Gasgoo Munich - China's passenger car market in January 2026 resembles William Faulkner’s The Sound and the Fury, published nearly a century ago. After a soaring movement, it suddenly shifted into abrupt, discordant notes, forcing its way into the next chapter. Headlines describing the January market are filled with words like "plummet," "bleak," and "slump," casting a dark shadow. Yet, just weeks earlier at the start of 2026, echoes of record highs in production and sales, record penetration rates for new energy vehicles, and record market share for Chinese brands still lingered...

1. High-Intensity Competition and the Prelude to a "New Balance"

Looking back at predictions made a year ago as 2026 begins, we find a striking blind spot: almost no mainstream institution foresaw that the 30 million unit milestone for passenger car production and sales would arrive so abruptly in 2025. A closer review shows that nearly all major analysts underestimated the speed of new energy vehicle penetration (exceeding 50% for the first time) and the powerful momentum of export growth (around 6 million units).

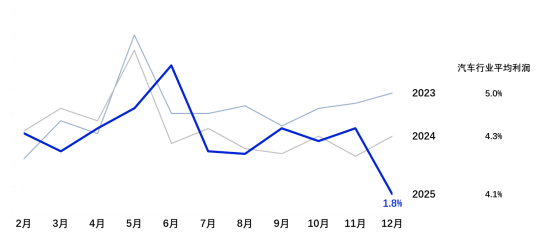

At the same time, neither analysts nor industry insiders anticipated that the auto sector would continue to face such squeezed profit margins in 2025. Under the shadow of price wars, the industry's profit margin had already slipped to 4.3% in 2024, but it slid further to 4.1% in 2025—well below the 5.9% average for industrial enterprises. Even more chilling is that the single-month profit margin for December 2025 plunged to 1.8%. Data shows that over 80% of models underwent official or disguised price cuts in 2025, with an average reduction of 8.2%, and cuts exceeding 11% in the new energy sector. Against this backdrop, a pushback against cutthroat competition has become the industry's main theme, forming a consensus from the top down that is now driving action from the bottom up.

Average profit margin in the automotive industry (2023-2025), Image source: Provided by the author

However, a paradigm shift inevitably brings waves of turbulence. At the start of the new year, changes to purchase tax policies and trade-in programs—combined with the harsh reality that over half of all brands failed to meet their 2025 sales targets—have reignited the "price war." It has kicked off the 2026 competition in the Chinese auto market with even more diverse tactics.

Taken together, the 2025 market was subjected to intense external disruption from the dual forces of policy support and intensifying competition. The market, companies, and the supply chain all deviated from the equilibrium of previous years. The market volatility seen at the start of 2026 is simply the prelude to a new balance following high-intensity competition. The road ahead will not be smooth; while the intensity may ease, the turbulence will persist—the wind does not stop just because the trees wish for stillness.

2. Relaxation Time Begins, But Value Exploration Accelerates

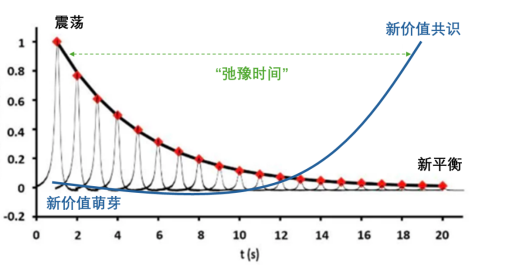

If we view the oscillating Chinese passenger car market through the lens of the popular "complex systems theory," it resembles a system knocked off balance by a shock. The stimulus comes from policy shifts, market competition, and the technological shifts of electrification and intelligence. Once stimulated, internal tensions and chaos arise—manifesting as price wars and squeezed profits. Yet complex factors like internal friction and viscosity—such as regulatory frameworks and consumer maturity—push the system back toward equilibrium. The time required to restore that balance is known as "relaxation time."

Projecting "relaxation time" onto the auto industry, we see that companies, consumers, and the supply chain are all painfully exploring rebalancing. A key direction is shifting from a "price war" to a "value war." According to McKinsey’s *2025 China Auto Consumer Insight*, the effects of the price war are fading; pure price cuts now drive less than 4% of purchase decisions. Over 60% of consumers say price drops alone have no impact on their choice. I fully agree with Professor Zhao Fuquan of Tsinghua University, who argues that the essence of a value war is how companies create and deliver better user experiences at lower cost—a contest of systemic capabilities supported by scale, cost, technology, ecosystems, and business models.

