Changan Auto's exports surge 140.7% YoY in North America丨China’s passenger vehicle exporters overview (Jan.-Oct. 2025)

From January to October, China's passenger vehicle exports showed a clear regional divergence. In Europe, SAIC Passenger Vehicle remained the market leader, while BYD Auto and Chery Auto posted rapid growth, and emerging players such as Leapmotor achieved multiple-fold increases from a low base. In Southeast Asia, BYD Auto dominated the market, nearly doubling exports on the strength of its new energy vehicle (NEV) lineup, while most peers expanded more moderately and a few saw declines.

In North America, Latin America, and the Middle East, opportunities and challenges also coexist. Automakers such as BYD Auto and Changan Auto have achieved rapid breakthroughs, while some traditional players are encountering growth bottlenecks. Behind the steady rise of Chinese brands' overseas penetration lies a broader competition in product strength and localization capabilities, with regional markets entering a more refined and differentiated phase of competition.

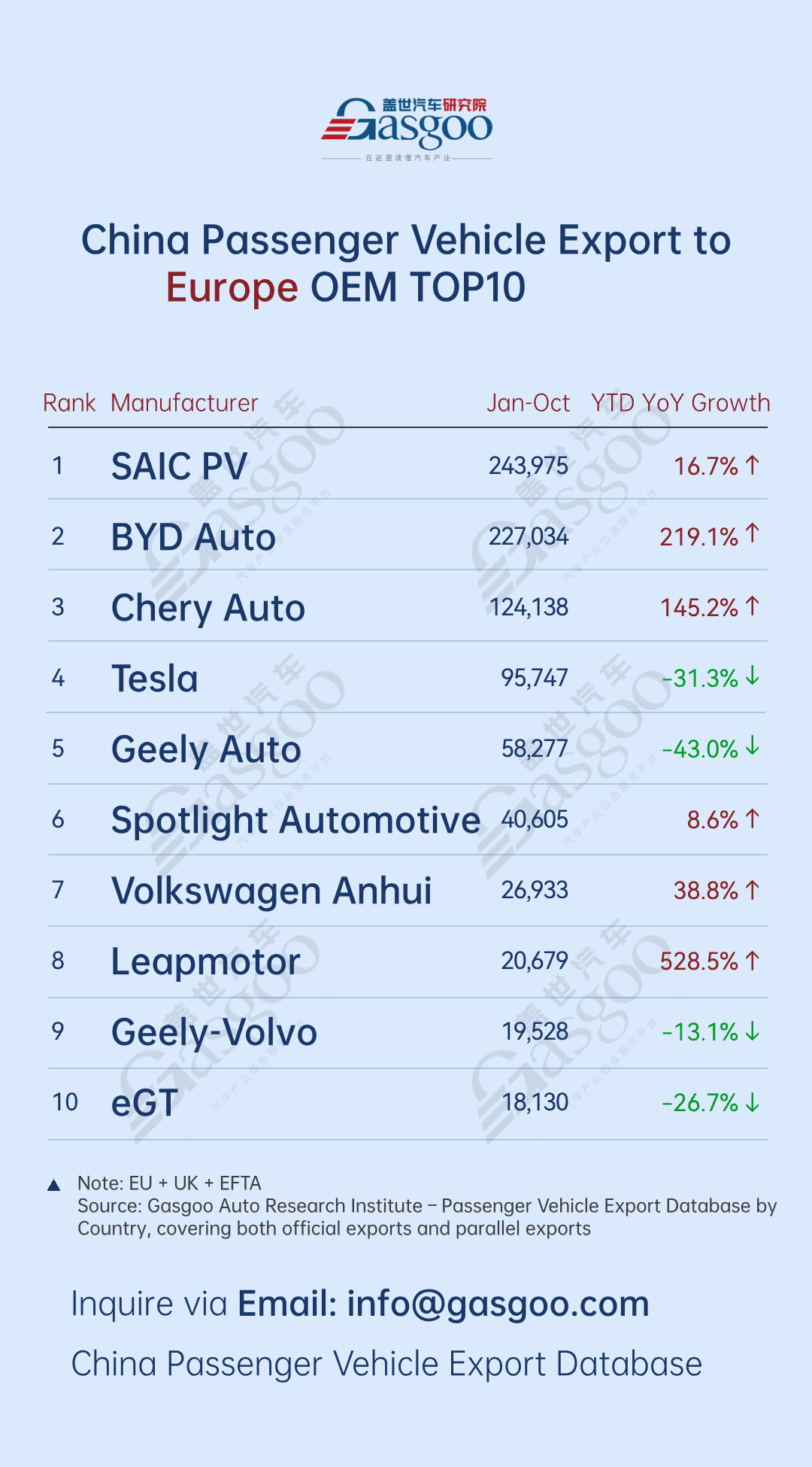

Top 10 Chinese automakers by passenger vehicle exports to Europe

SAIC PV: 243,975 units, up 16.7% year-on-year

BYD Auto: 227,034 units, up 219.1% year-on-year

Chery Auto: 124,138 units, up 145.2% year-on-year

Tesla: 95,747 units, down 31.3% year-on-year

Geely Auto: 58,277 units, down 43.0% year-on-year

Spotlight Automotive: 40,605 units, up 8.6% year-on-year

Volkswagen Anhui: 26,933 units, up 38.8% year-on-year

Leapmotor: 20,679 units, up 528.5% year-on-year

Geely–Volvo: 19,528 units, down 13.1% year-on-year

eGT: 18,130 units, down 26.7% year-on-year

From January to October, the European market was characterized by high concentration at the top and sharp differentiation among players. SAIC PV ranked first with 243,975 units exported, up 16.7% YoY. BYD Auto followed closely at 227,034 units, posting a 219.1% YoY increase and rapidly closing the gap, while Chery Auto ranked third with 124,138 units and 145.2% YoY growth, highlighting its strengthening competitiveness in Europe.

The surge of emerging players was increasingly striking. Leapmotor exported 20,679 units, with a remarkable 528.5% YoY increase, emerging as a fast-rising new force for Chinese brands in Europe. Meanwhile, Volkswagen Anhui exported 26,933 units, posting 38.8% YoY growth, highlighting how established global automakers are adapting locally and becoming new variables in China's passenger vehicle exports to Europe.

Meanwhile, market divergence continued to widen. Tesla exported 95,747 units, down 31.3% YoY, while Geely Auto saw exports fall 43.0% YoY to 58,277 units. Geely-Volvo and eGT also recorded declines of 13.1% and 26.7% YoY, respectively. These setbacks likely reflect intensifying competition from a surge of Chinese brands, faster electrification pushback from European incumbents, and the combined impact of product cycles and strategic adjustments.

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia

BYD Auto: 122,784 units, up 196.3% year-on-year

Geely Auto: 70,126 units, up 46.5% year-on-year

