Gasgoo Munich- On Feb. 1, 2026, Mercedes-Benz adjusted the manufacturer's suggested retail price on several models by roughly 10%, covering core volume sellers like the C-Class, GLC, and GLB. While price cuts typically signal a win for consumers, the reality on the showroom floor tells a different story.

Gasgoo contacted multiple Mercedes-Benz dealers and received a unanimous answer: while the sticker price on some models was indeed adjusted a few days ago, the final "drive-away" cost hasn't shifted much. As dealers narrowed their discounts to offset the official cut, the transaction price remains largely flat. "The MSRP for the C 260 L Sport is now 324,600 yuan," one salesperson explained, "but the final price is about the same as before. With a 95,000-yuan discount on the loan plan, you're still looking at a drive-away price of over 270,000 yuan."

This anomaly—official cuts that don't reach the consumer—has sparked industry-wide concern. If the price adjustment isn't trickling down to buyers, what does it reveal about the fragile state of the luxury car sector?

A Price Cut Unrelated to Consumers

The day after Mercedes-Benz's move, the Auto Dealers Chamber of the All-China Federation of Industry and Commerce (ACFIC) issued a statement praising the adjustment.

The roots of this price cut trace back to late 2025. At that time, multiple dealers flagged five core issues to the chamber: bloated inventory ratios, severe price inversion, delayed rebate payments (some stretching beyond 180 days, with rebates for domestic models restricted to vehicle credit rather than cash), excessive sales targets, and a lack of reasonable exit compensation.

Responding to these collective grievances, the chamber formally wrote to Beijing Mercedes-Benz Sales Service Co. on Dec. 9, 2025, urging policy changes—specifically capping inventory ratios at 1.0 and optimizing rebate mechanisms. While Mercedes-Benz China replied on Dec. 26 claiming it "highly valued" the feedback, dealers reported that substantive solutions remained elusive.

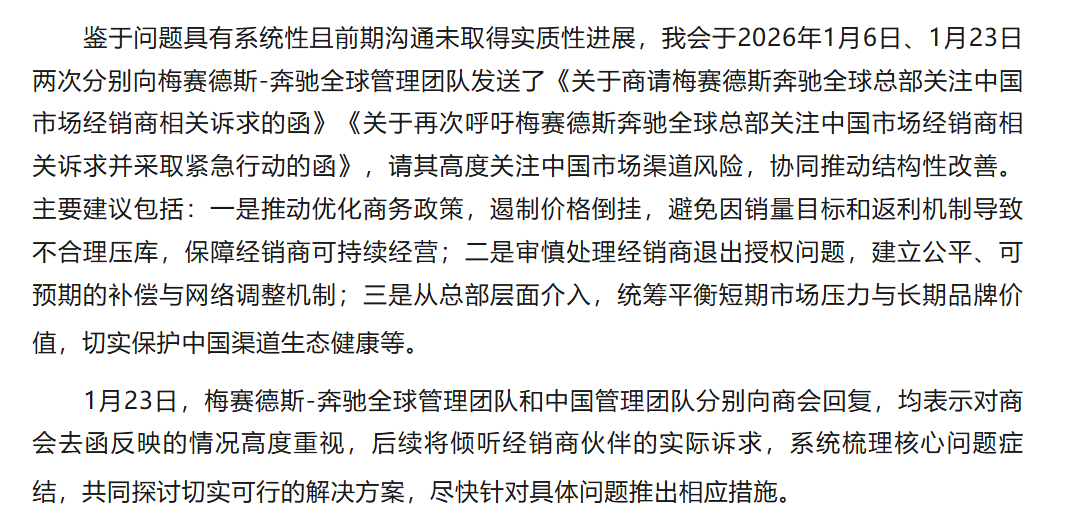

Image source: Screenshot courtesy of the Auto Dealers Chamber of the ACFIC

With talks at a standstill, the chamber escalated the issue. On Jan. 6, 2026, it sent a second letter—this time directly to Mercedes-Benz's global management team—urging headquarters to address the urgency of channel risks in China.

By Jan. 23, the chamber sent a third letter to headquarters, explicitly calling for "emergency action" in the subject line. The demands had evolved from specific policy tweaks to structural reform: headquarters intervention, a fair exit compensation mechanism, and a global balance between short-term volume and long-term brand value.

Under mounting pressure from its Chinese partners, both Mercedes-Benz's global and local management teams responded on Jan. 23, promising to "systematically review the issues" and "explore solutions." That commitment was followed by concrete action: on Feb. 1, the automaker officially adjusted prices on selected models.

This collective "mutiny" by Mercedes-Benz dealers is no isolated incident. It is a concentrated eruption of deep structural contradictions in China's luxury car market—a typical microcosm of the channel challenges facing foreign premium brands.

