Shanghai (Gasgoo)- In July, automakers in China bought the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles (MLI) for roughly 90,403 new energy vehicles (NEVs), representing a robust surge of 166.53% from a year ago, according to China Insurance Regulatory Commission (CIRC).

However, severely affected by the COVID-19 outbreak, China's NEV insurance registrations still plunged 30.26% year on year to 397,067 units for the first seven months.

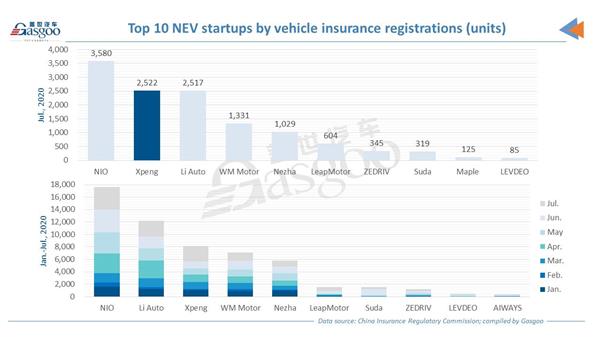

Among the NEVs registered in July, 12,743 units were from the EV startups, a marvelous year-on-year increase of 432.73%. As for the year-to-date performance, the insurance volume of the startup-built NEVs soared 72.81% from the previous year to 57,176 units thanks to the gradual growth in new products' deliveries.

The top five EV startups by the Jan.-Jul. vehicle insurance volume were still NIO, Li Auto, Xpeng Motors, WM Motor and HOZON Auto. With nearly 50,953 new vehicles registered so far this year, the five automakers accounted for roughly 90% of the total insurance volume of all Chinese startups.

NIO and Li Auto held remarkable advantages over their rivals with their Jan.-Jul. insurance volumes amounting to 17,628 units and 12,184 units respectively. Honored the second runner-up, Xpeng Motors saw its year-to-date insurance number total 8,185 units, 1,082 units more than that of the WM Motor. HOZON Auto was still ranked fifth with 5,853 vehicles registered.

NIO ES6's insurance registrations skyrocket 288% in July

NIO's insurance registrations reached 3,580 units in July, including 2,615 ES6s (+288% YoY). With 14,228 units registered in total, the ES6 took up 80.71% of NIO's Jan.-Jul. insurance volume. Among the China-made all-electric PV models, the ES6 was ranked fourth in terms of year-to-date insurance number.

NIO's third mass-produced model, the NIO EC6, went on sale at the Chengdu Motor Show 2020 with three variants offered at one go. The vehicle pre-subsidy prices range from 368,000 yuan ($52,542) to 526,000 yuan ($75,101). Its delivery is expected to kick off in late September.

(NIO ES6, photo source: NIO)

William Li, NIO's chairman and CEO, said in an interview that by September this year, the NIO-JAC plant will increase its production capacity by 25% to about 5,000 vehicles per month.

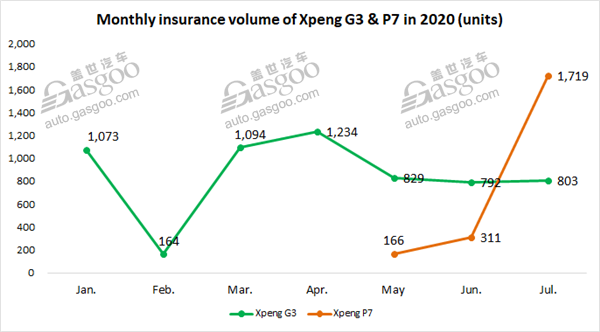

Xpeng Motors gains hike in July insurance volume thanks to impetus from Xpeng P7

Driven by the scale delivery of the Xpeng P7, Xpeng Motors witnessed its July insurance volume shoot up 130% month on month to 2,522 units, moving up to the No. 2 place by July number.

Last month, the Xpeng P7's insurance volume zoomed 450% over a month ago to 1,719 units, primarily stemming from the production ramp-up at Xpeng's self-built Zhaoqing plant and the scale delivery ceremonies simultaneously held in Beijing, Shanghai, Zhaoqing and Chengdu on July 17.

(Xpeng G3, photo source: Xpeng Motors)

Moreover, the insurance number of the Xpeng G3 reached 803 units in July and added up to 5,989 units in Jan.-Jul. period.

