January to October, the LiDAR market remained highly concentrated at the top. Huawei Technologies led the pack with a 41.8% share, followed by Hesai Technology (34.1%) and RoboSense (18.3%). The top 3 together accounted for 94.2% of total installations, leaving less than 6% to all other players. As ADAS adoption continues to rise, overall demand will expand, but high technical and scale barriers suggest the LiDAR market will remain firmly dominated by leading suppliers.

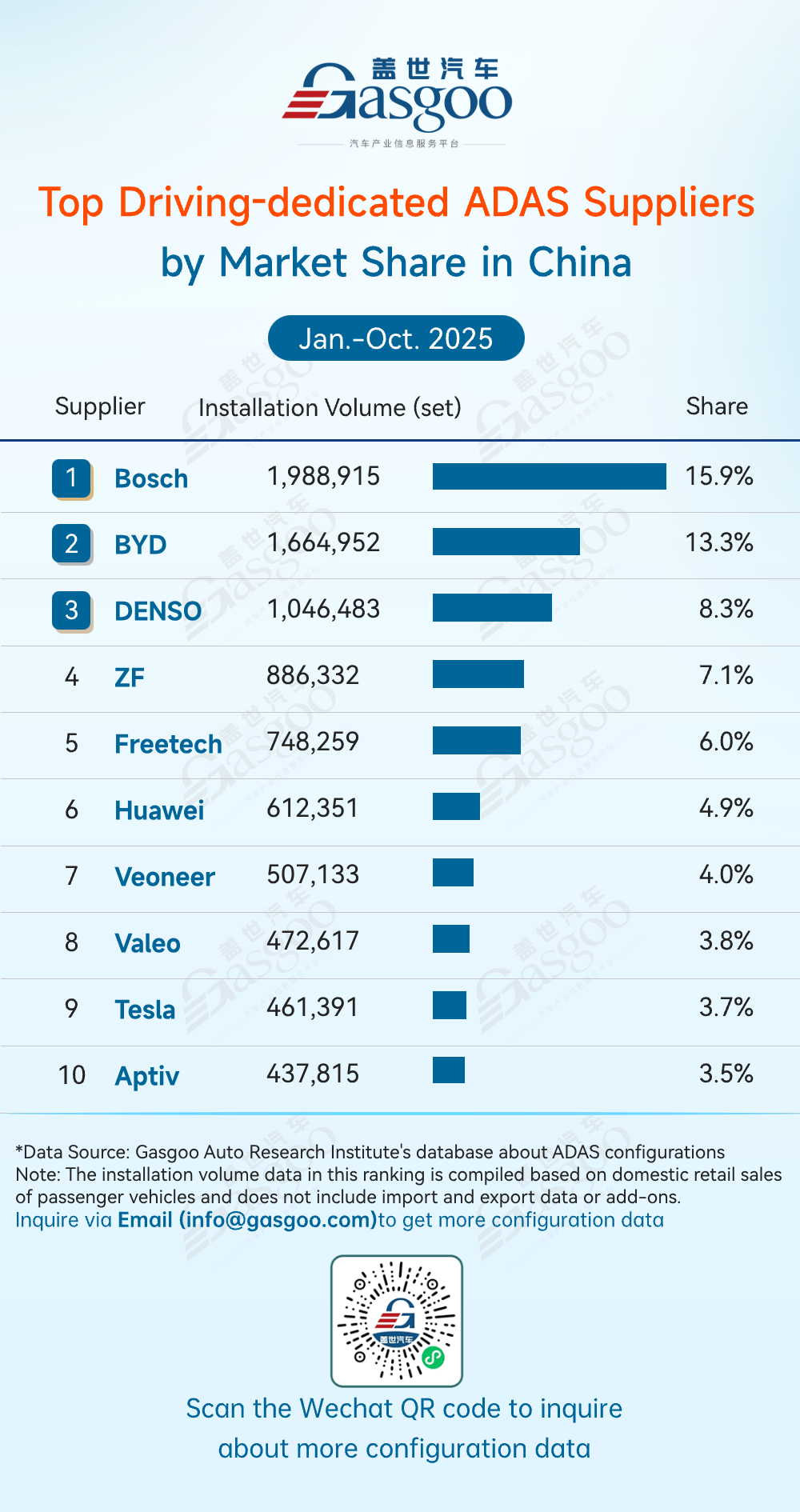

Top driving-dedicated ADAS suppliers

Bosch: 1,988,915 sets installed, 15.9% market share

BYD: 1,664,952 sets installed, 13.3% market share

DENSO: 1,046,483 sets installed, 8.3% market share

ZF: 886,332 sets installed, 7.1% market share

Freetech: 748,259 sets installed, 6.0% market share

Huawei: 612,351 sets installed, 4.9% market share

Veoneer: 507,133 sets installed, 4.0% market share

Valeo: 472,617 sets installed, 3.8% market share

Tesla: 461,391 sets installed, 3.7% market share

Aptiv: 437,815 sets installed, 3.5% market share

From January to October, the on-road ADAS market remained competitive. Bosch led the pack with a 15.9% share, followed by BYD at 13.3%, reflecting the rapid rise of OEM self-developed solutions. Traditional Tier 1 suppliers such as DENSO and ZF maintained stable positions, while technology players like Huawei gained share, intensifying cross-industry competition. Front-facing integrated camera solutions remain mainstream, and competition is expected to further intensify as intelligent driving adoption accelerates.

