Hello, everyone! Welcome to Gasgoo. In this episode of "Wheels of Change: Stories of Chinese Auto Giants," let's delve into the transition journey of Changan Automobile.

The in-house development of core technologies

Shifting gears from partnerships to pioneering its tech, Changan is consolidating various resouces on its core supply-chain in order to meet internal demands, aiming for both cost reduction and independent supply of core components.

Photo credit: Changan Automobile

In terms of electric drive system, Changan has upgraded from 3-in-1 electric drive to 7-in-1 electric drive. This new-generation system is much lighter, more compact, with higher efficiency, achieving up to 95% overall efficiency, and already in use in models like the DEEPAL SL03.

Changan's hybrid power technology follows a diversified approach. The Blue Core iDD plug-in hybrid electric solution, introduced last year, leverages Changan's expertise in traditional power systems, offering excellent fuel and power economy. Models equipped with this system boasts an NEDC-rated combined fuel consumption of only 0.8L/100km.

Photo credit: Changan Automobile

Moreover, the Blue Core iDD system, primarily used in UNI brand's vehicles, marks Changan's comprehensive transition towards hybrid technology. An upgrade to the Blue Core powertrain came on March 13 2024, with a new-generation HE hybrid-dediacted engine soon to launch.

The hybrid system that powers NEVO brand's vehicles is built upon a P1+P3 architecture, offering a cost-effective solution for budget-conscious families by focusing on electric drive efficiency and extended range at a lower cost than the P2 setup.

On the other hand, Changan’s range extension technology was deployed onto vehicles under the DEEPAL, NEVO, and AVATR brands. Compared with plug-in hybrid systems, it has a longer range, and can better meet the demands of consumers who pursue pure electric driving experience.

In the future, Changan plans to explore technical front such as SiC Force integrated electric drive, which covers 800V high-voltage platform, oil-cooling, and SiC technologies, among others.

Changan's approach to electric drive platforms is a combination of self R&D and cooperation, making sure it can cater to all its brands.

In April 2022, Changan launched the EPA1 platform, compatible with pure electric, range extended, and hydrogen fuel cell powertrains. This platform has been used in vehicles under DEEPAL and NEVO brands.

Photo credit: Changan Automobile

Similarly, the CHN platform, introduced in June 2022, in collaboration with Huawei and CATL, powers AVATR-branded vehicles. The platform pioneers a collaboration model featuring “new architecture, robust computing power, and high-voltage charging”.

Regarding E/E architecture, Changan's SDA architecture, introduced in August 2022, integrates the in-house designed UNIBrain central computing platform, featuring a smarter vehicle base. This architecture features adaptable scenarios, plug-and-play hardware, customizable ecosystem, and self-evolving system, marking a leap over traditional car architectures.

Based on the SDA platform, the automaker has launched the sub-brand Zhuge Intelligence, further improving Changan’s intelligent driving, interactive experience, and ecosystem offerings.

Photo credit: Changan Automobile

The NEVO CD701 will be the first model to ride on the SDA architecture.

In the fields of power batteries and intelligent driving, Changan still relies on third-party suppliers for now. According to data from Gasgoo Auto Research Institute, Changan’s main battery suppliers include CATL, CALB, Gotion High-tech, and EVE Energy, while maintaining tight ties with Bosch, Huawei, and Tencent in the intelligent driving and smart cockpit domains.

Moreover, Changan's ventures with CATL and NIO in supercharging and battery swapping networks aim to enhance its infrastructure network.

Gasgoo Auto Research Institute also suggests that Changan should move towards full in-house development in electrification and intelligence in the future, from the current joint-venture efforts.

Photo credit: Changan Automobile

In the latter half of 2023, Changan introduced the Golden Shield battery, with its first standardized battery cells rolling off the production line in the same year. These cells integrate 4C ultra-fast charging, enabling a recharge from 20% to 80% in just 10 minutes.

This year, Changan plans to mass-produce CTV (Cell-to-Vehicle) technology, aiming for an assembly efficiency of over 86%.

By 2030, Changan aims to unveil eight self-developed battery cells, including liquid, semi-solid, and solid-state ones. Furthermore, novel battery types like lithium-sulfur and metal batteries are slated for commercialization by 2035.