Chery Auto: 69,817 units, up 132.7% year-on-year

Changan Auto: 30,397 units, up 70.0% year-on-year

Great Wall Motor: 18,355 units, up 55.3% year-on-year

Tesla: 14,875 units, up 18.5% year-on-year

Jiangsu Yueda Kia: 14,598 units, up 6.3% year-on-year

SAIC PV: 13,134 units, down 39.6% year-on-year

Jiangling Motor: 12,979 units, up 9.1% year-on-year

SAIC-GM-Wuling: 10,409 units, down 49.0% year-on-year

From January to October, Southeast Asia maintained strong growth momentum, with the market showing a pattern of clear leadership at the top, broad-based expansion among most automakers, and selective declines for a few players.

Among leading players, BYD Auto topped the Southeast Asian market with 122,784 units, nearly doubling year on year (+196.3%), highlighting the strength of its NEV technology and localized channel strategy. Geely Auto ranked second with 70,126 units (+46.5% YoY), maintaining steady growth, while Chery Auto followed closely at 69,817 units, posting a sharp +132.7% YoY increase that underscores strong product-market fit. Meanwhile, Changan Auto, Great Wall Motor, Jiangsu Yueda Kia, and Jiangling Motor also delivered positive growth.

Overall, Chinese brands continue to gain penetration in Southeast Asia, with NEVs remaining the core driver of export growth. Leading players are further consolidating their positions through technological advantages and strong distribution networks. At the same time, declines among some automakers signal a shift in the market from pure volume expansion to more refined competition, where product localization and operational execution will become decisive factors.

Top 10 Chinese automakers by passenger vehicle exports to North America

SAIC-GM-Wuling: 94,786 units, up 18.8% year-on-year

BYD Auto: 81,580 units, up 86.9% year-on-year

Chery Auto: 33,372 units, up 33.4% year-on-year

SAIC PV: 32,095 units, down 37.9% year-on-year

Changan-Ford: 29,844 units, down 22.2% year-on-year

Geely Auto: 29,522 units, up 35.0% year-on-year

Jiangsu Yueda Kia: 25,507 units, up 3.2% year-on-year

SAIC-GM: 22,152 units, down 59.8% year-on-year

Changan Auto: 18,623 units, up 140.7% year-on-year

GAC Trumpchi: 13,280 units, up 28.5% year-on-year

From January to October, market divergence in North America continued to deepen. Automakers leading the NEV transition posted particularly strong momentum: SAIC-GM-Wuling ranked first with exports of 94,786 units, up 18.8% YoY; BYD Auto followed closely with 81,580 units and an 86.9% YoY surge, highlighting its rapidly growing market penetration. Changan Auto stood out with a sharp 140.7% increase, while Chery and Geely also expanded steadily, recording growth of 33.4% and 35.0%, respectively.

By contrast, some automakers faced clear growth headwinds. SAIC-GM saw exports plunge 59.8% YoY, while SAIC PV recorded a 37.9% decline, and Changan Ford also retreated with a 22.2% drop. These performances suggest that product portfolios still dominated by internal combustion vehicles are gradually losing competitiveness in the North American market. Mid-tier players remained largely stable but lacked momentum, with Jiangsu Yueda Kia posting only a modest 3.2% increase.