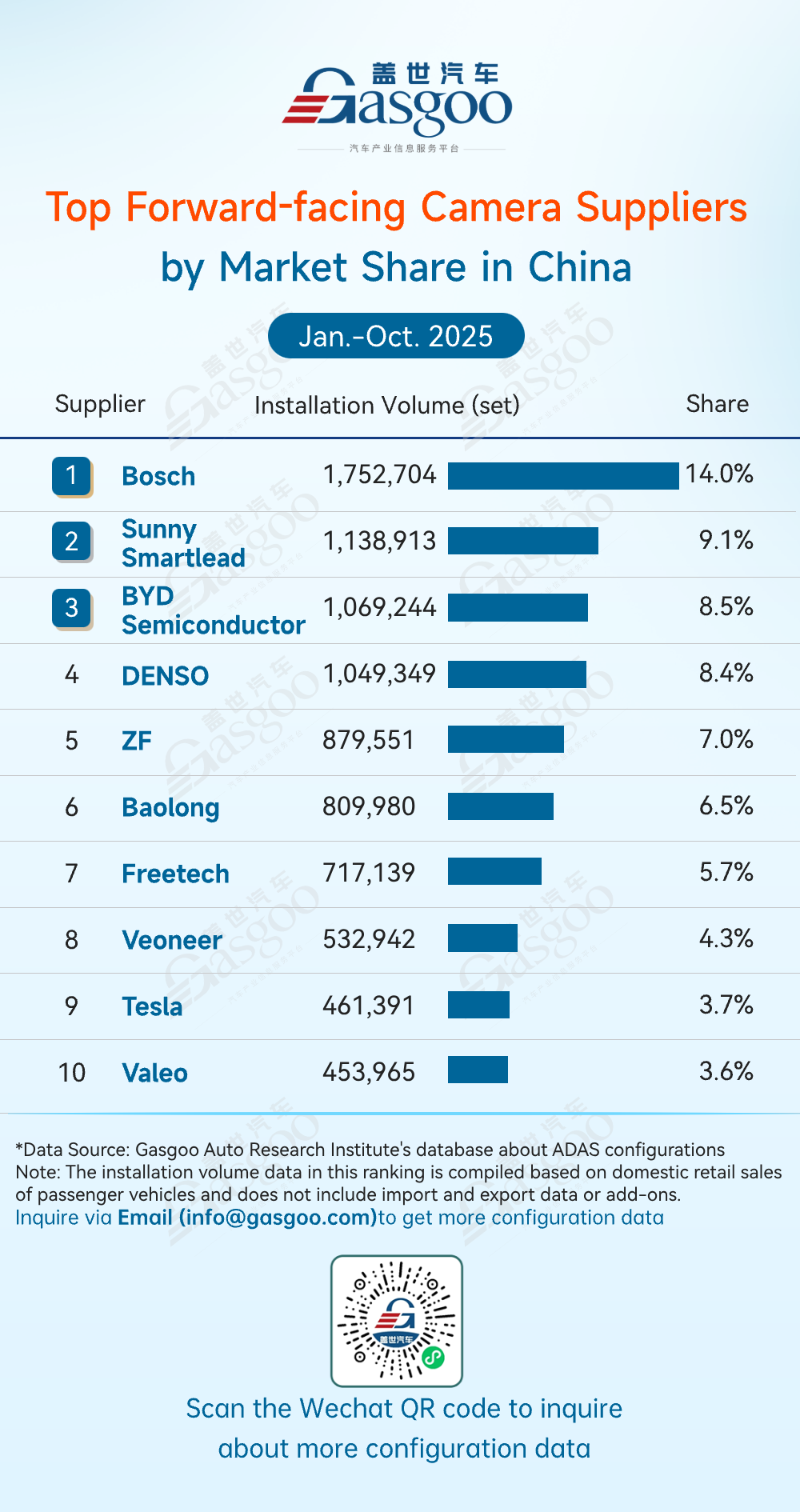

Top forward-facing camera suppliers

Bosch: 1,752,704 sets installed, 14.0% market share

Sunny Smartlead: 1,138,913 sets installed, 9.1% market share

BYD Semiconductor: 1,069,244 sets installed, 8.5% market share

DENSO: 1,049,349 sets installed, 8.4% market share

ZF: 879,551 sets installed, 7.0% market share

Baolong: 809,980 sets installed, 6.5% market share

Freetech: 717,139 sets installed, 5.7% market share

Veoneer: 532,942 sets installed, 4.3% market share

Tesla: 461,391 sets installed, 3.7% market share

Valeo: 453,965 sets installed, 3.6% market share

From January to October, the forward-facing camera market showed a pattern of foreign suppliers leading while China's local players accelerated their breakthrough. Bosch ranked first with a 14.0% market share, followed by Sunny Smartlead and BYD Semiconductor with 9.1% and 8.5%, respectively, emerging as key Chinese contenders. Meanwhile, local suppliers such as Baolong Automotive and Freetech continued to gain share, highlighting a clear upward trend for domestic players. Overall, the market is shifting from long-term foreign dominance toward a more competitive, multi-player landscape, with localization advancing at a faster pace.