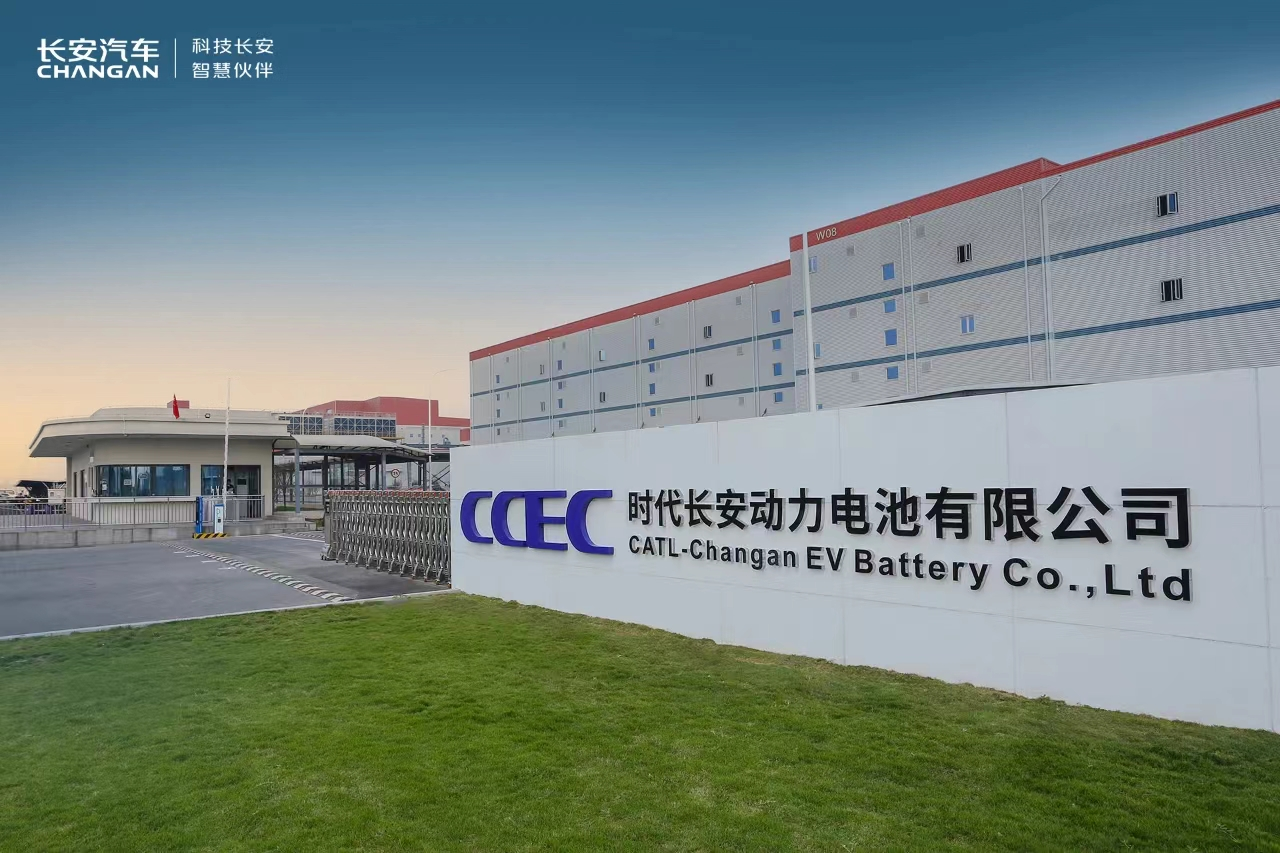

Given the high costs of establishing battery factories, Changan's self-developed battery cells are produced through a joint venture with CATL under the name CATL-Changan EV Battery Company (CCEC).

Photo credit: Changan Automobile

Wang Jun, Changan Automobile's President, disclosed the plan to establish a battery research institute. By the end of 2023, the institute already had over 1,200 battery R&D personnel. Wang Jun also revealed a future investment of 10 billion RMB, aiming to assemble a team of 3,000 people by 2024.

Since the integration of software, chassis systems become more and more important. It's no longer purely mechanical but also possess electronic and intelligent features, chassis development became a crucial battleground for smart vehicle competition among automakers. Thus, in 2022, Changan established Change Technology to offer comprehensive services for intelligent braking, steering, suspension, lightweighting, and integrated chassis systems.

Looking ahead, Changan plans to embark on new powertrain development practices, aiming to enhance driving comfort by integrating powertrain and chassis technologies based on existing driving experience development systems. This involves using technologies like distributed electric drive and big data to mitigate motion sickness for passengers. Besides, establishing a distributed electric drive function application matrix for different vehicle scenarios will enable the creation of ultimate driving experiences. Achieving a balance between driver handling and passenger comfort is currently challenging, but if Changan can pioneer this technology, it should receive positive market feedback.

Setting sail

During its transition towards electrification and intelligence, Changan has made significant strides in brand building and technology upgrades through a blend of self-cultivation and collaboration. This approach has not only led to a substantial growth in new energy vehicle sales but also improved its profitability fundamentals.

After seven years, Changan is expected to achieve a net profit of over 10 billion RMB in 2023. However, to realize its 2030 strategic vision of becoming a global frontrunner in the automotive industry, Changan must sell more cars globally and gain more profits.

Thus, Changan is leveraging investments and partnerships to boost its core component self-sufficiency capability, while also reaping investment returns.

Notably, Changan has made progress in its cooperation with Huawei.

Photo credit: Changan Automobile

As the first automaker to invest in Huawei's new venture, their newly formed joint venture is tentatively named Newcool. Industry insiders anticipate AVATR, the fruit of their previous CHN cooperation model, to benefit from the technological synergy first.

Meanwhile, as Chinese automakers expand their global footprint, Changan plans to cultivate the overseas market as a new growth driver through its "go-global + investment" strategy.

