Looking at the regional distribution of passenger vehicle exports from Chinese automakers in December 2025, BYD, Geely, and Chery have each carved out distinct paths, highlighting the diverse resilience of China's global auto expansion. BYD dominates the new energy market in Southeast Asia, using its core advantages to solidify its overseas foundation. Chery is seeing rapid growth in Europe's high-end market as well as emerging markets like the Middle East and South America, securing its spot in the top tier of exporters with a balanced layout. Geely is deepening its presence in the CIS and Africa while making steady inroads into Europe through brand synergy. Together, their unique strategies sketch a new landscape of Chinese brands advancing globally.

According to the export database of Gasgoo Automotive Research Institute, BYD's passenger vehicle export rankings by region for December 2025 are as follows:

NO.1 Southeast Asia: In December, BYD exported 32,427 units to the region.

NO.2 EU + UK + EFTA: In December, BYD exported 31,048 units to the region.

NO.3 Central & South America: In December, BYD exported 19,404 units to the region.

NO.4 Middle East: In December, BYD exported 18,078 units to the region.

NO.5 North America: In December, BYD exported 14,254 units to the region.

NO.6 CIS Countries: In December, BYD exported 7,400 units to the region.

NO.7 Oceania: In December, BYD exported 5,501 units to the region.

NO.8 Rest of Asia: In December, BYD exported 3,265 units to the region.

NO.9 Africa: In December, BYD exported 3,083 units to the region.

NO.10 Rest of Europe: In December, BYD exported 350 units to the region.

NO.11 Caucasus: In December, BYD exported 35 units to the region.

Data from Gasgoo Automotive Research Institute shows BYD's global layout in December 2025 featured stable core markets and multi-point breakthroughs in emerging ones, signaling a deepening phase of its globalization strategy. Southeast Asia topped the list with 32,427 units, driven by BYD's long-term cultivation of the ASEAN market—building brand recognition and channel foundations through local production, tailored product structures, and policy alignment. The EU, UK, and EFTA followed closely with 31,048 units, indicating rising acceptance of its new energy models in mainstream European markets.

Notably, exports to North America retreated to 14,254 units in December, a sharp swing from November's 34,618. The November surge was largely driven by front-loading shipments to avoid rising Mexican tariffs set for 2026. The December decline, meanwhile, reflects the risk of shipments arriving after the year-end cutoff, alongside adjustments in shipping cadence and supply chains. This underscores the lingering uncertainty in policy and trade environments within mature markets. By contrast, emerging markets like the Middle East, Central, and South America maintained steady growth, serving as a buffer for the overall export structure.

Structurally, BYD's export footprint is shifting toward a "balanced multi-regional layout." Southeast Asia and Europe form a dual core, supporting overall scale while boosting brand premium and technical image. Meanwhile, sustained volume growth in the Middle East and Latin America adds resilience and stability. If BYD can maintain expansion while optimizing overseas capacity, improving local supply chain response, and flexibly adjusting product mixes, its lead in the global electrification race is set to continue.

According to the export database of Gasgoo Automotive Research Institute, Geely Holding's passenger vehicle export rankings by region for December 2025 are as follows:

NO.1 CIS Countries: In December, Geely Holding exported 20,977 units to the region.

NO.2 Africa: In December, Geely Holding exported 16,763 units to the region.

NO.3 EU + UK + EFTA: In December, Geely Holding exported 11,883 units to the region.

NO.4 Middle East: In December, Geely Holding exported 9,577 units to the region.

NO.5 Southeast Asia: In December, Geely Holding exported 9,450 units to the region.

NO.6 Central & South America: In December, Geely Holding exported 5,338 units to the region.

NO.7 Rest of Asia: In December, Geely Holding exported 1,882 units to the region.

NO.8 North America: In December, Geely Holding exported 1,601 units to the region.

NO.9 Oceania: In December, Geely Holding exported 1,064 units to the region.

NO.10 Caucasus: In December, Geely Holding exported 302 units to the region.

NO.11 Rest of Europe: In December, Geely Holding exported 178 units to the region.

December data shows Geely Holding's globalization leans on emerging markets as primary pillars while gradually extending into higher-end segments. CIS countries and Africa contributed nearly half of total exports, indicating Geely has built a solid foundation in these regions. Through vehicle adaptations for local road conditions, flexible financing, and improving after-sales networks, brand awareness and channel penetration are rising. However, while this structure reduces competitive intensity in mature markets, it also leaves overall export performance exposed to external factors like currency volatility and policy shifts.

Compared to BYD's dominance in Southeast Asia, Geely's 9,450 units there suggest it is still in a cultivation phase, leaving room for growth in the region and the Middle East. In North America, exports of just 1,601 units reflect constraints from trade policies, channel systems, and brand recognition, signaling a cautious approach to mature markets in the short term.

In Europe, exports to the EU, UK, and EFTA exceeded 11,000 units, reflecting progress in Geely's shift toward premium and electric models. This transition could boost brand premiums over the long term and deepen Geely's integration into the global new energy vehicle supply chain.