Overall, Chinese automakers' exports to North America are at a pivotal stage marked by the rapid expansion of new-energy frontrunners and a deep adjustment among traditional players. Going forward, the pace of electrification and the sophistication of global operations will be the key variables shaping the competitive landscape in the North American market.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America

BYD Auto: 131,360 units, up 7.1% year-on-year

Chery Auto: 110,758 units, up 22.2% year-on-year

Great Wall Motor: 59,752 units, up 72.5% year-on-year

Jiangsu Yueda Kia: 41,056 units, down 0.1% year-on-year

Jiangling Motor: 31,664 units, up 86.5% year-on-year

Geely Auto: 24,500 units, up 20.1% year-on-year

SAIC-GM-Wuling: 21,736 units, down 14.7% year-on-year

DFSK: 20,119 units, up 77.3% year-on-year

SAIC PV: 19,302 units, up 38.4% year-on-year

Changan Auto: 18,491 units, up 10.8% year-on-year

From January to October, the China–Latin America market showed a pattern of "clear leaders with diverging growth, broad-based expansion with a few declines." BYD Auto remained the leader with exports of 131,360 units, though its cumulative volume edged down 7.1% YoY amid a high base and intensifying regional competition. Chery Auto followed closely with 110,758 units, posting a solid 22.2% YoY increase, reflecting the effectiveness of its cost-competitive product lineup and localized channel strategy in steadily narrowing the gap with the market leader.

Multiple automakers emerged as key growth engines in the region. Great Wall Motor, Jiangling Motor, and DFSK all recorded YoY growth exceeding 70%, with Jiangling Motor's standout performance underscoring the strong market fit of its passenger–commercial dual-use models in Latin America. SAIC PV also expanded steadily, posting 38.4% growth, highlighting the solid competitiveness of its product portfolio and its continued progress in market penetration.

Meanwhile, some automakers came under growth pressure. Jiangsu Yueda Kia posted a marginal 0.1% YoY decline, while SAIC-GM-Wuling fell by 14.7% YoY, suggesting the need for further optimization in regional strategy or product mix. In contrast, Changan Auto reversed its earlier downturn and returned to positive growth with a 10.8% YoY increase.

Overall, competition in the Latin American market has entered a phase of more refined and nuanced rivalry. Automakers are now required to compete on product differentiation, the depth of localization, and the pace of technological iteration. Only by closely aligning with regional energy structures and consumer preferences can sustainable and high-quality growth be achieved.

Top 10 Chinese automakers by passenger vehicle exports to Middle East

Chery Auto: 195,781 units, down 35.8% year-on-year

BYD Auto: 99,508 units, up 95.9% year-on-year

SAIC PV: 81,869 units, down 2.2% year-on-year

Changan Auto: 71,722 units, up 51.8% year-on-year

Jiangsu Yueda Kia: 70,207 units, up 18.8% year-on-year

Geely Auto: 68,376 units, down 8.1% year-on-year

FAW-Toyota: 64,373 units, up 87.1% year-on-year

Great Wall Motor: 43,463 units, up 115.3% year-on-year

Southeast Auto: 42,094 units, up 177.1% year-on-year

Beijing Hyundai: 35,215 units, up 42.7% year-on-year

From January to October, the Middle East market showed a pattern of stable leadership but sharply diverging growth trajectories. Chery Auto remained the largest exporter with 195,781 units, although its year-to-date volume declined by 35.8% YoY amid a high base and intensifying regional competition, narrowing its historical lead. In contrast, BYD Auto recorded strong momentum, exporting 99,508 units with a 95.9% YoY increase, significantly closing the gap with Chery Auto. This growth was largely driven by the rising policy alignment and consumer acceptance of NEVs in the Middle East, positioning NEVs as the key engine of export expansion.

Meanwhile, some automakers faced growth pressure. SAIC Passenger Vehicle edged down 2.2% YoY, while Geely Auto declined 8.1% YoY, suggesting that parts of the traditional lineup need faster strategic adjustment. In contrast, Changan Auto, Jiangsu Yueda Kia, FAW-Toyota, Great Wall Motor, Beijing Hyundai, and Southeast Auto all posted solid growth, with Southeast Auto standing out as the fastest-growing player, reflecting strong product–market fit in the region.

Overall, the Middle East has emerged as a key strategic destination for Chinese automakers' exports. The pace of new energy transition and the ability to differentiate products have become critical levers for market expansion. Traditional leaders need to accelerate region-specific adjustments, while fast-growing players must further strengthen product competitiveness and local channel development to secure long-term, sustainable growth.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service: buyer-support@gasgoo.com Seller Service: seller-support@gasgoo.com

All Rights Reserved. Do not reproduce, copy and use the editorial content without permission. Contact us: autonews@gasgoo.com.