Image source: Mercedes-Benz

In 2025, China's luxury retail sales slid 9.6% year-on-year. The traditional German triumvirate—BMW, Mercedes, and Audi—all posted declines. Mercedes-Benz sold 575,000 units in China, down 19.5%; BMW moved 625,500 units, a 12.5% drop; and Audi shifted 617,500 units, falling roughly 5%. This collective retreat reflects a fading halo for legacy luxury brands, squeezed between the electric transition and an aggressive offensive by domestic rivals.

The market chill inevitably reached the showroom floor. An August 2025 survey by the dealers' chamber found that among 40 brands, 32 were suffering from price inversion—selling below cost—with an average inversion depth of around 16.18%. For most dealers, this meant losing money on every unit sold. The chamber has widely urged automakers to shorten rebate payment cycles and reduce policy bundling.

By escalating their grievances to headquarters, Mercedes-Benz dealers brought an industry-wide open secret into the harsh light of day, forcing the automaker to confront the systemic risks accumulated across its channel network.

Industry insiders largely view this official price cut for what it is: financial relief aimed at dealers.

Zhang Xiang, secretary-general of the International Intelligent Transport Technology Association and a visiting professor at Huanghe Science and Technology University, offered a specific analysis: "It is rare for an automaker to cut the official guide price; this move breaks industry convention." Lowering the sticker price, he noted, directly reduces dealers' procurement costs, preserving their theoretical gross margin per vehicle. At the same time, a more competitive official price can stimulate foot traffic and sales, accelerating dealer cash turnover.

By slashing the MSRP at the source, the move aims to repair severe price inversion—essentially shifting profit from "back-end rebates" to upfront pricing to ease cash flow pressure. In its official statement, the chamber acknowledged that while the move falls short of all dealer demands, it "will, to a certain extent, release liquidity for Mercedes-Benz dealers."

Inventory, Inversion, and Delayed Rebates: The Triple Threat Facing Luxury Dealers

Broadly speaking, the distress facing luxury dealers falls into two categories. The first is "passive collapse"—dealerships buckling suddenly under sustained losses and financial strain.

A prime example is the Polyde Group, once a major private luxury dealer in East China. In November 2025, the court ruled for the bankruptcy and liquidation of the group and its 56 affiliates. The collapse of a giant that represented Mercedes-Benz, Porsche, and Rolls-Royce left owners unable to take delivery and voided prepaid maintenance packages—a stark illustration of the systemic risks large dealer groups face in a downturn.

Similar passive clearouts are occurring within single-brand networks. Audi, for instance, saw authorized dealerships close or exit the network in over ten provinces and cities—including Henan, Guangxi, and Beijing—between late 2025 and early 2026. In one case, the Kaifeng Jin Ao Audi dealership shut its doors after 11 years, leaving behind empty offices and thousands of yuan in worthless maintenance credits for customers.

The second form can be described as "active slimming," where brands anticipate the unsustainability of the traditional model and proactively restructure their networks.

Image source: Porsche China

Luxury brands like Porsche and BMW are already trimming their networks. According to Michael Liu, president of Porsche China, the dealer count was slashed from a peak of 150 to 114 in 2025, with a target of roughly 80 by 2026 as the brand pivots toward a hybrid "direct-sales + authorization" model. BMW plans to cut about 100 inefficient or loss-making outlets, opting not to renew contracts for underperformers and actively closing struggling stores.

These cases point to a single reality: the "mutiny" at Mercedes-Benz and the ensuing price adjustment are merely flashpoints in a broader channel shakeout. The dealers' chamber noted in a recent circular that it continues to receive complaints about unreasonable commercial policies from other brands, centering on inventory, price inversion, and rebate structures.

Beneath this chaos lies the failure of the business model that powered the golden age of luxury cars: "high pricing, forced inventory, and rebate-driven profits." The logic was simple: automakers set high MSRPs to maintain brand prestige; dealers bought at a discount, absorbing inventory and financing costs; profits came not just from the sales spread, but heavily from quarterly or annual rebates tied to sales, service, and financing targets.

Yet, in today's radically shifted market, that model has tangled itself into three intractable knots.

First is the pressure of market realities. The waves of electrification and intelligence are battering the walls of traditional luxury brands. New entrants like Tesla, NIO, and Li Auto, along with agile traditional giants like BYD, are gnawing away share in the high-end market. In the first three quarters of 2025, domestic newcomers captured 40.7% of the segment above 300,000 yuan, while traditional luxury brands saw their share slip below the 50% threshold to 49.8%.

Consumer values have shifted, too, moving beyond a simple reverence for the "Three-Pointed Star" or "Blue and White Propeller" badges to a holistic evaluation of smart features, electric performance, and user service.