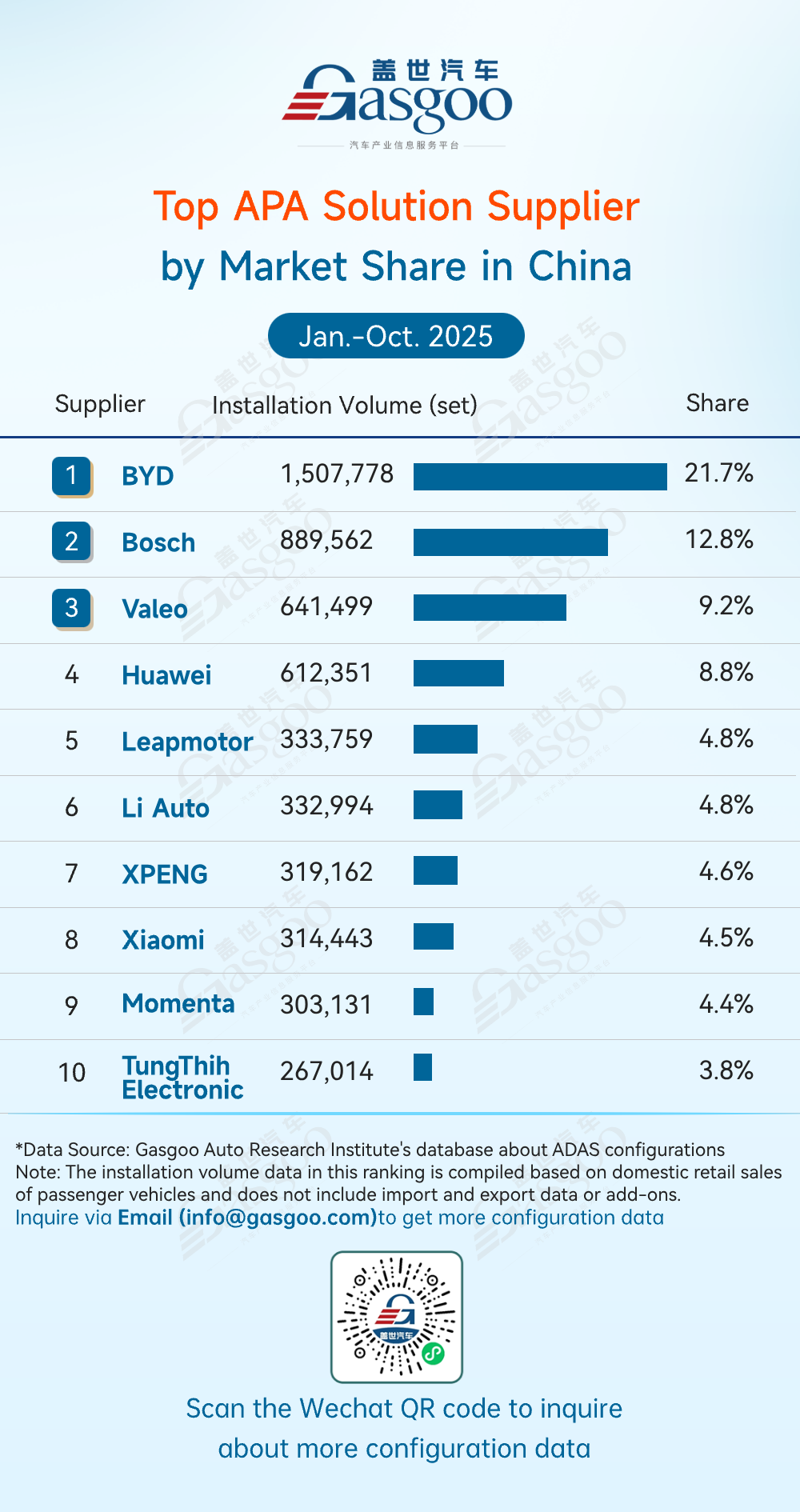

Top APA solution suppliers

BYD: 1,507,778 sets installed, 21.7% market share

Bosch: 889,562 sets installed, 12.8% market share

Valeo: 641,499 sets installed, 9.2% market share

Huawei: 612,351 sets installed, 8.8% market share

Leapmotor: 333,759 sets installed, 4.8% market share

Li Auto: 332,994 sets installed, 4.8% market share

XPENG: 319,162 sets installed, 4.6% market share

Xiaomi EV: 314,443 sets installed, 4.5% market share

Momenta: 303,131 sets installed, 4.4% market share

TungThih Electronic: 267,014 sets installed, 3.8% market share

From January to October, the APA solution market further strengthened the trend of rising domestic market share. BYD ranked first with a 21.7% share, building a clear lead. Chinese tech players such as Huawei, together with local OEMs including Leapmotor and Li Auto, are breaking through in parallel, forming a diversified competitive landscape alongside foreign suppliers like Bosch and Valeo. Meanwhile, companies such as Momenta and TungThih Electronic maintained stable positions. Overall, this trend reflects the rapid commercialization of China's local APA technologies and a significant upgrade in the localization and maturity of China's intelligent automotive supply chain.

Top HD map suppliers

AutoNavi: 1,061,977 sets installed, 53.6% market share

Tencent: 245,682 sets installed, 12.4% market share

Langge Technology: 241,930 sets installed, 12.2% market share

NavInfo: 120,713 sets installed, 6.1% market share

Others: 309,418 sets installed, 15.6% market share

From January to October, the HD map market showed a pattern of "dominant leaders with a second tier in hot pursuit." AutoNavi maintained a commanding position with a 53.6% market share and over one million sets installed. Tencent and Langge Technology formed the second tier with shares of 12.4% and 12.2%, respectively—Tencent leveraging its internet ecosystem for scenario-based applications, while Langge strengthened its position through regional focus and customized services. NavInfo held a 6.1% share, maintaining steady progress. Other players together accounted for 15.6%, indicating that while concentration is high, room for diversified competition remains.

Overall, as the industry evolves, requirements for HD maps—particularly in accuracy, update frequency, and scenario adaptability—will continue to rise, further reinforcing the "strong-get-stronger" concentration trend. Smaller players will need to rely on differentiated strengths in niche segments to secure a more sustainable position in the market.