A full-fledged assault on overseas markets

In 2023, Changan unveiled the Vast Ocean initiative, setting four "10 billion RMB" targets for the overseas market by 2030: investment exceeding $10 billion, annual overseas sales surpassing 1.2 million units, a workforce exceeding 10,000 employees, and establishing itself as a premier global automotive brand. To achieve these goals, Changan plans to introduce at least 60 global models by 2030.

Photo credit: Changan Automobile

Over the past two years, Changan has accelerated its foray into overseas markets, yielding promising results. In 2023, its overseas sales surged nearly 44% year-on-year, reaching 358,000 units. Presently, Changan operates in 63 countries and regions with 450 overseas sales channels.

As sales continue to rise, Changan knows it can't just rely on exporting rides anymore. It is ready to go big and set up shop abroad.

Photo credit: Changan Automobile

In terms of production capacity, Changan has committed to establishing a complete vehicle production base in Thailand, with the first phase targeting 100,000 units and the second phase aiming for another 100,000 units, expected to commence operations in the first quarter of 2025.

That's just the beginning. Changan is also eyeing spots in Europe and South America, aiming to produce over half a million vehicles overseas by 2025.

Towards the end of last year, Changan made a significant move in the Thai market, launching two right-hand drive models. The company plans to invest 4 billion RMB in the Thai production base, turning it into “a global hub for right-hand drive cars.”

Insiders say 2024 is Changan's big year for breaking into new markets. It is gearing up to hit key markets in the ASEAN and Europe regions this year, aiming to cover over 90% of global markets by 2030.

Changan is also adjusting its export product strategy.

Changan expanding into Saudi Arabia; photo credit: Changan Automobile

In the short term, oil-fueled vehicles such as the CS series, UNI series, and the Alsvin will serve as the primary export models. Changan also intends to beef up its global presence of new energy and commercial vehicles with the DEEPAL, AVATR, and Kaicene brands.

Moreover, it is also going global with a mix of synchronized global product development and localized strategies, tailoring its vehicles for different regions.

Last year, Changan's overseas exports showed promising signs, with its wholly-owned brands shipping around 236,000 vehicles. In January 2024, Changan sold around 47,000 vehicles overseas, marking a 1.6-fold increase year-on-year. According to Gasgoo Auto Research Institute’s forecasts, with increased export efforts from brands like DEEPAL and AVATR, Changan's self-owned brand exports are poised to surpass 300,000 units this year.

Beyond exporting vehicles, Changan is also working on bringing in talents and technologies.

Changan is scouting top talents globally to build a world-class innovation hub. For now, it has assembled an international design team of 835 members from 25 countries and hired over 50 top-notch designers like Klaus Zyciora, former Vice President and Head of Global Design at Volkswagen Group.

In the realm of R&D, Changan has established a global R&D network spanning six countries and ten locations, including Chongqing, Beijing, Shanghai, Hebei, Anhui, Turin in Italy, Yokohama in Japan, Birmingham in the UK, Detroit in the USA, and Munich in Germany.

Changan has already founded 17 technology companies, and built an R&D team of around 18,000 professionals from 30 countries and regions.

According to Wang Jun, by 2030, Changan plans to invest a whopping 200 billion RMB and add over 10,000 members to its technology team.

Right investments improve profit

Beyond just selling cars, Changan's figured out that proper investments are one of the keys to making profits.

One of Changan's most successful investment endeavors in recent years should be linking up with CATL. Back in 2017, Changan acquired a 0.3855% stake in CATL for 519 million RMB. This investment aimed to strengthen collaboration with CATL, promoting the industrial application of power battery products and technology. It was also a crucial part of Changan’s Shangri-La plan.

Photo credit: Changan Automobile

No one expected that three years later, Changan cashed out by selling the stake it previously bought from CATL for a staggering 1.97 billion RMB. Additionally, Changan pocketed 2.2 billion RMB through introducing strategic investors for Changan New Energy. Without these two profit windfalls, Changan would have remained in the red in 2020.

Encouraged by this success, Changan doubled down on strategic investments. Thus, when Huawei set up a new company dedicated to its auto components and Huawei Inside projects, Changan was the first to join.

Photo credit: Changan Automobile

Under the agreement, Changan and its affiliates are set to acquire up to 40% equity in Huawei's new company. According to Zhu Huarong, on January 8th 2024, both parties established a task force to explore new directions for the future development of Huawei’s Intelligent Automotive Solution Business Unit, planning to jointly create a platform rooted in the entire industry and radiating globally, focusing on seven major areas including intelligent driving solutions, intelligent cockpits, and intelligent automotive digital platforms.

Overall, amid the electrification and intelligent transformation, Changan continues to evolve, adjusting its pace and technological development path, and seizing every opportunity in niche markets. At present, Changan is still developing positively, with this year set to be a big year for its product releases, with at least 8 new models to hit the market.

Analysts at Gasgoo Auto Research Institute suggest that Changan's proactive changes to adapt to market shifts bode well for its performance this year. They forecasted passenger vehicle sales of Changan’s wholly-owned brands to reach 1.75 million units this year, up around 11% from last year's 1.57 million units.