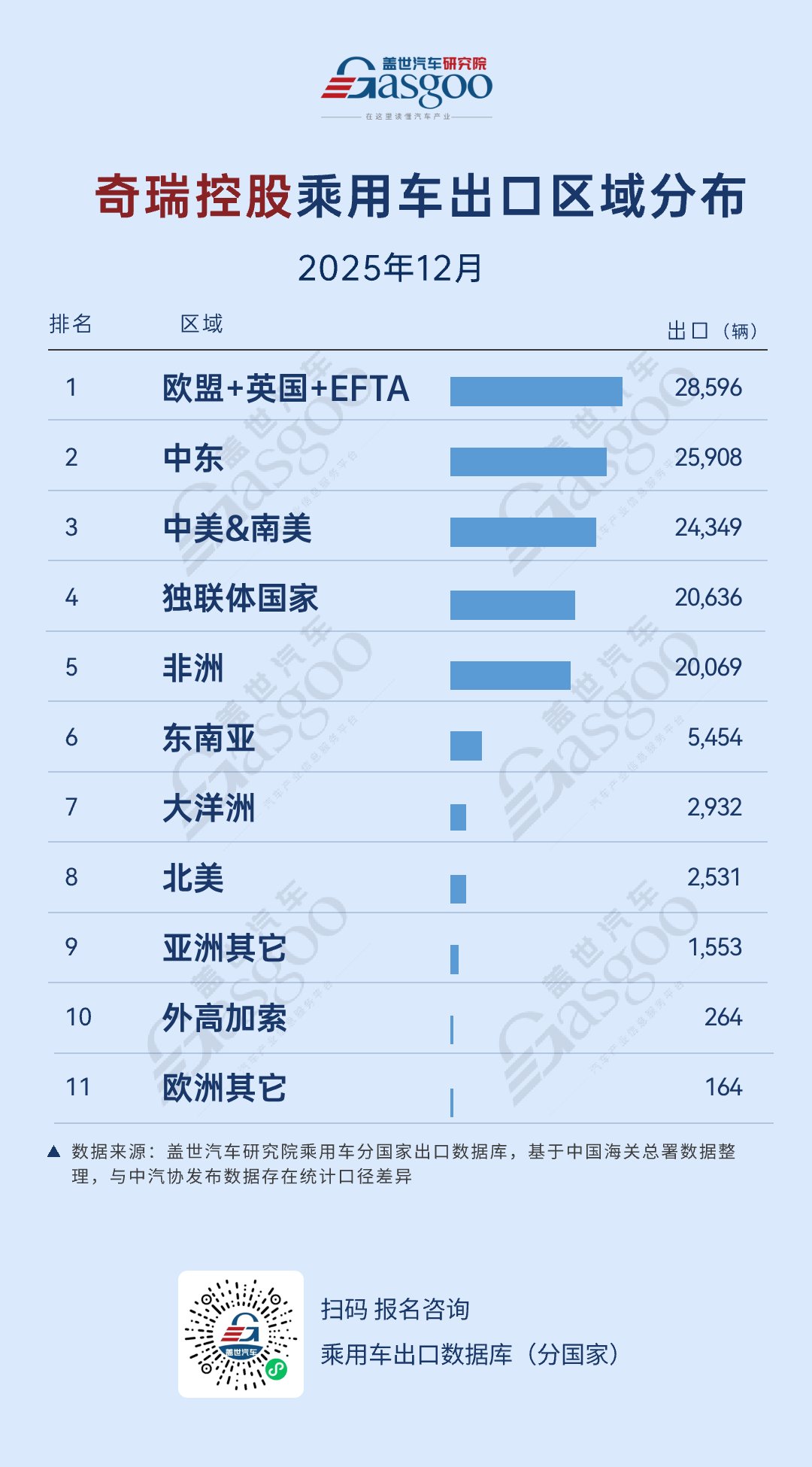

According to the export database of Gasgoo Automotive Research Institute, Chery Holding's passenger vehicle export rankings by region for December 2025 are as follows:

NO.1 EU + UK + EFTA: In December, Chery Holding exported 28,596 units to the region.

NO.2 Middle East: In December, Chery Holding exported 25,908 units to the region.

NO.3 Central & South America: In December, Chery Holding exported 24,349 units to the region.

NO.4 CIS Countries: In December, Chery Holding exported 20,636 units to the region.

NO.5 Africa: In December, Chery Holding exported 20,069 units to the region.

NO.6 Southeast Asia: In December, Chery Holding exported 5,454 units to the region.

NO.7 Oceania: In December, Chery Holding exported 2,932 units to the region.

NO.8 North America: In December, Chery Holding exported 2,531 units to the region.

NO.9 Rest of Asia: In December, Chery Holding exported 1,553 units to the region.

NO.10 Caucasus: In December, Chery Holding exported 264 units to the region.

NO.11 Rest of Europe: In December, Chery Holding exported 164 units to the region.

December data reveals Chery Holding is advancing in mature and emerging markets simultaneously, with a relatively dispersed regional distribution and a steady overall rhythm. The EU, UK, and EFTA led with 28,596 units, marking Chery's ability to enter the European mainstream with high-end and electric products—Europe is becoming a key pillar of its export structure.

Meanwhile, four regions—the Middle East, Central and South America, CIS countries, and Africa—each exceeded 20,000 units, forming the core of Chery's export volume. This multi-regional structure reduces reliance on a single market cycle, smoothing out the impact of policy, currency, and demand fluctuations. However, it also demands higher capabilities in product adaptation, channel depth, and supply chain coordination.

Compared to BYD's scale advantage in Southeast Asia, Chery's 5,454 units there indicate it is still in the strategic layout and channel-building phase, not yet in a volume cycle. In North America, 2,531 units show that expansion in mature markets remains constrained by trade environments, entry barriers, and brand premium capabilities, making it unlikely to be a major growth driver soon.

Overall, Chery's globalization path favors "broad coverage and steady progress." It uses Europe to raise its technological and brand ceiling while relying on emerging markets for sales volume. If it can accelerate local production in Southeast Asia and replicate its European electrification and compliance experience in emerging markets, the stability and risk resilience of its global export structure should further strengthen.