The pressing question is: which user experiences are consumers willing to pay for? Or, more specifically, which experiences trigger a purchase? These "non-standardized, non-quantifiable" user experiences are exactly what companies, consumers, and the supply chain are negotiating and grinding out during this "relaxation time," eventually forming a new consensus on value.

Relaxation Time concept diagram, Image source: Provided by the author

3. Two Case Studies: Ride Comfort and Global Operations

Case 1: Amid fierce competition, "comfort"—once a highly subjective metric—is becoming increasingly measurable and perceptible to consumers. According to J.D. Power’s *2025 China New-Vehicle Buyer Study*, ride comfort has risen to become a top-three purchase consideration. We see that automakers like BYD and NIO are applying double-glazed glass, active noise cancellation, and full-vehicle acoustic optimization to their flagship models. This keeps cabin noise at 60 km/h under 57 dB and at 120 km/h just above 62 dB, creating an environment akin to a library. Meanwhile, models from Deepal, Li Auto, and Leapmotor come standard with zero-gravity seats with reclining support, with user surveys showing over 80% of families believe this feature "significantly improves the ride experience for family members."

Case 2: As Chinese auto exports hold the global top spot for three consecutive years, Chinese automakers are moving from simple product exports to deeper global supply chain integration. According to Roland Berger’s *2025 China Automotive Industry Globalization Report: Focus on Auto Supply Chain*, the overseas sales share of Chinese automakers is expected to rise to 15–20% by 2030. During this expansion, the average export price per vehicle has climbed steadily from $16,000 in 2021 to nearly $20,000 in 2025. A Goldman Sachs report indicates that one leading automaker’s overseas gross margin is far higher than its corporate average, with overseas profits projected to account for 60% by 2028. At the same time, Chinese automakers are integrating deeper into local markets and supply chains. For instance, Leapmotor has leveraged its partnership with Stellantis in Europe to establish nearly 700 stores across 23 countries, including over 100 in Germany alone. Similarly, MG has seen sustained sales growth in Europe, surpassing 300,000 units sold in 2025, while expanding its retail network to more than 800 stores.

4. Value Migration Collides with "Relaxation Time": Speed and Resilience

The English term for "relaxation time" can be deceptive. Yet, whether in Clayton Christensen’s *The Innovator’s Dilemma* or John Kotter’s *Leading Change*, the lesson is clear when facing external disruption: one cannot allow "response lag" under structural constraints. Instead, companies must overcome internal viscosity and accelerate the transition to a "new balance."

As mentioned above, during value migration, the deceptive nature of "relaxation time" often means exploration yields no immediate feedback. However, whether aiming to be an industry "leader"—defining the values consumers will pay for—or a "follower" waiting for the right moment, speed and resilience are the keys to unlocking the future competitive feast.

Take smart driving chips as an example. While Nvidia and others continue to dominate the market, players like Horizon Robotics and SiEngine have released high-compute chips exceeding 500 TOPS, which are already in mass production and application. Meanwhile, automakers like XPENG are exploring a more pragmatic approach to "effective computing power" and "cost-performance ratio," shifting from "parameter involution" to a new stage that prioritizes both experience and efficiency.

Another example is BYD, which focuses on tackling "three-electric and one-chip" technologies, maintaining continuous investment in the safety and energy efficiency of core components. According to Gasgoo’s electrification supplier installation report, BYD’s core sub-brands, FinDreams Battery and FinDreams Power, topped the installation rankings in the three key areas of power batteries, drive motors, and electronic control systems. Similarly, Chery has built a global R&D layout. By establishing key nodes like the "Yaoguang Laboratory"—focusing on core product technologies for current market needs—and the "Kaiyang Laboratory"—collaborating with global universities on forward-looking tech incubation—Chery is building a modular "technology shelf" in areas like powertrains and smart driving, internalizing its aggregated strengths.

No one knows exactly how the market will evolve in 2026. From AI model simulations to debates at industry forums, we see both contradictions and concerns. Bill Gates’ famous quote seems to have been inverted for the Chinese auto market in 2026: we remain optimistic about long-term trends, but deeply pessimistic about the short-term struggle.

The movement toward a "new balance" has begun, and the industry’s "relaxation time" has started. It is a cruel equalizer for companies, consumers, and the supply chain alike. Speed and resilience are easy to discuss but hard to execute. The path of climbing to the peak of the new value curve amidst volatility brings to mind Alex Honnold free-soloing El Capitan: the summit is right there! Yet the route is fraught with danger, every step a heart-stopper.

"It was the best of times, it was the worst of times; it was the spring of hope, it was the winter of despair"...