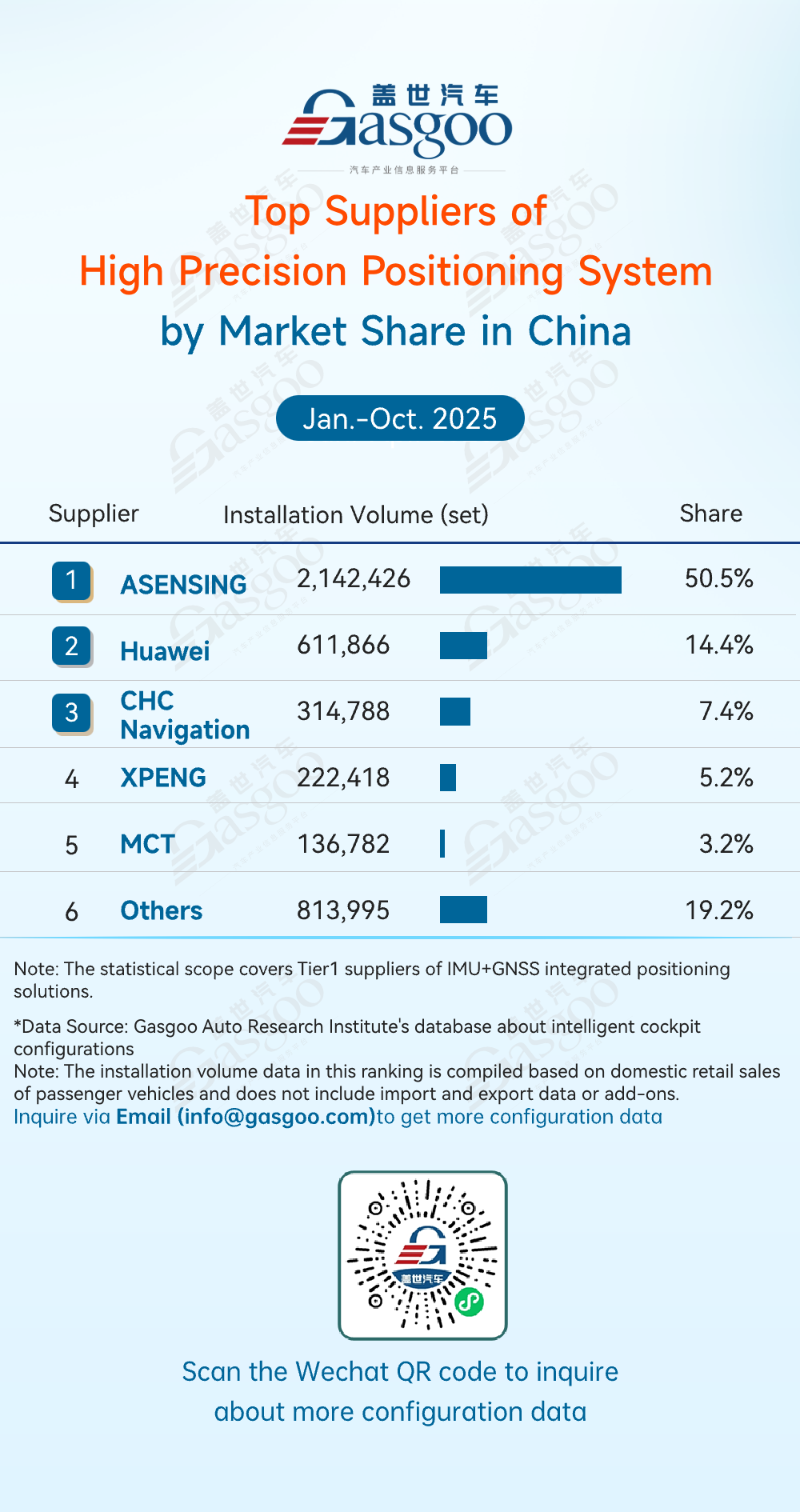

Top suppliers of high precision positioning system

ASENSING: 2,142,426 sets installed, 50.5% market share

Huawei: 611,866 sets installed, 14.4% market share

CHC Navigation: 314,788 sets installed, 7.4% market share

XPENG: 222,418 sets installed, 5.2% market share

MCT: 136,782 sets installed, 3.2% market share

Others: 813,995 sets installed, 19.2% market share

From January to October, China's high precision positioning market maintained a leader-led, multi-player competitive structure, with the onboard adoption of integrated positioning solutions continuing to accelerate. ASENSING remained firmly in the lead, capturing 50.5% market share with 2,142,426 sets installed, reflecting its strong advantages in fusion positioning and large-scale deployment. Huawei ranked second with a 14.4% share, underscoring its deep penetration into the intelligent vehicle ecosystem. CHC Navigation, XPENG, and MCT followed with smaller but stable shares, while other players accounted for 19.2%, indicating that although concentration at the top remains high, competition in segmented application scenarios persists.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.