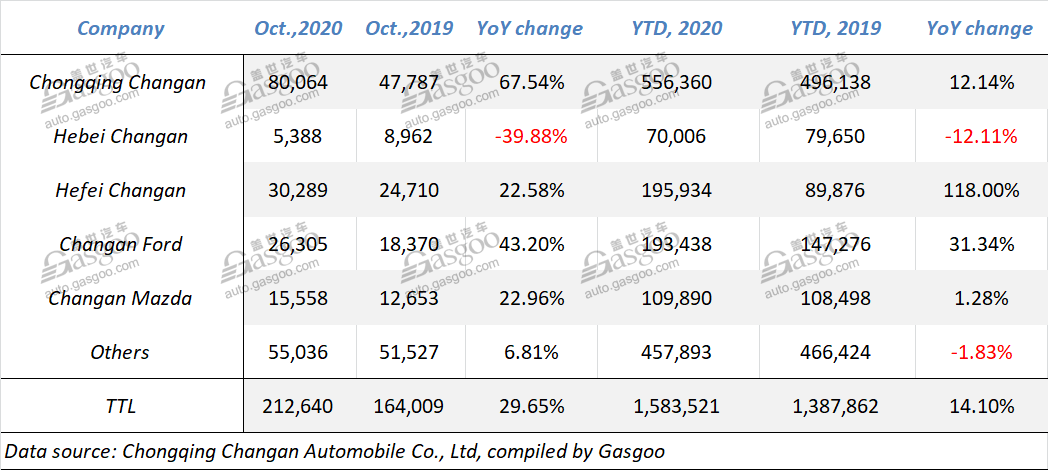

Shanghai (Gasgoo)- Chongqing Changan Automobile Co., Ltd. (Changan Auto) gained a 29.65% year-on-year growth by selling 212,640 vehicles last month. As of Oct., the automaker had achieved increase for the seventh month in a row.

In the Jan.-Oct. period, Changan Auto sold a total of 1,583,521 vehicles, posting a double-digit growth of 14.1%.

CS75 PLUS; photo source: Changan Auto

Last month, Chongqing Changan was honored the fast-growing subsidiary with a year-on-year hike of 67.54%. Hefei Changan posted a substantial slowdown with its year-on-year growth shrinking to 22.58% from 51.24% in September.

Regarding joint ventures, both Changan Ford and Changan Mazda nabbed double-digit growth in Oct. sales. Notably, the growth in Changan Mazda's year-to-date sales turned positive for the first time so far this year.

Changan Auto said the sales of its self-owned brands leapt 30.5% from a year ago to 161,465 units, of which 112,153 units were PVs, representing an impressive surge of 47.1%.

UNI-T; photo credit: Changan Auto

With regard to specific models, the sales of the Changan CS75 and CS55 SUVs reached 30,963 units and 13,440 units in October. The Eado sedan series had a sales volume of 20,405 units. Moreover, the sales of the UNI-T, the first mass-produced model of Changan's UNI sequence, stood at 11,227 units last month, exceeding 10,000 units for four straight months.

The second of the UNI family is named “UNI-K”, the automaker announced last week. It is the volume production model of the Vision-V concept unveiled at the Auto China 2020.

Changan Auto said its Q1-Q3 net profit attributable to shareholders amounted to 3.486 billion yuan ($520.318 million), shooting up 230.98% over a year ago.

The revenue for the same period leapt 23.77% year on year to 55.842 billion yuan ($8.335 billion). Meanwhile, the net cash flow generated by operating activities was 7.019 billion yuan ($1.048 billion), surging 86.8% from a year ago.

The substantial growth in the net profit should be mainly thanks to the increase in company's auto sales, the optimization in product structure and the improvement in the profitability of its self-owned and joint-venture businesses, said Changan Auto.

The automaker also announced non-recurring items brought nearly 5.6 billion yuan ($835.858 million) to the Q1-Q3 net profit attributable to shareholders.