Second is the fracture of profit logic. In the fierce battle for market share, brutal price wars have made price inversion the norm. To hit sales targets and secure rebates, dealers are forced to slash prices, keeping transaction prices far below their acquisition costs for long periods. "Selling one unit means losing money on one unit" has become the status quo. With sales margins blocked, dealers are forced to pin their survival on delayed, conditional rebates.

This creates immense financial pressure—the straw that breaks the camel's back. As Mercedes-Benz dealers noted, delayed rebate payments (often exceeding 180 days) and restrictions on using rebates for anything except stocking inventory severely tie up operating capital, exacerbating cash flow crunches.

On the other flank, financing massive inventory generates high interest costs. The chamber's survey found that among 40 brands, 53.19% of dealers carried an inventory ratio exceeding 1.5, with 29.36% sitting on ratios above 2.0.

Zhang offered a blunt assessment of the market reality: "For most dealers, selling cars basically generates no profit." Survival depends heavily on derivatives like auto financing and maintenance. Yet, slow rebate payments and bloated inventory are the heavy burdens crushing them.

When sales revenue fails to cover costs and rebates lag, broken cash chains become inevitable. The collapse of Polyde Group is a case in point: the company reportedly used "dual account books" to mask losses before crumbling under insolvency with 6.8 billion yuan in debt. "Indebtedness" is now the norm—data from the China Automobile Dealers Association shows that 52.6% of dealers were in the red in the first half of 2025.

Whether it manifests as "escalating complaints," "passive flight," or "active slimming," the essence is identical: in this new market environment, the "high pricing, forced inventory, rebate-chasing" logic that luxury brands relied on for years is breaking down.

From Confrontation to Symbiosis: How Can Channels Be Reshaped?

As the old model becomes untenable, finding a new path is critical for the industry's survival. The Mercedes-Benz incident and the broader channel crisis are forcing a deep restructuring of the automotive supply chain, particularly the relationship between automakers and dealers.

The traditional OEM-dealer dynamic has often resembled a hierarchical "manager and subordinate" model, where automakers drive behavior through sales targets, commercial policies, and rebate KPIs. These conflicts could be masked during periods of rapid growth, but in a stagnant or shrinking market, the inherent antagonism is laid bare.

In its letters to Mercedes-Benz, the chamber has outlined a viable blueprint for a new relationship: a partnership built on fairness, transparency, stability, and empathy. This includes setting realistic sales targets that avoid forced inventory for the sake of numbers; establishing a clear, timely rebate mechanism that serves as a reliable cash flow source rather than a drag; and, crucially, creating a fair exit compensation mechanism that allows partners to "withdraw with dignity" when the partnership ends.

Lang Xuehong, deputy secretary-general of the China Automobile Dealers Association, commented that a healthy OEM-dealer relationship should be a "community of shared destiny." "Automakers must realize that a strong dealer network is the foundation of their brand in China," she said. "Harming dealer interests will eventually backfire on the brand itself." This means automakers must integrate dealer profitability and survival into their core strategic decisions.

As relationships are redefined, channel models are also undergoing a transformation.

Image source: @Tesla

New forces like Tesla, NIO, and Li Auto widely adopt the direct-sales model. The automaker owns the retail network entirely, enforcing unified pricing and service to ensure brand consistency and price transparency. The upside is strong control and direct access to user data, but it requires massive capital investment in channel construction and operations.

Recently, some traditional brands have experimented with the agency model during their transition. Here, dealers become "agents" while vehicle ownership remains with the automaker. Agents handle display, sales, and delivery for a commission fee. This eliminates inventory pressure and capital occupation for agents and ensures a unified national price, though their profit margins are relatively fixed, potentially dampening sales initiative.

The hybrid model is a path many traditional luxury brands, including Porsche, are currently exploring. This involves opening brand-owned flagship stores in core cities or key regions to set benchmarks, while continuing to work with an optimized network of authorized dealers in broader markets. This approach attempts to balance brand control with expansion efficiency and asset-light operations.

Despite the heated debate on channel reform, Secretary-General Zhang remains cautious about the pace and scope of change. "For at least the next five years, the authorized dealer model will remain dominant," he analyzed. The logic is straightforward: building a vast direct-sales network requires capital that most traditional automakers simply do not have. The future will likely focus on deep optimization and relationship restructuring within the existing dealer framework, rather than a total overhaul of the model.

The official Mercedes-Benz price cut on Feb. 1, 2026, was the direct result of collective dealer bargaining—a mere glimpse of the deep-seated issues plaguing luxury car channels.

Whether dealers are "running away" or brands are "slimming down," these are merely different symptoms of the same underlying disease. The old rules of the game have failed, and industry consensus is shifting toward a single imperative: the need to rebuild a new order that is more transparent, fair, and built for coexistence.