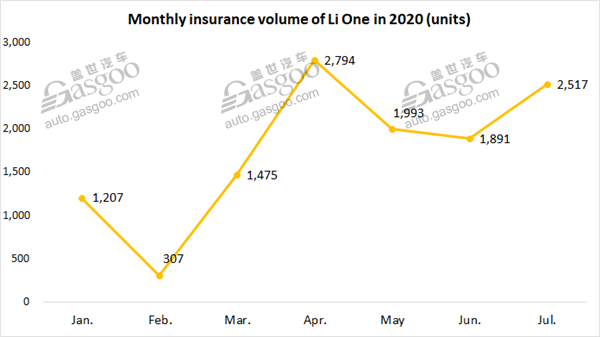

Li One maintains runner-up place in Jul. among China-made plug-in PV models

The insurance registrations of the Li One reached 2,517 units in July, jumping 33.1% compared to June and only outsold by the BMW 5 Series PHEV. With 12,182 units registered in total, the Li One was still honored the runner-up among the domestically built plug-in PV models by Jan.-Jul. insurance volume.

Li Auto is stepping up the efforts to perfect its off-line sales channels. As of August 10, the startup has had 25 retail outlets in 21 cities across China. Between August and September, Li Auto plans to let the retailing spots in such cities as Foshan, Hefei, Lanzhou, Dalian, Wuxi, Xiamen, Guiyang, Harbin and Shenyang start operations.

(Li One, photo source: Li Auto)

The after-sales service network is expanding as well. According to Li Auto, its after-sales service outlets have tapped 39 cities in China as of August 10 and are expected to be landed in a number of cities like Changchun, Xining, Jiaxing, Jinhua, Quanzhou, Linyi, Weifang, Yantai, Baoding, Nantong and Shaoxing in the third quarter of the year.

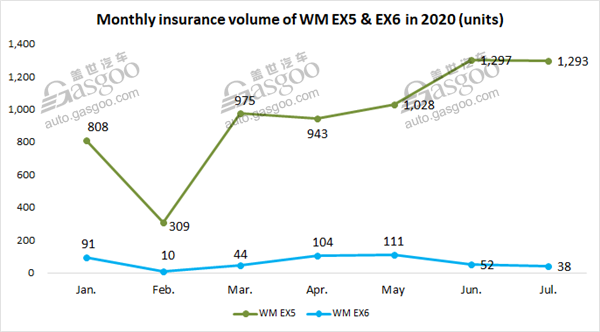

WM Motor's July insurance volume remains flat compared to June

The insurance registrations of WM Motor's vehicles stood at 1,331 units in July, only 18 units fewer than that of a month ago.

Among the vehicles registered last month, 1,293 units were from the EX5. The company announced last month it delivered the 30,000th EX5 on July 6. In reaching this milestone, WM Motor became the first Chinese BEV startup that surpassed the 30,000-units sales with a single vehicle model.

The share of younger drivers among WM Motor's customer base has continued to grow. The startup revealed that the Jan.-Jun. number of users born after 1995 surged 43.4% compared to the year-ago period. Additionally, the drivers who are parents of young children now accounted for 69% of the company's customer base.

(EX5, photo source: WM Motor)

WM Motor has also quickened its pace of sales network expansion. By the end of July, the EV manufacturer has newly set up 64 sales outlets across the country so far this year, of which 18 were launched last month.

Moreover, WM Motor is also enlarging its partnerships for charging ecosystem. It has formed cooperation with up to 13 Chinese mainstream charging operators, such as State Grid and TELD, and has been given access to around 200,000 public charging piles in over 260 cities.

HONZON Auto scores remarkable hike in July Nezha U's registrations

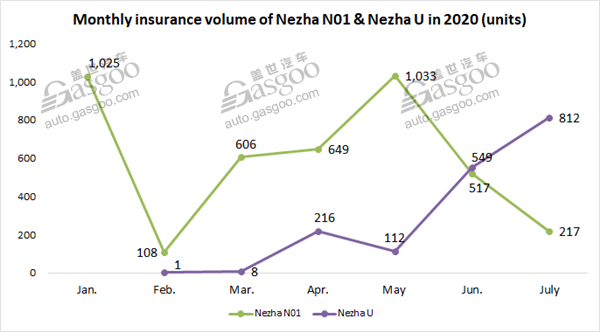

HOZON Auto, the startup operating a brand named after the teen hero of Chinese mythology “Nezha”, saw its July insurance registrations reach 1,029 units, of which 812 units were the Nezha U compact SUVs, a month-on-month surge of 47.9%.

(Nezha U, photo source: HOZON Auto)

However, among the Nezha Us registered in July, 794 units were delivered to business users, while only 18 units belonged to individual users. In fact, since the BEV model was for the first time included by CIRC's data in Feb., its cumulative registrations for personal use amounted to 321 units, accounting for only 18.9% of the Nezha U's total insurance volume. It suggested that the startup's second mass-produced model hasn’t broken through a way out among private users, which might tell against the sales of the Nezha V, the company's third production model to hit the market in 2020's third quarter.